Exhibit (a)(13)

Delivering superior value with Desktop Metal combination J U N E 2 0 2 3

HIGHLY PRELIMINARY DRAFT – SUBJECT TO REVISION Disclaimer 2 Forward - Looking Statements This document contains forward - looking statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, the actual results of Stratasys Ltd. and its consolidated subsidiaries (“Stratasys”) may differ materially from those expressed or implied by such forward - looking statements and assumptions. All statements other than statements of historical fact are statements that could be deemed forward - looking statements. Such forward - looking statements include statements relating to the proposed transaction between Stratasys and Desktop Metal, Inc. (“Desktop Metal”), including statements regarding the benefits of the transaction and the anticipated timing of the transaction, and information regarding the businesses of Stratasys and Desktop Metal, including expectations regarding outlook and all underlying assumptions, Stratasys’ and Desktop Metal’s objectives, plans and strategies, information relating to operating trends in markets where Stratasys and Desktop Metal operate, statements that contain projections of results of operations or of financial condition and all other statements other than statements of historical fact that address activities, events or developments that Stratasys or Desktop Metal intends, expects, projects, believes or anticipates will or may occur in the future. Such statements are based on management’s beliefs and assumptions made based on information currently available to management. All statements in this communication, other than statements of historical fact, are forward - looking statements that may be identified by the use of the words “outlook,” “guidance,” “expects,” “believes,” “anticipates,” “should,” “estimates,” and similar expressions. These forward - looking statements involve known and unknown risks and uncertainties, which may cause Stratasys’ or Desktop Metal’s actual results and performance to be materially different from those expressed or implied in the forward - looking statements. Factors and risks that may impact future results and performance include, but are not limited to those factors and risks described in Item 3.D “Key Information - Risk Factors”, Item 4 “Information on the Company”, and Item 5 “Operating and Financial Review and Prospects” in Stratasys’ Annual Report on Form 20 - F for the year ended December 31, 2022 and Part 1, Item 1A, “Risk Factors” in Desktop Metal’s Annual Report on Form 10 - K for the year ended December 31, 2022, each filed with the Securities and Exchange Commission (the “SEC”), and in other filings by Stratasys and Desktop Metal with the SEC. These include, but are not limited to: factors relating to the partial tender offer commenced by Nano Dimension Ltd. (“Nano”), including actions taken by Nano in connection with the offer, actions taken by Stratasys or its shareholders in respect of the offer and the effects of the offer on Stratasys’ businesses, or other developments involving Nano, the ultimate outcome of the proposed transaction between Stratasys and Desktop Metal, including the possibility that Stratasys or Desktop Metal shareholders will reject the proposed transaction; the effect of the announcement of the proposed transaction on the ability of Stratasys and Desktop Metal to operate their respective businesses and retain and hire key personnel and to maintain favorable business relationships; the timing of the proposed transaction; the occurrence of any event, change or other circumstance that could give rise to the termination of the proposed transaction; the ability to satisfy closing conditions to the completion of the proposed transaction (including any necessary shareholder approvals); other risks related to the completion of the proposed transaction and actions related thereto; changes in demand for Stratasys’ or Desktop Metal’s products and services; global market, political and economic conditions, and in the countries in which Stratasys and Desktop Metal operate in particular; government regulations and approvals; the extent of growth of the 3D printing market generally; the global macro - economic environment, including headwinds caused by inflation, rising interest rates, unfavorable currency exchange rates and potential recessionary conditions; the impact of shifts in prices or margins of the products that Stratasys or Desktop Metal sells or services Stratasys or Desktop Metal provides, including due to a shift towards lower margin products or services; the potential adverse impact that recent global interruptions and delays involving freight carriers and other third parties may have on Stratasys’ or Desktop Metal’s supply chain and distribution network and consequently, Stratasys’ or Desktop Metal’s ability to successfully sell both existing and newly - launched 3D printing products; litigation and regulatory proceedings, including any proceedings that may be instituted against Stratasys or Desktop Metal related to the proposed transaction; impacts of rapid technological change in the additive manufacturing industry, which requires Stratasys and Desktop Metal to continue to develop new products and innovations to meet constantly evolving customer demands and which could adversely affect market adoption of Stratasys’ or Desktop Metal’s products; and disruptions of Stratasys’ or Desktop Metal’s information technology systems. These risks, as well as other risks related to the proposed transaction, are included in the registration statement on Form F - 4 and joint proxy statement/prospectus that has been filed with the Securities and Exchange Commission (“SEC”) in connection with the proposed transaction. While the list of factors presented here is, and the list of factors presented in the registration statement on Form F - 4 are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. For additional information about other factors that could cause actual results to differ materially from those described in the forward - looking statements, please refer to Stratasys’ and Desktop Metal’s respective periodic reports and other filings with the SEC, including the risk factors identified in Stratasys’ and Desktop Metal’s Annual Reports on Form 20 - F and Form 10 - K, respectively, and Stratasys’ Form 6 - K reports that published its results for the quarter ended March 31, 2023, which it furnished to the SEC on May 16, 2023, and Desktop Metal’s most recent Quarterly Reports on Form 10 - Q. The forward - looking statements included in this communication are made only as of the date hereof. Neither Stratasys nor Desktop Metal undertakes any obligation to update any forward - looking statements to reflect subsequent events or circumstances, except as required by law. No Offer or Solicitation This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

