Make additive work for you Q3 2024 Results Speakers Dr. Yoav Zeif, CEO Eitan Zamir, CFO Yonah Lloyd, CCO & VP IR November 13, 2024

Conference Call and Webcast Details US Toll-Free Dial-In 1-877-407-0619 International Dial-In +1-412-902-1012 Live Webcast and Replay https://event.choruscall.com/mediaframe/ webcast.html?webcastid=xEC56y1o Make additive work for you

Forward-Looking Statements Cautionary Statement Regarding Forward- Looking Statements The statements in this slide presentation regarding Stratasys' strategy, and the statements regarding its projected future financial performance, including the financial guidance concerning its expected results for 2024, are forward- looking statements reflecting management's current expectations and beliefs. These forward-looking statements are based on current information that is, by its nature, subject to rapid and even abrupt change. Due to risks and uncertainties associated with Stratasys' business, actual results could differ materially from those projected or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to: the degree of our success at introducing new or improved products and solutions that gain market share; the extent of growth of the 3D printing market generally; global macro-economic trends that have been adversely affecting, and may continue to adversely affect, our results, including relatively high interest rates that reduce capital expenditures; the impact of potential shifts in the prices or margins of the products that we sell or services that we provide, including due to a shift towards lower margin products or services; the impact of competition and new technologies; the degree of our success in implementing our board’s strategic restructuring plan for our company; potential further charges against earnings that we could be required to take due to impairment of additional goodwill or other intangible assets that we have recently acquired or may acquire in the future; the extent of our success at successfully integrating into our existing business, or making additional, acquisitions or investments in new businesses, technologies, products or services; potential adverse impact that recent global interruptions involving freight carriers and other third parties may have on our supply chain and distribution network; potential changes in our management and board of directors; global market, political and economic conditions, in the countries in which we operate in particular (including risks stemming from Russia’s invasion of Ukraine); the degree of impact of Israel’s war against the terrorist organizations Hamas and Hezbollah, given our Israeli headquarters, factories and significant operations; costs and potential liability relating to litigation and regulatory proceedings; risks related to infringement of our intellectual property rights by others or infringement of others' intellectual property rights by us; potential cyber attacks against, or other breaches to, our information technologies systems; the extent of our success at maintaining our liquidity and financing our operations and capital needs; the impact of tax regulations on our results of operations and financial condition; and those additional factors referred to in Item 3.D “Key Information - Risk Factors”, Item 4, “Information on the Company”, Item 5, “Operating and Financial Review and Prospects,” and all other parts of our Annual Report on Form 20-F for the year ended December 31, 2023, filed with the SEC on March 11, 2024 (the “2023 Annual Report”). Readers are urged to carefully review and consider the various disclosures made throughout our 2023 Annual Report and the Report of Foreign Private Issuer on Form 6-K that will attach Stratasys’ unaudited, condensed consolidated financial statements and its review of its results of operations and financial condition for the quarter and nine months ended September 30, 2024, which Stratasys will furnish to the SEC on or about November 13, 2024, and our other reports filed with or furnished to the SEC, which are designed to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects. Any guidance provided, and other forward-looking statements made, in this slide presentation are made as of the date hereof, and Stratasys undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Make additive work for you

