Exhibit (a)(5)(KK)

Support Nano Dimension’s Slate of Directors at Stratasys’ August 8th Annual Shareholder Meeting to Create Shareholder Value by Optimizing Strategic Consolidation JULY 2023 STRICTLY PRIVATE & CONFIDENTIAL

Forward Looking Statements This presentation of Nano Dimension Ltd. (the “Company” or “Nano Dimension”) contains “forward looking statements” within the meaning of the Private Securities Litigation Reform Act and other securities laws. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements. For example, the Company is using forward-looking statements when it discusses the objectives and outlook for Nano Dimension’s business, the Company’s plans for replacing the current Board of Directors of Stratasys Ltd. (“Stratasys”), the Company’s plans to explore industry consolidating transactions, the comparative benefits of the Company’s tender offer weighed against the anticipated outcome of the alternative transaction between Stratasys and Desktop Metal Inc. (“Desktop”), the integration of Stratasys’ assets, business verticals, and customer base into the Company’s current operations, the integration of Desktop’s assets, business verticals, and customer base into Stratasys’ current operations, and the potential upside of the Company’s and Stratasys’s products opportunities. Because such statements deal with future events and are based on the Company’s current expectations, they are subject to various risks and uncertainties. Actual results, performance, or achievements of Company’s could differ materially from those described in or implied by the statements in this Forward-looking statements are not historical facts, and are based upon management’s current expectations, beliefs and projections, many of which, by their nature, are inherently uncertain. Such expectations, beliefs and projections are expressed in good faith. However, there can be no assurance that management’s expectations, beliefs and projections will be achieved, and actual results may differ materially from what is expressed in or indicated by the forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the forward-looking statements. For a more detailed description of the risks and uncertainties affecting the Company and Stratasys, reference is made to the Company’s and Stratasys’s reports filed from time to time with the Securities and Exchange Commission (“SEC”), including, but not limited to, the risks detailed in the Company’s annual report for the year ended December 31, 2022, and the risks detailed in Stratasys’s annual report for the year ended December 31, 2022, filed with the SEC. Forward-looking statements speak only as of the date the statements are made. The Company assumes no obligation to update forward-looking statements to reflect actual results, subsequent events or circumstances, changes in assumptions or changes in other factors affecting forward-looking information except to the extent required by applicable securities laws. If the Company does update one or more forward-looking statements, no inference should be drawn that the Company will make additional updates with respect thereto or with respect to other forward-looking statements. Certain of the statistical and graphical information contained in this presentation is drawn from research databases and other sources, including websites of the Company’s competitors. Such expectations, beliefs and projections as they relate to information derived from these sources are expressed in good faith, but the actual data and information derived from these sources may differ materially from what is described herein. Nano Dimension

Important Information About the Special Tender Offer This presentation is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell any ordinary shares of Stratasys Ltd. (“Stratasys”) or any other securities, nor is it a substitute for the tender offer materials described herein. A tender offer statement on Schedule TO, including an offer to purchase, a related letter of transmittal and other tender offer documents, was filed with the SEC by Nano Dimension on May 25, 2023, as subsequently amended and supplemented. Stratasys filed with the SEC a solicitation/recommendation statement on Schedule 14D-9, as required by the tender offer rules, on May 30, 2023, as subsequently amended. INVESTORS AND SECURITY HOLDERS ARE URGED TO CAREFULLY READ BOTH THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 REGARDING THE OFFER, AS THEY MAY BE AMENDED FROM TIME TO TIME, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT INVESTORS AND SECURITY HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SECURITIES. Investors and security holders may obtain a free copy of the Offer to Purchase, the related Letter of Transmittal, certain other tender offer documents and the Solicitation/Recommendation Statement and other documents filed with the SEC at the website maintained by the SEC at www.sec.gov or by directing such requests to the information agent for the tender offer, which will be named in the tender offer statement. In addition, Stratasys files annual reports, interim financial statements and other information, and Nano Dimension files annual reports, interim financial statements and other information with the SEC, which are available to the public from commercial document-retrieval services and at the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by Stratasys may be obtained at no charge on the investor relations page of Stratasys’ website at www.stratasys.com. Copies of the documents filed with the SEC by Nano Dimension may be obtained at no charge on the investor relations page of Nano Dimension’s website at www.nano-di.com. Nano Dimension

Executive Summary: Stratasys’ Board Has Failed Shareholders Through its Value Destructive Actions Stratasys’ Board Continues to Destroy Shareholder Value Stratasys’ Board has fundamentally breached its fiduciary duty to maximize shareholder value Board refusal to engage and even consider multiple offers it received at a significant premium is irresponsible and represents a complete neglect of the Board’s responsibility to shareholders Instead, the Board has relied on its Shareholder Rights Plan (or “Poison Pill”) to remain in control of the company and thwart the consolidation that is needed to accelerate value creation and reverse Stratasys’ underperformance Stratasys’ Board is Entrenched and Over Tenured, Leading to Conflicted Decision Making and Ineffective Oversight Entrenched Board is acting with self-interest, with 5 of 8 directors conflicted, having already secured Board positions in proposed Desktop Metal combination Four directors have served for 10+ years, despite having overseen $450+ million of value destruction during their tenures(1) Stratasys’ Board Pursues an Ill-Conceived Deal to Combine with Desktop Metal The proposed Desktop Metal transaction is defensive and has been received poorly by various market participants and stakeholders; both on the buy-side and sell-side(2) The deal is highly dilutive to all Stratasys shareholders The transaction is a lifeline for Desktop Metal with a risky and uncertain outlook for the combined company Note: (1) Change in Stratasys’ market cap since December 2012; (2) Refer to page 16 Nano Dimension

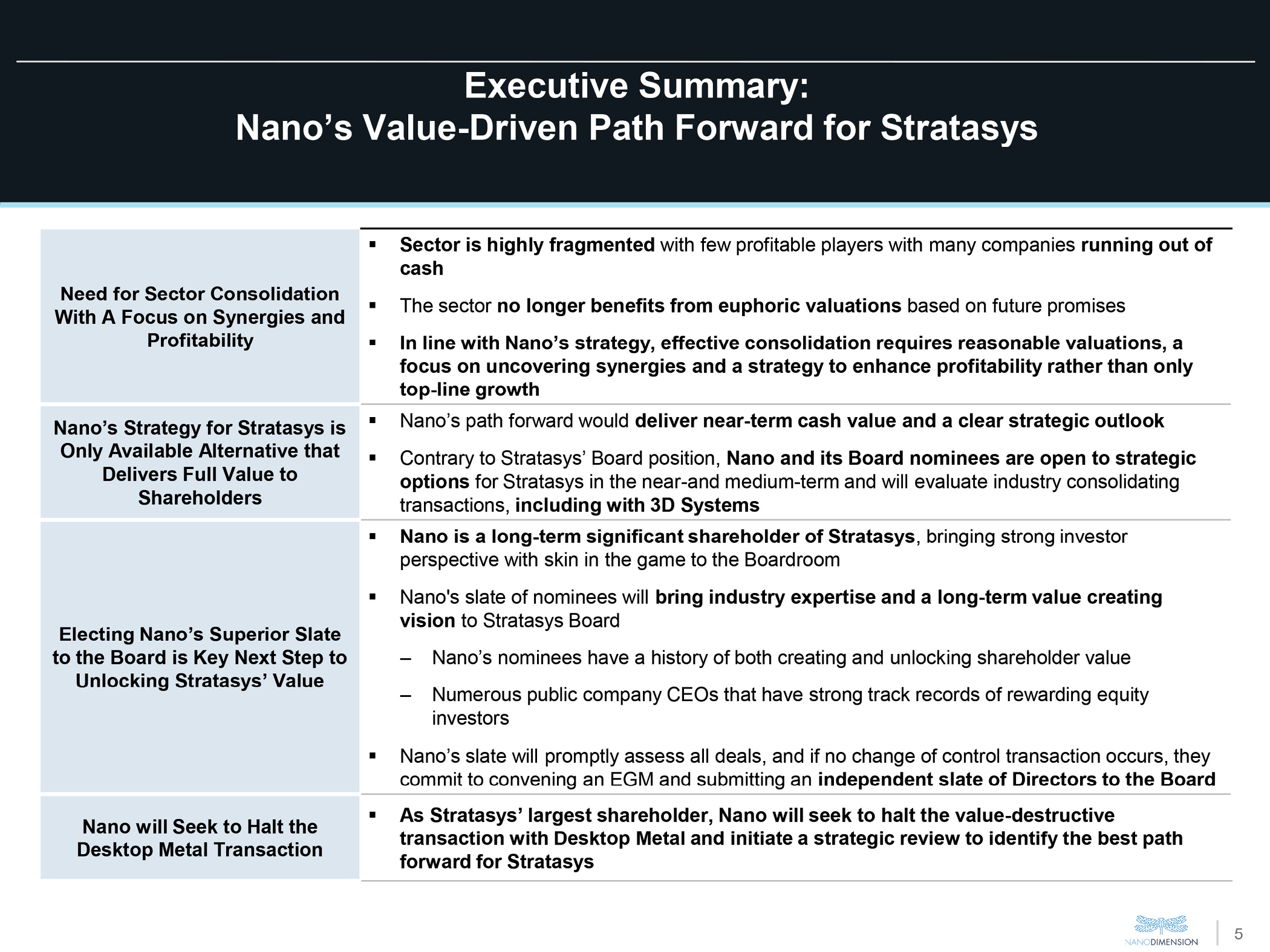

Executive Summary: Nano’s Value-Driven Path Forward for Stratasys Need for Sector Consolidation With A Focus on Synergies and Profitability Sector is highly fragmented with few profitable players with many companies running out of cash The sector no longer benefits from euphoric valuations based on future promises In line with Nano’s strategy, effective consolidation requires reasonable valuations, a focus on uncovering synergies and a strategy to enhance profitability rather than only top-line growth Nano’s Strategy for Stratasys is Only Available Alternative that Delivers Full Value to Shareholders Nano’s path forward would deliver near-term cash value and a clear strategic outlook Contrary to Stratasys’ Board position, Nano and its Board nominees are open to strategic options for Stratasys in the near-and medium-term and will evaluate industry consolidating transactions, including with 3D Systems Electing Nano’s Superior Slate to the Board is Key Next Step to Unlocking Stratasys’ Value Nano is a long-term significant shareholder of Stratasys, bringing strong investor perspective with skin in the game to the Boardroom Nano’s slate of nominees will bring industry expertise and a long-term value creating vision to Stratasys Board ‒Nano’s nominees have a history of both creating and unlocking shareholder value ‒Numerous public company CEOs that have strong track records of rewarding equity investors Nano’s slate will promptly assess all deals, and if no change of control transaction occurs, they commit to convening an EGM and submitting an independent slate of Directors to the Board Nano will Seek to Halt the Desktop Metal Transaction As Stratasys’ largest shareholder, Nano will seek to halt the value-destructive transaction with Desktop Metal and initiate a strategic review to identify the best path forward for Stratasys Nano Dimension

Executive Summary: Nano’s Value-Driven Path Forward for Stratasys Nano Encourages Stratasys Shareholders to Vote for Nano’s Nominees on August 8th Nano urges Stratasys shareholders to protect their investment and the future of Stratasys Use the white proxy card to vote “FOR” the nominees proposed by Nano and replace Stratasys’ nominees Votes must be received by 11:59 p.m. ET on August 7th, 2023 via proxy card for Record Shareholders or voting instruction form for shareholders who hold their shares through bank or brokerage accounts, online atwww.proxyvote.com, or by phone Nano Dimension

Stratasys’ Board has Continuously Destroyed Value and Failed Shareholders Nano Dimension Electrifying Additive Manufacturing

