Exhibit (a)(40)

Protecting and maximizing value for all Stratasys shareholders J U L Y 2 0 2 3

Disclaimer 2 Forward - Looking Statements This document contains forward - looking statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, the actual results of Stratasys Ltd. and its consolidated subsidiaries (“Stratasys”) may differ materially from those expressed or implied by such forward - looking statements and assumptions. All statements other than statements of historical fact are statements that could be deemed forward - looking statements. Such forward - looking statements include statements relating to the proposed transaction between Stratasys and Desktop Metal, Inc. (“Desktop Metal”), including statements regarding the benefits of the transaction and the anticipated timing of the transaction, and information regarding the businesses of Stratasys and Desktop Metal, including expectations regarding outlook and all underlying assumptions, Stratasys’ and Desktop Metal’s objectives, plans and strategies, information relating to operating trends in markets where Stratasys and Desktop Metal operate, statements that contain projections of results of operations or of financial condition and all other statements other than statements of historical fact that address activities, events or developments that Stratasys or Desktop Metal intends, expects, projects, believes or anticipates will or may occur in the future. Such statements are based on management’s beliefs and assumptions made based on information currently available to management. All statements in this communication, other than statements of historical fact, are forward - looking statements that may be identified by the use of the words “outlook,” “guidance,” “expects,” “believes,” “anticipates,” “should,” “estimates,” and similar expressions. These forward - looking statements involve known and unknown risks and uncertainties, which may cause Stratasys’ or Desktop Metal’s actual results and performance to be materially different from those expressed or implied in the forward - looking statements. Factors and risks that may impact future results and performance include, but are not limited to those factors and risks described in Item 3.D “Key Information - Risk Factors”, Item 4 “Information on the Company”, and Item 5 “Operating and Financial Review and Prospects” in Stratasys’ Annual Report on Form 20 - F for the year ended December 31, 2022 and Part 1, Item 1A, “Risk Factors” in Desktop Metal’s Annual Report on Form 10 - K for the year ended December 31, 2022, each filed with the Securities and Exchange Commission (the “SEC”), and in other filings by Stratasys and Desktop Metal with the SEC. These include, but are not limited to: factors relating to the partial tender offer commenced by Nano Dimension Ltd. (“Nano”), including actions taken by Nano in connection with the offer, actions taken by Stratasys or its shareholders in respect of the offer and the effects of the offer on Stratasys’ businesses, or other developments involving Nano, the ultimate outcome of the proposed transaction between Stratasys and Desktop Metal, including the possibility that Stratasys or Desktop Metal shareholders will reject the proposed transaction; the effect of the announcement of the proposed transaction on the ability of Stratasys and Desktop Metal to operate their respective businesses and retain and hire key personnel and to maintain favorable business relationships; the timing of the proposed transaction; the occurrence of any event, change or other circumstance that could give rise to the termination of the proposed transaction; the ability to satisfy closing conditions to the completion of the proposed transaction (including any necessary shareholder approvals); other risks related to the completion of the proposed transaction and actions related thereto; changes in demand for Stratasys’ or Desktop Metal’s products and services; global market, political and economic conditions, and in the countries in which Stratasys and Desktop Metal operate in particular; government regulations and approvals; the extent of growth of the 3D printing market generally; the global macro - economic environment, including headwinds caused by inflation, rising interest rates, unfavorable currency exchange rates and potential recessionary conditions; the impact of shifts in prices or margins of the products that Stratasys or Desktop Metal sells or services Stratasys or Desktop Metal provides, including due to a shift towards lower margin products or services; the potential adverse impact that recent global interruptions and delays involving freight carriers and other third parties may have on Stratasys’ or Desktop Metal’s supply chain and distribution network and consequently, Stratasys’ or Desktop Metal’s ability to successfully sell both existing and newly - launched 3D printing products; litigation and regulatory proceedings, including any proceedings that may be instituted against Stratasys or Desktop Metal related to the proposed transaction; impacts of rapid technological change in the additive manufacturing industry, which requires Stratasys and Desktop Metal to continue to develop new products and innovations to meet constantly evolving customer demands and which could adversely affect market adoption of Stratasys’ or Desktop Metal’s products; and disruptions of Stratasys’ or Desktop Metal’s information technology systems. These risks, as well as other risks related to the proposed transaction, are included in the registration statement on Form F - 4 and joint proxy statement/prospectus that has been filed with the Securities and Exchange Commission (“SEC”) in connection with the proposed transaction. While the list of factors presented here is, and the list of factors presented in the registration statement on Form F - 4 are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. For additional information about other factors that could cause actual results to differ materially from those described in the forward - looking statements, please refer to Stratasys’ and Desktop Metal’s respective periodic reports and other filings with the SEC, including the risk factors identified in Stratasys’ and Desktop Metal’s Annual Reports on Form 20 - F and Form 10 - K, respectively, and Stratasys’ Form 6 - K reports that published its results for the quarter ended March 31, 2023, which it furnished to the SEC on May 16, 2023, and Desktop Metal’s most recent Quarterly Reports on Form 10 - Q. The forward - looking statements included in this communication are made only as of the date hereof. Neither Stratasys nor Desktop Metal undertakes any obligation to update any forward - looking statements to reflect subsequent events or circumstances, except as required by law. No Offer or Solicitation This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Disclaimer 3 Important Additional Information In connection with the proposed transaction, Stratasys filed with the SEC a registration statement on Form F - 4 that includes a joint proxy statement of Stratasys and Desktop Metal and that also constitutes a prospectus of Stratasys. Each of Stratasys and Desktop Metal may also file other relevant documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration statement or any other document that Stratasys or Desktop Metal may file with the SEC. The registration statement has not yet become effective. After the registration statement is effective, the definitive joint proxy statement/prospectus will be mailed to shareholders of Stratasys and Desktop Metal. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration statement and definitive joint proxy statement/prospectus and other documents containing important information about Stratasys, Desktop Metal and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with, or furnished, to the SEC by Stratasys will be available free of charge on Stratasys’ website at https://investors.stratasys.com/sec - filings. Copies of the documents filed with the SEC by Desktop Metal will be available free of charge on Desktop Metal’s website at https://ir.desktopmetal.com/sec - filings/all - sec - filings. This communication is not an offer to purchase or a solicitation of an offer to sell the ordinary shares of Stratasys. In response to a tender offer commenced by Nano, Stratasys has filed with the Securities and Exchange Commission a Solicitation/Recommendation Statement on Schedule 14D - 9. STRATASYS SHAREHOLDERS ARE ADVISED TO READ STRATASYS’ SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D - 9 AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY DECISION WITH RESPECT TO ANY TENDER OFFER BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Stratasys shareholders may obtain a copy of the Solicitation/Recommendation Statement on Schedule 14D - 9, as well as any other documents filed by Stratasys in connection with the tender offer by Nano or one of its affiliates, free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders may obtain free copies of these documents from Stratasys by directing a request to Stratasys Ltd., 1 Holtzman Street, Science Park, P.O. Box 2496, Rehovot 7612, Israel, Attn: Yonah Lloyd, VP Investor Relations, or by calling +972 - 74 - 745 - 4029. Participants in the Solicitation Stratasys, Desktop Metal and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Stratasys, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Stratasys’ proxy statement for its 2023 Annual General Meeting of Shareholders, which was filed with the SEC on July 12, 2023, and Stratasys’ Annual Report on Form 20 - F for the fiscal year ended December 31, 2022, which was filed with the SEC on March 3, 2023. Information about the directors and executive officers of Desktop Metal, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Desktop Metal’s proxy statement for its 2023 Annual Meeting of Stockholders, which was filed with the SEC on April 25, 2023 and Desktop Metal’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2022, which was filed with the SEC on March 1, 2023. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the joint proxy statement/prospectus and other relevant materials filed with the SEC regarding the proposed transaction. Investors should read the joint proxy statement/prospectus carefully before making any voting or investment decisions. You may obtain free copies of these documents from Stratasys or Desktop Metal using the sources indicated above. Use of Non - GAAP Financial Measures This communication contains certain forward - looking non - GAAP measures, which are based on internal forecasts and represent management’s best judgment. Reconciliation of such measures to the most directly comparable GAAP financial measures cannot be furnished without unreasonable efforts due to inherent difficulty in forecasting the amount and timing of certain adjustments that are necessary for such reconciliations and which may significantly impact our GAAP results. In particular, sufficient information is not available to calculate certain adjustments that are required to prepare a forward - looking statement of revenue, margin and EBITDA in accordance with GAAP for fiscal years 2024 and beyond. Stratasys also believes that such reconciliations would also imply a degree of precision that would be confusing or inappropriate for these forward - looking measures, which are inherently uncertain. All revenue, margin, EBITDA and other P&L references are non - GAAP unless specified otherwise.

Agenda Why object to Nano’s partial tender offer? Why vote for the Stratasys slate? 1 2 3 4 Nano is unfit to run a large industry - leading public company

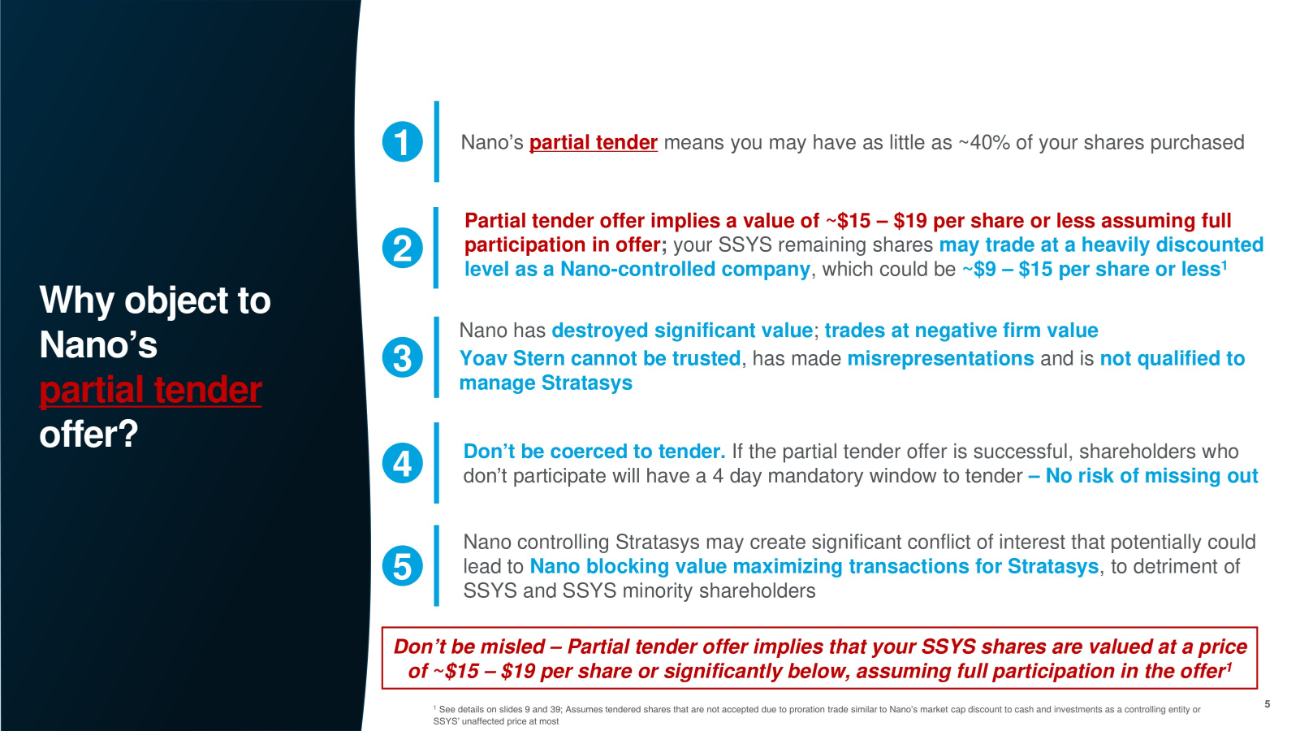

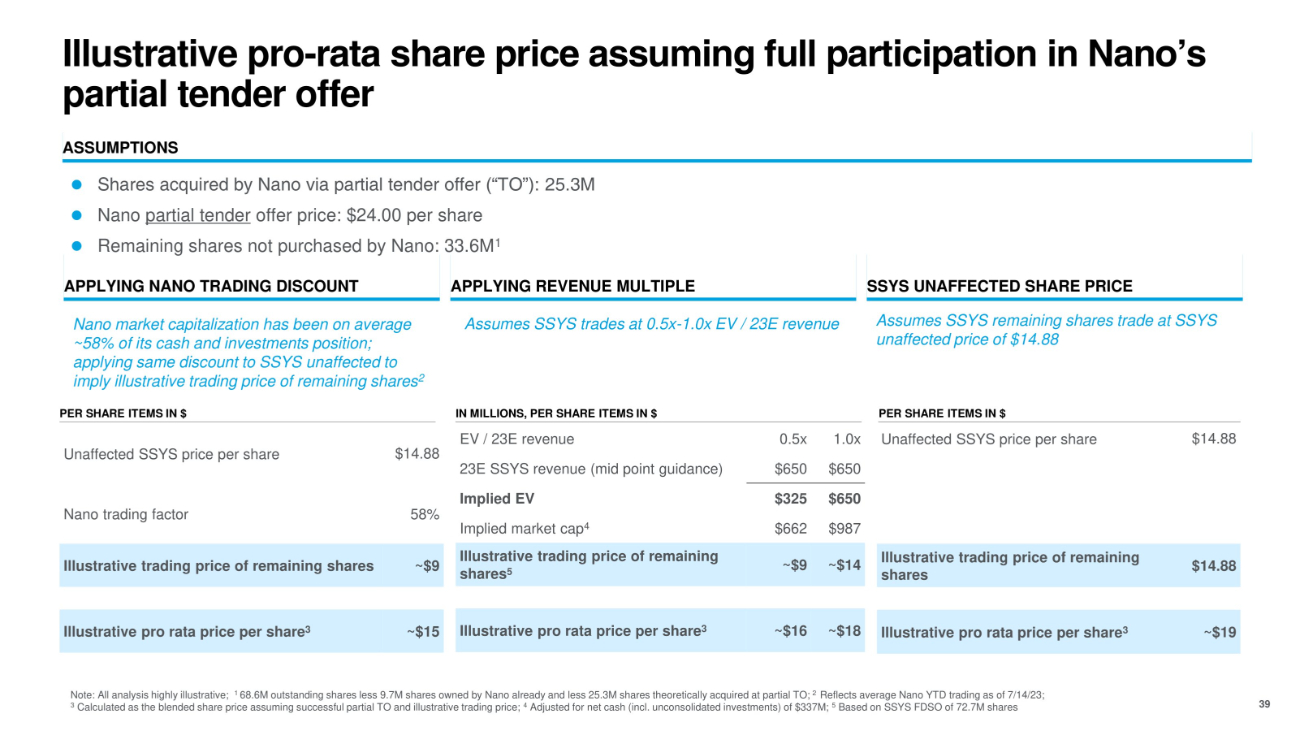

Why object to Nano’s partial tender offer? 5 Nano has destroyed significant value ; trades at negative firm value Yoav Stern cannot be trusted , has made misrepresentations and is not qualified to manage Stratasys 3 1 Nano’s partial tender means you may have as little as ~40% of your shares purchased Don’t be misled – Partial tender offer implies that your SSYS shares are valued at a price of ~$15 – $19 per share or significantly below, assuming full participation in the offer 1 5 Nano controlling Stratasys may create significant conflict of interest that potentially could lead to Nano blocking value maximizing transactions for Stratasys , to detriment of SSYS and SSYS minority shareholders 1 See details on slides 9 and 39; Assumes tendered shares that are not accepted due to proration trade similar to Nano’s market cap discount to cash and investments as a controlling entity or SSYS’ unaffected price at most 2 Partial tender offer implies a value of ~$15 – $19 per share or less assuming full participation in offer ; your SSYS remaining shares may trade at a heavily discounted level as a Nano - controlled company , which could be ~$9 – $15 per share or less 1 4 Don’t be coerced to tender. If the partial tender offer is successful, shareholders who don’t participate will have a 4 day mandatory window to tender – No risk of missing out