HIGHLY PRELIMINARY DRAFT – SUBJECT TO REVISION Disclaimer 3 Important Additional Information In connection with the proposed transaction, Stratasys filed with the SEC a registration statement on Form F - 4 that includes a joint proxy statement of Stratasys and Desktop Metal and that also constitutes a prospectus of Stratasys. Each of Stratasys and Desktop Metal may also file other relevant documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration statement or any other document that Stratasys or Desktop Metal may file with the SEC. The registration statement has not yet become effective. After the registration statement is effective, the definitive joint proxy statement/prospectus will be mailed to shareholders of Stratasys and Desktop Metal. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration statement and definitive joint proxy statement/prospectus and other documents containing important information about Stratasys, Desktop Metal and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with, or furnished, to the SEC by Stratasys will be available free of charge on Stratasys’ website at https://investors.stratasys.com/sec - filings. Copies of the documents filed with the SEC by Desktop Metal will be available free of charge on Desktop Metal’s website at https://ir.desktopmetal.com/sec - filings/all - sec - filings. This communication is not an offer to purchase or a solicitation of an offer to sell the ordinary shares of Stratasys. In response to a tender offer commenced by Nano, Stratasys has filed with the Securities and Exchange Commission a Solicitation/Recommendation Statement on Schedule 14D - 9. STRATASYS SHAREHOLDERS ARE ADVISED TO READ STRATASYS’ SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D - 9 AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY DECISION WITH RESPECT TO ANY TENDER OFFER BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Stratasys shareholders may obtain a copy of the Solicitation/Recommendation Statement on Schedule 14D - 9, as well as any other documents filed by Stratasys in connection with the tender offer by Nano or one of its affiliates, free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders may obtain free copies of these documents from Stratasys by directing a request to Stratasys Ltd., 1 Holtzman Street, Science Park, P.O. Box 2496, Rehovot 7612, Israel, Attn: Yonah Lloyd, VP Investor Relations, or by calling +972 - 74 - 745 - 4029. Participants in the Solicitation Stratasys, Desktop Metal and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Stratasys, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Stratasys’ proxy statement for its 2022 Annual General Meeting of Shareholders, which was filed with the SEC on August 8, 2022, and Stratasys’ Annual Report on Form 20 - F for the fiscal year ended December 31, 2022, which was filed with the SEC on March 3, 2023. Information about the directors and executive officers of Desktop Metal, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Desktop Metal’s proxy statement for its 2023 Annual Meeting of Stockholders, which was filed with the SEC on April 25, 2023 and Desktop Metal’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2022, which was filed with the SEC on March 1, 2023. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the joint proxy statement/prospectus and other relevant materials filed with the SEC regarding the proposed transaction. Investors should read the joint proxy statement/prospectus carefully before making any voting or investment decisions. You may obtain free copies of these documents from Stratasys or Desktop Metal using the sources indicated above. Use of Non - GAAP Financial Measures This communication contains certain forward - looking non - GAAP measures, which are based on internal forecasts and represent management’s best judgment. Reconciliation of such measures to the most directly comparable GAAP financial measures cannot be furnished without unreasonable efforts due to inherent difficulty in forecasting the amount and timing of certain adjustments that are necessary for such reconciliations and which may significantly impact our GAAP results. In particular, sufficient information is not available to calculate certain adjustments that are required to prepare a forward - looking statement of revenue, margin and EBITDA in accordance with GAAP for fiscal years 2024 and beyond. Stratasys also believes that such reconciliations would also imply a degree of precision that would be confusing or inappropriate for these forward - looking measures, which are inherently uncertain. All revenue, margin, EBITDA and other P&L references are non - GAAP unless specified otherwise.

Agenda Desktop Metal is highly complementary and creates significant value Assessing 3D Systems proposal 1 4 2 Desktop Metal is a superior combination to 3D Systems 3

Desktop Metal is highly complementary to Stratasys with strong innovative growth drivers Combining the best metal innovation company with the best Go - To - Market company to create an AM powerhouse 1 1 . Stratasys’ (“SSYS”) mission to lead the Additive Manufacturing (“AM”) into mass production will be accelerated by having a metal manufacturing solution alongside its robust polymer offering 2 2 . Through extensive analysis of the metal landscape , we believe Desktop Metal (“DM”) has the best and most advanced technology for mass production 3 3 . DM brings a complementary portfolio of growth assets which will be accelerated by Stratasys’ extensive market reach to create immediate to long - term impact 4 4 . DM’s innovative portfolio and technology pipeline stands out amongst AM players with strong IP across applications 5 5 . This combination will create the first >$1B AM company , with sufficient scale to lead the AM industry into mass production, and yield synergies $50M+ in cost and additional $50M in revenue synergies 6 6 . The combined business is expected to generate above $300M of EBITDA in 2026 5 Growth Innovation Mass Production Scale Performance