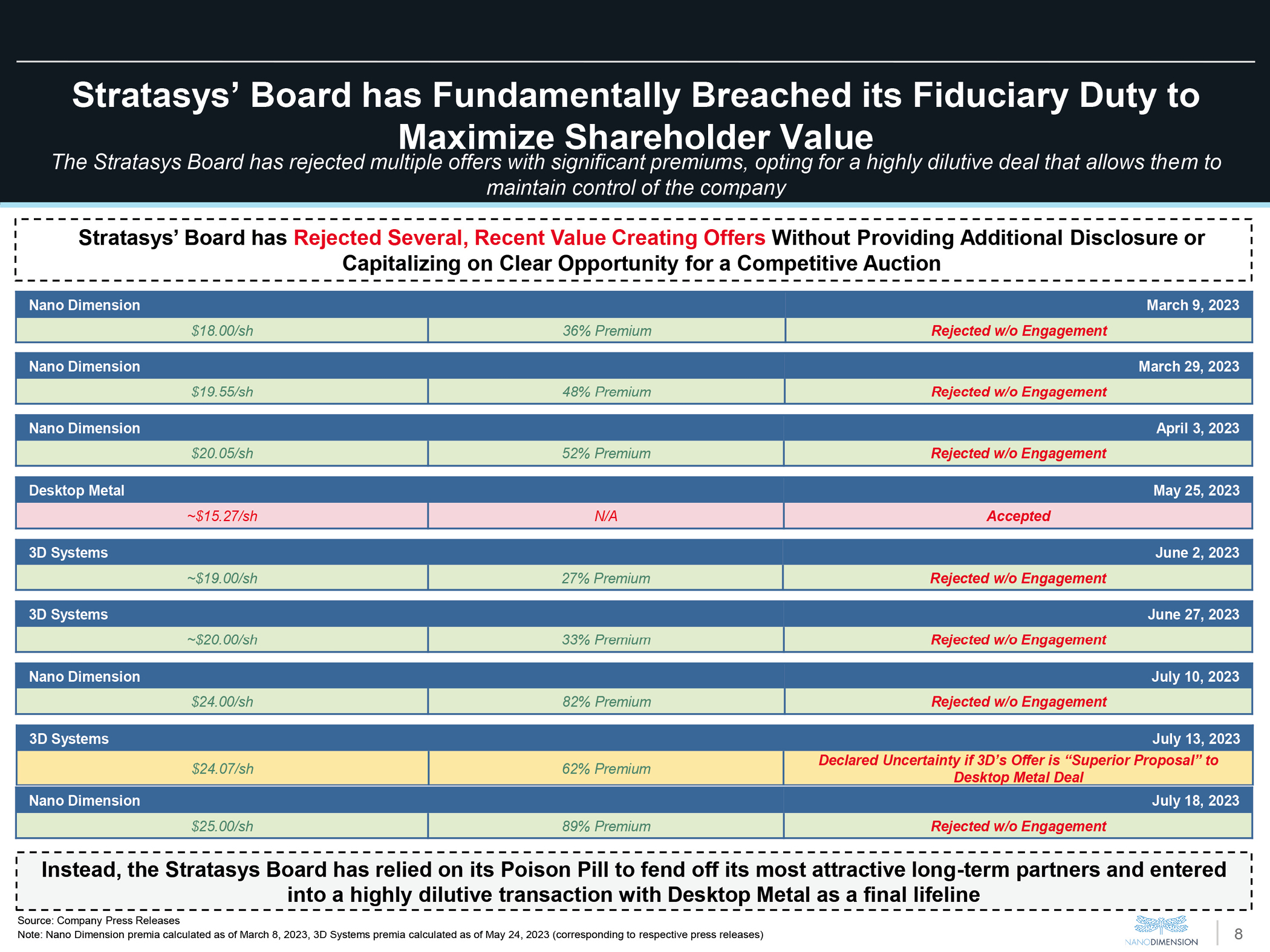

Stratasys’ Board has Fundamentally Breached its Fiduciary Duty to Maximize Shareholder Value Stratasys’ Board has Rejected Several, Recent Value Creating Offers Without Providing Additional Disclosure or Capitalizing on Clear Opportunity for a Competitive Auction8 The Stratasys Board has rejected multiple offers with significant premiums, opting for a highly dilutive deal that allows them to maintain control of the company Nano Dimension March 9, 2023 $18.00/sh 36% Premium Rejected w/o Engagement Nano Dimension March 29, 2023 $19.55/sh 48% Premium Rejected w/o Engagement Nano Dimension April 3, 2023 $20.05/sh 52% Premium Rejected w/o Engagement Desktop Metal May 25, 2023 ~$15.27/sh N/A Accepted 3D Systems June 2, 2023 ~$19.00/sh 27% Premium Rejected w/o Engagement 3D Systems June 27, 2023 ~$20.00/sh 33% Premium Rejected w/o Engagement Nano Dimension July 10, 2023 $24.00/sh 82% Premium Rejected w/o Engagement 3D Systems July 13, 2023 $24.07/sh 62% Premium Declared Uncertainty if 3D’s Offer is “Superior Proposal” to Desktop Metal Deal Nano Dimension July 18, 2023 $25.00/sh 89% Premium Rejected w/o Engagement Instead, the Stratasys Board has relied on its Poison Pill to fend off its most attractive long-term partners and entered into a highly dilutive transaction with Desktop Metal as a final lifeline Source: Company Press Releases Note: Nano Dimension premia calculated as of March 8, 2023, 3D Systems premia calculated as of May 24, 2023 (corresponding to respective press releases) Nano Dimension

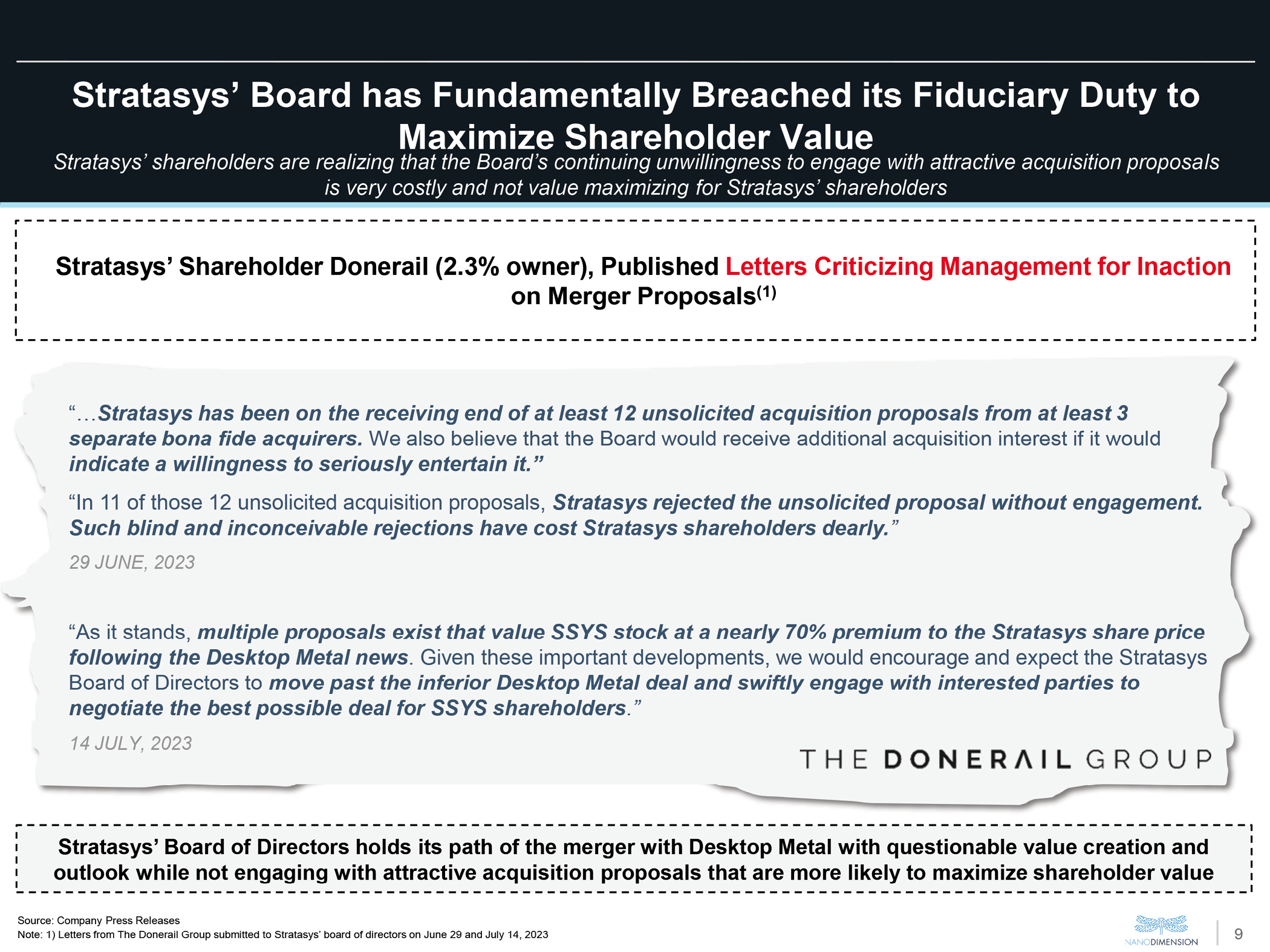

Stratasys’ Board has Fundamentally Breached its Fiduciary Duty to Maximize Shareholder Value Stratasys’ shareholders are realizing that the Board’s continuing unwillingness to engage with attractive acquisition proposals is very costly and not value maximizing for Stratasys’ shareholders Stratasys’ Shareholder Donerail (2.3% owner), PublishedLetters Criticizing Management for Inaction on Merger Proposals(1) “…Stratasys has been on the receiving end of at least 12 unsolicited acquisition proposals from at least 3 separate bona fide acquirers. We also believe that the Board would receive additional acquisition interest if it would indicate a willingness to seriously entertain it.” “In 11 of those 12 unsolicited acquisition proposals, Stratasys rejected the unsolicited proposal without engagement. Such blind and inconceivable rejections have cost Stratasys shareholders dearly.” 29 JUNE, 2023 “As it stands, multiple proposals exist that value SSYS stock at a nearly 70% premium to the Stratasys share price following the Desktop Metal news. Given these important developments, we would encourage and expect the Stratasys Board of Directors to move past the inferior Desktop Metal deal and swiftly engage with interested parties to negotiate the best possible deal for SSYS shareholders.” 14 JULY, 2023 Stratasys’ Board of Directors holds its path of the merger with Desktop Metal with questionable value creation and outlook while not engaging with attractive acquisition proposals that are more likely to maximize shareholder value Source: Company Press Releases Note: 1) Letters from The Donerail Group submitted to Stratasys’ board of directors on June 29 and July 14, 2023 The Donerail group Nano Dimension

Stratasys’ Board is Both Entrenched and Over Tenured, Leading to Conflicted Decision Making and Absence of Oversight Nano Dimension Electrifying Additive Manufacturing

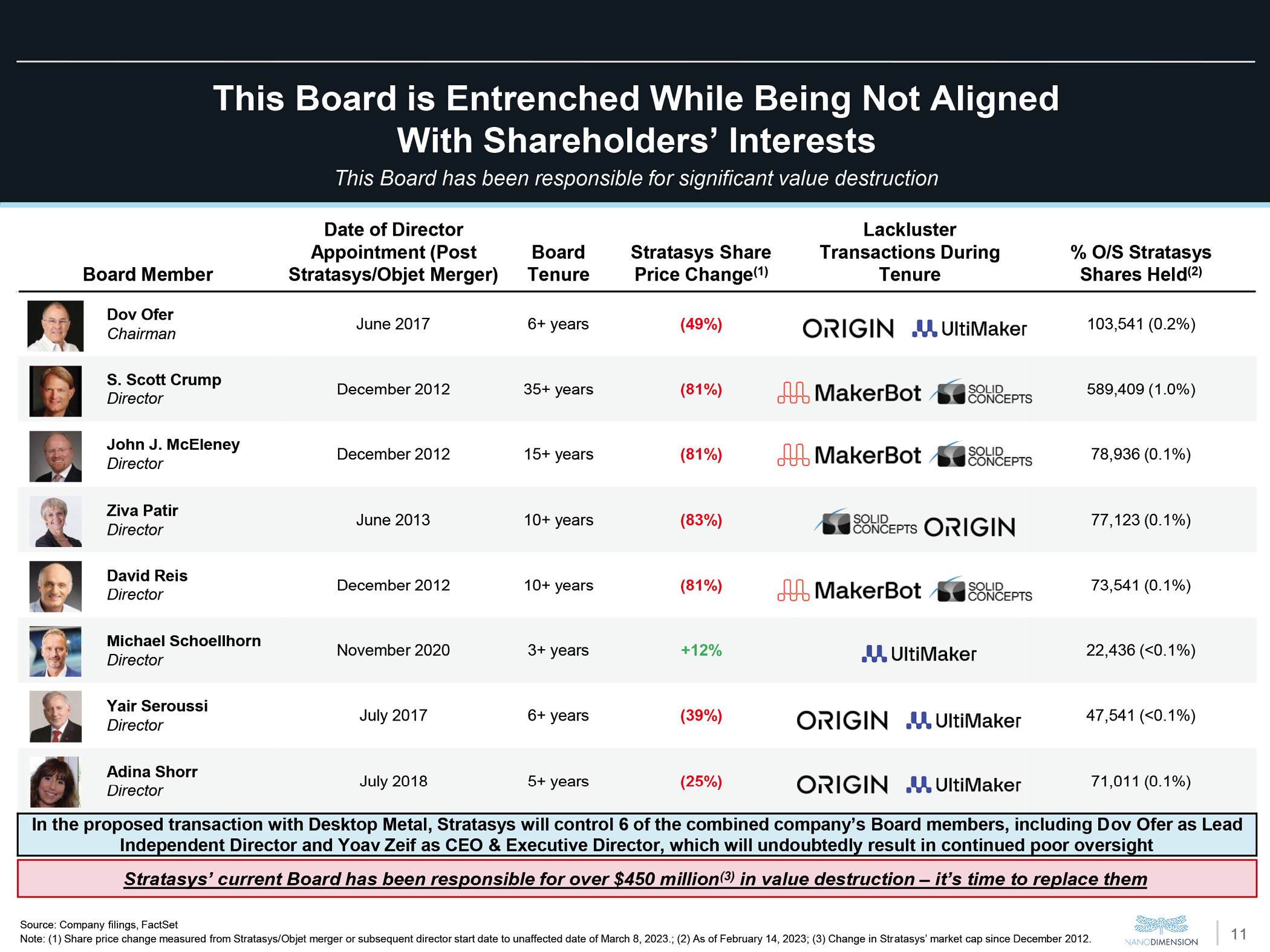

This Board is Entrenched While Being Not Aligned With Shareholders’ Interests This Board has been responsible for significant value destruction Board Member Date of Director Appointment (Post Stratasys/Objet Merger) Board Tenure Stratasys Share Price Change(1) Lackluster Transactions During Tenure% O/S Stratasys Shares Held(2) Board Member Date of Director Appointment (Post Stratasys/Objet Merger) Board Tenure Stratasys Share Price Change(1) Lackluster Transactions During Tenure% O/S Stratasys Shares Held(2) Dov Ofer Chairman June 2017 6+ years (49%) 103,541 (0.2%) S. Scott Crump Director December 2012 35+ years (81%) 589,409 (1.0%) John J. McEleney Director December 2012 15+ years (81%) 78,936 (0.1%) Ziva Patir Director June 2013 10+ years (83%) 77,123 (0.1%) David Reis Director December 2012 10+ years (81%) 73,541 (0.1%) Michael Schoellhorn Director November 2020 3+ years +12% 22,436 (<0.1%) Yair Seroussi Director July 2017 6+ years (39%) 47,541 (<0.1%) Adina Shorr Director July 2018 5+ years (25%) 71,011 (0.1%) In the proposed transaction with Desktop Metal, Stratasys will control 6 of the combined company’s Board members, including Dov Ofer as Lead Independent Director and Yoav Zeif as CEO & Executive Director, which will undoubtedly result in continued poor oversight Stratasys’ current Board has been responsible for over $450 million(3) in value destruction – it’s time to replace them Source: Company filings, FactSet Note: (1) Share price change measured from Stratasys/Objet merger or subsequent director start date to unaffected date of March 8, 2023.; (2) As of February 14, 2023; (3) Change in Stratasys’ market cap since December 2012.