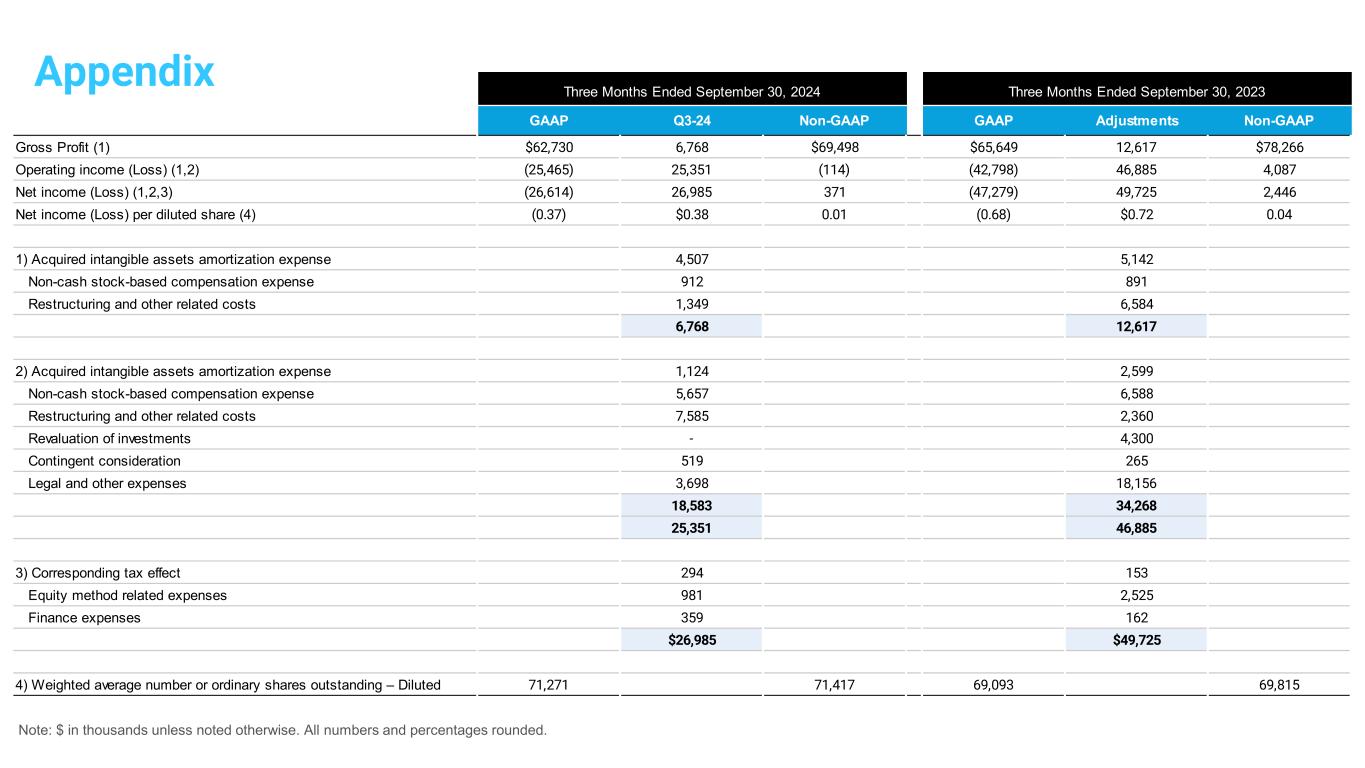

Use of Non-GAAP Financial Information Use of Non-GAAP Financial Measures The non-GAAP data included herein, which excludes certain items as described below, are non-GAAP financial measures. Our management believes that these non-GAAP financial measures are useful information for investors and shareholders of our Company in gauging our results of operations (i) on an ongoing basis after excluding mergers, acquisitions, divestments and strategic process-related expense or gains and reorganization-related charges or gains, legal provisions, and (ii) excluding non- cash items such as stock-based compensation expenses, acquired intangible assets amortization, including intangible assets amortization related to equity method investments, impairment of long- lived assets and goodwill, revaluation of our investments and the corresponding tax effect of those items. The items eliminated via these non-GAAP adjustments either do not reflect actual cash outlays that impact our liquidity and our financial condition or have a non-recurring impact on the statement of operations, as assessed by management. These non-GAAP financial measures are presented to permit investors to more fully understand how management assesses our performance for internal planning and forecasting purposes. The limitations of using these non-GAAP financial measures as performance measures are that they provide a view of our results of operations without including all items indicated above during a period, which may not provide a comparable view of our performance to other companies in our industry. Investors and other readers should consider non-GAAP measures only as supplements to, not as substitutes for or as superior measures to, the measures of financial performance prepared in accordance with GAAP. Reconciliation between results on a GAAP and non-GAAP basis is provided in a table later in this slide presentation. Make additive work for you

CEO Dr. Yoav Zeif Agile, strong and well-positioned after transformative cost-cuts and enhanced focus on growth opportunities F3300 has generated excitement from the market and is expected to help us expand our presence in manufacturing TrueDent solution is proven and highly regarded for its groundbreaking disruption in dentures Return to profitability demonstrates seamless execution of a comprehensive undertaking, an attribute that sets Stratasys apart Eighth straight quarter of recurring consumables revenue growth underscores stability of our recurring revenue model, and our customers' accelerating transition from prototyping to manufacturing Targeting emerging megatrends - supply chain, onshoring, new mobility, sustainability, and greater efficiency Make additive work for you

Make additive work for you F3300 Update Continue to drive demand for our new, flagship F3300 industrial platform Showcased at the International Manufacturing Technology Show in Chicago in September Designed for superior performance, the F3300 delivers high-quality, durable thermoplastic parts with unmatched accuracy Delivers faster print speeds with industry-leading repeatability, and significantly reduces downtime, making it the premier offering in its class Generate interest and orders and already shipping systems to key leading companies across automotive, aerospace and defense industries, along with commercial and industrial manufacturers

Make additive work for you $50M share repurchase execution to help maximize shareholder value has started, while maintaining a strong balance sheet and taking steps to monetize certain high value assets. Origin 2 launched along with the Origin Cure post- processing system, focused on injection- molding quality for short production runs. A great end-market example is connectors - customers such as TE Connectivity that serve Aero, Auto and other sectors. Neo Build Processor launched for Investment Casting to accelerate production of high-quality master patterns with faster file processing and print speeds, streamlining the 3DP workflow for manufacturers and service bureaus in Aerospace and other industries. Q3 Updates

Make additive work for you Restructuring Update Strategic initiatives recently implemented designed to reinforce our industry leadership and ensure sustainable profitability across market cycles Action plan to realign operational costs with current market dynamics through a workforce reduction of 15%, while intensifying our focus on accelerating customer adoption by eliminating implementation barriers Plan is ahead of pace, seeing impact already in Q3 and on track to achieve our target of $40 million in annual cost savings, starting in Q1 2025 Enhancing go-to-market strategy to focus on the highest growth products, materials and software solutions to build a long-term profitable, cash-generating business ready to respond quickly when customer spending returns