Creating an AM powerhouse marked by innovation, operating efficiency and unmatched execution The first industrial AM company covering the full manufacturing lifecycle from design to mass production in both polymers and metal Innovation leader in polymer 3D printing Best operations and GTM in AM A leader in mass production of metal, ceramics and restorative dental 3D printing Best - in - class metal innovation in AM 6

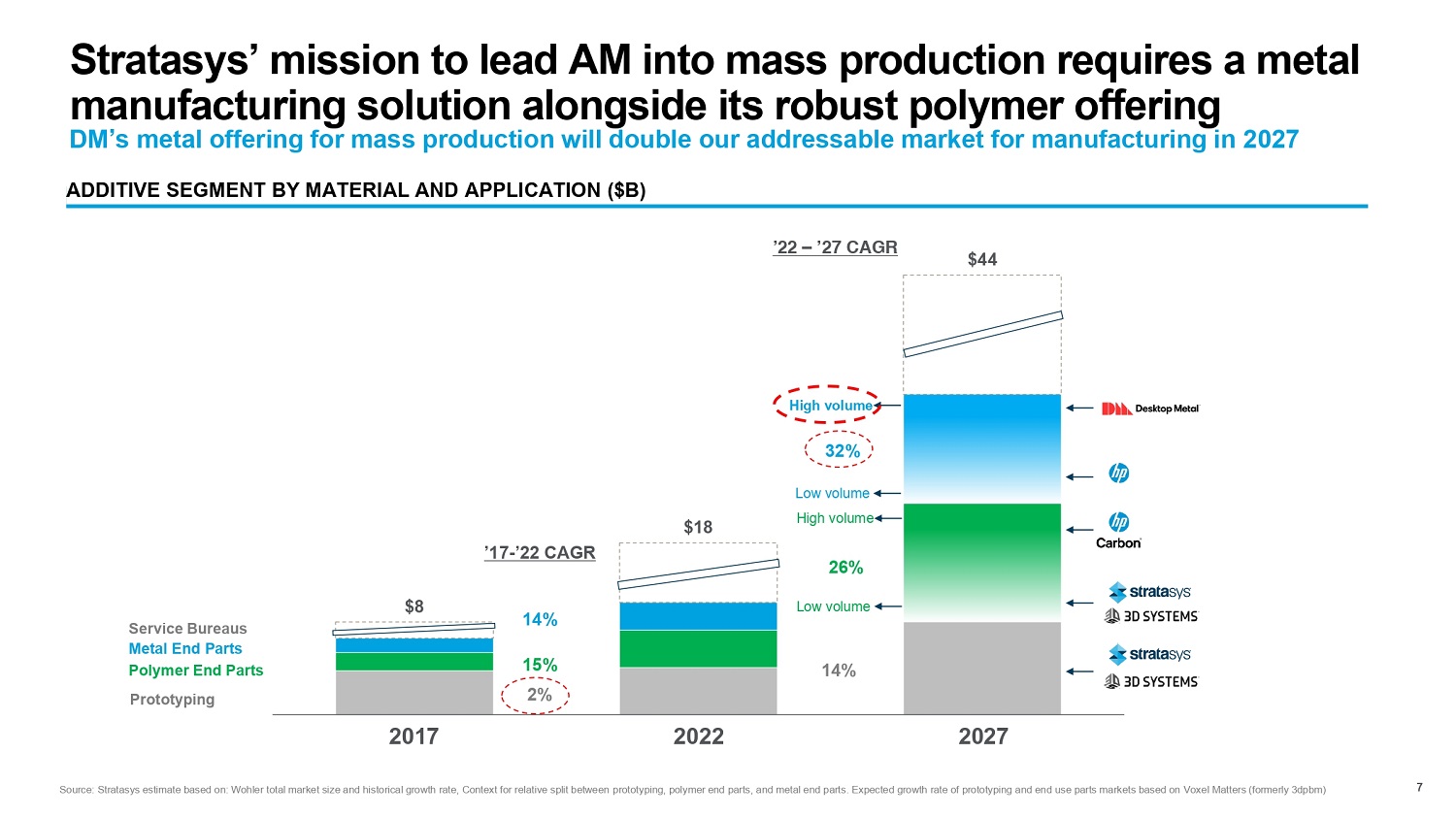

$8 $18 $44 ’17 - ’22 CAGR 14% 15% 26% 14% 2% 2017 2022 2027 ’22 – ’27 CAGR 7 DM’s metal offering for mass production will double our addressable market for manufacturing in 2027 ADDITIVE SEGMENT BY MATERIAL AND APPLICATION ($B) Service Bureaus Metal End Parts Polymer End Parts Prototyping High volume 32% Low volume Low volume High volume Source: Stratasys estimate based on: Wohler total market size and historical growth rate, Context for relative split between prototyping, polymer end parts, and metal end parts. Expected growth rate of prototyping and end use parts markets based on Voxel Matters (formerly 3dpbm) Stratasys’ mission to lead AM into mass production requires a metal manufacturing solution alongside its robust polymer offering