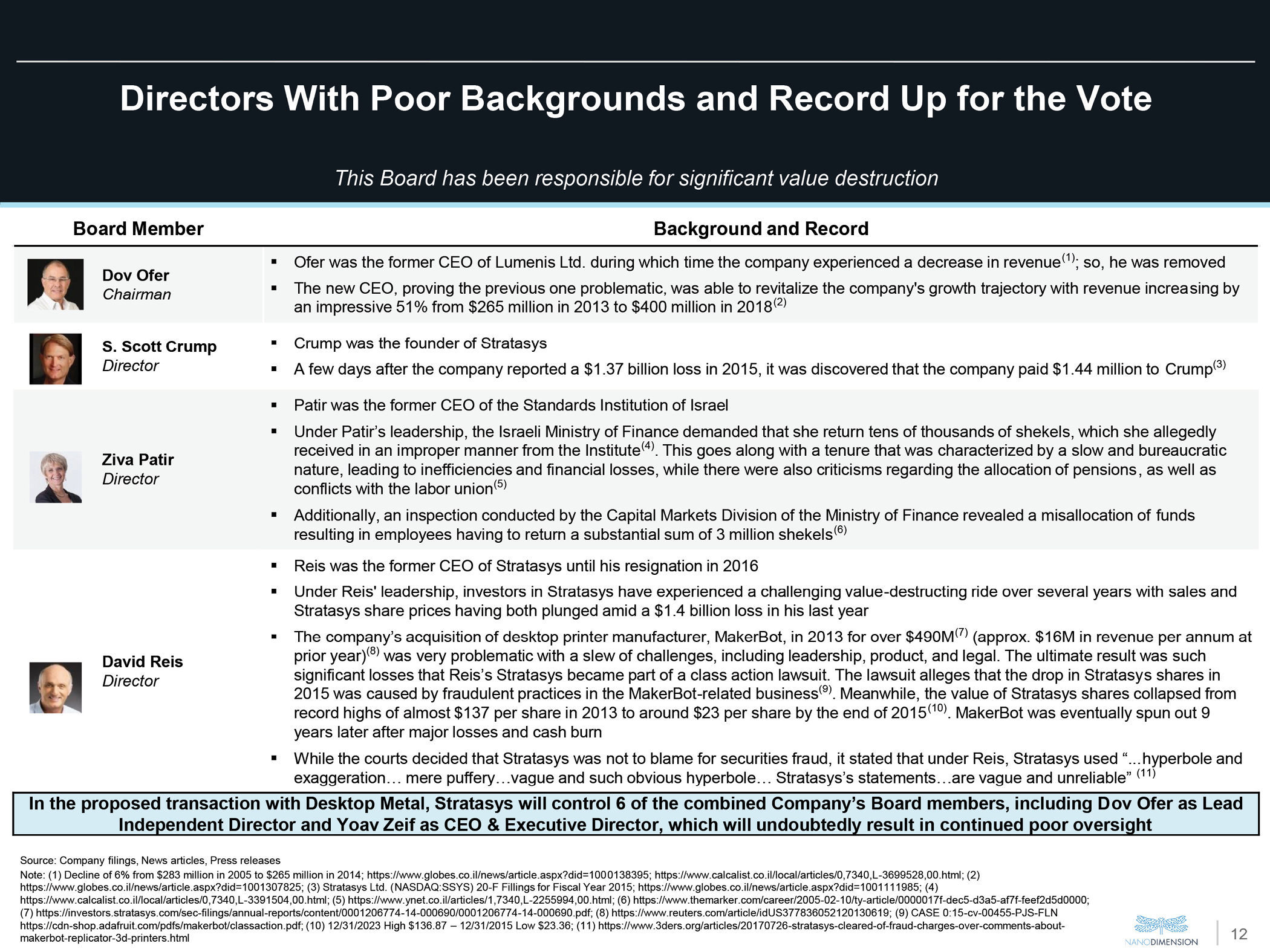

Directors With Poor Backgrounds and Record Up for the Vote This Board has been responsible for significant value destruction Board Member Background and Record Board Member Background and Record Dov Ofer Chairman Ofer was the former CEO of Lumenis Ltd. during which time the company experienced a decrease in revenue(1); so, he was removed The new CEO, proving the previous one problematic, was able to revitalize the company’s growth trajectory with revenue increasing by an impressive 51% from $265 million in 2013 to $400 million in 2018(2) S. Scott Crump Director Crump was the founder of Stratasys A few days after the company reported a $1.37 billion loss in 2015, it was discovered that the company paid $1.44 million to Crump(3) Ziva Patir Director Patir was the former CEO of the Standards Institution of Israel Under Patir’s leadership, the Israeli Ministry of Finance demanded that she return tens of thousands of shekels, which she allegedly received in an improper manner from the Institute(4). This goes along with a tenure that was characterized by a slow and bureaucratic nature, leading to inefficiencies and financial losses, while there were also criticisms regarding the allocation of pensions, as well as conflicts with the labor union(5) Additionally, an inspection conducted by the Capital Markets Division of the Ministry of Finance revealed a misallocation of funds resulting in employees having to return a substantial sum of 3 million shekels(6) David Reis Director Reis was the former CEO of Stratasys until his resignation in 2016 Under Reis’ leadership, investors in Stratasys have experienced a challenging value-destructing ride over several years with sales and Stratasys share prices having both plunged amid a $1.4 billion loss in his last year The company’s acquisition of desktop printer manufacturer, MakerBot, in 2013 for over $490M(7) (approx. $16M in revenue per annum at prior year)(8) was very problematic with a slew of challenges, including leadership, product, and legal. The ultimate result was such significant losses that Reis’s Stratasys became part of a class action lawsuit. The lawsuit alleges that the drop in Stratasys shares in 2015 was caused by fraudulent practices in the MakerBot-related business(9). Meanwhile, the value of Stratasys shares collapsed from record highs of almost $137 per share in 2013 to around $23 per share by the end of 2015(10). MakerBot was eventually spun out 9 years later after major losses and cash burn While the courts decided that Stratasys was not to blame for securities fraud, it stated that under Reis, Stratasys used “...hyperbole and exaggeration… mere puffery…vague and such obvious hyperbole… Stratasys’s statements…are vague and unreliable” (11) In the proposed transaction with Desktop Metal, Stratasys will control 6 of the combined Company’s Board members, including Dov Ofer as Lead Independent Director and Yoav Zeif as CEO & Executive Director, which will undoubtedly result in continued poor oversight Source: Company filings, News articles, Press releases Note: (1) Decline of 6% from $283 million in 2005 to $265 million in 2014; https://www.globes.co.il/news/article.aspx?did=1000138395; https://www.calcalist.co.il/local/articles/0,7340,L-3699528,00.html; (2) https://www.globes.co.il/news/article.aspx?did=1001307825; (3) Stratasys Ltd. (NASDAQ:SSYS) 20-F Fillings for Fiscal Year 2015; https://www.globes.co.il/news/article.aspx?did=1001111985; (4) https://www.calcalist.co.il/local/articles/0,7340,L-3391504,00.html; (5) https://www.ynet.co.il/articles/1,7340,L-2255994,00.html; (6) https://www.themarker.com/career/2005-02-10/ty-article/0000017f-dec5-d3a5-af7f-feef2d5d0000; (7) https://investors.stratasys.com/sec-filings/annual-reports/content/0001206774-14-000690/0001206774-14-000690.pdf; (8) https://www.reuters.com/article/idUS377836052120130619; (9) CASE 0:15-cv-00455-PJS-FLN https://cdn-shop.adafruit.com/pdfs/makerbot/classaction.pdf; (10) 12/31/2023 High $136.87 – 12/31/2015 Low $23.36; (11) https://www.3ders.org/articles/20170726-stratasys-cleared-of-fraud-charges-over-comments-about-makerbot-replicator-3d-printers.html

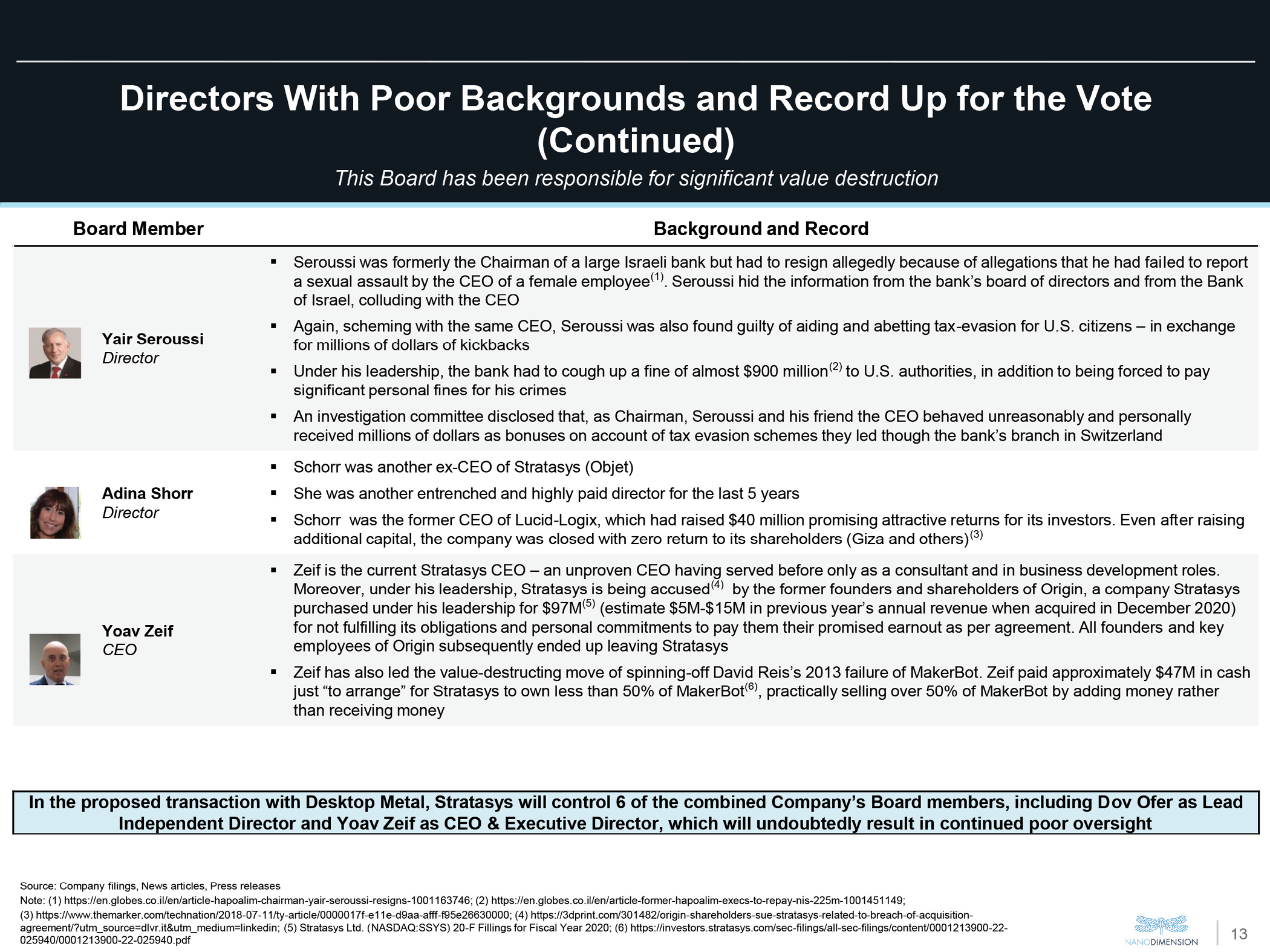

Directors With Poor Backgrounds and Record Up for the Vote (Continued) This Board has been responsible for significant value destruction Board Member Background and Record Yair Seroussi Director Seroussi was formerly the Chairman of a large Israeli bank but had to resign allegedly because of allegations that he had failed to report a sexual assault by the CEO of a female employee(1). Seroussi hid the information from the bank’s board of directors and from the Bank of Israel, colluding with the CEO Again, scheming with the same CEO, Seroussi was also found guilty of aiding and abetting tax-evasion for U.S. citizens – in exchange for millions of dollars of kickbacks Under his leadership, the bank had to cough up a fine of almost $900 million(2) to U.S. authorities, in addition to being forced to pay significant personal fines for his crimes An investigation committee disclosed that, as Chairman, Seroussi and his friend the CEO behaved unreasonably and personally received millions of dollars as bonuses on account of tax evasion schemes they led though the bank’s branch in Switzerland Adina Shorr Director Schorr was another ex-CEO of Stratasys (Objet) She was another entrenched and highly paid director for the last 5 years Schorr was the former CEO of Lucid-Logix, which had raised $40 million promising attractive returns for its investors. Even after raising additional capital, the company was closed with zero return to its shareholders (Giza and others)(3) Yoav Zeif CEO Zeif is the current Stratasys CEO – an unproven CEO having served before only as a consultant and in business development roles. Moreover, under his leadership, Stratasys is being accused(4) by the former founders and shareholders of Origin, a company Stratasys purchased under his leadership for $97M(5) (estimate $5M-$15M in previous year’s annual revenue when acquired in December 2020) for not fulfilling its obligations and personal commitments to pay them their promised earnout as per agreement. All founders and key employees of Origin subsequently ended up leaving Stratasys Zeif has also led the value-destructing move of spinning-off David Reis’s 2013 failure of MakerBot. Zeif paid approximately $47M in cash just “to arrange” for Stratasys to own less than 50% of MakerBot(6), practically selling over 50% of MakerBot by adding money rather than receiving money In the proposed transaction with Desktop Metal, Stratasys will control 6 of the combined Company’s Board members, including Dov Ofer as Lead Independent Director and Yoav Zeif as CEO & Executive Director, which will undoubtedly result in continued poor oversight Source: Company filings, News articles, Press releases Note: (1) https://en.globes.co.il/en/article-hapoalim-chairman-yair-seroussi-resigns-1001163746; (2) https://en.globes.co.il/en/article-former-hapoalim-execs-to-repay-nis-225m-1001451149; (3) https://www.themarker.com/technation/2018-07-11/ty-article/0000017f-e11e-d9aa-afff-f95e26630000; (4) https://3dprint.com/301482/origin-shareholders-sue-stratasys-related-to-breach-of-acquisition-agreement/?utm_source=dlvr.it&utm_medium=linkedin; (5) Stratasys Ltd. (NASDAQ:SSYS) 20-F Fillings for Fiscal Year 2020; (6) https://investors.stratasys.com/sec-filings/all-sec-filings/content/0001213900-22-025940/0001213900-22-025940.pdf