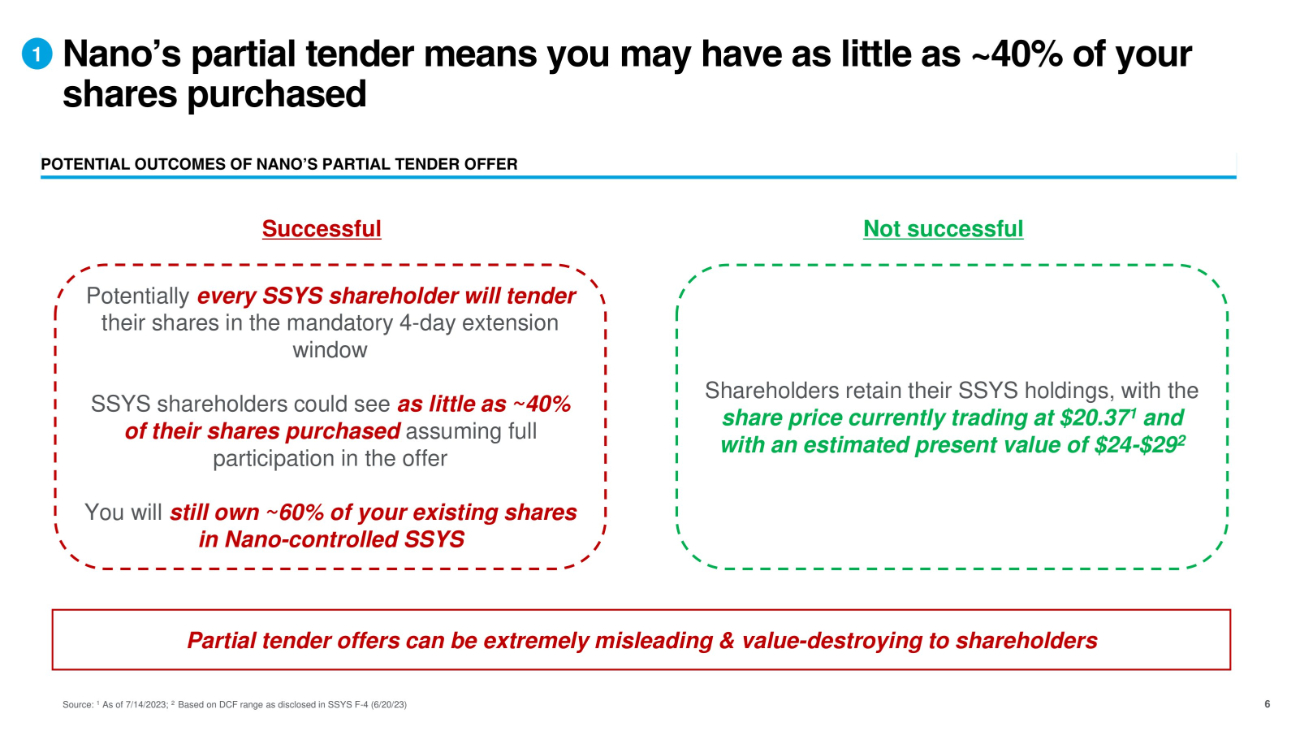

Nano’s partial tender means you may have as little as ~40% of your shares purchased 6 Source: 1 As of 7/14/2023; 2 Based on DCF range as disclosed in SSYS F - 4 (6/20/23) Not successful Shareholders retain their SSYS holdings, with the share price currently trading at $20.37 1 and with an estimated present value of $24 - $29 2 Successful Potentially every SSYS shareholder will tender their shares in the mandatory 4 - day extension window SSYS shareholders could see as little as ~40% of their shares purchased assuming full participation in the offer You will still own ~60% of your existing shares in Nano - controlled SSYS 1 POTENTIAL OUTCOMES OF NANO’S PARTIAL TENDER OFFER Partial tender offers can be extremely misleading & value - destroying to shareholders

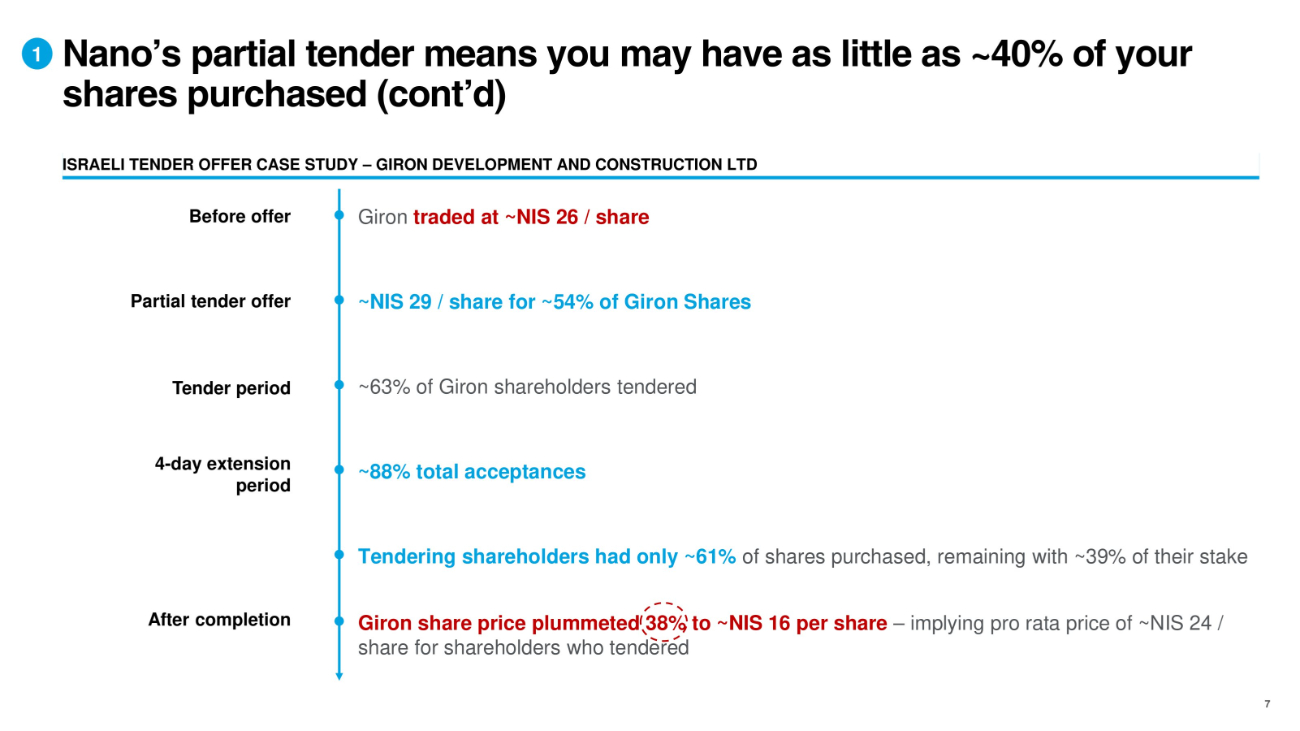

Giron traded at ~NIS 26 / share ~NIS 29 / share for ~54% of Giron Shares ~63% of Giron shareholders tendered ~88% total acceptances Tendering shareholders had only ~61% of shares purchased, remaining with ~39% of their stake Giron share price plummeted 38% to ~NIS 16 per share – implying pro rata price of ~NIS 24 / share for shareholders who tendered Before offer Partial tender offer 4 - day extension period After completion Tender period ISRAELI TENDER OFFER CASE STUDY – GIRON DEVELOPMENT AND CONSTRUCTION LTD Nano’s partial tender means you may have as little as ~40% of your shares purchased (cont’d) 1 7

Shares in a Nano - controlled company may trade at a significant discount 2 Nano does not understand SSYS business Significant conflict of interest will exist, likely detrimental to SSYS and SSYS minority shareholders Nano could block any future deal that might maximize value for minority shareholders of SSYS Float and liquidity will be significantly limited, leading to less efficient trading Customer concerns and employee attrition across the ranks could significantly damage SSYS business Nano does not have experience in operating a large - scale business 8

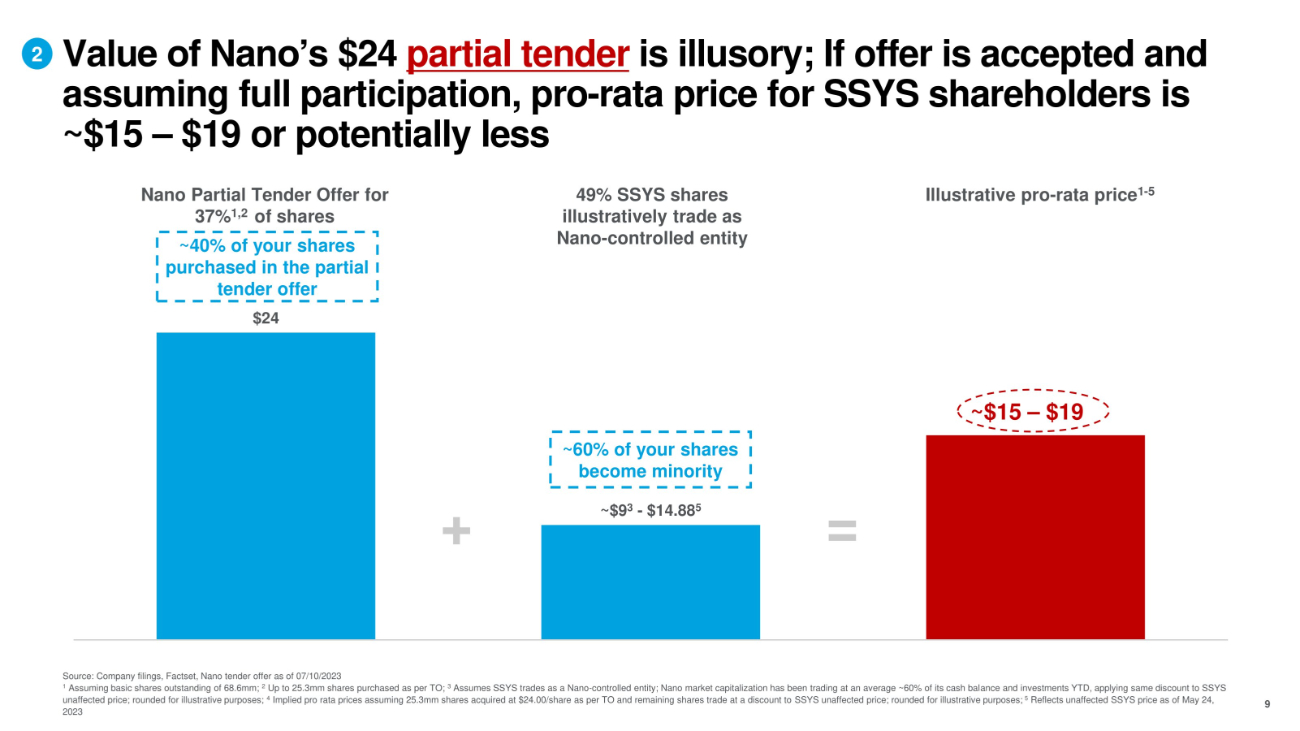

$24 ~$9 3 - $14.88 5 Nano Partial Tender Offer for 37% 1,2 of shares + = 49% SSYS shares illustratively trade as Nano - controlled entity Illustrative pro - rata price 1 - 5 ~60% of your shares become minority ~40% of your shares purchased in the partial tender offer Value of Nano’s $24 partial tender is illusory; If offer is accepted and assuming full participation, pro - rata price for SSYS shareholders is ~$15 – $19 or potentially less 9 Source: Company filings, Factset, Nano tender offer as of 07/10/2023 1 Assuming basic shares outstanding of 68.6mm; 2 Up to 25.3mm shares purchased as per TO; 3 Assumes SSYS trades as a Nano - controlled entity; Nano market capitalization has been trading at an average ~60% of its cash balance and investments YTD, applying same discount to SSYS unaffected price; rounded for illustrative purposes; 4 Implied pro rata prices assuming 25.3mm shares acquired at $24.00/share as per TO and remaining shares trade at a discount to SSYS unaffected price; rounded for illustrative purposes; 5 Reflects unaffected SSYS price as of May 24, 2023 ~$15 – $19 2

Yoav Stern is unqualified for Stratasys’ Board 10 Yoav Stern does not fundamentally understand SSYS’ business and risks destroying value for SSYS shareholders YOAV STERN’S PROFILE History of poor corporate governance Overseen destruction of hundreds of millions of dollars of shareholder value at Nano Attempted to take 10% of Nano’s equity by a deceptive re - pricing of warrants below the cash value per share 1 Refused to acknowledge the call for a special meeting by his own shareholder, Murchinson Continues to contest the validity of the Murchinson convened meeting in the Israeli courts Track record of misrepresenting the truth Does not respect the will of shareholders who voted him out of Nano by a vote of 92% of the shares that voted 3 1 As outlined in the Notice Of A Special General Meeting Of Shareholders from November 7, 2022