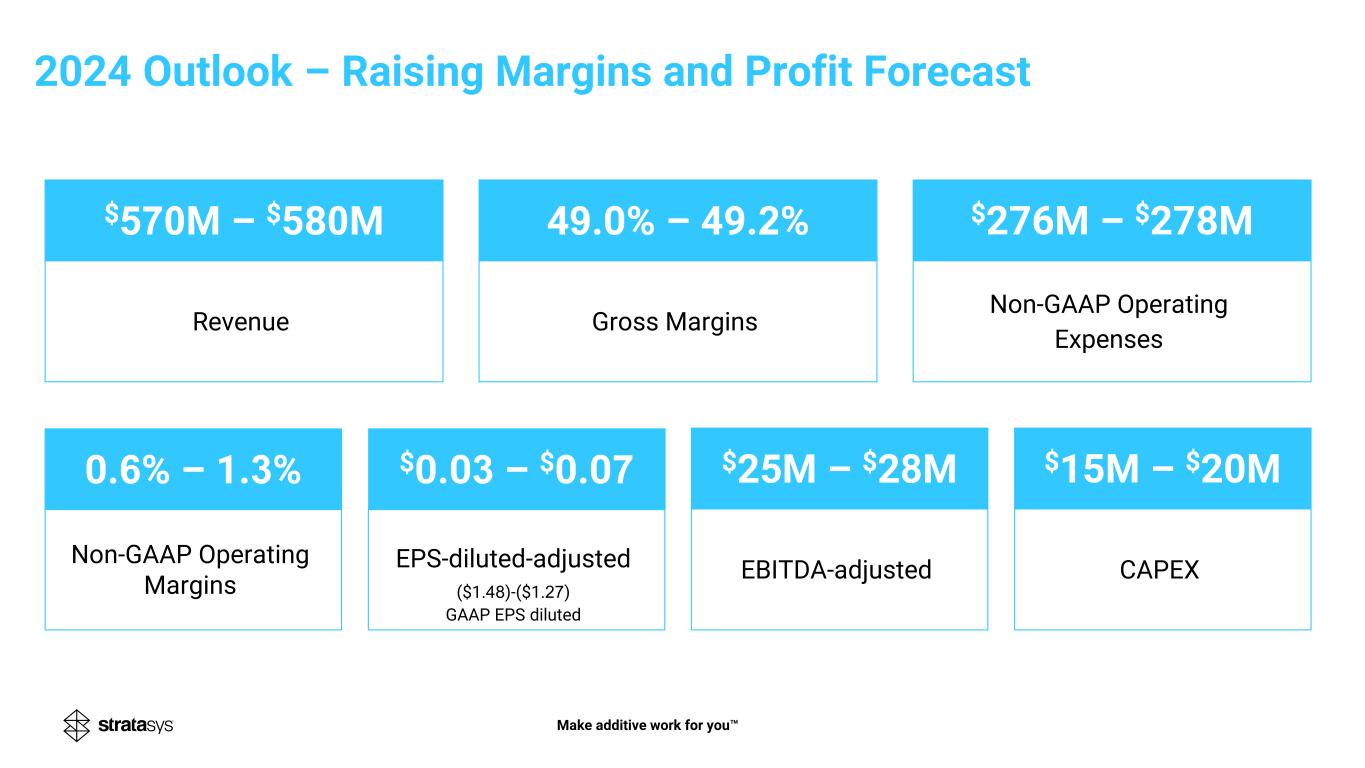

CFO Eitan Zamir Resilience of our operating model – a key differentiator relative to peers in our sector Fast actions of our team, as we delivered improved gross margins and bottom-line profit despite year-over-year pressure on revenues Another quarter of YoY growth in consumables sales and faster than anticipated progress on our cost control initiatives, enabling us to increase our profitability expectations for the year 2024 Outlook – Raising margins and profits for the full year Make additive work for you