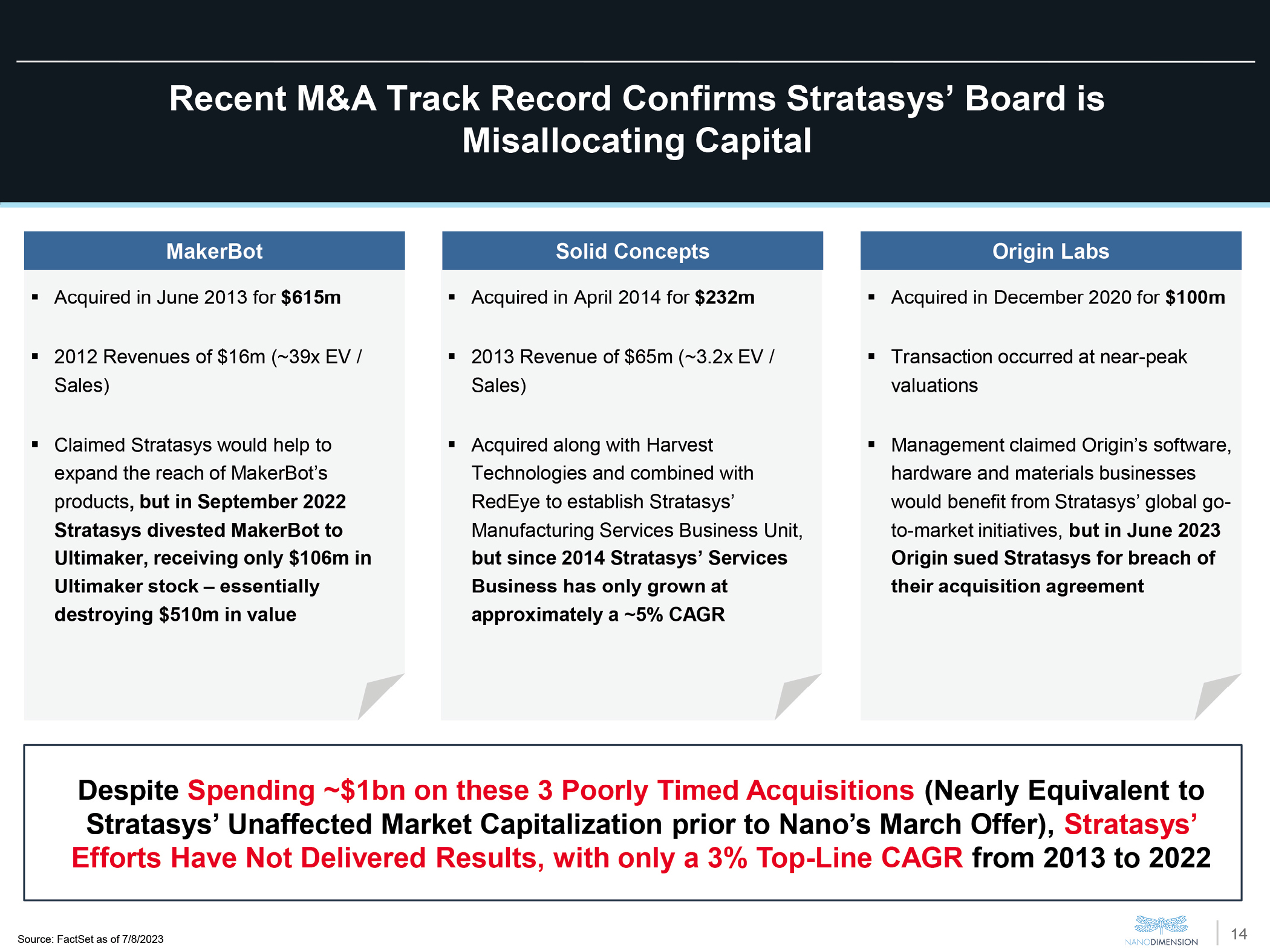

Recent M&A Track Record Confirms Stratasys’ Board is Misallocating Capital MakerBot Solid Concepts Origin Labs Acquired in June 2013 for $615m 2012 Revenues of $16m (~39x EV / Sales) Claimed Stratasys would help to expand the reach of MakerBot’s products, but in September 2022 Stratasys divested MakerBot to Ultimaker, receiving only $106m in Ultimaker stock – essentially destroying $510m in value Acquired in April 2014 for $232m 2013 Revenue of $65m (3.2x EV / Sales) Acquired along with Harvest Technologies and combined with RedEye to establish Stratasys’ Manufacturing Services Business Unit, but since 2014 Stratasys’ Services Business has only grown at approximately a 5% CAGR Acquired in December 2020 for $100m Transaction occurred at near-peak valuations Management claimed Origin’s software, hardware and materials businesses would benefit from Stratasys’ global go-to-market initiatives, but in June 2023 Origin sued Stratasys for breach of their acquisition agreement Despite Spending ~$1bn on these 3 Poorly Timed Acquisitions (Nearly Equivalent to Stratasys’ Unaffected Market Capitalization prior to Nano’s March Offer), Stratasys’ Efforts Have Not Delivered Results, with only a 3% Top-Line CAGR from 2013 to 2022 Source: FactSet as of 7/8/2023

Over the Last 10 Years, Stratasys has Substantially Lagged Other Benchmarks Four of the Eight current Board members oversaw this poor performance Stratasys Share Price Performance vs. Key Indexes – Last 10 Years from Unaffected (3/8/2023) 0% 100% 200% 300% 400% 500% 600% 700% 800% 900% Mar-13 Jun-14 Sep-15 Dec-16 Mar-18 Jun-19 Sep-20 Dec-21 Mar-23 S&P 500 Hardware & Technology +708% NASDAQ +336% Source: FactSet as of 7/19/2023 Note: Share price change represents percentage change from 3/8/2013 to 3/8/2023.

Current Stratasys Board is Pursuing an Ill-Conceived Deal to Combine with Desktop Metal at the Expense of Shareholders Nano dimension Electrifying Additive Manufacturing

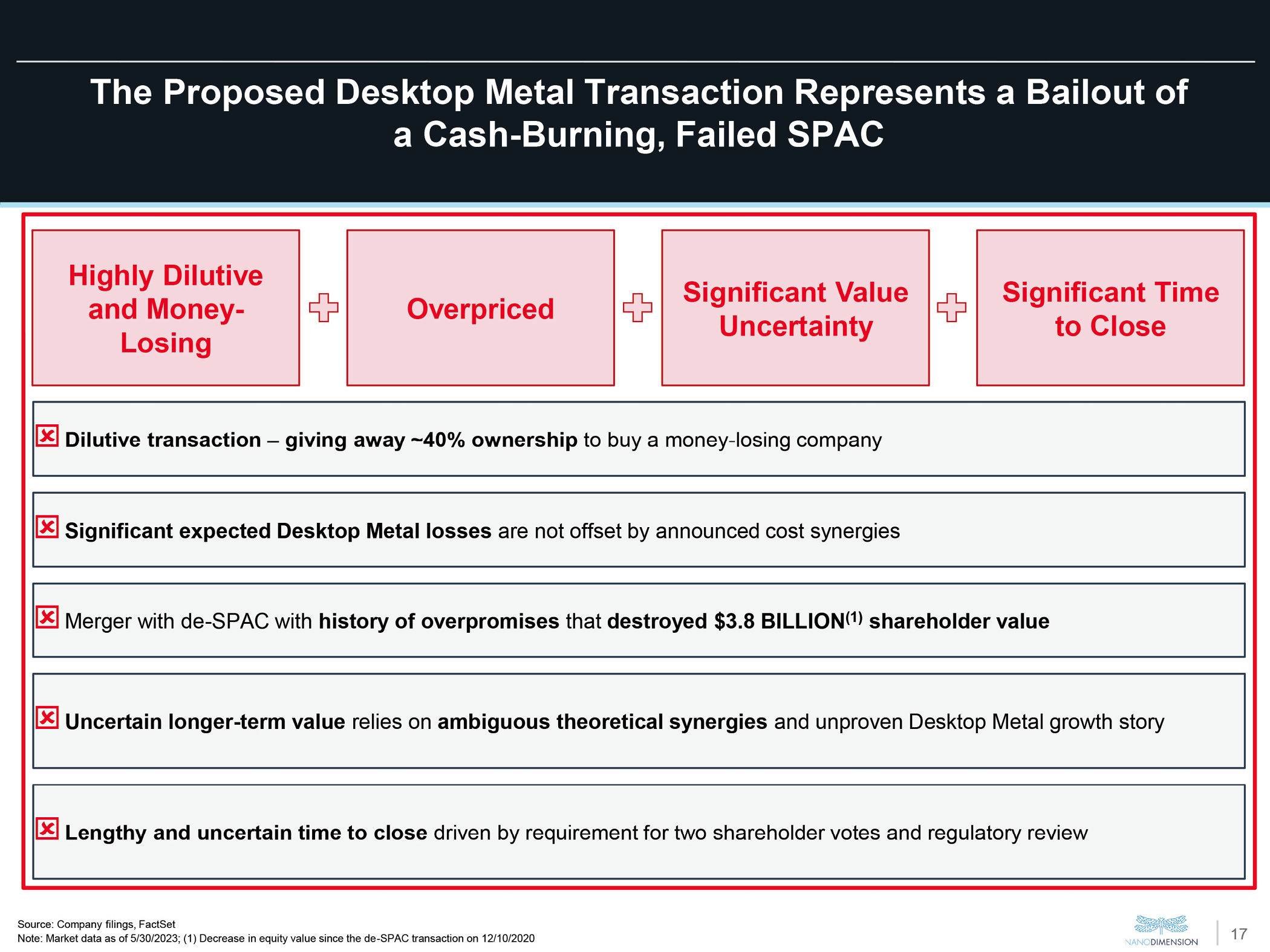

The Proposed Desktop Metal Transaction Represents a Bailout of a Cash-Burning, Failed SPAC Highly Dilutive and Money-Losing Overpriced Significant Value Uncertainty Significant Time to Close Dilutive transaction – giving away ~40% ownership to buy a money-losing company Significant expected Desktop Metal losses are not offset by announced cost synergies Merger with de-SPAC with history of overpromises that destroyed $3.8 BILLION(1) shareholder value Uncertain longer-term value relies on ambiguous theoretical synergies and unproven Desktop Metal growth story Lengthy and uncertain time to close driven by requirement for two shareholder votes and regulatory review Source: Company filings, FactSet Note: Market data as of 5/30/2023; (1) Decrease in equity value since the de-SPAC transaction on 12/10/2020 Nano dimension