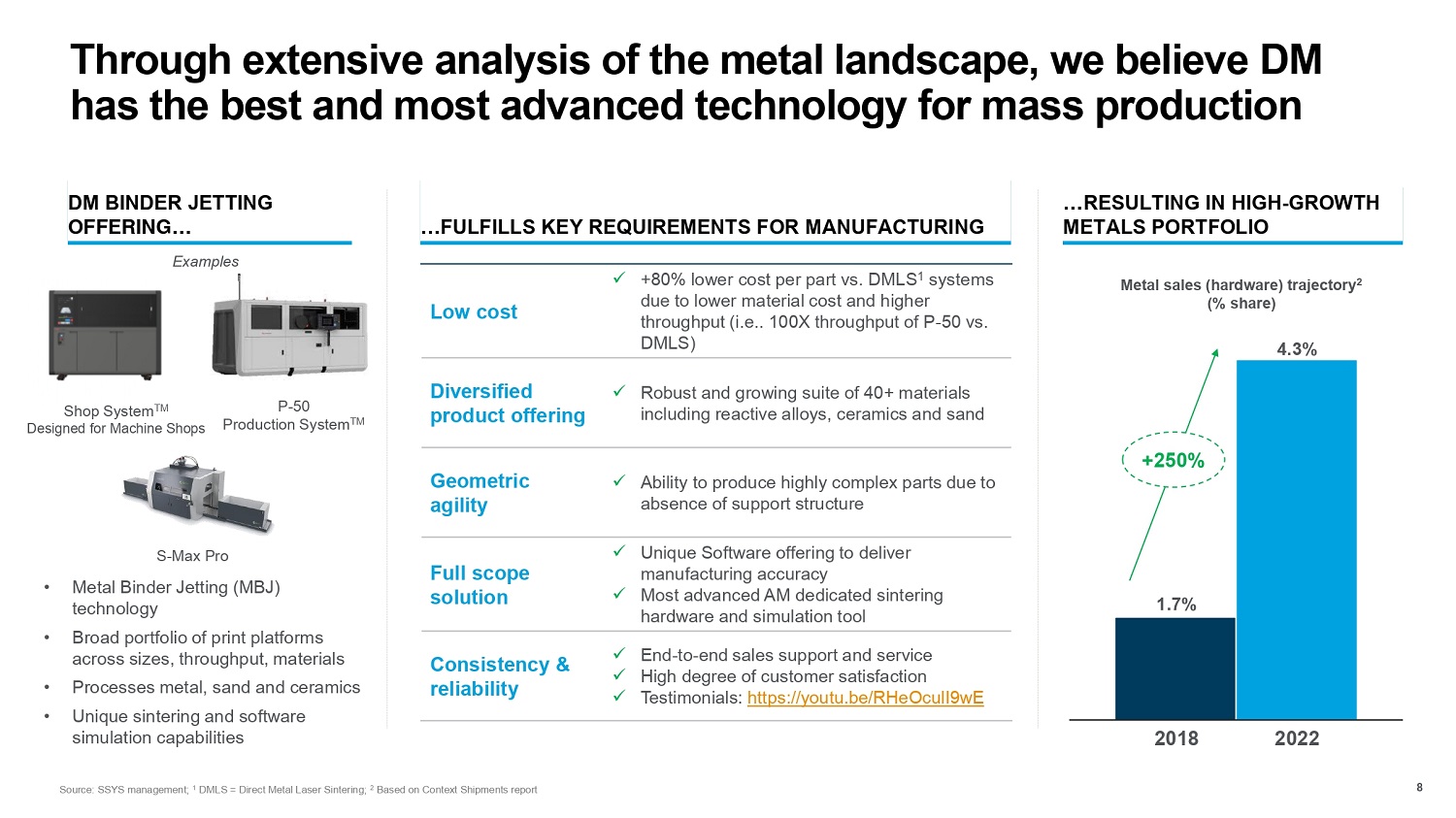

Through extensive analysis of the metal landscape, we believe DM has the best and most advanced technology for mass production 8 DM BINDER JETTING OFFERING… x +80% lower cost per part vs. DMLS 1 systems due to lower material cost and higher throughput (i.e.. 100X throughput of P - 50 vs. DMLS) Low cost x Robust and growing suite of 40+ materials including reactive alloys, ceramics and sand Diversified product offering x Ability to produce highly complex parts due to absence of support structure Geometric agility x Unique Software offering to deliver manufacturing accuracy x Most advanced AM dedicated sintering hardware and simulation tool Full scope solution x End - to - end sales support and service x High degree of customer satisfaction x Testimonials: https://youtu.be/RHeOculI9wE Consistency & reliability …FULFILLS KEY REQUIREMENTS FOR MANUFACTURING 2018 2022 …RESULTING IN HIGH - GROWTH METALS PORTFOLIO Source: SSYS management; 1 DMLS = Direct Metal Laser Sintering; 2 Based on Context Shipments report P - 50 Production System TM 1.7% Shop System TM Designed for Machine Shops Examples S - Max Pro • Metal Binder Jetting (MBJ) technology • Broad portfolio of print platforms across sizes, throughput, materials • Processes metal, sand and ceramics • Unique sintering and software simulation capabilities +250% Metal sales (hardware) trajectory 2 (% share) 4.3%

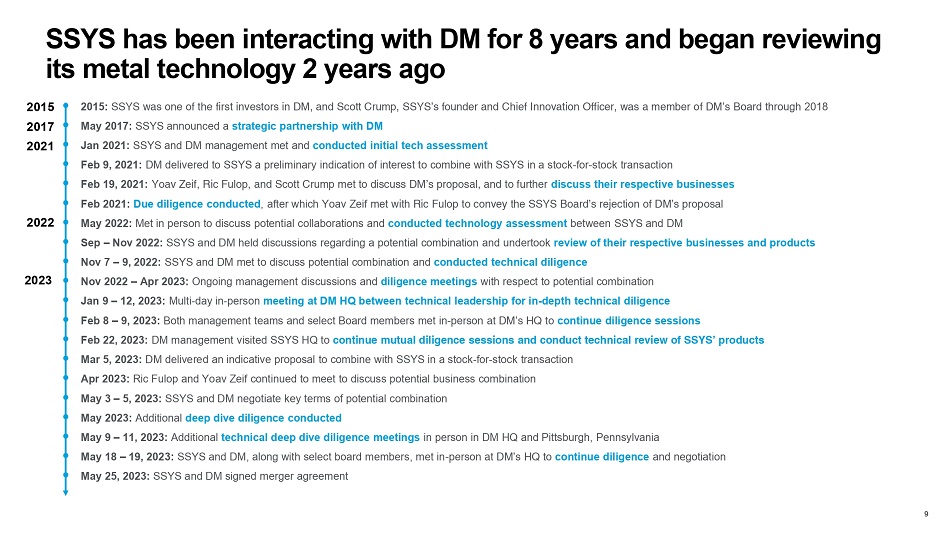

SSYS has been interacting with DM for 8 years and began reviewing its metal technology 2 years ago ⚫ 2015: SSYS was one of the first investors in DM, and Scott Crump, SSYS’s founder and Chief Innovation Officer, was a member of DM’s Board through 2018 ⚫ May 2017: SSYS announced a strategic partnership with DM ⚫ Jan 2021: SSYS and DM management met and conducted initial tech assessment ⚫ Feb 9, 2021: DM delivered to SSYS