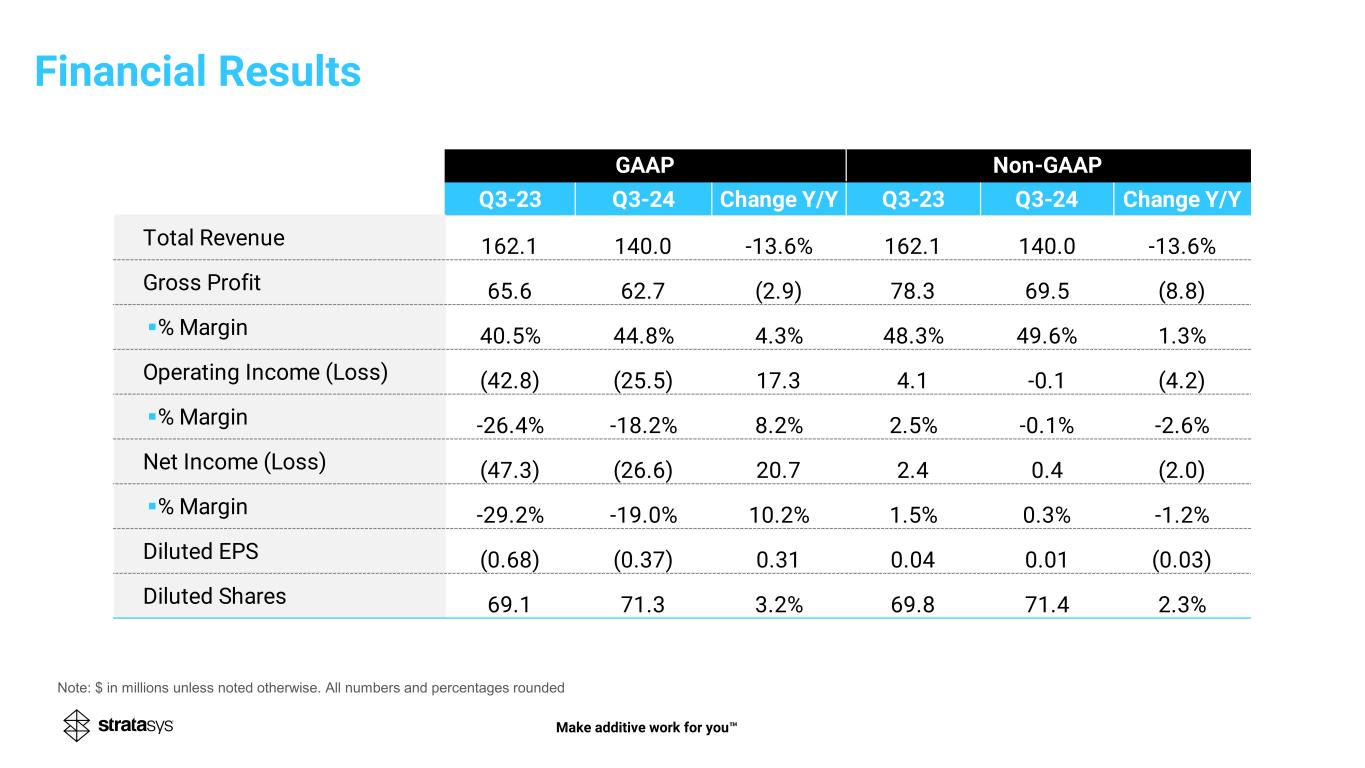

Financial Results Make additive work for you Note: $ in millions unless noted otherwise. All numbers and percentages rounded Q3-23 Q3-24 Change Y/Y Q3-23 Q3-24 Change Y/Y Total Revenue 162.1 140.0 -13.6% 162.1 140.0 -13.6% Gross Profit 65.6 62.7 (2.9) 78.3 69.5 (8.8) % Margin 40.5% 44.8% 4.3% 48.3% 49.6% 1.3% Operating Income (Loss) (42.8) (25.5) 17.3 4.1 -0.1 (4.2) % Margin -26.4% -18.2% 8.2% 2.5% -0.1% -2.6% Net Income (Loss) (47.3) (26.6) 20.7 2.4 0.4 (2.0) % Margin -29.2% -19.0% 10.2% 1.5% 0.3% -1.2% Diluted EPS (0.68) (0.37) 0.31 0.04 0.01 (0.03) Diluted Shares 69.1 71.3 3.2% 69.8 71.4 2.3% GAAP Non-GAAP