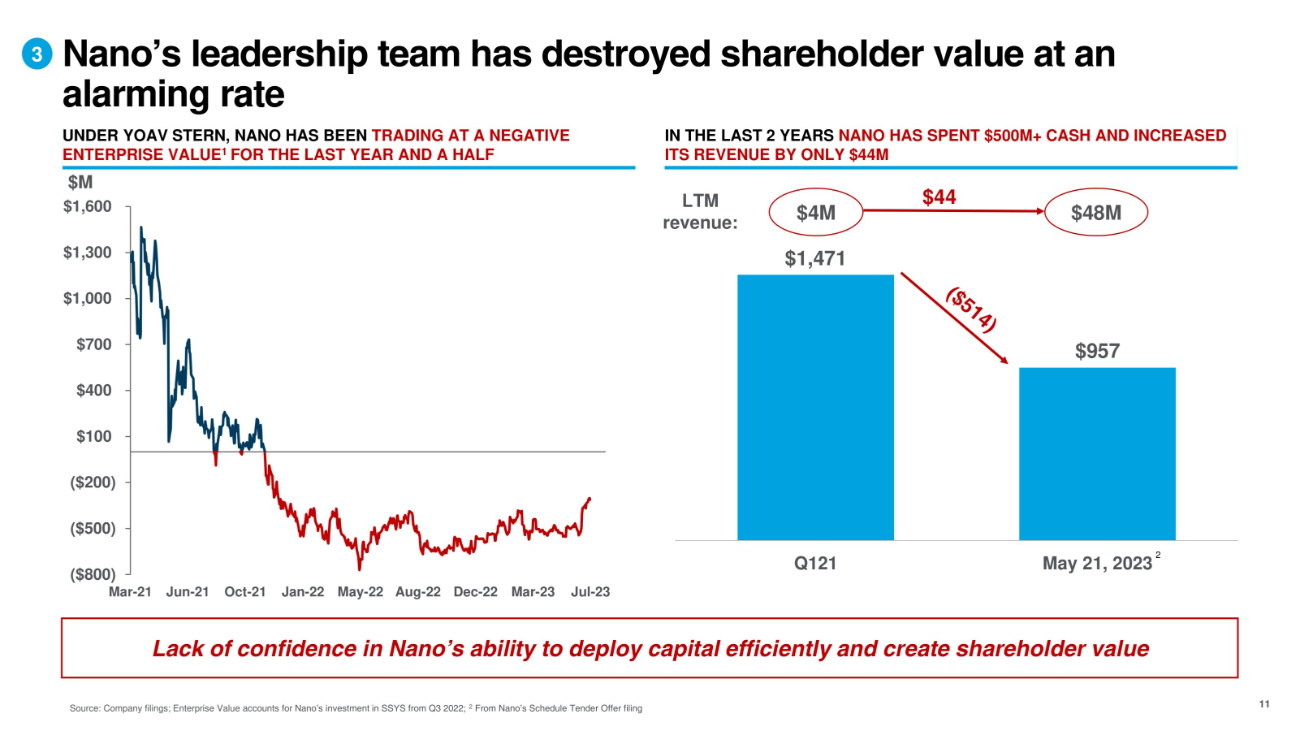

Nano’s leadership team has destroyed shareholder value at an alarming rate 11 Source: Company filings; Enterprise Value accounts for Nano’s investment in SSYS from Q3 2022; 2 From Nano’s Schedule Tender Offer filing Lack of confidence in Nano’s ability to deploy capital efficiently and create shareholder value UNDER YOAV STERN, NANO HAS BEEN TRADING AT A NEGATIVE ENTERPRISE VALUE 1 FOR THE LAST YEAR AND A HALF $1,471 $957 Q121 May 21, 2023 2 IN THE LAST 2 YEARS NANO HAS SPENT $500M+ CASH AND INCREASED ITS REVENUE BY ONLY $44M ($800) Mar - 21 Jun - 21 Oct - 21 Jan - 22 May - 22 Aug - 22 Dec - 22 Mar - 23 Jul - 23 $400 $100 ($200) ($500) $700 $1,000 $1,300 $M $1,600 3 $4M $48M LTM revenue: $44

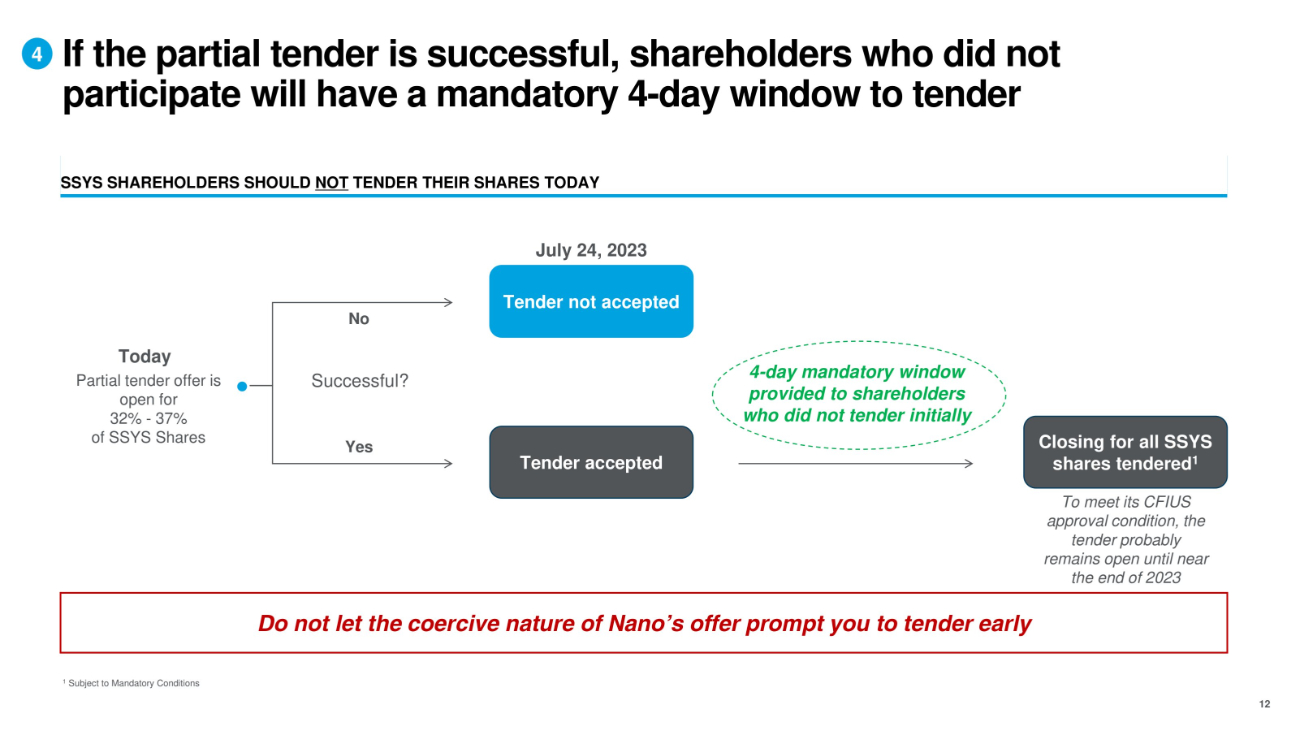

If the partial tender is successful, shareholders who did not participate will have a mandatory 4 - day window to tender Do not let the coercive nature of Nano’s offer prompt you to tender early Today Partial tender offer is open for 32% - 37% of SSYS Shares Tender not accepted Tender accepted Closing for all SSYS shares tendered 1 4 - day mandatory window provided to shareholders who did not tender initially Successful? No Yes SSYS SHAREHOLDERS SHOULD NOT TENDER THEIR SHARES TODAY July 24, 2023 1 Subject to Mandatory Conditions To meet its CFIUS approval condition, the tender probably remains open until near the end of 2023 4 12

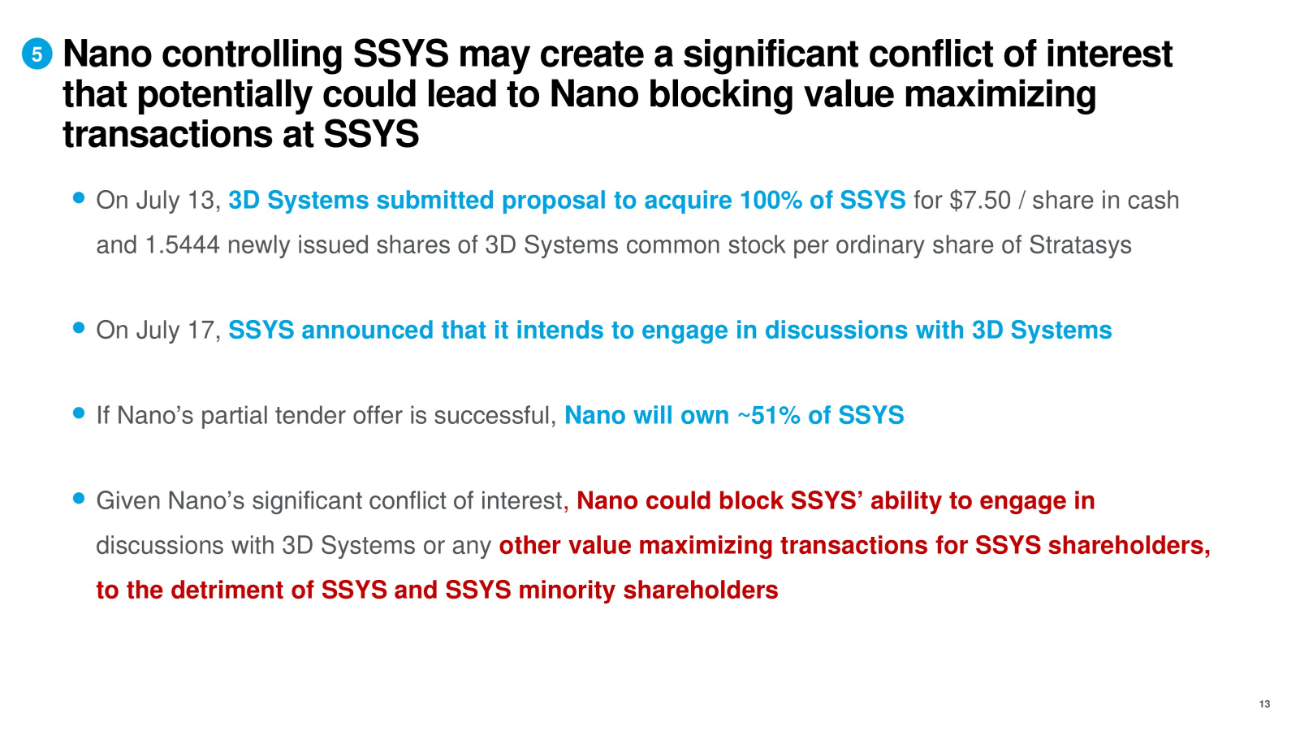

Nano controlling SSYS may create a significant conflict of interest that potentially could lead to Nano blocking value maximizing transactions at SSYS 5 13 O n J u ly 13, 3D Syst e m s submitted proposal to ac q uir e 10 0 % of SSYS for $7.50 / s hare i n c a s h an d 1. 5 444 new l y i s s u e d sh ares of 3D Sy s tems c o m m o n sto c k per or d i nary share of St rat a s y s O n Ju l y 17, SS Y S announc ed that it intend s to engag e in discu s sion s with 3D Systems If Na n o ’s par ti a l t en d er off e r is s u c c e s sf u l, Nano will own ~51% of SSYS Giv e n Na n o ’s s i gn i fi c ant c o nf l i c t of i nt ere s t , Nano could blo c k SSYS’ abi lit y to eng ag e in d is c u s s i ons wit h 3D S y stems or a ny oth e r val u e m a xi m izing tran sact ion s fo r SSYS sh a reholders, to th e detri m ent of SSYS and SSYS min o rit y sh a rehol ders

SSYS’ Board unanimously recommends SSYS shareholders to NOT tender shares into the Nano partial tender offer 14 For assistance in withdrawing your Stratasys ordinary shares or filing a Notice of objection, you can contact your broker or Stratasys’ information agent, Morrow Sodali LLC toll - free at (800) 662 - 5200 or (203) 658 - 9400 or via email at SSYS@info.morrowsodali.com Just to refrain from tendering is simply not enough! Not taking any action could lead to Nano acquiring a controlling interest in Stratasys Stratasys shareholders should take action to file a Notice of Objection to block the partial tender offer

Agenda Why object to Nano’s partial tender offer? Why vote for the Stratasys slate? 3 Nano is unfit to run a large industry - leading public company 1 2 15

Why vote “FOR” Stratasys slate? Nano’s director candidates are not qualified 2 3 Nano’s Board and CEO presided over serious corporate governance failings 4 SSYS board is highly qualified, truly independent and purpose built 1 Voting for Nano slate will enable Nano to take control of Stratasys without paying shareholders, irrespective of the partial tender offer 5 SSYS board is highly focused on maximizing shareholder value and engages with multiple industry participants for the benefit of all SSYS shareholders 16

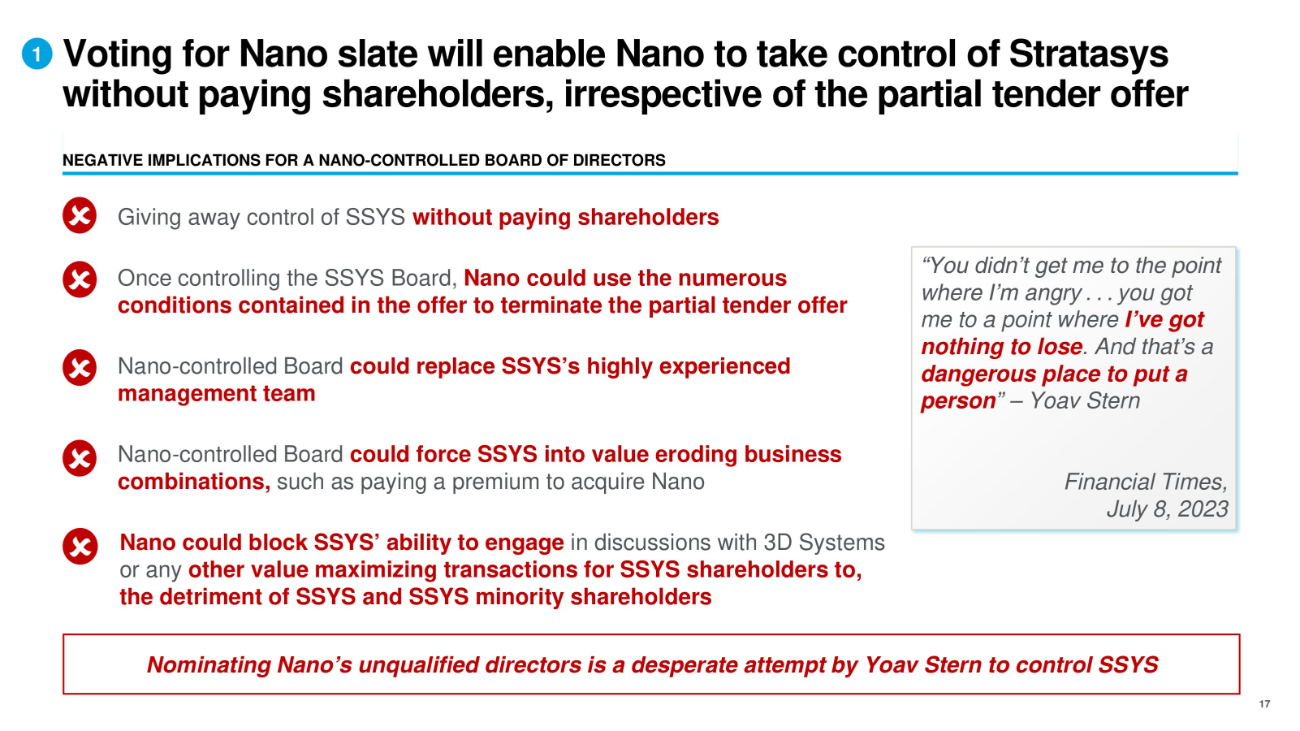

Voting for Nano slate will enable Nano to take control of Stratasys without paying shareholders, irrespective of the partial tender offer 1 Nominating Nano’s unqualified directors is a desperate attempt by Yoav Stern to control SSYS NEGATIVE IMPLICATIONS FOR A NANO - CONTROLLED BOARD OF DIRECTORS “You didn’t get me to the point where I’m angry . . . you got me to a point where I’ve got nothing to lose . And that’s a dangerous place to put a person ” – Yoav Stern Financial Times, July 8, 2023 Giving away control of SSYS without paying shareholders Once controlling the SSYS Board, Nano could use the numerous conditions contained in the offer to terminate the partial tender offer Nano - controlled Board could replace SSYS’s highly experienced management team Nano - controlled Board could force SSYS into value eroding business combinations, such as paying a premium to acquire Nano 17 Nano could block SSYS’ ability to engage in discussions with 3D Systems or any other value maximizing transactions for SSYS shareholders to, the detriment of SSYS and SSYS minority shareholders