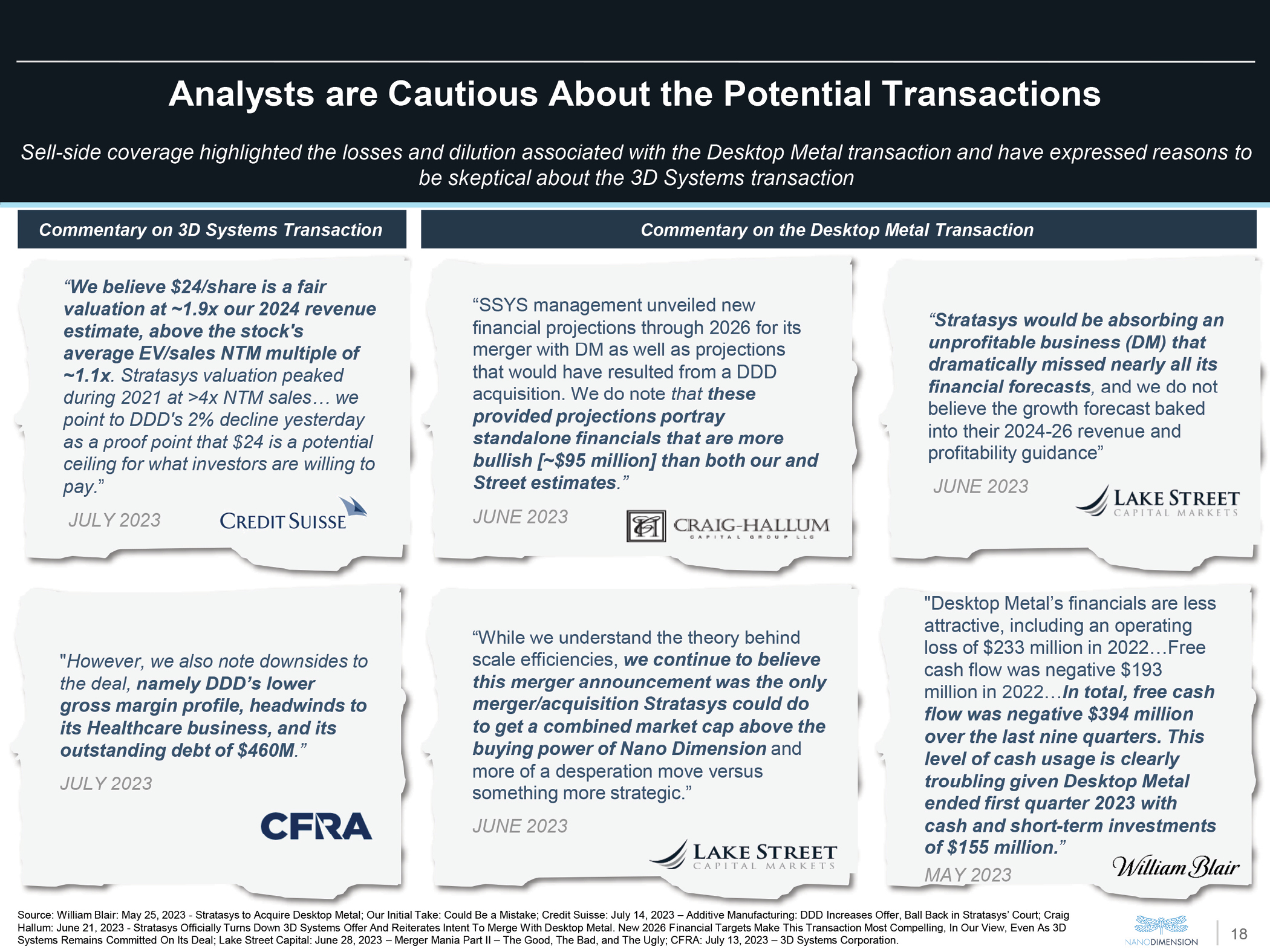

Analysts are Cautious About the Potential Transactions Sell-side coverage highlighted the losses and dilution associated with the Desktop Metal transaction and have expressed reasons to be skeptical about the 3D Systems transaction18 Source: William Blair: May 25, 2023 - Stratasys to Acquire Desktop Metal; Our Initial Take: Could Be a Mistake; Credit Suisse: July 14, 2023 – Additive Manufacturing: DDD Increases Offer, Ball Back in Stratasys’ Court; Craig Hallum: June 21, 2023 - Stratasys Officially Turns Down 3D Systems Offer And Reiterates Intent To Merge With Desktop Metal. New 2026 Financial Targets Make This Transaction Most Compelling, In Our View, Even As 3D Systems Remains Committed On Its Deal; Lake Street Capital: June 28, 2023 – Merger Mania Part II – The Good, The Bad, and The Ugly; CFRA: July 13, 2023 – 3D Systems Corporation. Credit Suisse Commentary on 3D Systems Transaction “We believe $24/share is a fair valuation at ~1.9x our 2024 revenue estimate, above the stock’s average EV/sales NTM multiple of ~1.1x. Stratasys valuation peaked during 2021 at >4x NTM sales… we point to DDD’s 2% decline yesterday as a proof point that $24 is a potential ceiling for what investors are willing to pay.” JULY 2023 Craig hallum Capital group LLG Commentary on the Desktop Metal Transaction “SSYS management unveiled new financial projections through 2026 for its merger with DM as well as projections that would have resulted from a DDD acquisition. We do note that these provided projections portray standalone financials that are more bullish [~$95 million] than both our and Street estimates.” JUNE 2023 Lake Street capital Markets “Stratasys would be absorbing an unprofitable business (DM) that dramatically missed nearly all its financial forecasts, and we do not believe the growth forecast baked into their 2024-26 revenue and profitability guidance” JUNE 2023 “However, we also note downsides to the deal, namely DDD’s lower gross margin profile, headwinds to its Healthcare business, and its outstanding debt of $460M.” JULY 2023 CFRA “While we understand the theory behind scale efficiencies, we continue to believe this merger announcement was the only merger/acquisition Stratasys could do to get a combined market cap above the buying power of Nano Dimension and more of a desperation move versus something more strategic.” JUNE 2023 William Blair “Desktop Metal’s financials are less attractive, including an operating loss of $233 million in 2022…Free cash flow was negative $193 million in 2022…In total, free cash flow was negative $394 million over the last nine quarters. This level of cash usage is clearly troubling given Desktop Metal ended first quarter 2023 with cash and short-term investments of $155 million.” MAY 2023 Source: William Blair: May 25, 2023 - Stratasys to Acquire Desktop Metal; Our Initial Take: Could Be a Mistake; Credit Suisse: July 14, 2023 – Additive Manufacturing: DDD Increases Offer, Ball Back in Stratasys’ Court; Craig Hallum: June 21, 2023 - Stratasys Officially Turns Down 3D Systems Offer And Reiterates Intent To Merge With Desktop Metal. New 2026 Financial Targets Make This Transaction Most Compelling, In Our View, Even As 3D Systems Remains Committed On Its Deal; Lake Street Capital: June 28, 2023 – Merger Mania Part II – The Good, The Bad, and The Ugly; CFRA: July 13, 2023 – 3D Systems Corporation. Nano dimension

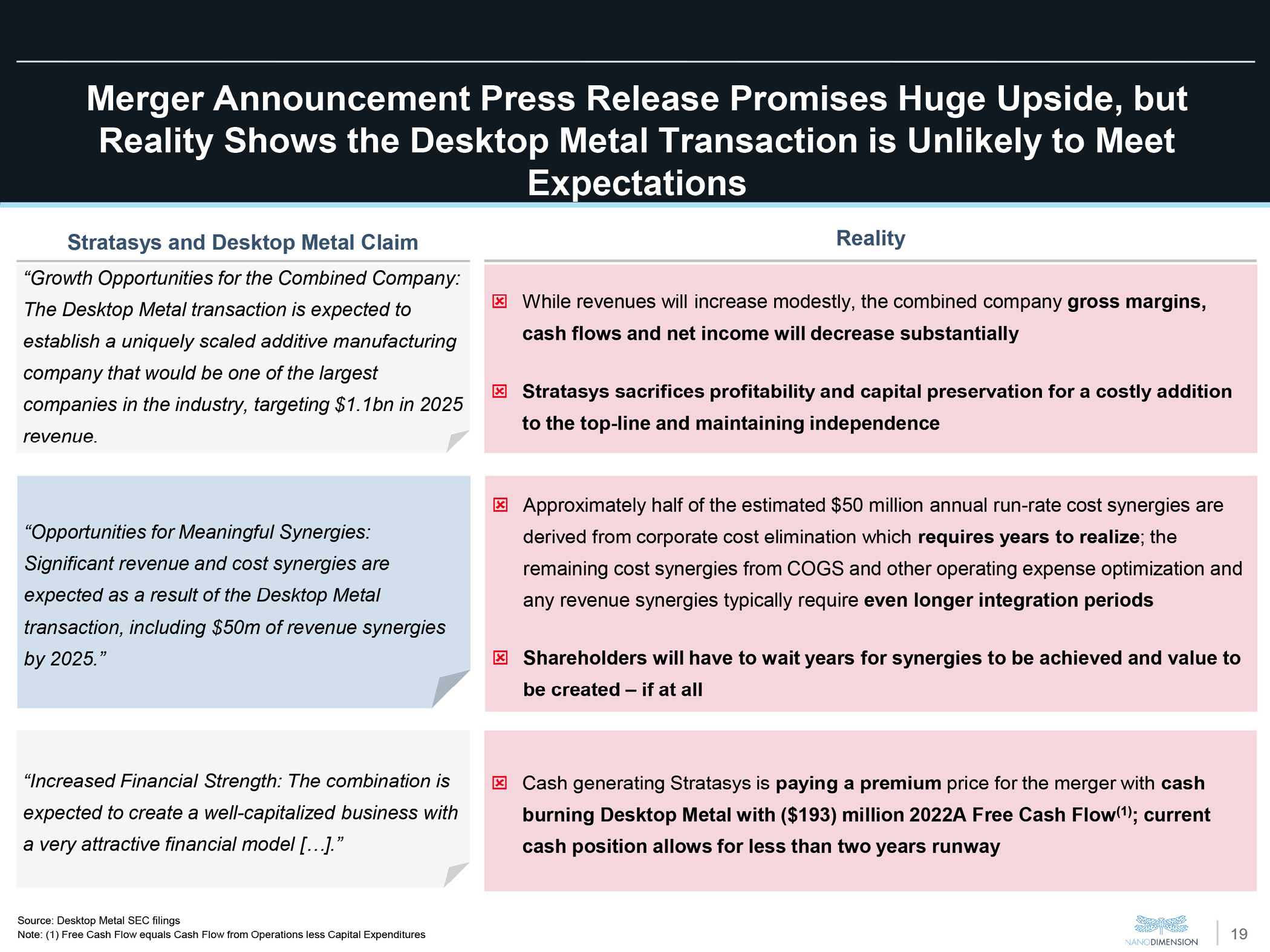

Merger Announcement Press Release Promises Huge Upside, but Reality Shows the Desktop Metal Transaction is Unlikely to Meet Expectations Stratasys and Desktop Metal Claim “Growth Opportunities for the Combined Company: The Desktop Metal transaction is expected to establish a uniquely scaled additive manufacturing company that would be one of the largest companies in the industry, targeting $1.1bn in 2025 revenue. “Opportunities for Meaningful Synergies: Significant revenue and cost synergies are expected as a result of the Desktop Metal transaction, including $50m of revenue synergies by 2025.” “Increased Financial Strength: The combination is expected to create a well-capitalized business with a very attractive financial model […].” Reality While revenues will increase modestly, the combined company gross margins, cash flows and net income will decrease substantially Stratasys sacrifices profitability and capital preservation for a costly addition to the top-line and maintaining independence Approximately half of the estimated $50 million annual run-rate cost synergies are derived from corporate cost elimination which requires years to realize; the remaining cost synergies from COGS and other operating expense optimization and any revenue synergies typically require even longer integration periods Shareholders will have to wait years for synergies to be achieved and value to be created – if at all Cash generating Stratasys is paying a premium price for the merger with cash burning Desktop Metal with ($193) million 2022A Free Cash Flow(1); current cash position allows for less than two years runway Source: Desktop Metal SEC filings Note: (1) Free Cash Flow equals Cash Flow from Operations less Capital Expenditures Nano dimension

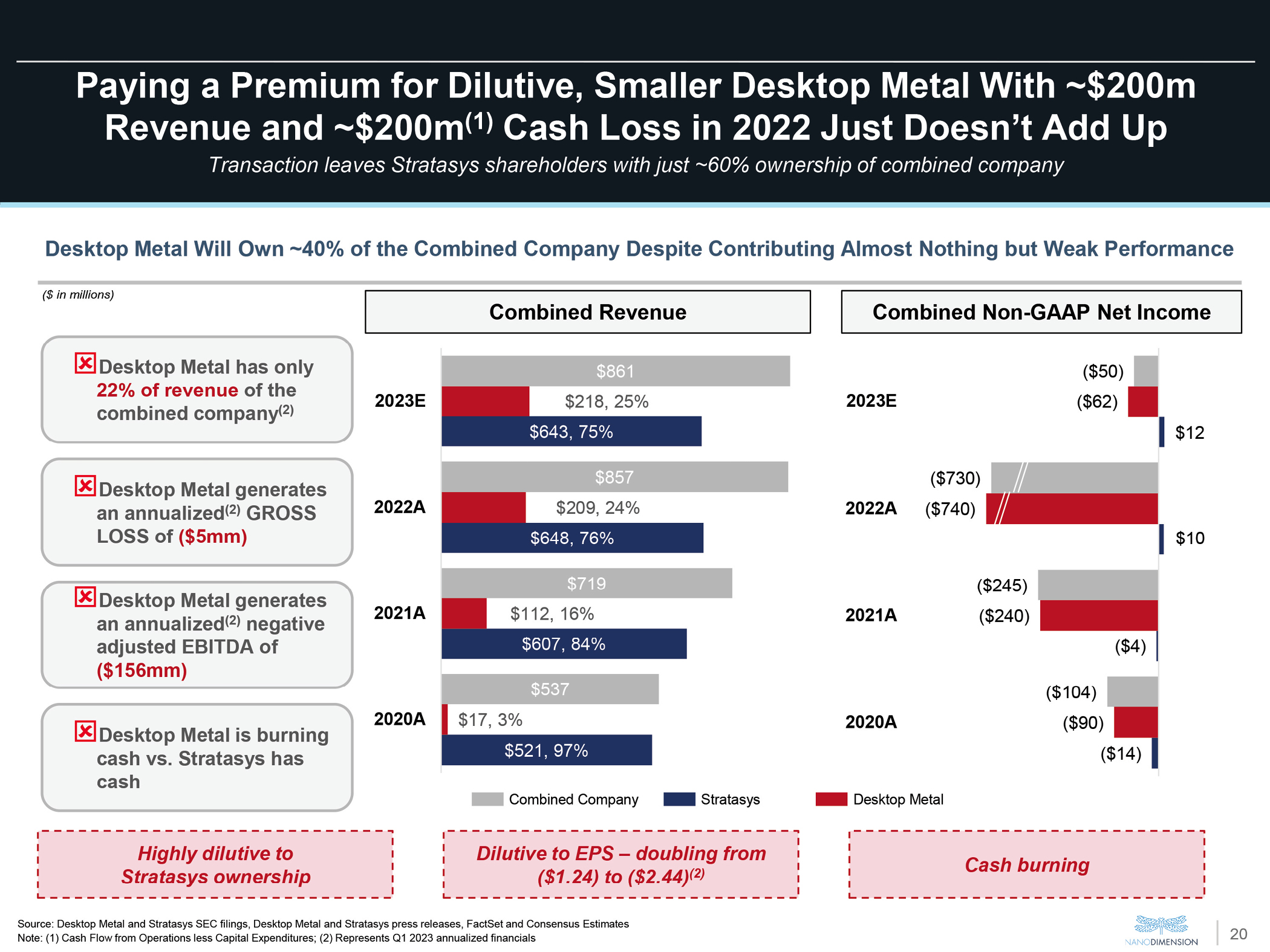

Paying a Premium for Dilutive, Smaller Desktop Metal With ~$200m Revenue and ~$200m(1) Cash Loss in 2022 Just Doesn’t Add Up20Transaction leaves Stratasys shareholders with just ~60% ownership of combined companySource: Desktop Metal and Stratasys SEC filings, Desktop Metal and Stratasys press releases, FactSet and Consensus EstimatesNote: (1) Cash Flow from Operations less Capital Expenditures; (2) Represents Q1 2023 annualized financialsDesktop Metal Will Own ~40% of the Combined Company Despite Contributing Almost Nothing but Weak PerformanceHighly dilutive toStratasys ownershipDesktop Metal has only 22% of revenue of the combined company(2)Desktop Metal generates an annualized(2) GROSS LOSS of ($5mm)Desktop Metal generates an annualized(2) negative adjusted EBITDA of ($156mm)Desktop Metal is burning cash vs. Stratasys has cashCombined RevenueCombined Non-GAAP Net Income$521, 97%$607, 84%$648, 76%$643, 75%$17, 3%$112, 16%$209, 24%$218, 25%$537$719$857$8612020A2021A2022A2023E($14)($4)$10$12($90)($240)($740)($62)($104)($245)($730)($50)2020A2021A2022A2023EDilutive to EPS – doubling from ($1.24) to ($2.44)(2)Cash burning