a preliminary indication of interest to combine with SSYS in a stock - for - stock transaction ⚫ Feb 19, 2021: Yoav Zeif, Ric Fulop, and Scott Crump met to discuss DM’s proposal, and to further discuss their respective businesses ⚫ Feb 2021: Due diligence conducted , after which Yoav Zeif met with Ric Fulop to convey the SSYS Board’s rejection of DM’s proposal 2022 ؘ May 2022: Met in person to discuss potential collaborations and conducted technology assessment between SSYS and DM ⚫ Sep – Nov 2022: SSYS and DM held discussions regarding a potential combination and undertook review of their respective businesses and products ⚫ Nov 7 – 9, 2022: SSYS and DM met to discuss potential combination and conducted technical diligence ⚫ Nov 2022 – Apr 2023: Ongoing management discussions and diligence meetings with respect to potential combination ⚫ Jan 9 – 12, 2023: Multi - day in - person meeting at DM HQ between technical leadership for in - depth technical diligence ⚫ Feb 8 – 9, 2023: Both management teams and select Board members met in - person at DM’s HQ to continue diligence sessions ⚫ Feb 22, 2023: DM management visited SSYS HQ to continue mutual diligence sessions and conduct technical review of SSYS’ products ⚫ Mar 5, 2023: DM delivered an indicative proposal to combine with SSYS in a stock - for - stock transaction ⚫ Apr 2023: Ric Fulop and Yoav Zeif continued to meet to discuss potential business combination ⚫ May 3 – 5, 2023: SSYS and DM negotiate key terms of potential combination ⚫ May 2023: Additional deep dive diligence conducted ⚫ May 9 – 11, 2023: Additional technical deep dive diligence meetings in person in DM HQ and Pittsburgh, Pennsylvania ⚫ May 18 – 19, 2023: SSYS and DM, along with select board members, met in - person at DM’s HQ to continue diligence and negotiation ⚫ May 25, 2023: SSYS and DM signed merger agreement 2023 2015 2017 2021 9