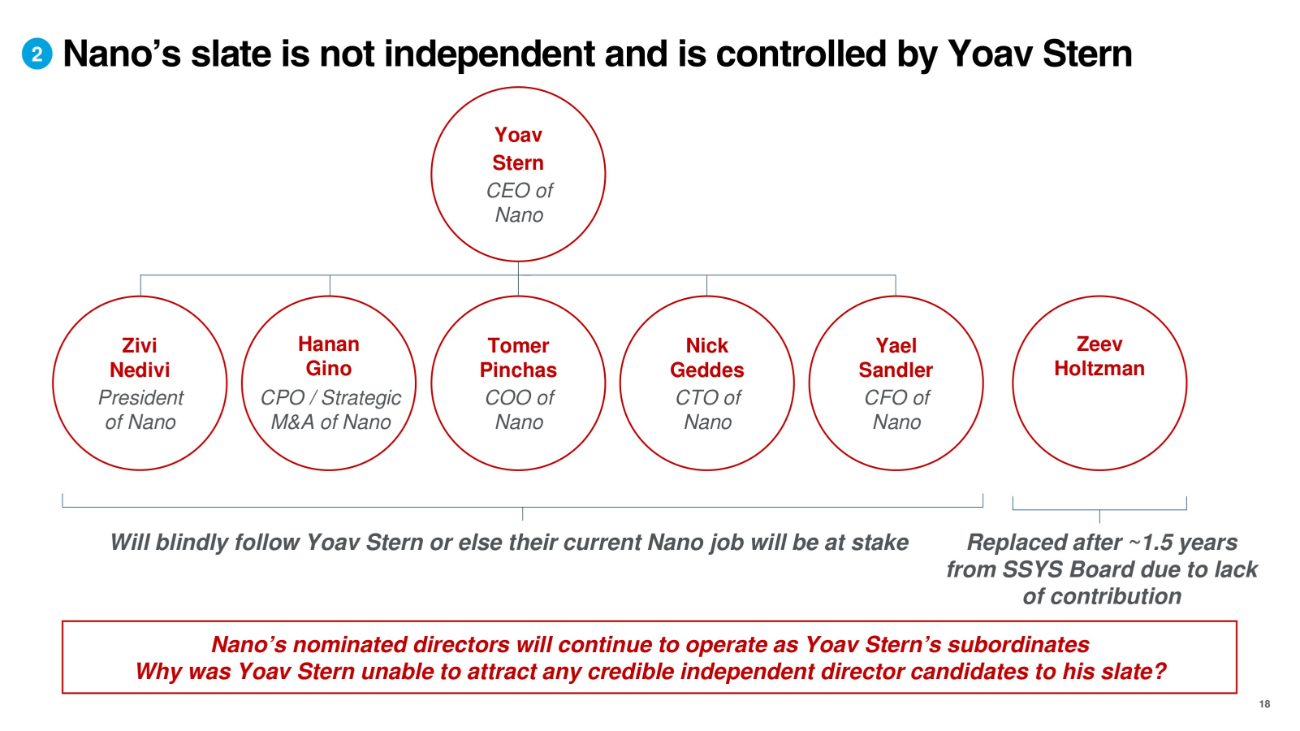

Nano’s slate is not independent and is controlled by Yoav Stern Will blindly follow Yoav Stern or else their current Nano job will be at stake Nano’s nominated directors will continue to operate as Yoav Stern’s subordinates Why was Yoav Stern unable to attract any credible independent director candidates to his slate? Replaced after ~1.5 years from SSYS Board due to lack of contribution 2 Zeev Holtzman Zivi Nedivi President of Nano Hanan Gino CPO / Strategic M&A of Nano Tomer Pinchas COO of Nano Nick Geddes CTO of Nano Yael Sandler CFO of Nano Yoav Stern CEO of Nano 18

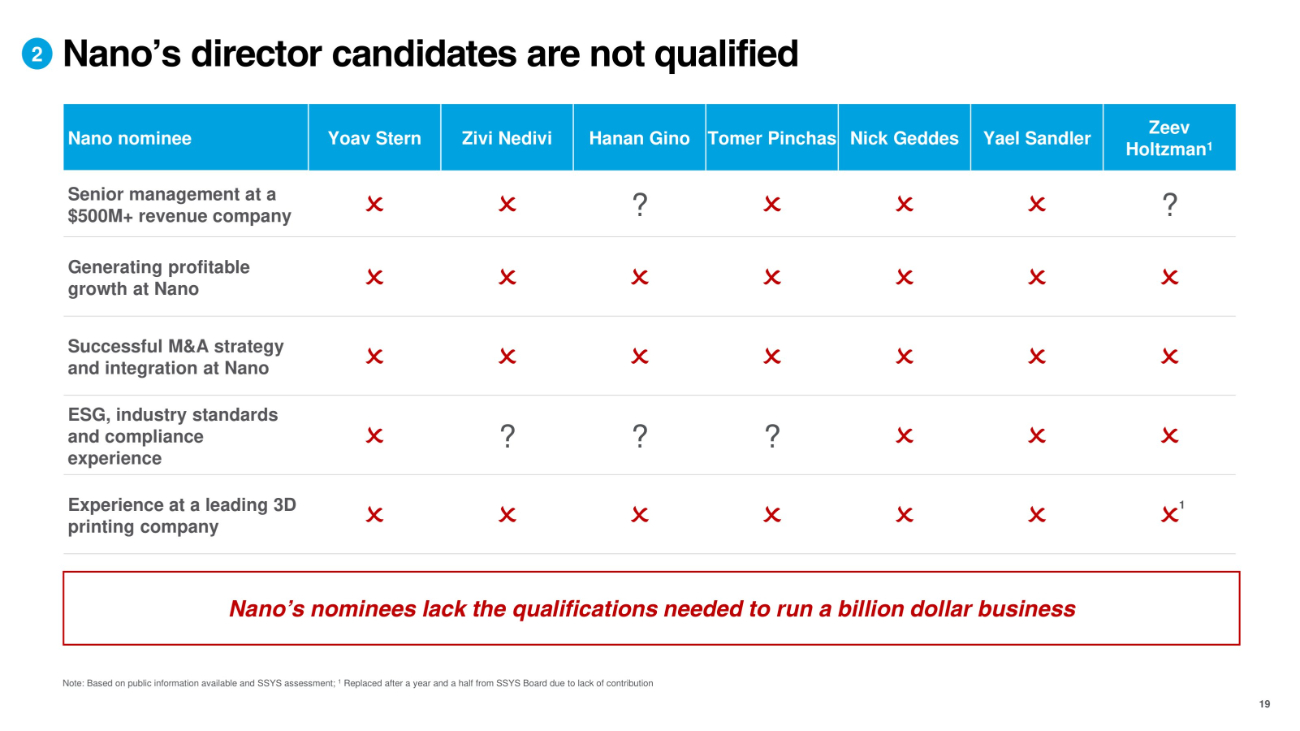

Zeev Holtzman 1 Yael Sandler Nick Geddes Tomer Pinchas Hanan Gino Zivi Nedivi Yoav Stern Nano nominee ? ? Senior management at a $500M+ revenue company Generating profitable growth at Nano Successful M&A strategy and integration at Nano ? ? ? ESG, industry standards and compliance experience 1 Experience at a leading 3D printing company Nano’s director candidates are not qualified 2 19 Nano’s nominees lack the qualifications needed to run a billion dollar business Note: Based on public information available and SSYS assessment; 1 Replaced after a year and a half from SSYS Board due to lack of contribution

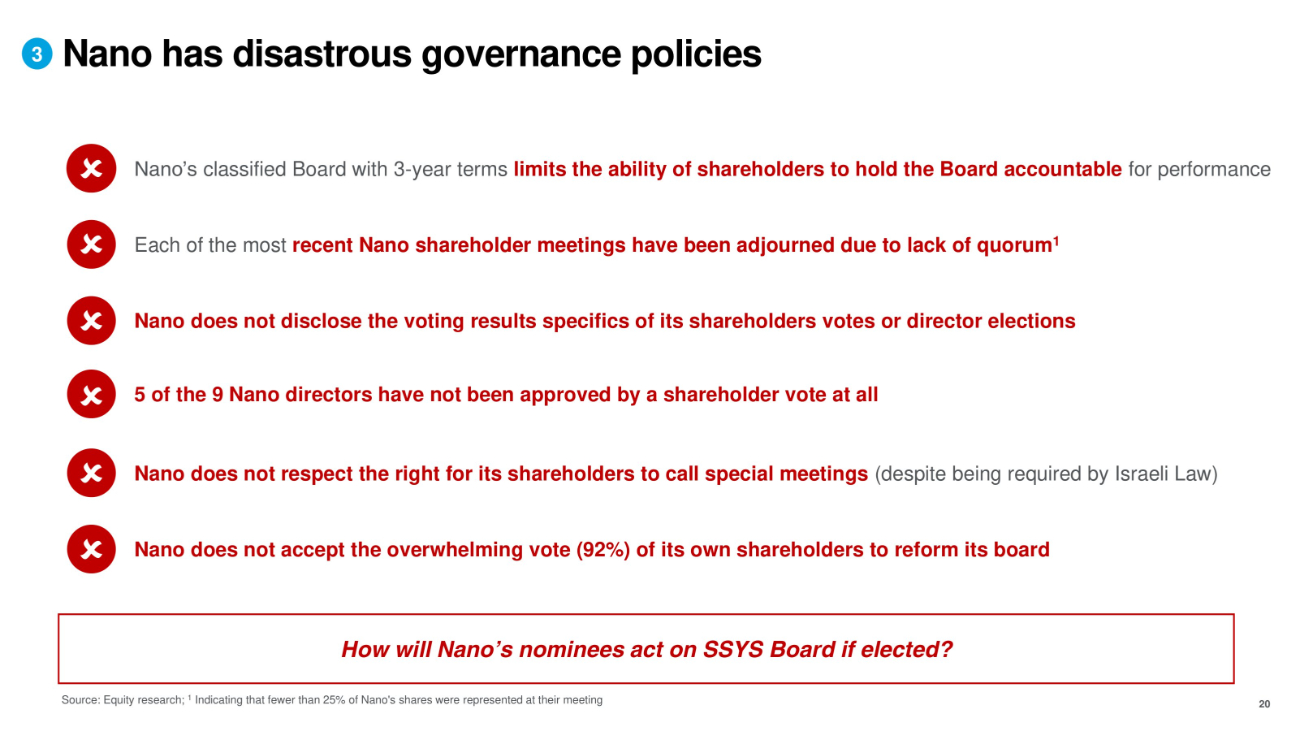

Nano has disastrous governance policies 20 5 of the 9 Nano directors have not been approved by a shareholder vote at all Source: Equity research; 1 Indicating that fewer than 25% of Nano's shares were represented at their meeting How will Nano’s nominees act on SSYS Board if elected? Nano’s classified Board with 3 - year terms limits the ability of shareholders to hold the Board accountable for performance Nano does not respect the right for its shareholders to call special meetings (despite being required by Israeli Law) Nano does not accept the overwhelming vote (92%) of its own shareholders to reform its board Each of the most recent Nano shareholder meetings have been adjourned due to lack of quorum 1 3 Nano does not disclose the voting results specifics of its shareholders votes or director elections