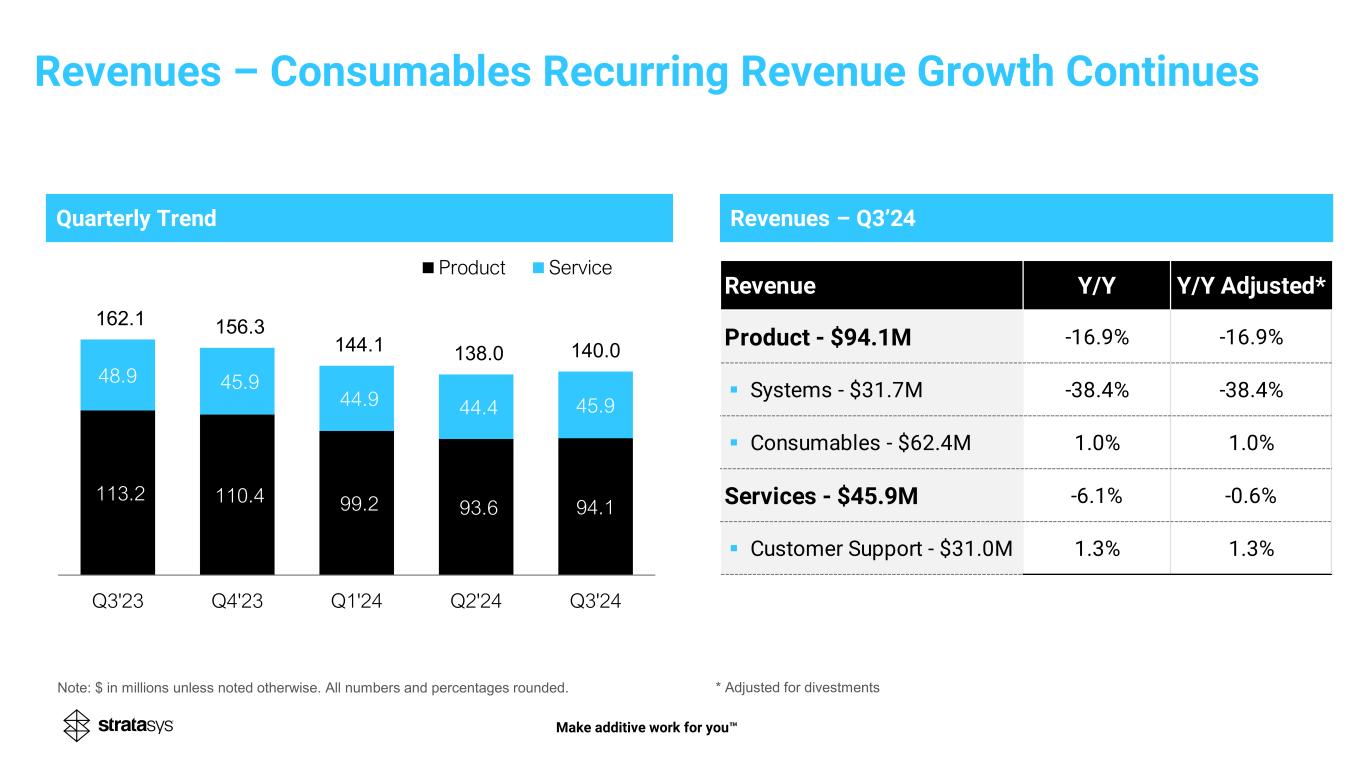

Revenues – Q3’24 * Adjusted for divestments Quarterly Trend 113.2 110.4 99.2 93.6 94.1 48.9 45.9 44.9 44.4 45.9 162.1 156.3 144.1 138.0 140.0 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Product Service Revenues – Consumables Recurring Revenue Growth Continues Note: $ in millions unless noted otherwise. All numbers and percentages rounded. Make additive work for you Revenue Y/Y Y/Y Adjusted* Product - $94.1M -16.9% -16.9% Systems - $31.7M -38.4% -38.4% Consumables - $62.4M 1.0% 1.0% Services - $45.9M -6.1% -0.6% Customer Support - $31.0M 1.3% 1.3%