The Additive Manufacturing Sector Needs Consolidation Which Nano’s Team is Poised to Lead

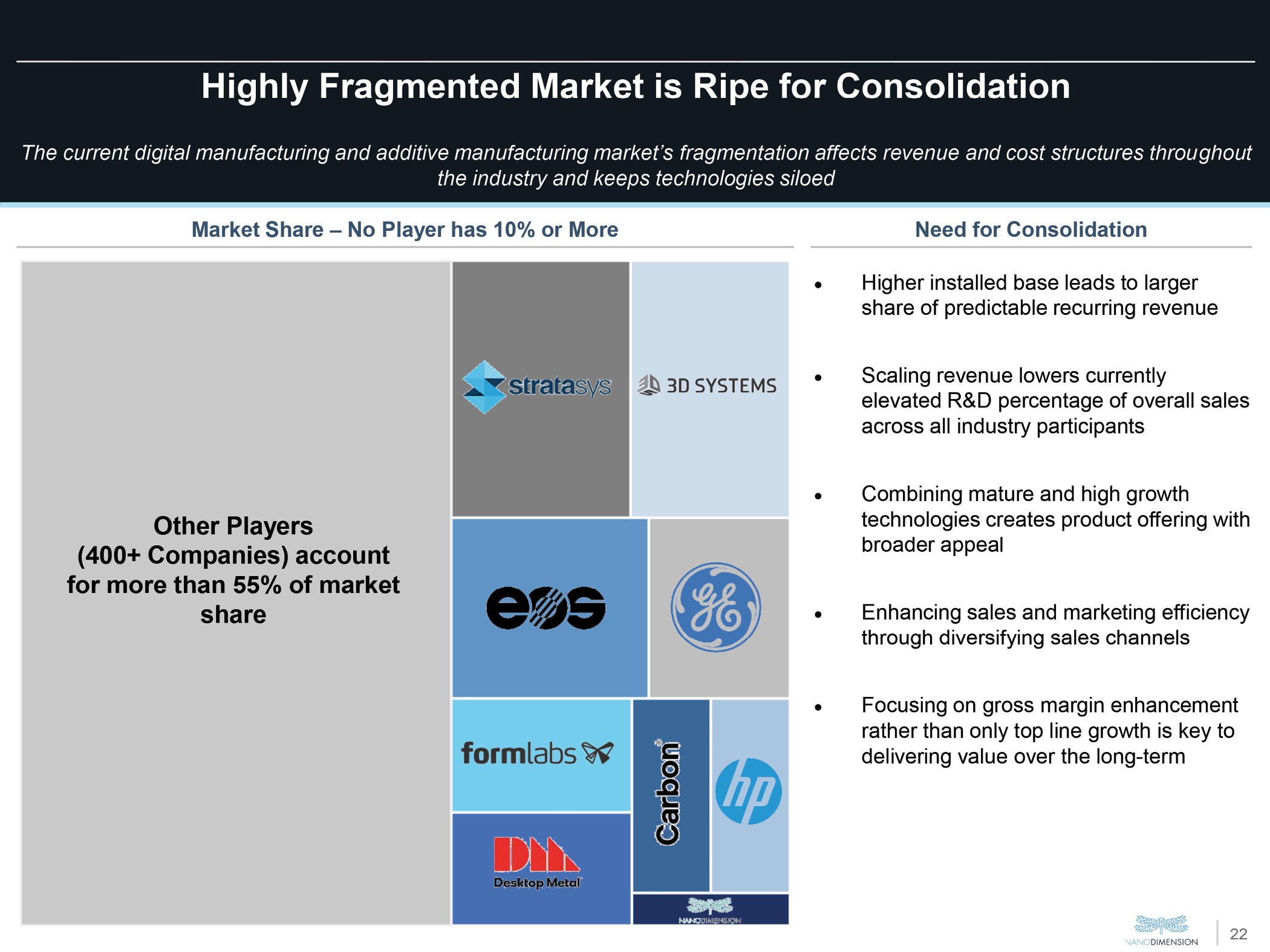

Highly Fragmented Market is Ripe for Consolidation The current digital manufacturing and additive manufacturing market’s fragmentation affects revenue and cost structures throughout the industry and keeps technologies siloed Market Share – No Player has 10% or More Need for Consolidation Other Players (400+ Companies) account for more than 55% of market share Higher installed base leads to larger share of predictable recurring revenue Scaling revenue lowers currently elevated R&D percentage of overall sales across all industry participants Combining mature and high growth technologies creates product offering with broader appeal Enhancing sales and marketing efficiency through diversifying sales channels Focusing on gross margin enhancement rather than only top line growth is key to delivering value over the long-term

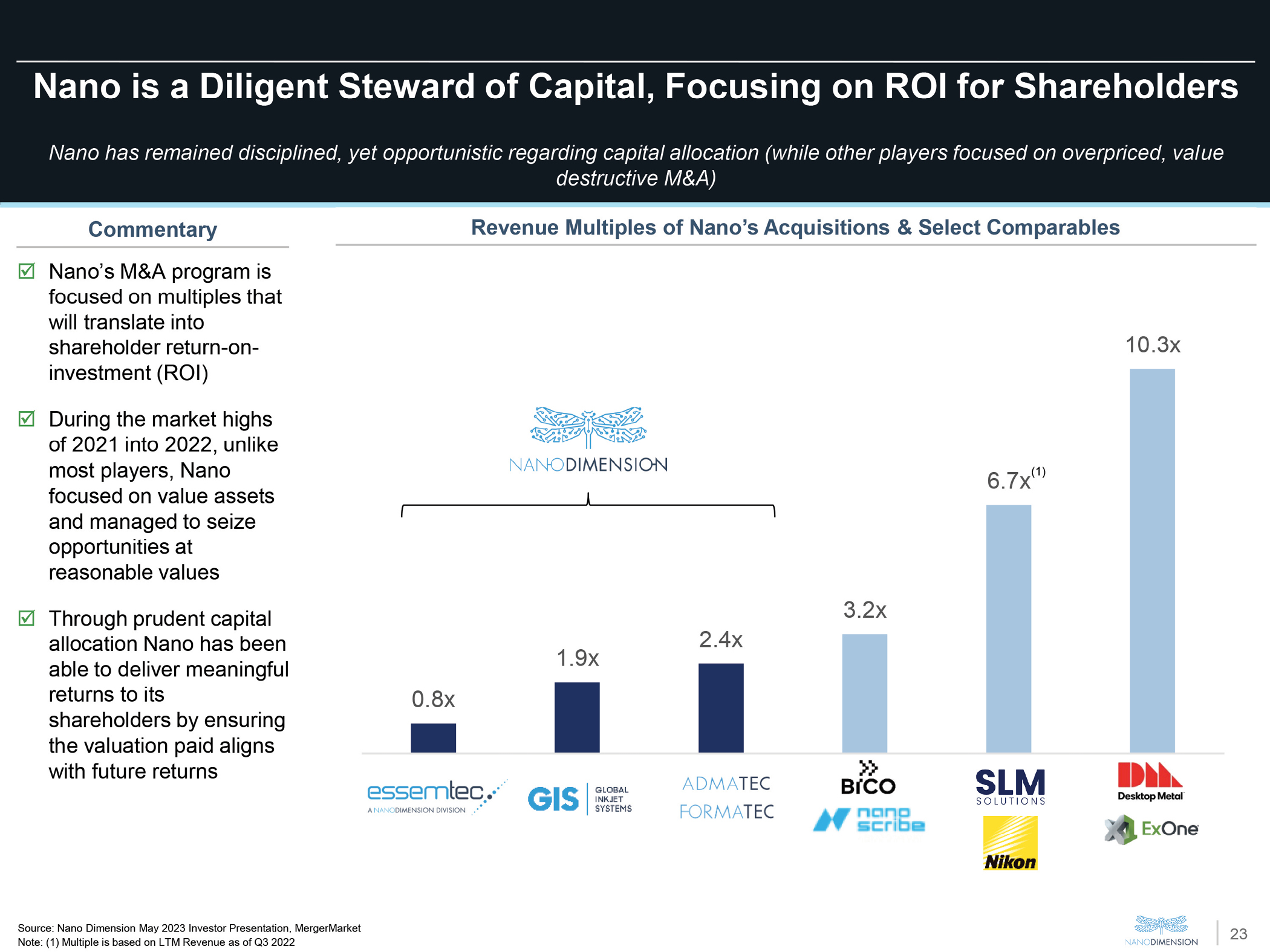

Nano is a Diligent Steward of Capital, Focusing on ROI for Shareholders Nano has remained disciplined, yet opportunistic regarding capital allocation (while other players focused on overpriced, value destructive M&A) Commentary Revenue Multiples of Nano’s Acquisitions & Select Comparables Nano’s M&A program is focused on multiples that will translate into shareholder return-on-investment (ROI) During the market highs of 2021 into 2022, unlike most players, Nano focused on value assets and managed to seize opportunities at reasonable values Through prudent capital allocation Nano has been able to deliver meaningful returns to its shareholders by ensuring the valuation paid aligns with future returns Source: Nano Dimension May 2023 Investor Presentation, MergerMarket Note: (1) Multiple is based on LTM Revenue as of Q3 2022

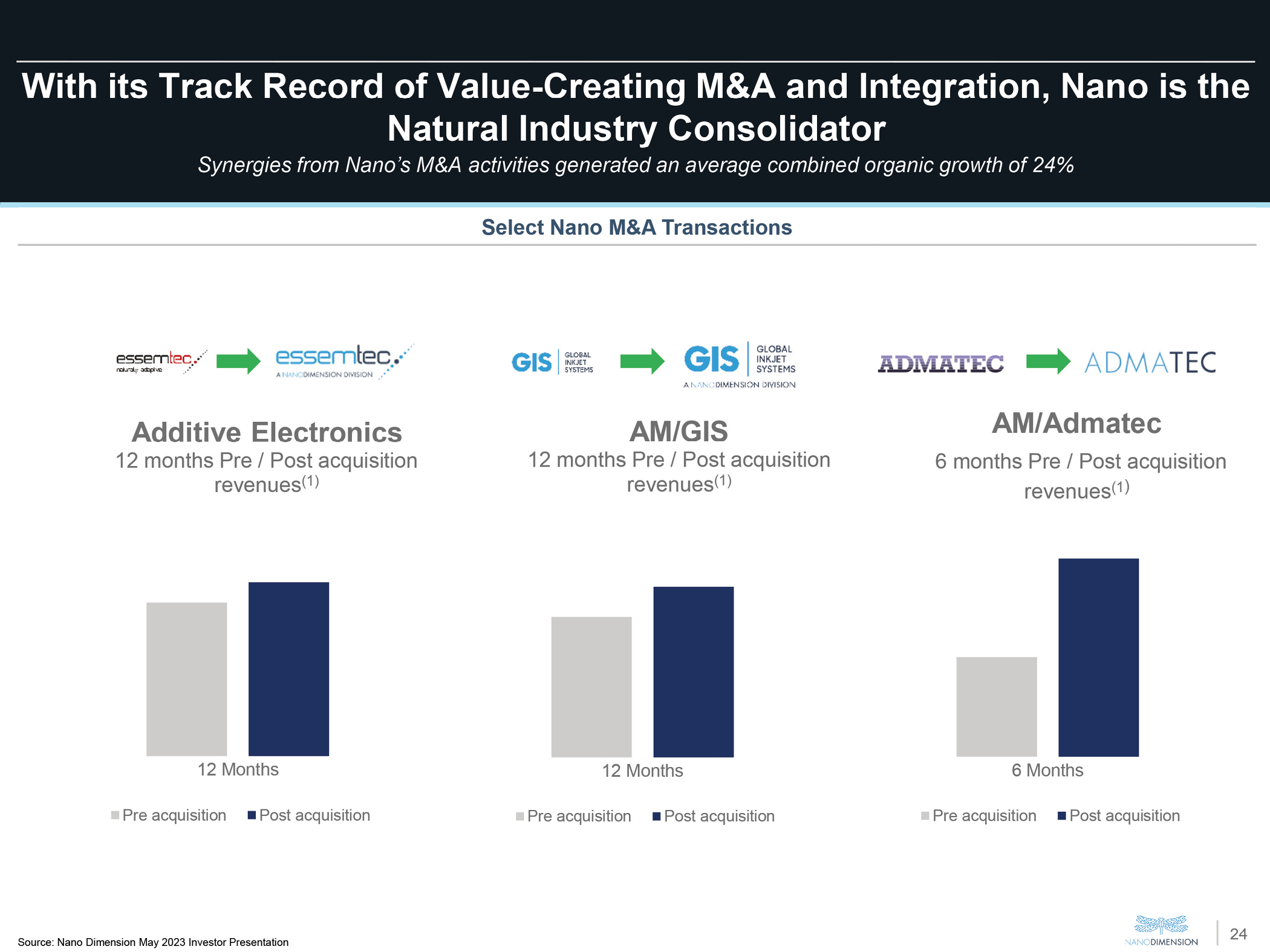

With its Track Record of Value-Creating M&A and Integration, Nano is the Natural Industry Consolidator Synergies from Nano’s M&A activities generated an average combined organic growth of 24% Select Nano M&A Transactions Source: Nano Dimension May 2023 Investor Presentation