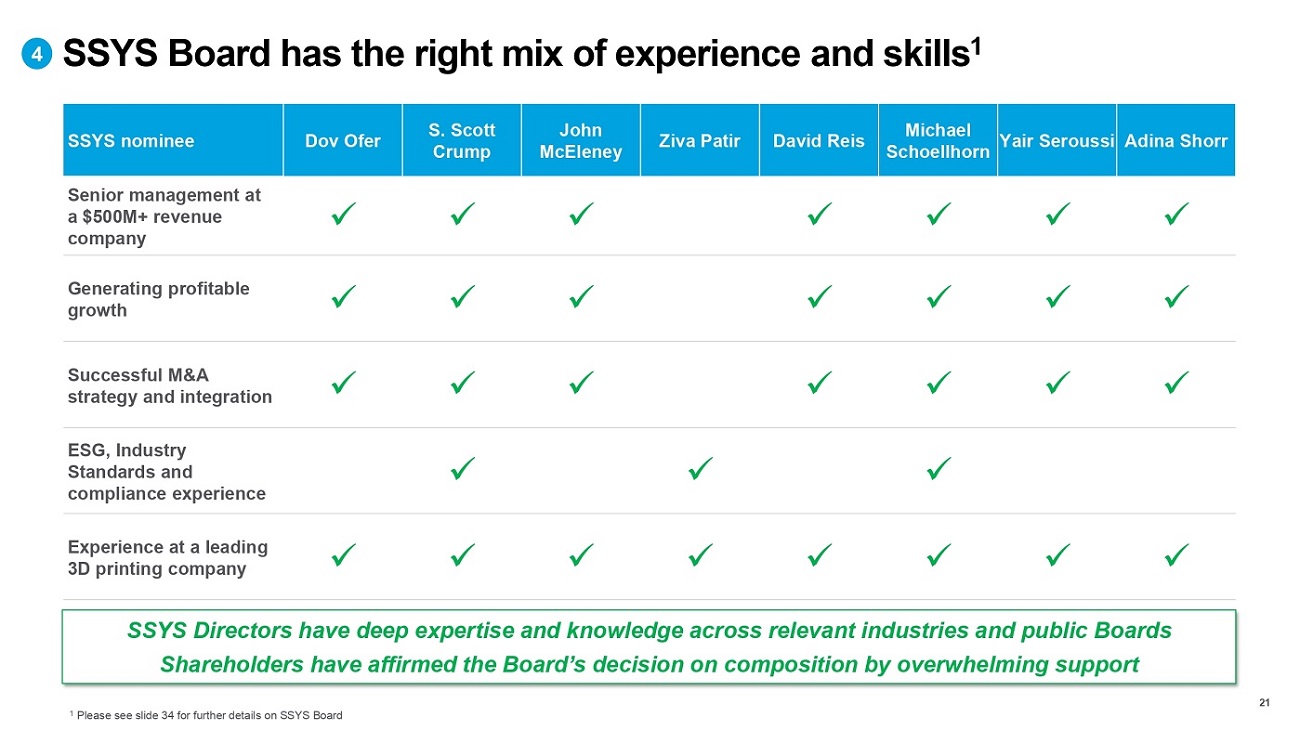

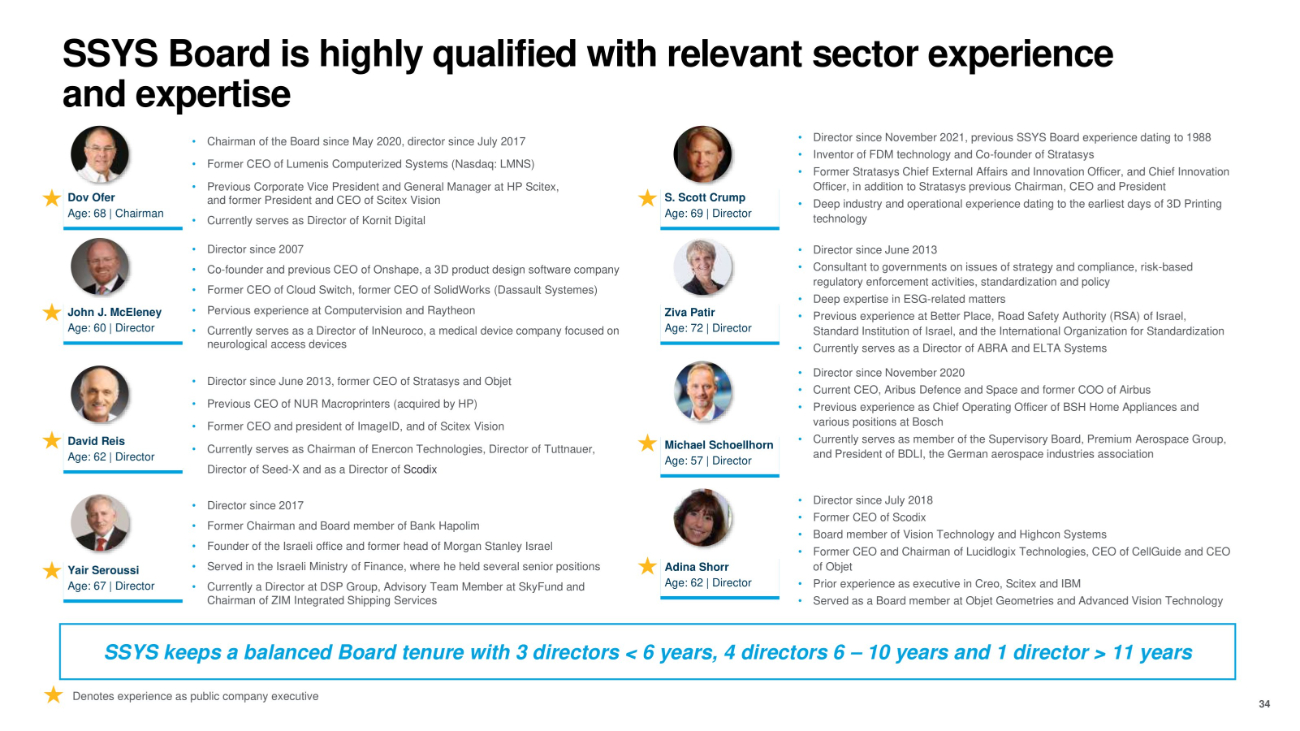

Adina Shorr Yair Seroussi Michael Schoellhorn David Reis Ziva Patir John McEleney S. Scott Crump Dov Ofer SSYS nominee x x x x x x Senior management at a $500M+ revenue company x x x x x x x Generating profitable growth x x x x x x x Successful M&A strategy and integration x x x ESG, Industry Standards and compliance experience x x x x x x x x Experience at a leading 3D printing company SSYS Board has the right mix of experience and skills 1 21 4 SSYS Directors have deep expertise and knowledge across relevant industries and public Boards Shareholders have affirmed the Board’s decision on composition by overwhelming support 1 Please see slide 34 for further details on SSYS Board

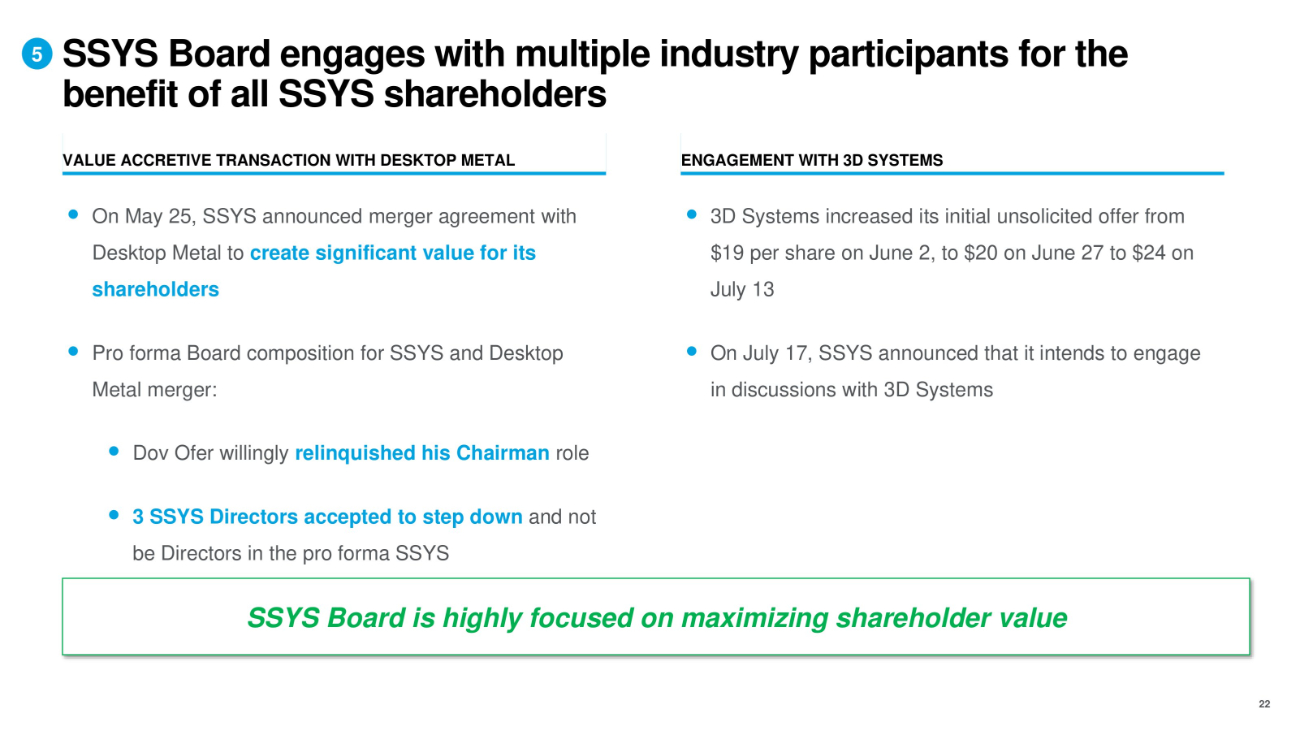

SSYS Board engages with multiple industry participants for the benefit of all SSYS shareholders 5 SSYS Board is highly focused on maximizing shareholder value VALUE ACCRETIVE TRANSACTION WITH DESKTOP METAL ENGAGEMENT WITH 3D SYSTEMS 22 On May 25, SSYS announced merger agreement with Desktop Metal to create significant value for its shareholders Pro forma Board composition for SSYS and Desktop Metal merger: Dov Ofer willingly relinquished his Chairman role 3 SSYS Directors accepted to step down and not be Directors in the pro forma SSYS 3D Systems increased its initial unsolicited offer from $19 per share on June 2, to $20 on June 27 to $24 on July 13 On July 17, SSYS announced that it intends to engage in discussions with 3D Systems

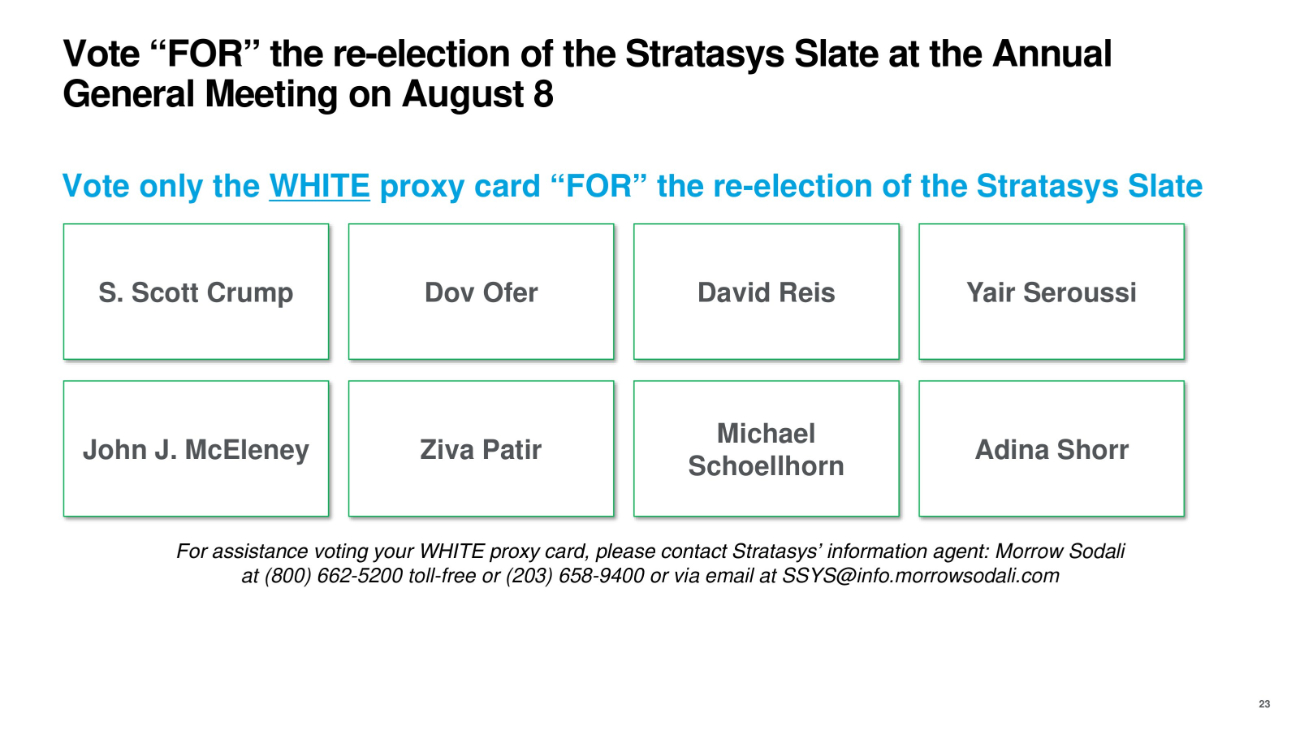

Vote “FOR” the re - election of the Stratasys Slate at the Annual General Meeting on August 8 For assistance voting your WHITE proxy card, please contact Stratasys’ information agent: Morrow Sodali at (800) 662 - 5200 toll - free or (203) 658 - 9400 or via email at SSYS@info.morrowsodali.com Vote only the WHITE proxy card “FOR” the re - election of the Stratasys Slate S. Scott Crump Dov Ofer David Reis Yair Seroussi John J. McEleney Ziva Patir Michael Schoellhorn Adina Shorr 23

Agenda Why object to Nano’s partial tender offer? Why vote for the Stratasys slate? Nano is unfit to run a large industry - leading public company 1 3 2 24

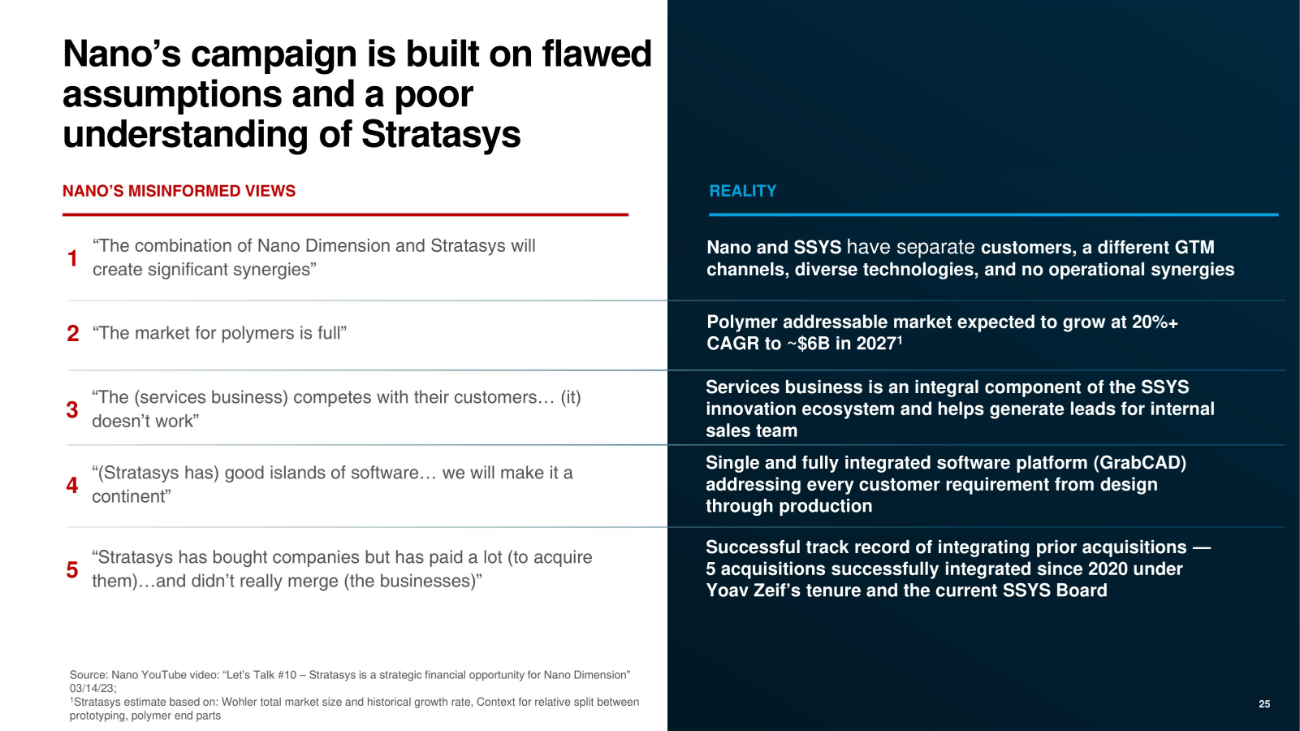

Nano’s campaign is built on flawed assumptions and a poor understanding of Stratasys “The market for polymers is full” 2 “The (services business) competes with their customers… (it) doesn’t work” 3 “(Stratasys has) good islands of software… we will make it a continent” 4 25 NANO’S MISINFORMED VIEWS REALITY Source: Nano YouTube video: “Let’s Talk #10 – Stratasys is a strategic financial opportunity for Nano Dimension” 03/14/23; 1 Stratasys estimate based on: Wohler total market size and historical growth rate, Context for relative split between prototyping, polymer end parts “Stratasys has bought companies but has paid a lot (to acquire them)…and didn’t really merge (the businesses)” 5 1 Nano and SSYS have separate customers, a different GTM channels, diverse technologies, and no operational synergies Polymer addressable market expected to grow at 20%+ CAGR to ~$6B in 2027 1 Services business is an integral component of the SSYS innovation ecosystem and helps generate leads for internal sales team Single and fully integrated software platform (GrabCAD) addressing every customer requirement from design through production Successful track record of integrating prior acquisitions — 5 acquisitions successfully integrated since 2020 under Yoav Zeif’s tenure and the current SSYS Board “The combination of Nano Dimension and Stratasys will create significant synergies”