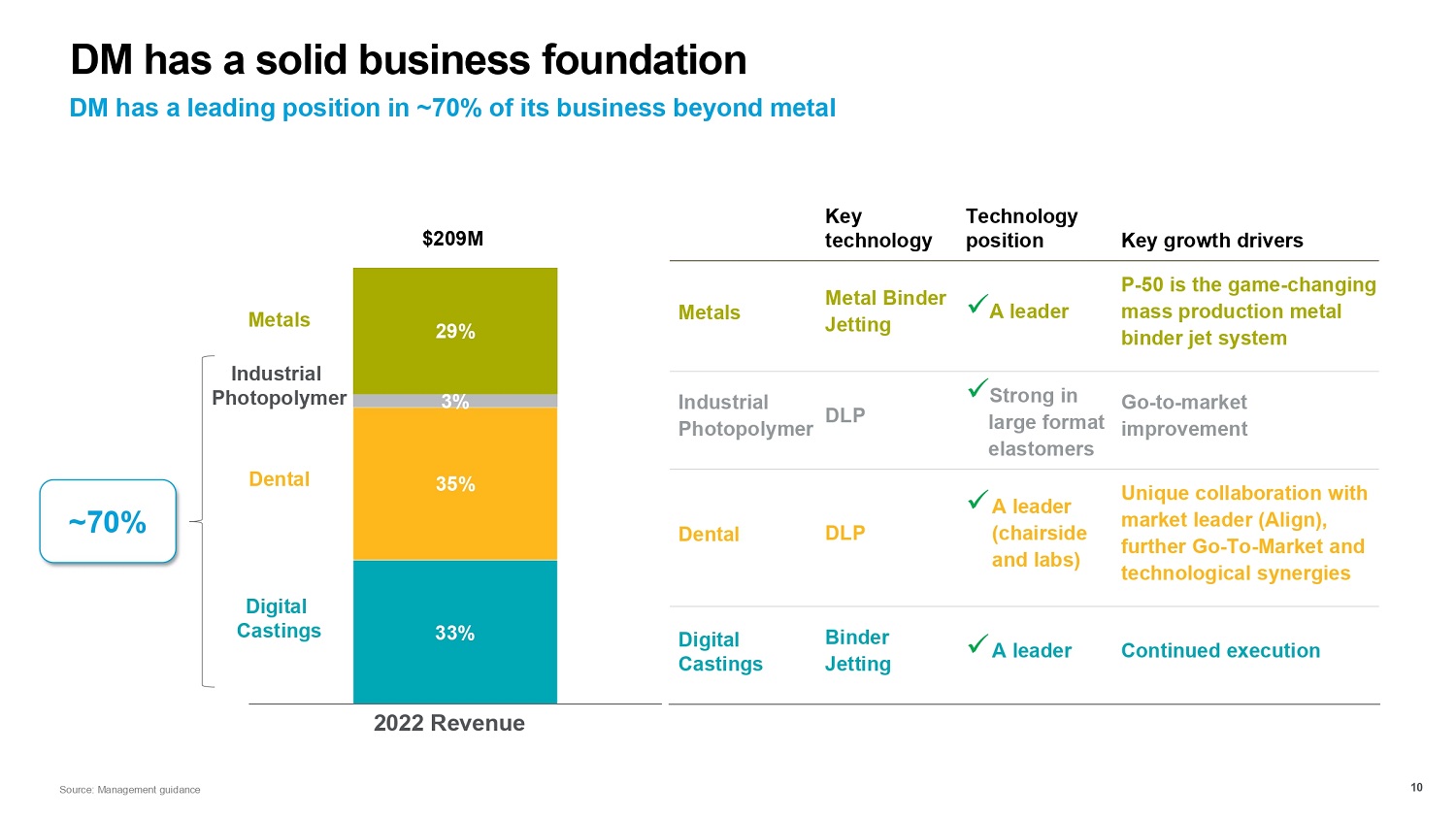

Key growth drivers Technology position Key technology P - 50 is the game - changing mass production metal binder jet system x A leader Metal Binder Jetting Metals Go - to - market improvement x Strong in large format elastomers DLP Industrial Photopolymer Unique collaboration with market leader (Align), further Go - To - Market and technological synergies x A leader (chairside and labs) DLP Dental Continued execution x A leader Binder Jetting Digital Castings DM has a solid business foundation DM has a leading position in ~70% of its business beyond metal 33% 35% 3% 29% Digital Castings Metals Dental Industrial Photopolymer $209M 2022 Revenue 10 ~70% Source: Management guidance