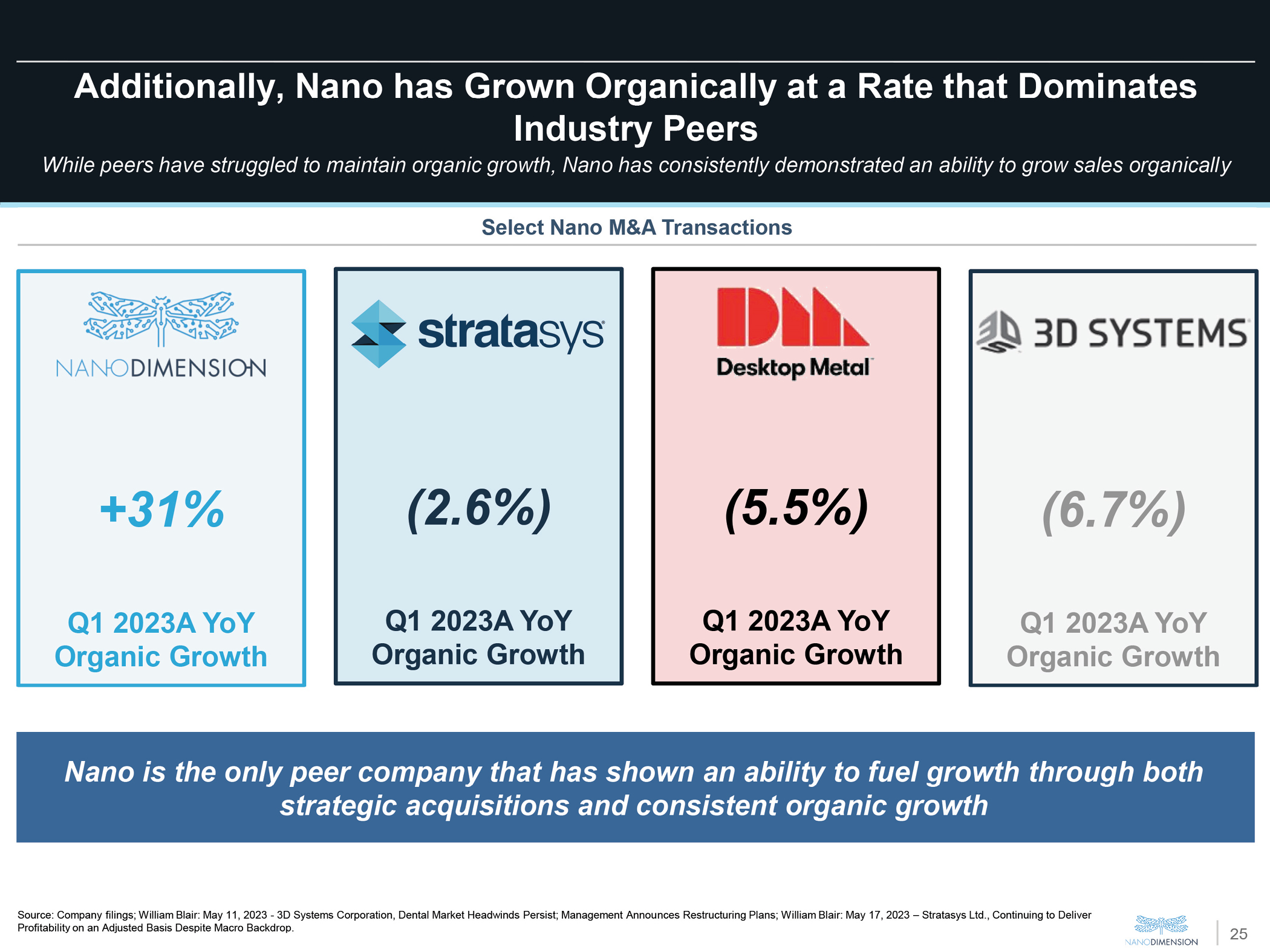

Additionally, Nano has Grown Organically at a Rate that Dominates Industry Peers While peers have struggled to maintain organic growth, Nano has consistently demonstrated an ability to grow sales organically Select Nano M&A Transactions +31% Q1 2023A YoY Organic Growth (2.6%) Q1 2023A YoY Organic Growth (5.5%) Q1 2023A YoY Organic Growth (6.7%) Q1 2023A YoY Organic Growth Nano is the only peer company that has shown an ability to fuel growth through both strategic acquisitions and consistent organic growth Source: Company filings; William Blair: May 11, 2023 - 3D Systems Corporation, Dental Market Headwinds Persist; Management Announces Restructuring Plans; William Blair: May 17, 2023 – Stratasys Ltd., Continuing to Deliver Profitability on an Adjusted Basis Despite Macro Backdrop.

Nano’s Superior Strategy to Unlocking Value for Stratasys Shareholders – Including Exploring All Options for Growth Nano Dimension Electrifying Additive Manufacturing*

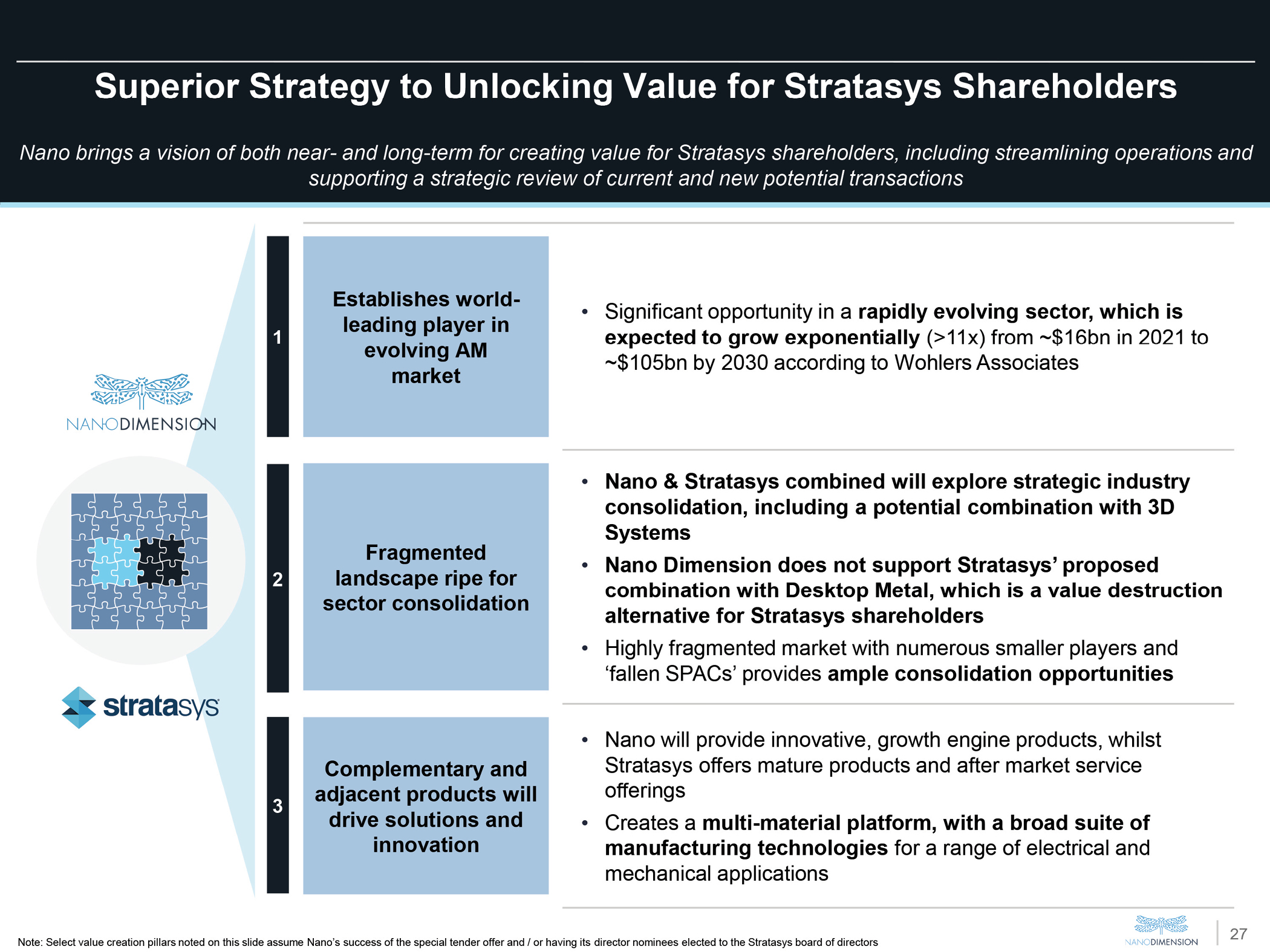

t Superior Strategy to Unlocking Value for Stratasys Shareholders Nano brings a vision of both near- and long-term for creating value for Stratasys shareholders, including streamlining operations and supporting a strategic review of current and new potential transactions 1 Establishes world-leading player in evolving AM market •Significant opportunity in a rapidly evolving sector, which is expected to grow exponentially (>11x) from ~$16bn in 2021 to ~$105bn by 2030 according to Wohlers Associates 2 Fragmented landscape ripe for sector consolidation •Nano & Stratasys combined will explore strategic industry consolidation, including a potential combination with 3D Systems •Nano Dimension does not support Stratasys’ proposed combination with Desktop Metal, which is a value destruction alternative for Stratasys shareholders •Highly fragmented market with numerous smaller players and ‘fallen SPACs’ provides ample consolidation opportunities 3 Complementary and adjacent products will drive solutions and innovation •Nano will provide innovative, growth engine products, whilst Stratasys offers mature products and after market service offerings •Creates a multi-material platform, with a broad suite of manufacturing technologies for a range of electrical and mechanical applications Nano Dimension Stratasys Note: Select value creation pillars noted on this slide assume Nano’s success of the special tender offer and / or having its director nominees elected to the Stratasys board of directors Nano Dimension

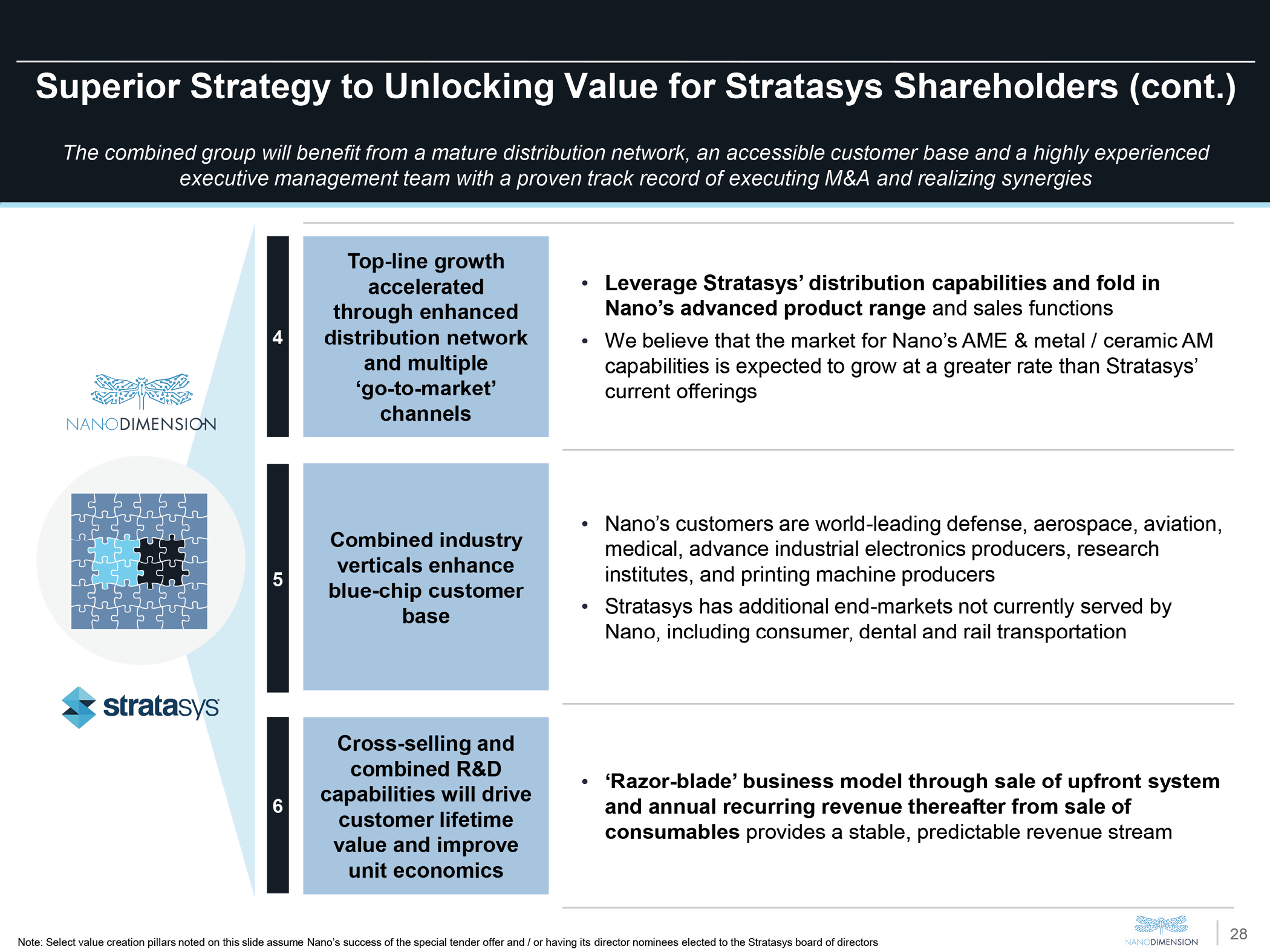

Superior Strategy to Unlocking Value for Stratasys Shareholders (cont.)The combined group will benefit from a mature distribution network, an accessible customer base and a highly experienced executive management team with a proven track record of executing M&A and realizing synergies4 Top-line growth accelerated through enhanced distribution network and multiple ‘go-to-market’ channels •Leverage Stratasys’ distribution capabilities and fold in Nano’s advanced product range and sales functions •We believe that the market for Nano’s AME & metal / ceramic AM capabilities is expected to grow at a greater rate than Stratasys’ current offerings5 Combined industry verticals enhance blue-chip customer base •Nano’s customers are world-leading defense, aerospace, aviation, medical, advance industrial electronics producers, research institutes, and printing machine producers •Stratasys has additional end-markets not currently served by Nano, including consumer, dental and rail transportation6 Cross-selling and combined R&D capabilities will drive customer lifetime value and improve unit economics •‘Razor-blade’ business model through sale of upfront system and annual recurring revenue thereafter from sale of consumables provides a stable, predictable revenue stream Note: Select value creation pillars noted on this slide assume Nano’s success of the special tender offer and / or having its director nominees elected to the Stratasys board of directors Nano Dimension