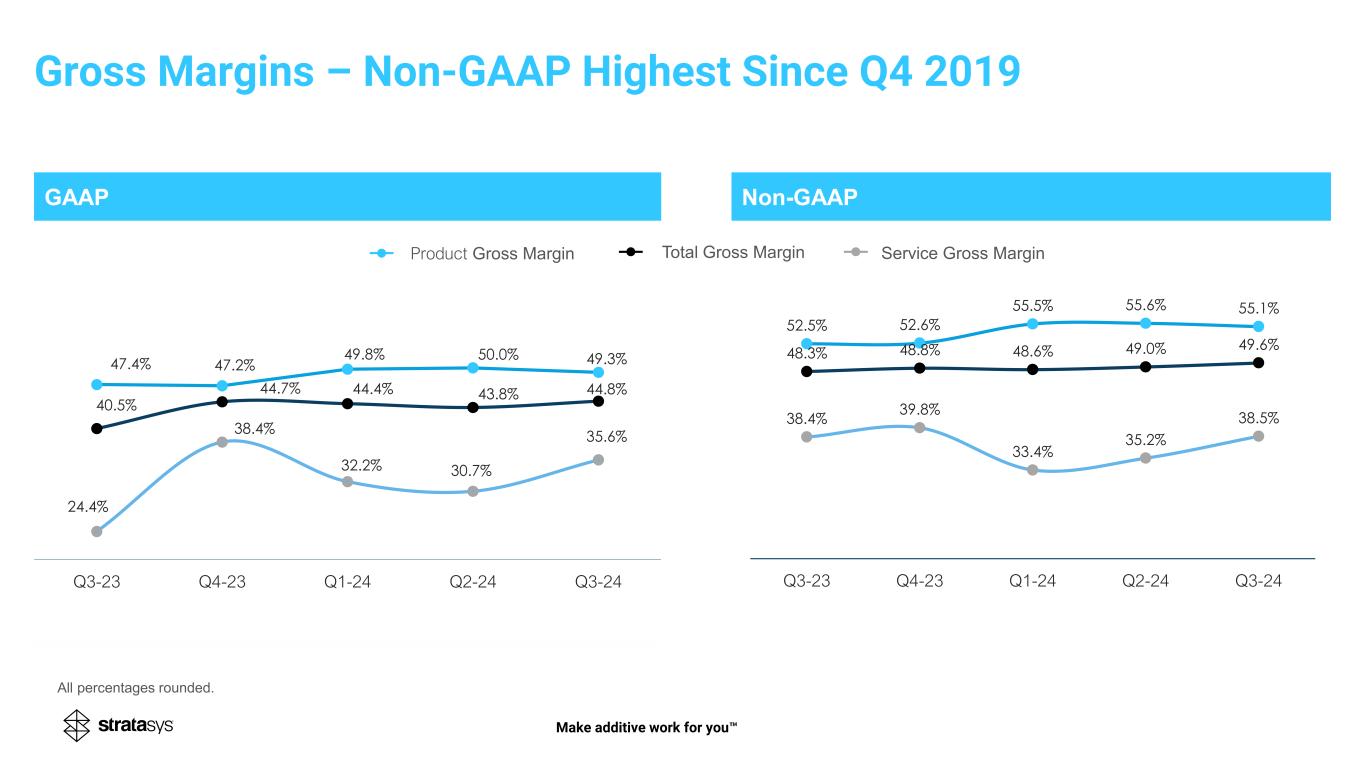

GAAP Non-GAAP 47.4% 47.2% 49.8% 50.0% 49.3% 24.4% 38.4% 32.2% 30.7% 35.6% 40.5% 44.6% 44.4% 43.8% 44.8% Q3-23 Q4-23 Q1-24 Q2-24 Q3-24 48.3% 48.8% 48.6% 49.0% 49.6% 52.5% 52.6% 55.5% 55.6% 55.1% 38.4% 39.8% 33.4% 35.2% 38.5% Q3-23 Q4-23 Q1-24 Q2-24 Q3-24 Service Gross MarginProduct Gross Margin Total Gross Margin Gross Margins – Non-GAAP Highest Since Q4 2019 Make additive work for you All percentages rounded. . . . . . . . . . . . . . . . - - - - - 47.4% 47.2% 49.8% 50.0% 49.3% 24.4% 38.4% 32.2% 30.7% 35.6% 40.5% 44.6% 44.4% 43.8% 44.8% Q3-23 Q4-23 Q1-24 Q2-24 Q3-24 7

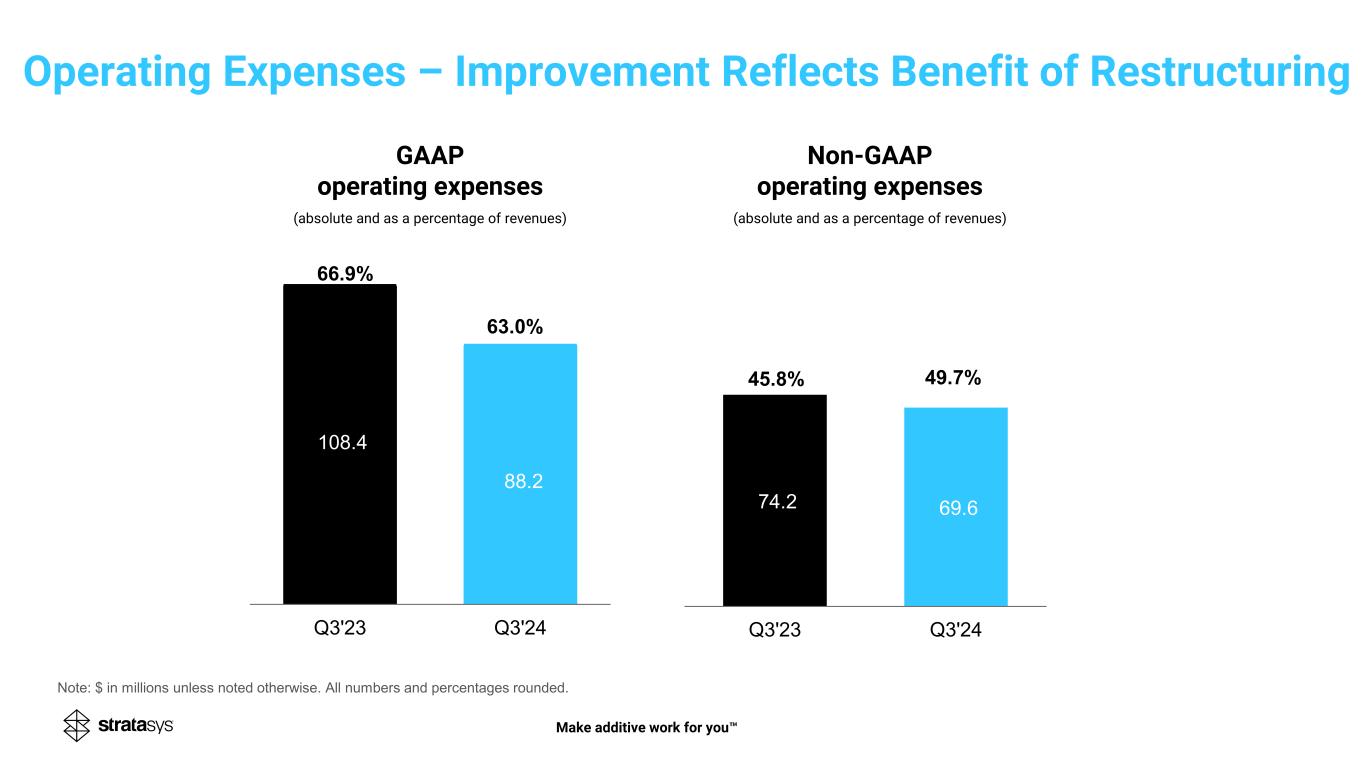

GAAP operating expenses (absolute and as a percentage of revenues) Non-GAAP operating expenses (absolute and as a percentage of revenues) 108.4 88.2 63.0% Q3'23 Q3'24 74.2 69.6 Q3'23 Q3'24 49.7% 66.9% 45.8% Make additive work for you Note: $ in millions unless noted otherwise. All numbers and percentages rounded. Operating Expenses – Improvement Reflects Benefit of Restructuring