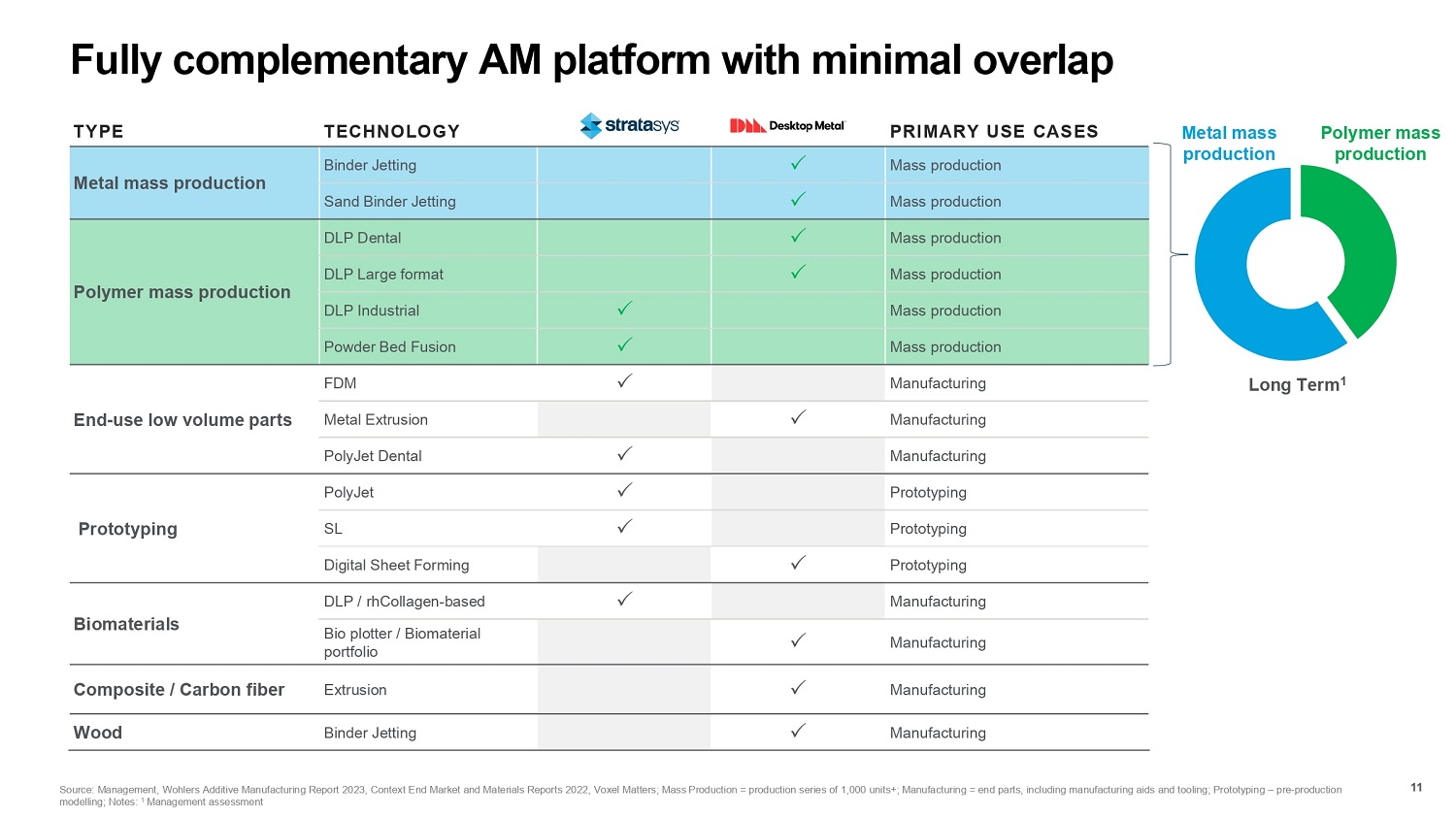

Fully complementary AM platform with minimal overlap PRIMARY USE CASES TECHNOLOGY TYPE Mass production ᴣ Binder Jetting Metal mass production Mass production ᴣ Sand Binder Jetting Mass production ᴣ DLP Dental Polymer mass production Mass production ᴣ DLP Large format Mass production ᴣ DLP Industrial Mass production ᴣ Powder Bed Fusion Manufacturing ᴣ FDM End - use low volume parts Manufacturing ᴣ Metal Extrusion Manufacturing ᴣ PolyJet Dental Prototyping ᴣ PolyJet Prototyping Prototyping ᴣ SL Prototyping ᴣ Digital Sheet Forming Manufacturing ᴣ DLP / rhCollagen - based Biomaterials Manufacturing ᴣ Bio plotter / Biomaterial portfolio Manufacturing ᴣ Extrusion Composite / Carbon fiber Manufacturing ᴣ Binder Jetting Wood 11 Polymer mass production Metal mass production Long Term 1 Source: Management, Wohlers Additive Manufacturing Report 2023, Context End Market and Materials Reports 2022, Voxel Matters; Mass Production = production series of 1,000 units+; Manufacturing = end parts, including manufacturing aids and tooling; Prototyping – pre - production modelling; Notes: 1 Management assessment