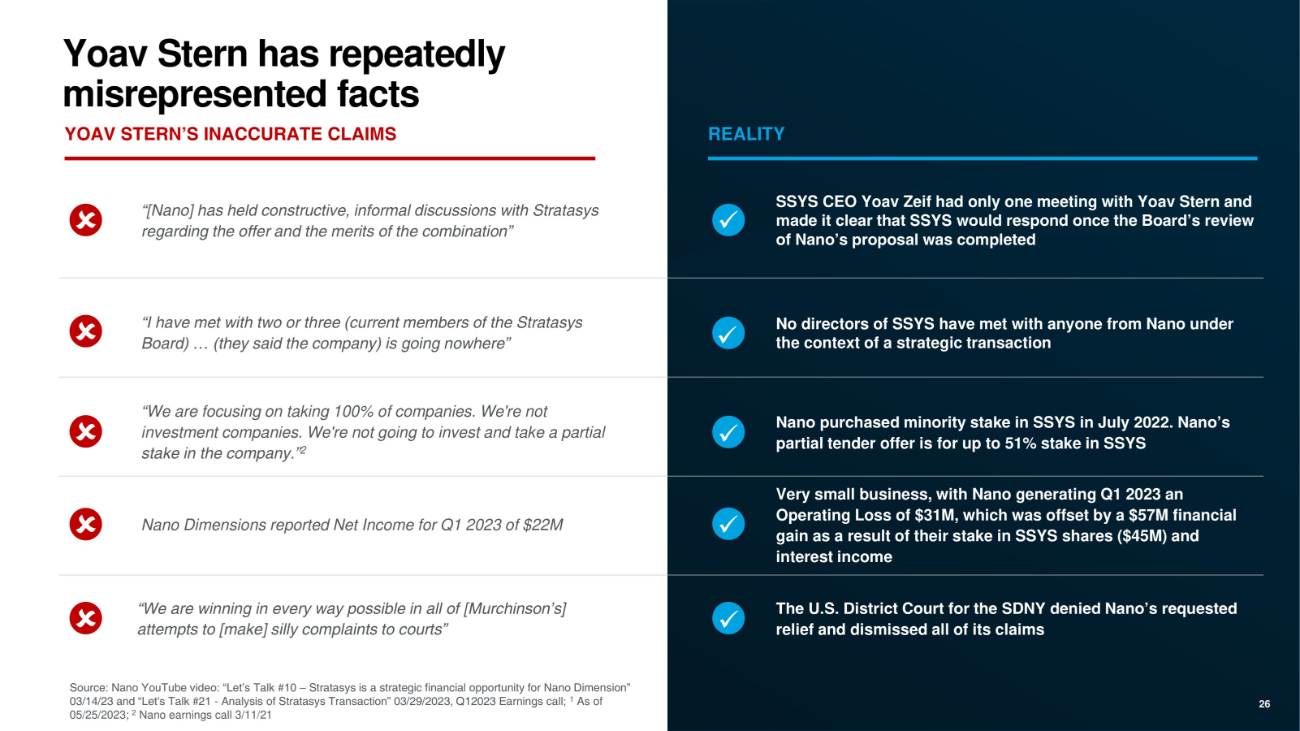

Yoav Stern has repeatedly misrepresented facts YOAV STERN’S INACCURATE CLAIMS REALITY Source: Nano YouTube video: “Let’s Talk #10 – Stratasys is a strategic financial opportunity for Nano Dimension” 03/14/23 and “Let's Talk #21 - Analysis of Stratasys Transaction” 03/29/2023, Q12023 Earnings call; 1 As of 05/25/2023; 2 Nano earnings call 3/11/21 x SSYS CEO Yoav Zeif had only one meeting with Yoav Stern and made it clear that SSYS would respond once the Board’s review of Nano’s proposal was completed “[Nano] has held constructive, informal discussions with Stratasys regarding the offer and the merits of the combination” 26 “I have met with two or three (current members of the Stratasys Board) … (they said the company) is going nowhere” No directors of SSYS have met with anyone from Nano under the context of a strategic transaction x Nano Dimensions reported Net Income for Q1 2023 of $22M Very small business, with Nano generating Q1 2023 an Operating Loss of $31M, which was offset by a $57M financial gain as a result of their stake in SSYS shares ($45M) and interest income x “We are winning in every way possible in all of [Murchinson’s] attempts to [make] silly complaints to courts” x The U.S. District Court for the SDNY denied Nano’s requested relief and dismissed all of its claims “We are focusing on taking 100% of companies. We're not investment companies. We're not going to invest and take a partial stake in the company.” 2 Nano purchased minority stake in SSYS in July 2022. Nano’s partial tender offer is for up to 51% stake in SSYS x

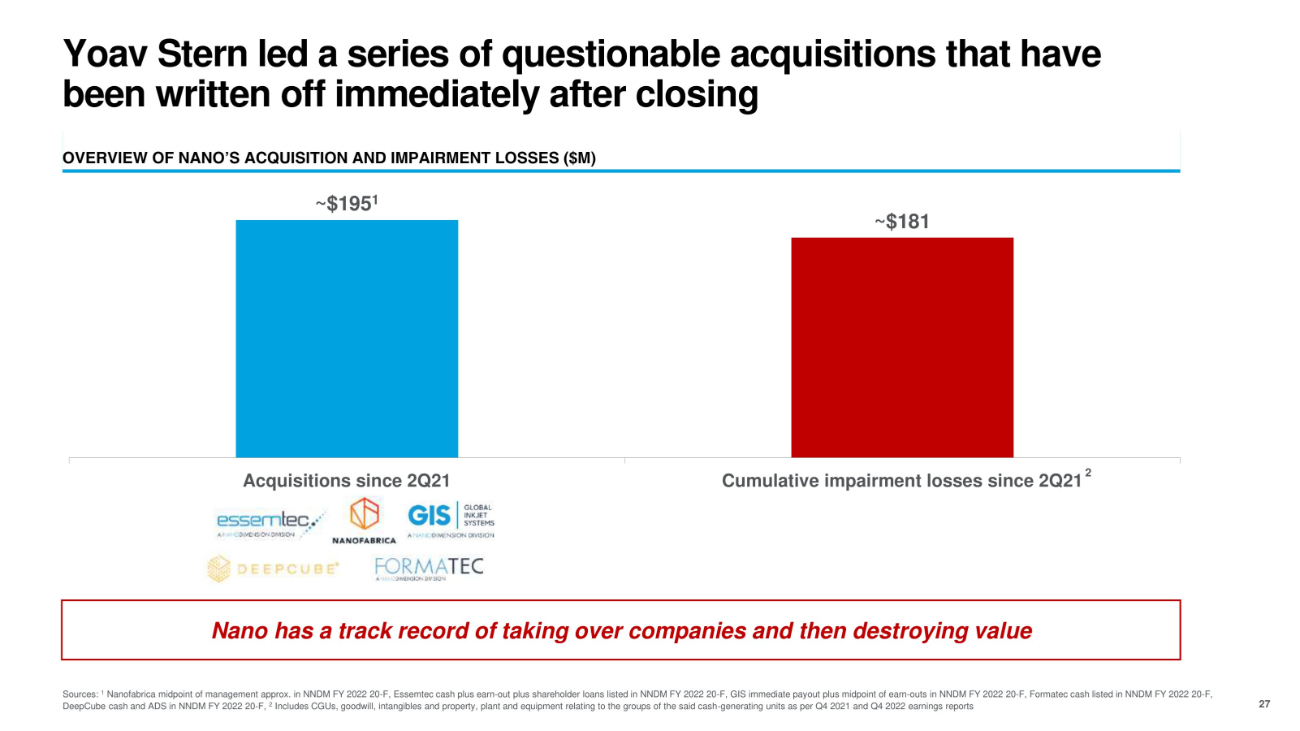

27 Yoav Stern led a series of questionable acquisitions that have been written off immediately after closing Sources: 1 Nanofabrica midpoint of management approx. in NNDM FY 2022 20 - F, Essemtec cash plus earn - out plus shareholder loans listed in NNDM FY 2022 20 - F, GIS immediate payout plus midpoint of earn - outs in NNDM FY 2022 20 - F, Formatec cash listed in NNDM FY 2022 20 - F, DeepCube cash and ADS in NNDM FY 2022 20 - F, 2 Includes CGUs, goodwill, intangibles and property, plant and equipment relating to the groups of the said cash - generating units as per Q4 2021 and Q4 2022 earnings reports ~$181 Acquisitions since 2Q21 Cumulative impairment losses since 2Q21 2 OVERVIEW OF NANO’S ACQUISITION AND IMPAIRMENT LOSSES ($M) ~$195 1 Nano has a track record of taking over companies and then destroying value

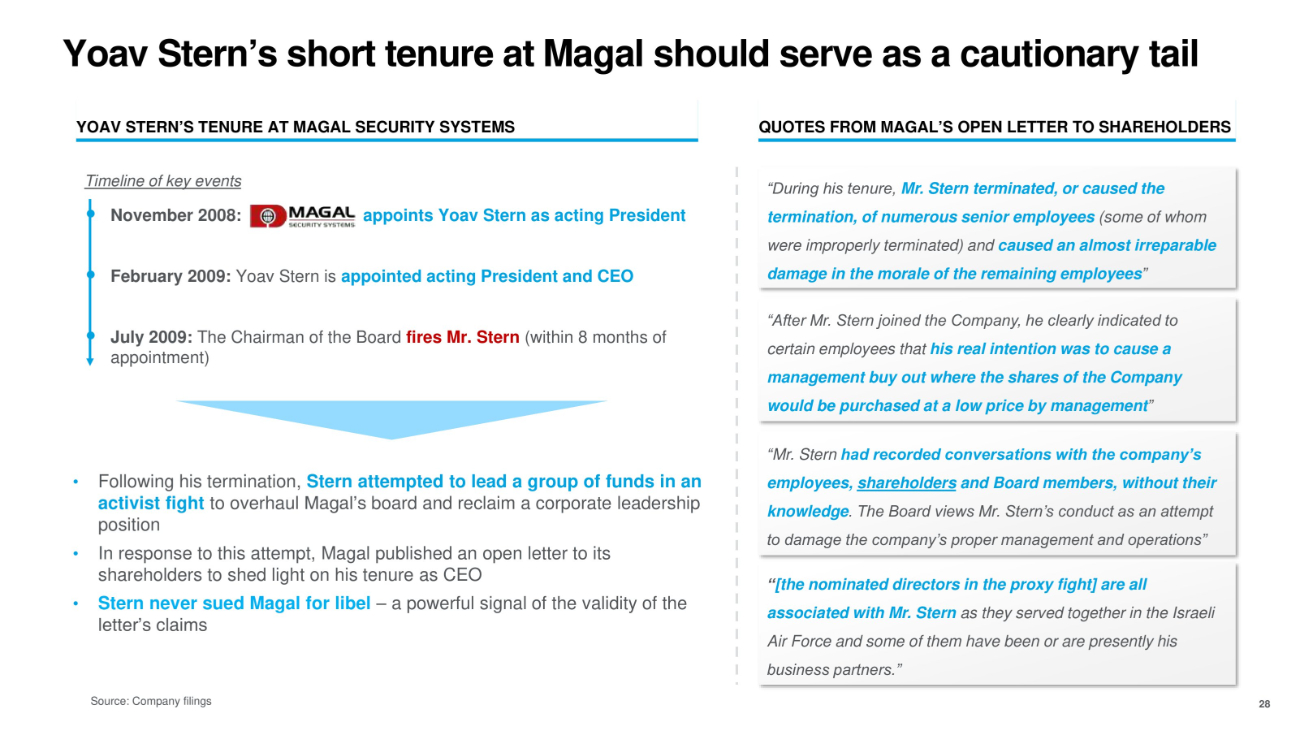

Yoav Stern’s short tenure at Magal should serve as a cautionary tail • Following his termination, Stern attempted to lead a group of funds in an activist fight to overhaul Magal’s board and reclaim a corporate leadership position • In response to this attempt, Magal published an open letter to its shareholders to shed light on his tenure as CEO • Stern never sued Magal for libel – a powerful signal of the validity of the letter’s claims YOAV STERN’S TENURE AT MAGAL SECURITY SYSTEMS 28 QUOTES FROM MAGAL’S OPEN LETTER TO SHAREHOLDERS “After Mr. Stern joined the Company, he clearly indicated to certain employees that his real intention was to cause a management buy out where the shares of the Company would be purchased at a low price by management ” “ [the nominated directors in the proxy fight] are all associated with Mr. Stern as they served together in the Israeli Air Force and some of them have been or are presently his business partners.” “During his tenure, Mr. Stern terminated, or caused the termination, of numerous senior employees (some of whom were improperly terminated) and caused an almost irreparable damage in the morale of the remaining employees ” Source: Company filings appoints Yoav Stern as acting President February 2009: Yoav Stern is appointed acting President and CEO July 2009: The Chairman of the Board fires Mr. Stern (within 8 months of appointment) Timeline of key events November 2008: “Mr. Stern had recorded conversations with the company’s employees, shareholders and Board members, without their knowledge . The Board views Mr. Stern’s conduct as an attempt to damage the company’s proper management and operations”

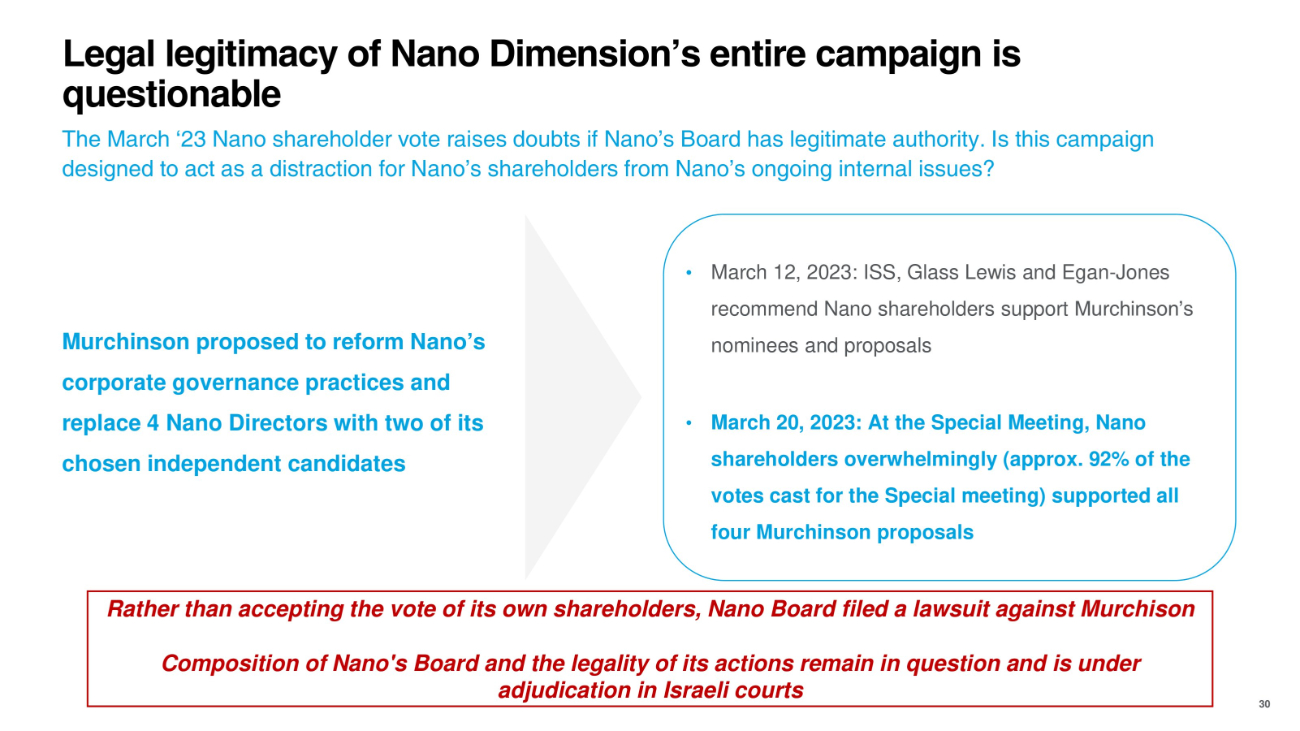

Nano Board and CEO presided over corporate governance failings 29 Source: Company filings, ISS, Glass Lewis, Egan Jones Yoav Stern and the Nano Board have demonstrated a blatant lack of regard for the voice of their own shareholders and the recommendation of all the Independent Proxy Advisory firms. How would they treat the public minority shareholders of Stratasys? Pay and performance misalignment Lagging performance Corporate governance failures / concerns • Nano’s stock price has traded well below the cash value per share on its balance sheet for over a year, raising questions whether Nano’s Board and management will misuse its cash • The Nano Board tried to re - price CEO and Chairman Yoav Stern’s severely out - of - the - money options to a strike price well below Nano’s cash and securities per share • Shareholders voted this proposal down at the meeting in December 2022 • All three major, independent proxy advisory firms recommended to remove four sitting Nano directors including Yoav Stern at a special meeting on March 20, 2023 • 92% of Nano shareholders who voted supported removal of the four directors , and the election of two new independent directors nominated by Murchinson