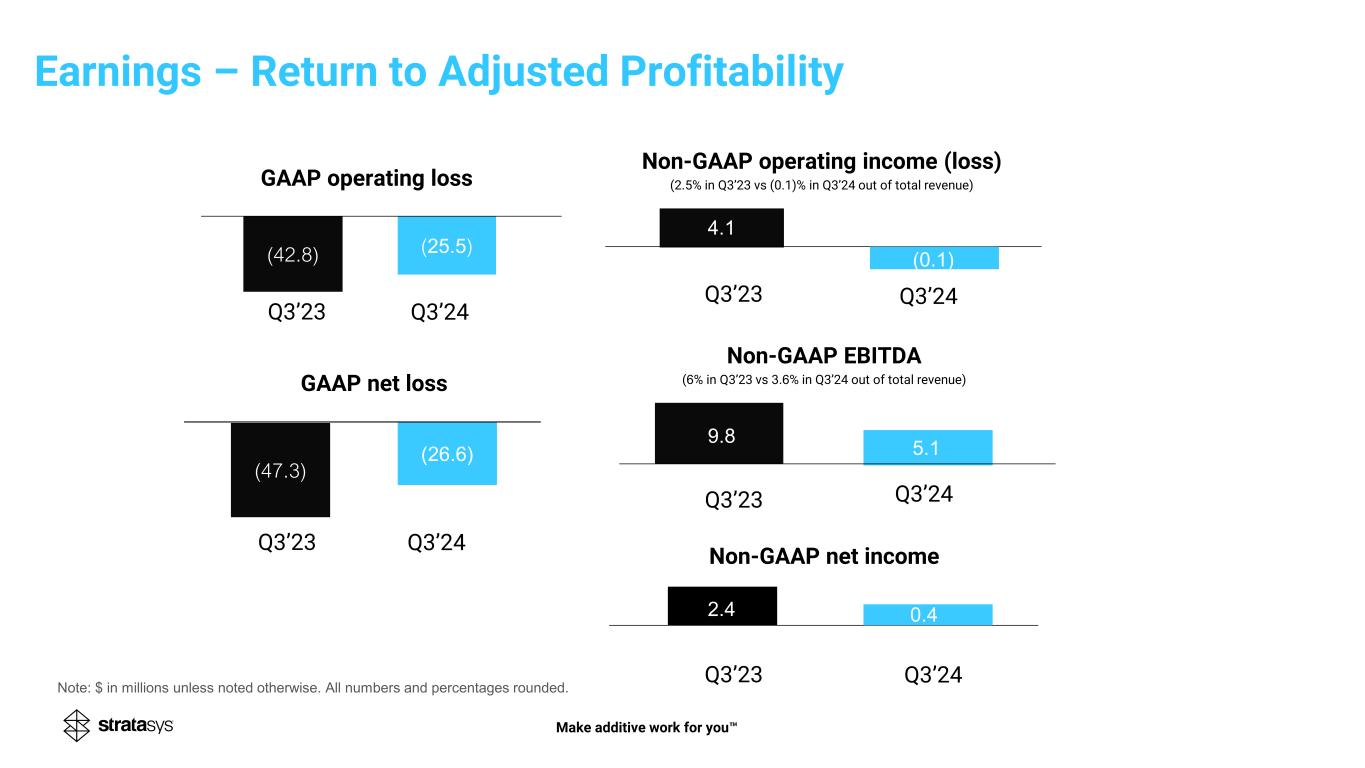

(47.3) )26.6( (42.8) (25.5) Non-GAAP operating income (loss) (2.5% in Q3’23 vs (0.1)% in Q3’24 out of total revenue)GAAP operating loss Non-GAAP net income GAAP net loss Note: $ in millions unless noted otherwise. All numbers and percentages rounded. Q3’23 Q3’24 5.19.8 0.4 Non-GAAP EBITDA (6% in Q3’23 vs 3.6% in Q3’24 out of total revenue) 4.1 (0.1) 2.4 Q3’23 Q3’24 Q3’23 Q3’24 Q3’23 Q3’24 Q3’23 Q3’24 Make additive work for you Earnings – Return to Adjusted Profitability