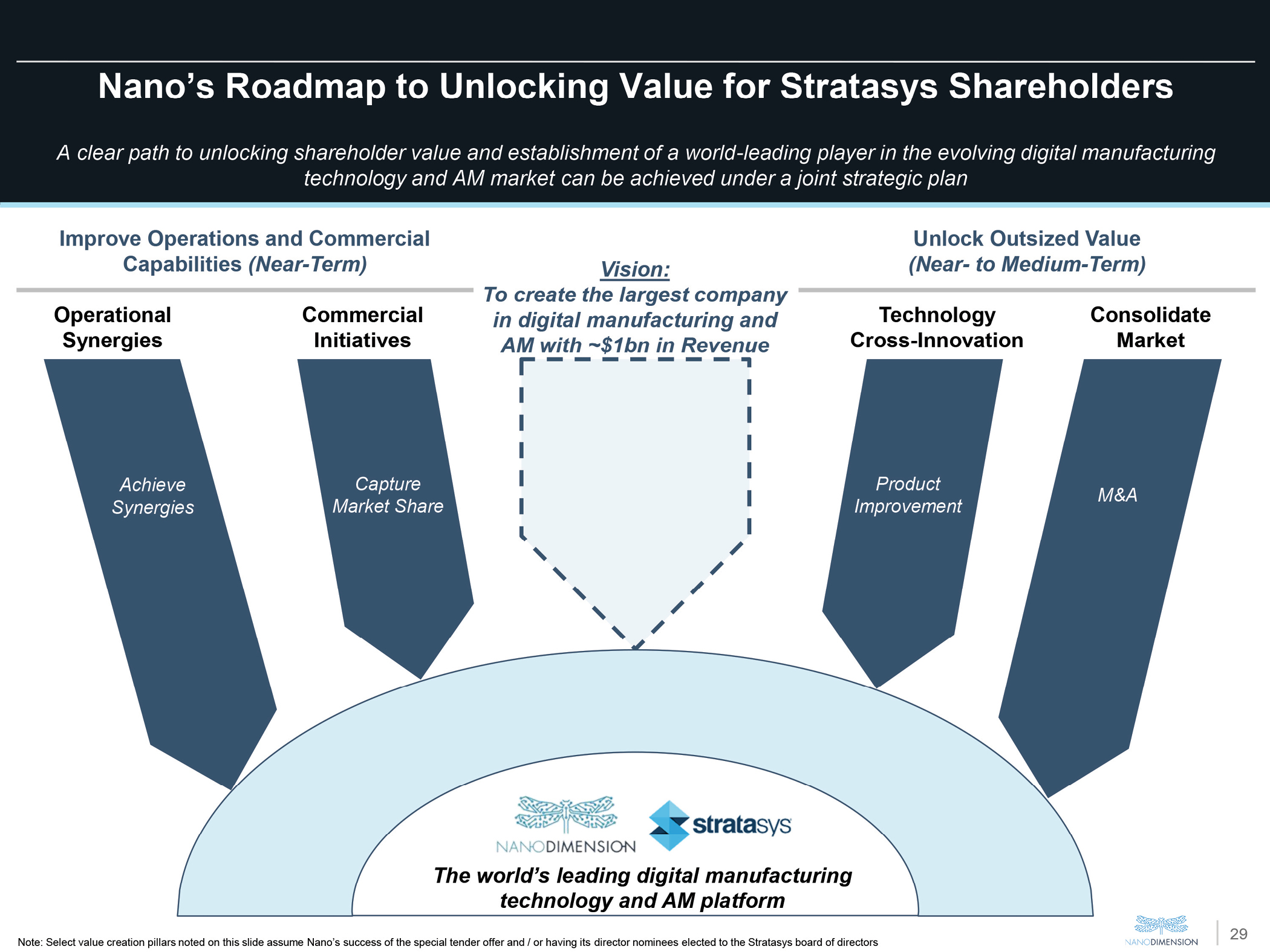

Nano’s Roadmap to Unlocking Value for Stratasys Shareholders A clear path to unlocking shareholder value and establishment of a world-leading player in the evolving digital manufacturing technology and AM market can be achieved under a joint strategic plan Improve Operations and Commercial Capabilities (Near-Term)Vision: Unlock Outsized Value (Near- to Medium-Term)Operational Synergies Commercial Initiatives Achieve Synergies Capture Market Share To create the largest company in digital manufacturing and AM with ~$1bn in Revenue Technology Cross-Innovation Consolidate Market Product Improvement M&A The world’s leading digital manufacturing technology and AM platform NanoDimension stratasys Note: Select value creation pillars noted on this slide assume Nano’s success of the special tender offer and / or having its director nominees elected to the Stratasys board of directors NanoDimension

Nano Dimension’s Nominees Bring a Strong Track Record and a Shareholder Perspective to the Board, to the Benefit of ALL Stratasys Shareholders NANODIMENSION Electrifying Additive Manufacturing*

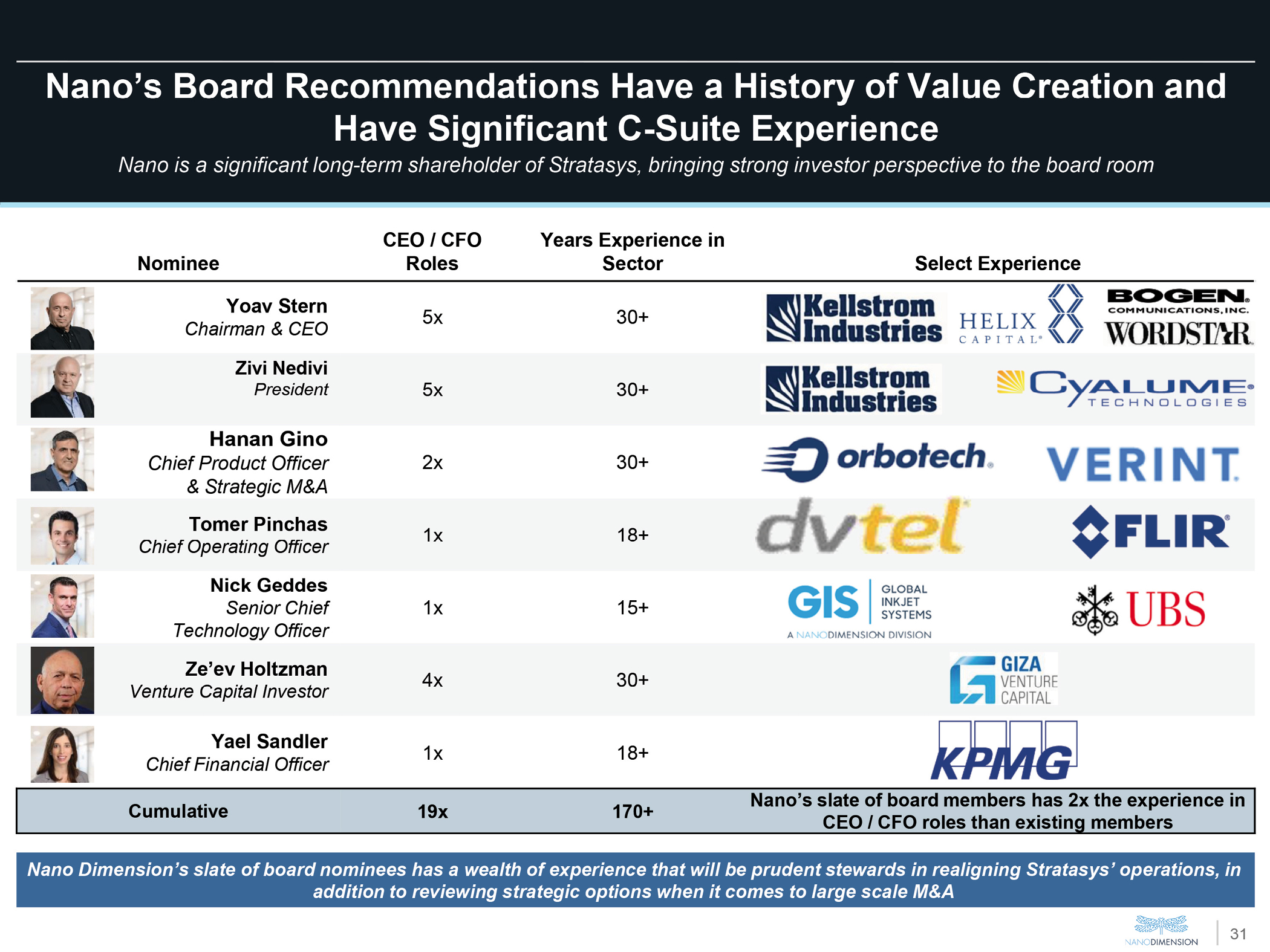

Nano’s Board Recommendations Have a History of Value Creation and Have Significant C-Suite Experience 31 Nano is a significant long-term shareholder of Stratasys, bringing strong investor perspective to the board room Nominee CEO / CFO Roles Years Experience in Sector Select Experience Yoav Stern Chairman & CEO 5x 30+Kellstrom Industries HELIX CAPITAL BOGEN COMMUNICATIONS, INC. Zivi Nedivi President 5x 30+ Kellstrom Industries Cyalume TECHNOLOGIES Hanan Gino Chief Product Officer & Strategic M&A 2x 30+ Orbotech VERINT Tomer Pinchas Chief Operating Officer 1x 18+ Dvtel FLIR Nick Geddes Senior Chief Technology Officer 1x 15+GIS GLOBAL INKJET SYSTEMS A NANODIMENSION DIVISION UBS Ze’ev Holtzman Venture Capital Investor 4x 30+GIZA VENTURE CAPITAL Yael Sandler Chief Financial Officer 1x 18+ KPMG Cumulative 19x 170+ Nano’s slate of board members has 2x the experience in CEO / CFO roles than existing members Nano Dimension’s slate of board nominees has a wealth of experience that will be prudent stewards in realigning Stratasys’ operations, in addition to reviewing strategic options when it comes to large scale M&A NANODIMENSION

Demonstrated Track Record in Building Businesses and Creating Value Nano’s team of ex-founders and veteran CEOs has a proven track record of growing and integrating successful companies in the space Select Management Case Studies Kellstrom Industries Dvtel Yoav Stern Built several companies from $8m to $300m+ in annual revenue through strategy development and M&A Kellstrom Industries Zivi Nedivi As CEO, grew revenue from $8m to $300m in a 5-year period; oversaw nine acquisitions Lumenis Energy to health care Zivi NediviAs COO, oversaw ~1,100 employees across five continents GIS GLOBAL INKJET SYSTEMA NANODIMENSION DIVISION Nick Geddes Co-Founded Global Inkjet Systems (GIS), built it into a profitable business and successfully exited NANODIMENSION

Nano Dimension Commits to a Fair and Transparent Process for Stratasys Shareholders NANO DIMENSION Electrifying Additive Manufacturing*

Nano’s Slate Commits to Immediate Action for a Sound Process in the Interests of All Stratasys Shareholders On Stratasys’ Board, our slate of Directors will run an open, unbiased, strategic review in the interests of all investors NANODIMENSION 1 Commitment #1: Nano’s Slate Commits to Select the Best Deal Possible for Shareholders Our Directors’ First and Immediate Task on Stratasys’ Board will be to Assess all Deals on the Table Through a Shareholder Perspective Electing Nano’s slate will break open the bolt for consolidation to finally materialize Nano’s slate commits to bring to all shareholders the best deal possible and full value realization for their investment “May the best bid win!”stratasys2Commitment #2:Should No Deal Materialize, an EGM Will Be Convened as Soon as Practical to Elect an Independent Slate If Stratasys does not enter into a change of control transaction shortly following Nano’s Board slate being elected, we commit to convene an EGM as soon as practical and submit a fully independent slate of Directors to be approved by shareholders Stratasys’ current Board has disenfranchised shareholders and complicated the situation to a point where recruiting robust independent Director profiles is not currently possible After our slate prioritizes remedying an unsound process, the conditions will be met for the Board to be independent NANODIMENSION

How to Vote for Nano Dimension’s Nominees for Stratasys’ Board of Directors NANODIMENSION Electrifying Additive Manufacturing*

Stratasys Annual General Meeting to Be Held on August 8th, 2023Voting guidelines for Stratasys shareholders at the Stratasys Board of Directors Election Meeting on August 8th, 2023How to Vote Nano Dimension urges Stratasys shareholders to protect their investment and the future of Stratasys – use the white proxy card to vote “FOR” the nominees proposed by Nano Dimension and not Stratasys’ eight nominees If you are a record shareholder or a street holder (i.e., you hold your shares through a bank, broker or other nominee) and receive a physical proxy card or voting instruction form, respectively, you may complete and sign it and send it in to Broadridge, Stratasys’ agent for tallying the votes for the Meeting, in the envelope to be enclosed Whether you are a record shareholder or a street holder, you may also vote or provide voting instructions to your bank, broker or nominee online (atwww.proxyvote.com) or via telephone In all such cases, your vote must be received by 11:59 p.m., Eastern time, on Monday, August 7th, 2023. If you are a record shareholder and send in your white proxy card directly to Stratasys’ registered office, it must be received at least four hours prior to the appointed time for the Meeting (i.e., 11:00 a.m., Israel time, on Tuesday, August 8th, 2023) If you have any questions or require assistance with voting your shares, please contact our proxy solicitor, Innisfree M&A Incorporated, at 1 (800) 422-8620 (toll-free from the U.S. and Canada) or +1 (412) 232-3651 (from other countries) NANODIMENSION