Legal legitimacy of Nano Dimension’s entire campaign is questionable The March ‘23 Nano shareholder vote raises doubts if Nano’s Board has legitimate authority. Is this campaign designed to act as a distraction for Nano’s shareholders from Nano’s ongoing internal issues? Murchinson proposed to reform Nano’s corporate governance practices and replace 4 Nano Directors with two of its chosen independent candidates Rather than accepting the vote of its own shareholders, Nano Board filed a lawsuit against Murchison Composition of Nano's Board and the legality of its actions remain in question and is under adjudication in Israeli courts • March 12, 2023: ISS, Glass Lewis and Egan - Jones recommend Nano shareholders support Murchinson’s nominees and proposals 30 • March 20, 2023: At the Special Meeting, Nano shareholders overwhelmingly (approx. 92% of the votes cast for the Special meeting) supported all four Murchinson proposals

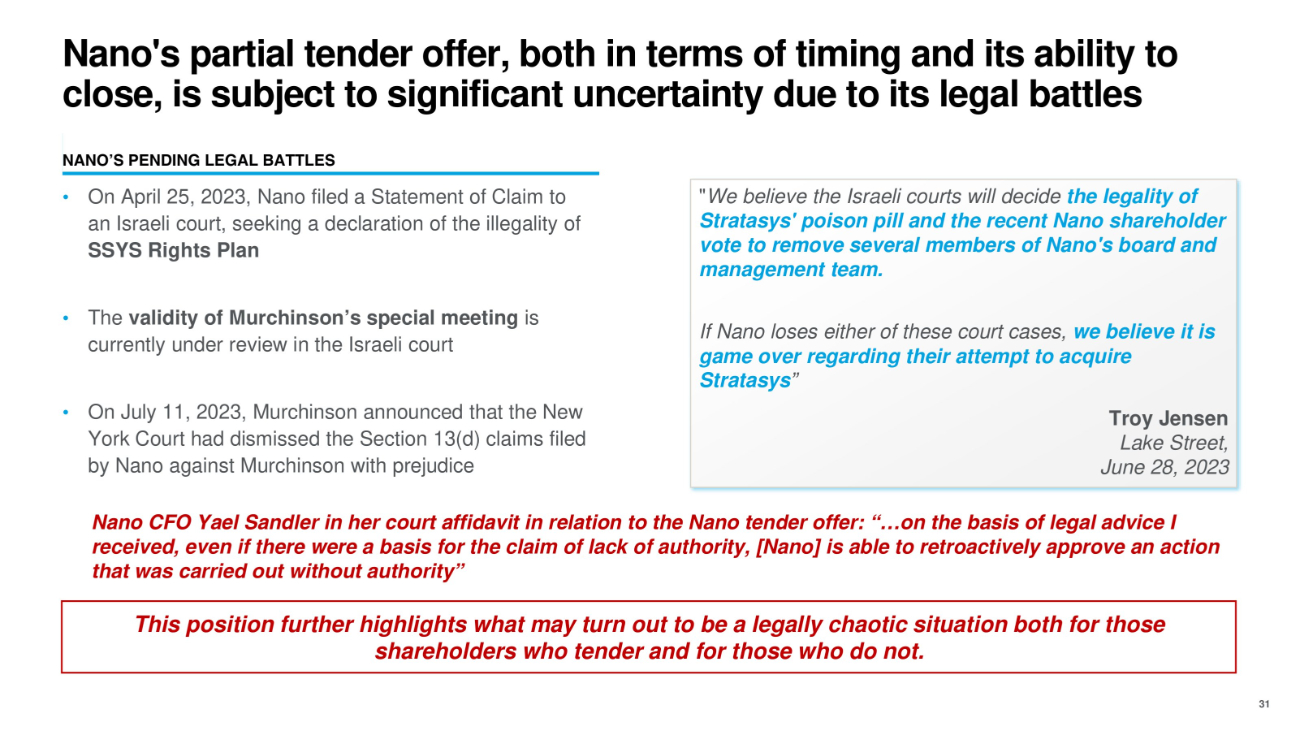

Nano's partial tender offer, both in terms of timing and its ability to close, is subject to significant uncertainty due to its legal battles This position further highlights what may turn out to be a legally chaotic situation both for those shareholders who tender and for those who do not. NANO’S PENDING LEGAL BATTLES • On April 25, 2023, Nano filed a Statement of Claim to an Israeli court, seeking a declaration of the illegality of SSYS Rights Plan • The validity of Murchinson’s special meeting is currently under review in the Israeli court • On July 11 , 2023 , Murchinson announced that the New York Court had dismissed the Section 13 (d) claims filed by Nano against Murchinson with prejudice " We believe the Israeli courts will decide the legality of Stratasys' poison pill and the recent Nano shareholder vote to remove several members of Nano's board and management team. If Nano loses either of these court cases, we believe it is game over regarding their attempt to acquire Stratasys ” Troy Jensen Lake Street, June 28, 2023 31 Nano CFO Yael Sandler in her court affidavit in relation to the Nano tender offer: “…on the basis of legal advice I received, even if there were a basis for the claim of lack of authority, [Nano] is able to retroactively approve an action that was carried out without authority”

Agenda 32 Supporting Materials

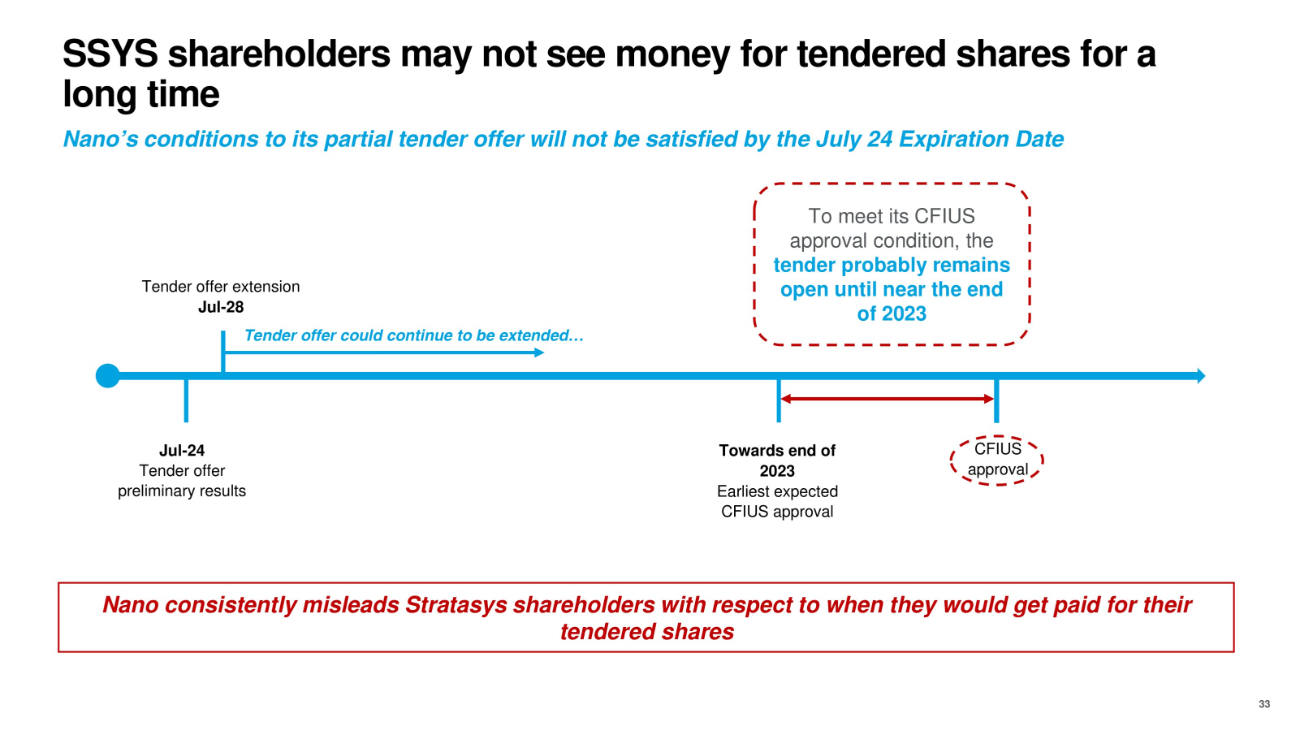

SSYS shareholders may not see money for tendered shares for a long time Nano’s conditions to its partial tender offer will not be satisfied by the July 24 Expiration Date Nano consistently misleads Stratasys shareholders with respect to when they would get paid for their tendered shares Jul - 24 Tender offer preliminary results Tender offer extension Jul - 28 Tender offer could continue to be extended… Towards end of 2023 Earliest expected CFIUS approval CFIUS approval To meet its CFIUS approval condition, the tender probably remains open until near the end of 2023 33

SSYS Board is highly qualified with relevant sector experience and expertise • Chairman of the Board since May 2020, director since July 2017 • Former CEO of Lumenis Computerized Systems (Nasdaq: LMNS) • Previous Corporate Vice President and General Manager at HP Scitex, and former President and CEO of Scitex Vision • Currently serves as Director of Kornit Digital • Director since November 2021, previous SSYS Board experience dating to 1988 • Inventor of FDM technology and Co - founder of Stratasys • Former Stratasys Chief External Affairs and Innovation Officer, and Chief Innovation Officer, in addition to Stratasys previous Chairman, CEO and President • Deep industry and operational experience dating to the earliest days of 3D Printing technology • Director since June 2013 • Consultant to governments on issues of strategy and compliance, risk - based regulatory enforcement activities, standardization and policy • Deep expertise in ESG - related matters • Previous experience at Better Place, Road Safety Authority (RSA) of Israel, Standard Institution of Israel, and the International Organization for Standardization • Currently serves as a Director of ABRA and ELTA Systems Ziva Patir Age: 72 | Director Dov Ofer Age: 68 | Chairman Denotes experience as public company executive • Director since 2007 • Co - founder and previous CEO of Onshape, a 3D product design software company • Former CEO of Cloud Switch, former CEO of SolidWorks (Dassault Systemes) • Pervious experience at Computervision and Raytheon • Currently serves as a Director of InNeuroco, a medical device company focused on neurological access devices John J. McEleney Age: 60 | Director • Director since June 2013, former CEO of Stratasys and Objet • Previous CEO of NUR Macroprinters (acquired by HP) • Former CEO and president of ImageID, and of Scitex Vision • Currently serves as Chairman of Enercon Technologies, Director of Tuttnauer, Director of Seed - X and as a Director of Scodix David Reis Age: 62 | Director • Director since 2017 • Former Chairman and Board member of Bank Hapolim • Founder of the Israeli office and former head of Morgan Stanley Israel • Served in the Israeli Ministry of Finance, where he held several senior positions • Currently a Director at DSP Group, Advisory Team Member at SkyFund and Chairman of ZIM Integrated Shipping Services Yair Seroussi Age: 67 | Director S. Scott Crump Age: 69 | Director • Director since July 2018 • Former CEO of Scodix • Board member of Vision Technology and Highcon Systems • Former CEO and Chairman of Lucidlogix Technologies, CEO of CellGuide and CEO of Objet • Prior experience as executive in Creo, Scitex and IBM • Served as a Board member at Objet Geometries and Advanced Vision Technology Adina Shorr Age: 62 | Director • Director since November 2020 • Current CEO, Aribus Defence and Space and former COO of Airbus • Previous experience as Chief Operating Officer of BSH Home Appliances and various positions at Bosch • Currently serves as member of the Supervisory Board, Premium Aerospace Group, and President of BDLI, the German aerospace industries association Michael Schoellhorn Age: 57 | Director SSYS keeps a balanced Board tenure with 3 directors < 6 years, 4 directors 6 – 10 years and 1 director > 11 years 34

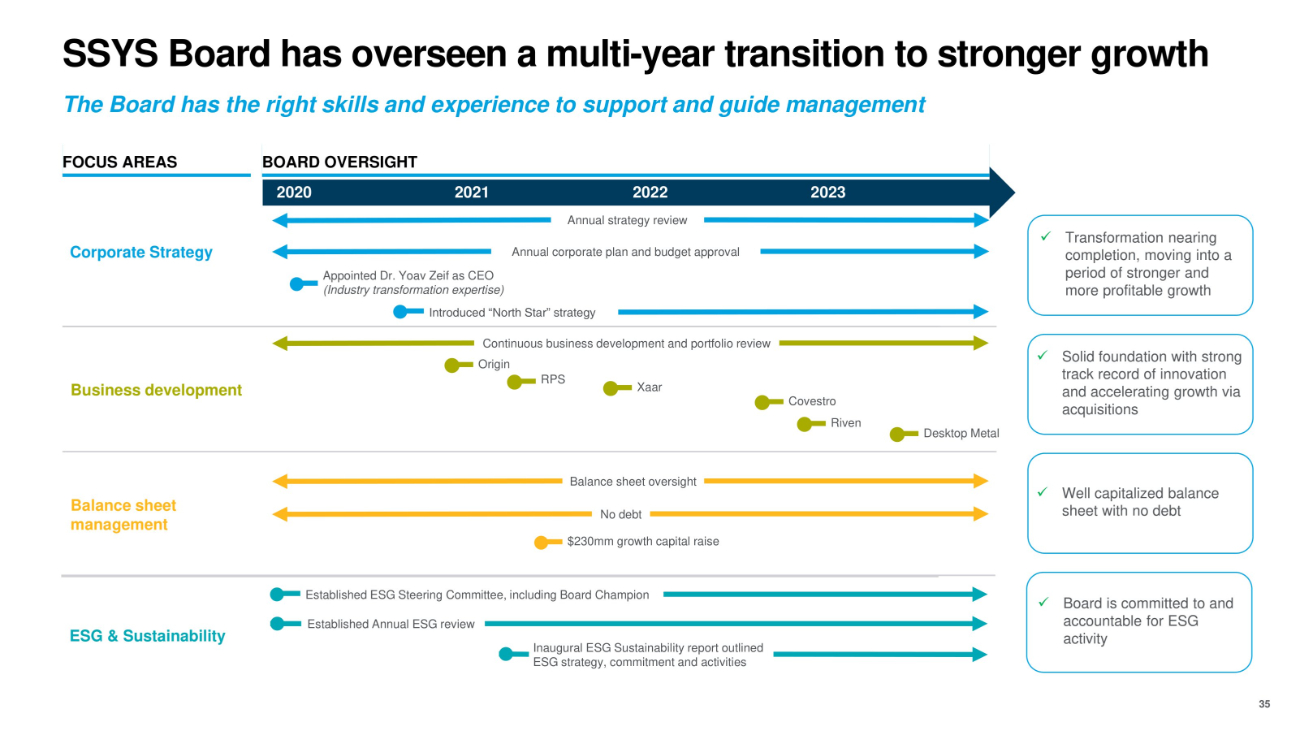

SSYS Board has overseen a multi - year transition to stronger growth FOCUS AREAS Corporate Strategy Business development 2020 2021 2023 Balance sheet management x Transformation nearing completion, moving into a period of stronger and more profitable growth x Well capitalized balance sheet with no debt BOARD OVERSIGHT 2022 Annual strategy review Appointed Dr. Yoav Zeif as CEO (Industry transformation expertise) The Board has the right skills and experience to support and guide management Annual corporate plan and budget approval Introduced “North Star” strategy x Solid foundation with strong track record of innovation and accelerating growth via acquisitions Continuous business development and portfolio review Origin Riven Desktop Metal Covestro x Board is committed to and accountable for ESG activity ESG & Sustainability Established Annual ESG review Inaugural ESG Sustainability report outlined ESG strategy, commitment and activities Established ESG Steering Committee, including Board Champion RPS Xaar $230mm growth capital raise No debt Balance sheet oversight 35