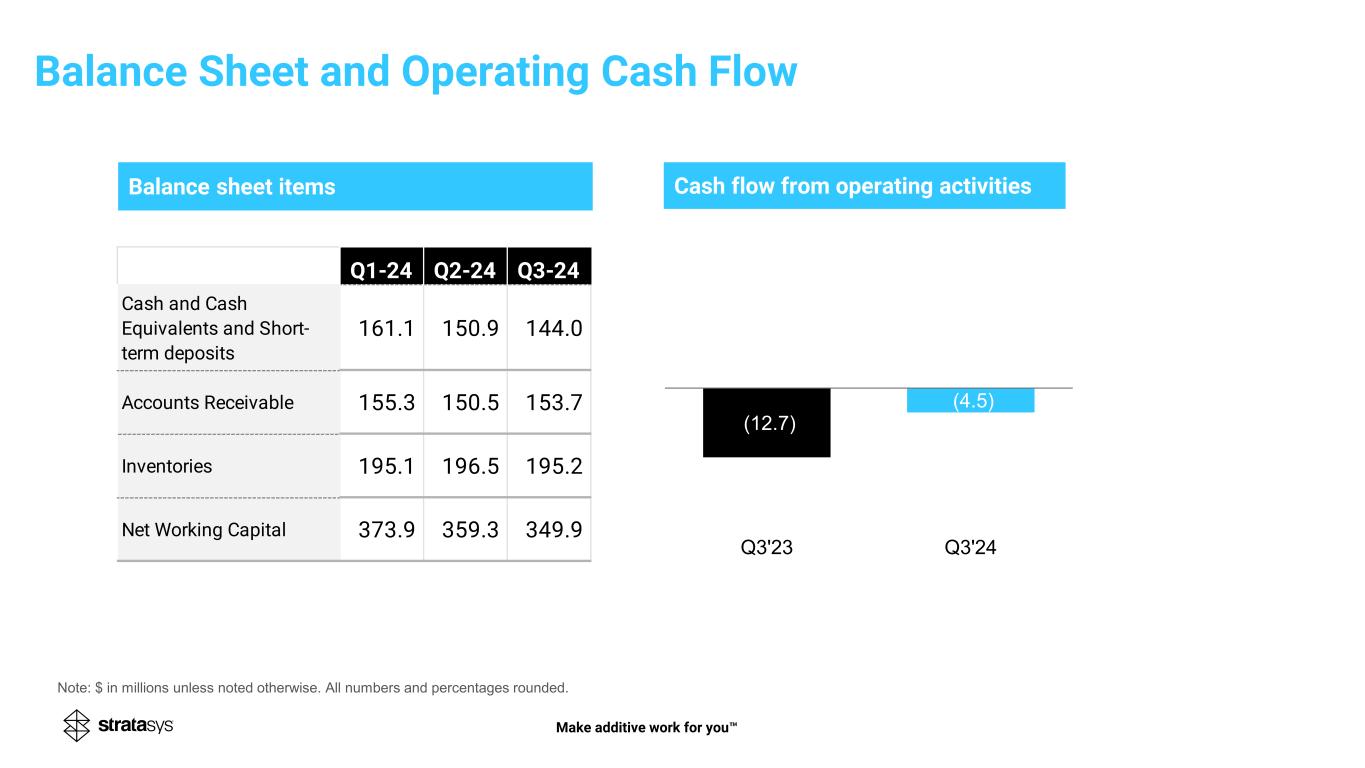

Balance sheet items Cash flow from operating activities 15 (12.7) (4.5) Q3'23 Q3'24 (75.4) (62.3) Make additive work for you Balance Sheet and Operating Cash Flow Note: $ in millions unless noted otherwise. All numbers and percentages rounded. Q1-24 Q2-24 Q3-24 Cash and Cash Equivalents and Short- term deposits 161.1 150.9 144.0 Accounts Receivable 155.3 150.5 153.7 Inventories 195.1 196.5 195.2 Net Working Capital 373.9 359.3 349.9

Revenue Gross Margins Non-GAAP Operating Expenses Non-GAAP Operating Margins EPS-diluted-adjusted ($1.48)-($1.27) GAAP EPS diluted CAPEXEBITDA-adjusted $570M – $580M 49.0% – 49.2% $276M – $278M $15M – $20M$25M – $28M Make additive work for you 2024 Outlook – Raising Margins and Profit Forecast $0.03 – $0.070.6% – 1.3%

CEO Dr. Yoav Zeif Summary Effective implementation of key initiatives to transform the company has streamlined the operations, improved margins, and tightened our focus to the most compelling use-cases Enabling our customers to more easily ramp their adoption of additive manufacturing with more intimate go-to-market engagements and better education for their system users Laser-focused on delivering enhanced profitability while preserving our strong balance sheet. With our market- leading systems, software and consumables we are poised to outperform when capital spending returns Repositioned the company to extend our leadership, setting the stage for a return to outsized growth, expanded profitability, and value creation for our shareholders Make additive work for you

Make additive work for you THANK YOU

Note: $ in thousands unless noted otherwise. All numbers and percentages rounded. GAAP Q3-24 Non-GAAP GAAP Adjustments Non-GAAP Gross Profit (1) $62,730 6,768 $69,498 $65,649 12,617 $78,266 Operating income (Loss) (1,2) (25,465) 25,351 (114) (42,798) 46,885 4,087 Net income (Loss) (1,2,3) (26,614) 26,985 371 (47,279) 49,725 2,446 Net income (Loss) per diluted share (4) (0.37) $0.38 0.01 (0.68) $0.72 0.04 1) Acquired intangible assets amortization expense 4,507 5,142 Non-cash stock-based compensation expense 912 891 Restructuring and other related costs 1,349 6,584 6,768 12,617 2) Acquired intangible assets amortization expense 1,124 2,599 Non-cash stock-based compensation expense 5,657 6,588 Restructuring and other related costs 7,585 2,360 Revaluation of investments - 4,300 Contingent consideration 519 265 Legal and other expenses 3,698 18,156 18,583 34,268 25,351 46,885 3) Corresponding tax effect 294 153 Equity method related expenses 981 2,525 Finance expenses 359 162 $26,985 $49,725 4) Weighted average number or ordinary shares outstanding – Diluted 71,271 71,417 69,093 69,815 Three Months Ended September 30, 2024 Three Months Ended September 30, 2023 Appendix