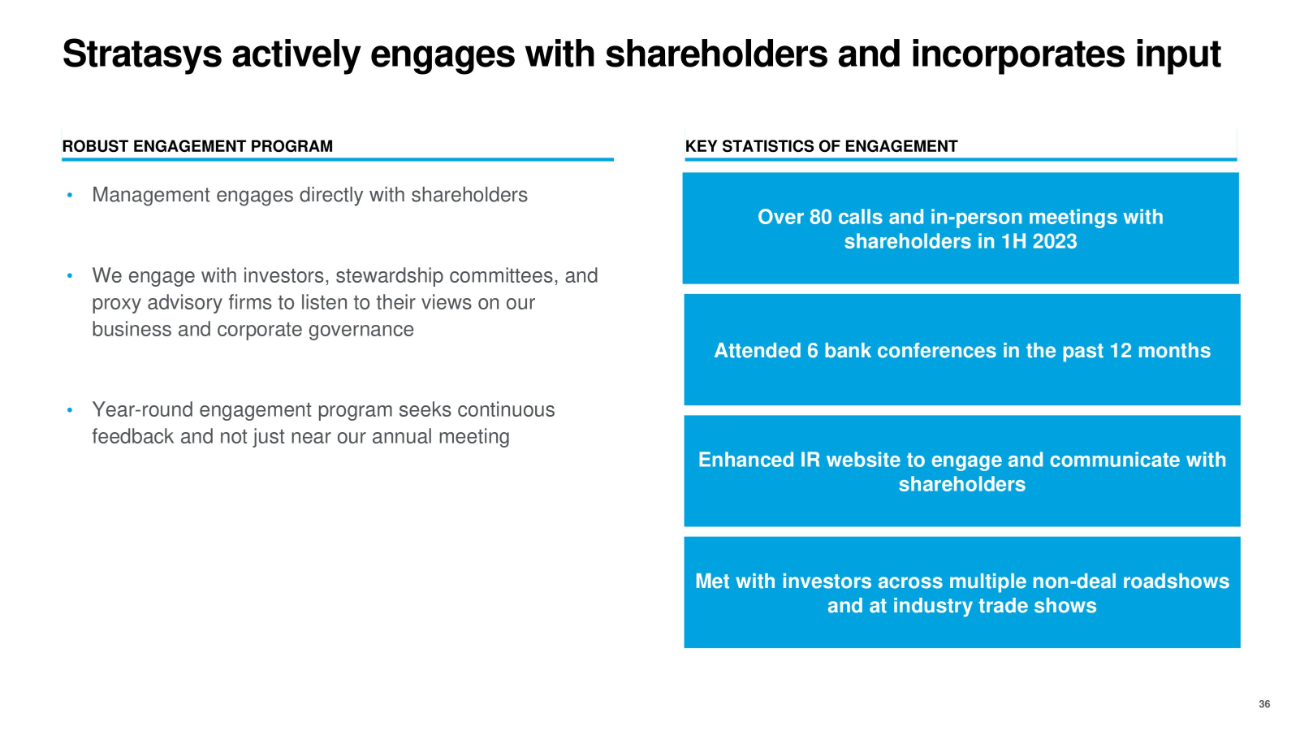

Stratasys actively engages with shareholders and incorporates input • Management engages directly with shareholders Over 80 calls and in - person meetings with shareholders in 1H 2023 KEY STATISTICS OF ENGAGEMENT ROBUST ENGAGEMENT PROGRAM • We engage with investors, stewardship committees, and proxy advisory firms to listen to their views on our business and corporate governance Attended 6 bank conferences in the past 12 months • Year - round engagement program seeks continuous feedback and not just near our annual meeting Enhanced IR website to engage and communicate with shareholders Met with investors across multiple non - deal roadshows and at industry trade shows 36

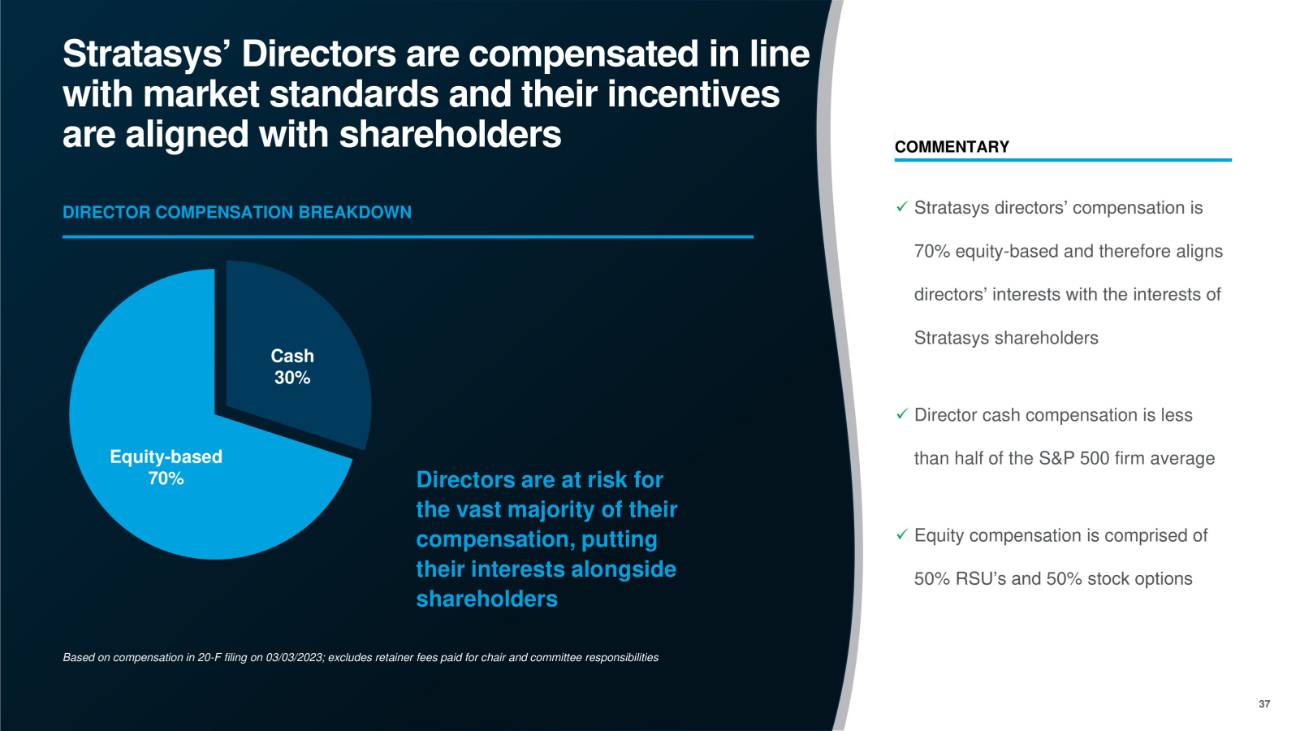

Stratasys’ Directors are compensated in line with market standards and their incentives are aligned with shareholders Cash 30% Equity - based 70% Based on compensation in 20 - F filing on 03/03/2023; excludes retainer fees paid for chair and committee responsibilities Directors are at risk for the vast majority of their compensation, putting their interests alongside shareholders x Stratasys directors’ compensation is 70% equity - based and therefore aligns directors’ interests with the interests of Stratasys shareholders x Director cash compensation is less than half of the S&P 500 firm average x Equity compensation is comprised of 50% RSU’s and 50% stock options COMMENTARY DIRECTOR COMPENSATION BREAKDOWN 37

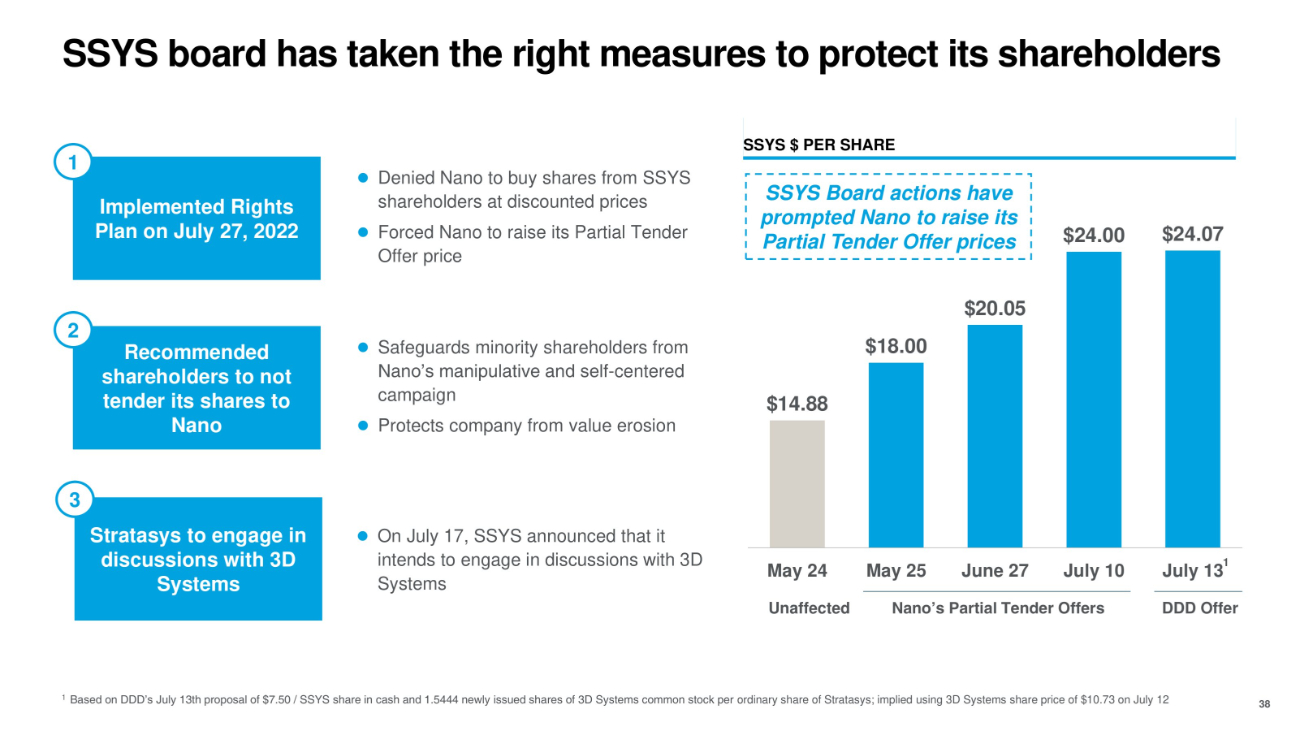

SSYS board has taken the right measures to protect its shareholders 38 SSYS $ PER SHARE $14.88 $18.00 $20.05 $24.00 $24.07 May 24 July 13 1 May 25 June 27 July 10 Nano’s Partial Tender Offers Denied Nano to buy shares from SSYS shareholders at discounted prices Forced Nano to raise its Partial Tender Offer price Implemented Rights Plan on July 27, 2022 1 Safeguards minority shareholders from Nano’s manipulative and self - centered campaign Protects company from value erosion Recommended shareholders to not tender its shares to Nano 2 Unaffected SSYS Board actions have prompted Nano to raise its Partial Tender Offer prices On July 17, SSYS announced that it intends to engage in discussions with 3D Systems Stratasys to engage in discussions with 3D Systems 3 DDD Offer 1 Based on DDD’s July 13th proposal of $7.50 / SSYS share in cash and 1.5444 newly issued shares of 3D Systems common stock per ordinary share of Stratasys; implied using 3D Systems share price of $10.73 on July 12

Illustrative pro - rata share price assuming full participation in Nano’s partial tender offer 39 Nano market capitalization has been on average ~58% of its cash and investments position; applying same discount to SSYS unaffected to imply illustrative trading price of remaining shares 2 $14.88 Unaffected SSYS price per share 58% Nano trading factor ~$9 Illustrative trading price of remaining shares ~$15 Illustrative pro rata price per share 3 Note: All analysis highly illustrative; 1 68.6M outstanding shares less 9.7M shares owned by Nano already and less 25.3M shares theoretically acquired at partial TO; 2 Reflects average Nano YTD trading as of 7/14/23; 3 Calculated as the blended share price assuming successful partial TO and illustrative trading price; 4 Adjusted for net cash (incl. unconsolidated investments) of $337M; 5 Based on SSYS FDSO of 72.7M shares Assumes SSYS trades at 0.5x - 1.0x EV / 23E revenue 1.0x 0.5x EV / 23E revenue $650 $650 23E SSYS revenue (mid point guidance) $650 $325 Implied EV $987 $662 Implied market cap 4 ~$14 ~$9 Illustrative trading price of remaining shares 5 ~$18 ~$16 Illustrative pro rata price per share 3 Shares acquired by Nano via partial tender offer (“TO”): 25.3M Nano partial tender offer price: $24.00 per share Remaining shares not purchased by Nano: 33.6M 1 APPLYING NANO TRADING DISCOUNT APPLYING REVENUE MULTIPLE PER SHARE ITEMS IN $ IN MILLIONS, PER SHARE ITEMS IN $ ASSUMPTIONS Assumes SSYS remaining shares trade at SSYS unaffected price of $14.88 SSYS UNAFFECTED SHARE PRICE PER SHARE ITEMS IN $ $14.88 Unaffected SSYS price per share $14.88 Illustrative trading price of remaining shares ~$19 Illustrative pro rata price per share 3

Thank You 40