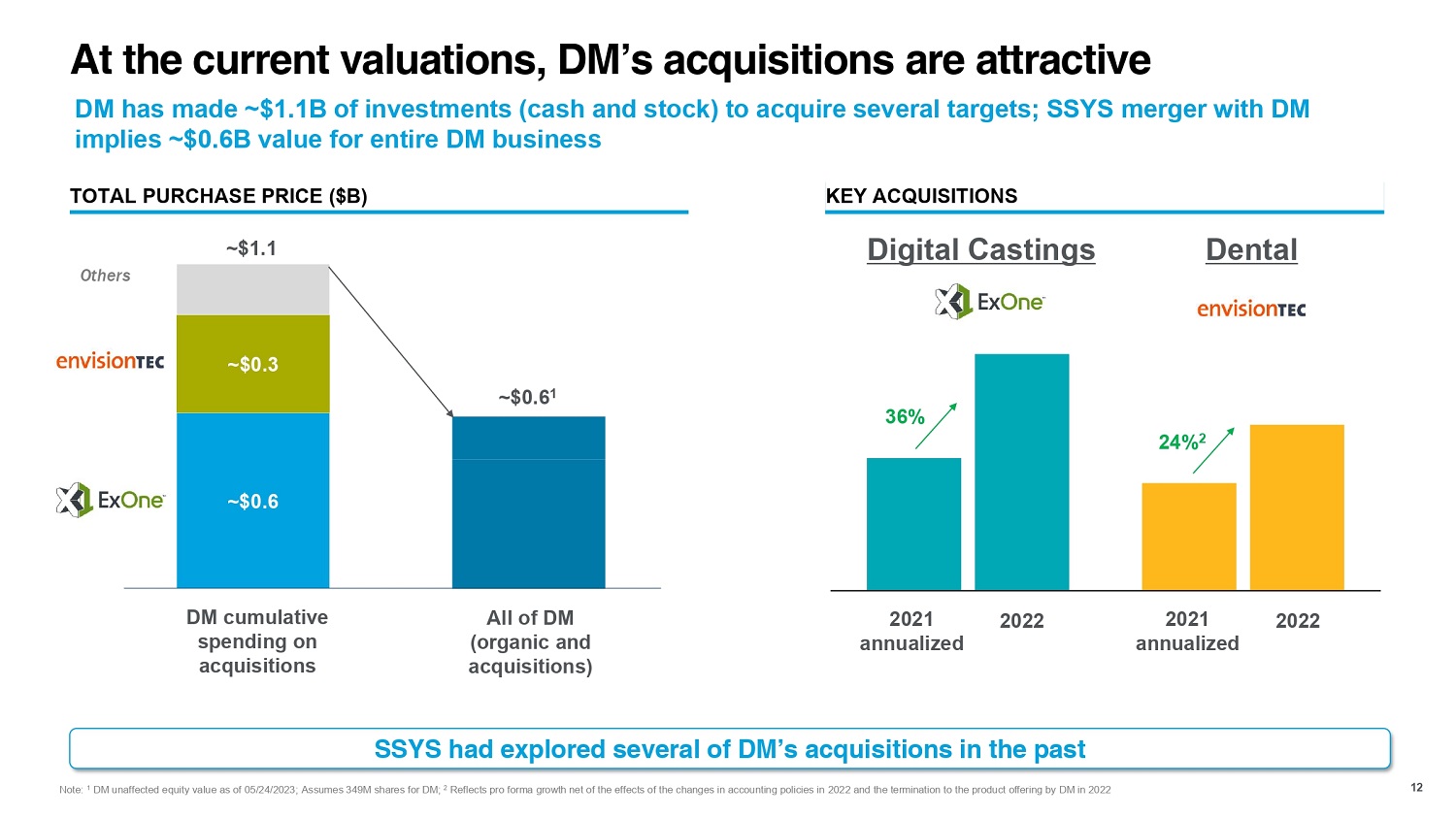

At the current valuations, DM’s acquisitions are attractive ~$0.6 ~$0.3 DM cumulative spending on acquisitions All of DM (organic and acquisitions) DM has made ~$1.1B of investments (cash and stock) to acquire several targets; SSYS merger with DM implies ~$0.6B value for entire DM business Others TOTAL PURCHASE PRICE ($B) SSYS had explored several of DM’s acquisitions in the past Note: 1 DM unaffected equity value as of 05/24/2023; Assumes 349M shares for DM; 2 Reflects pro forma growth net of the effects of the changes in accounting policies in 2022 and the termination to the product offering by DM in 2022 KEY ACQUISITIONS 2021 annualized 2022 2022 2021 annualized 36% Digital Castings Dental ~$1.1 ~$0.6 1 24% 2 12

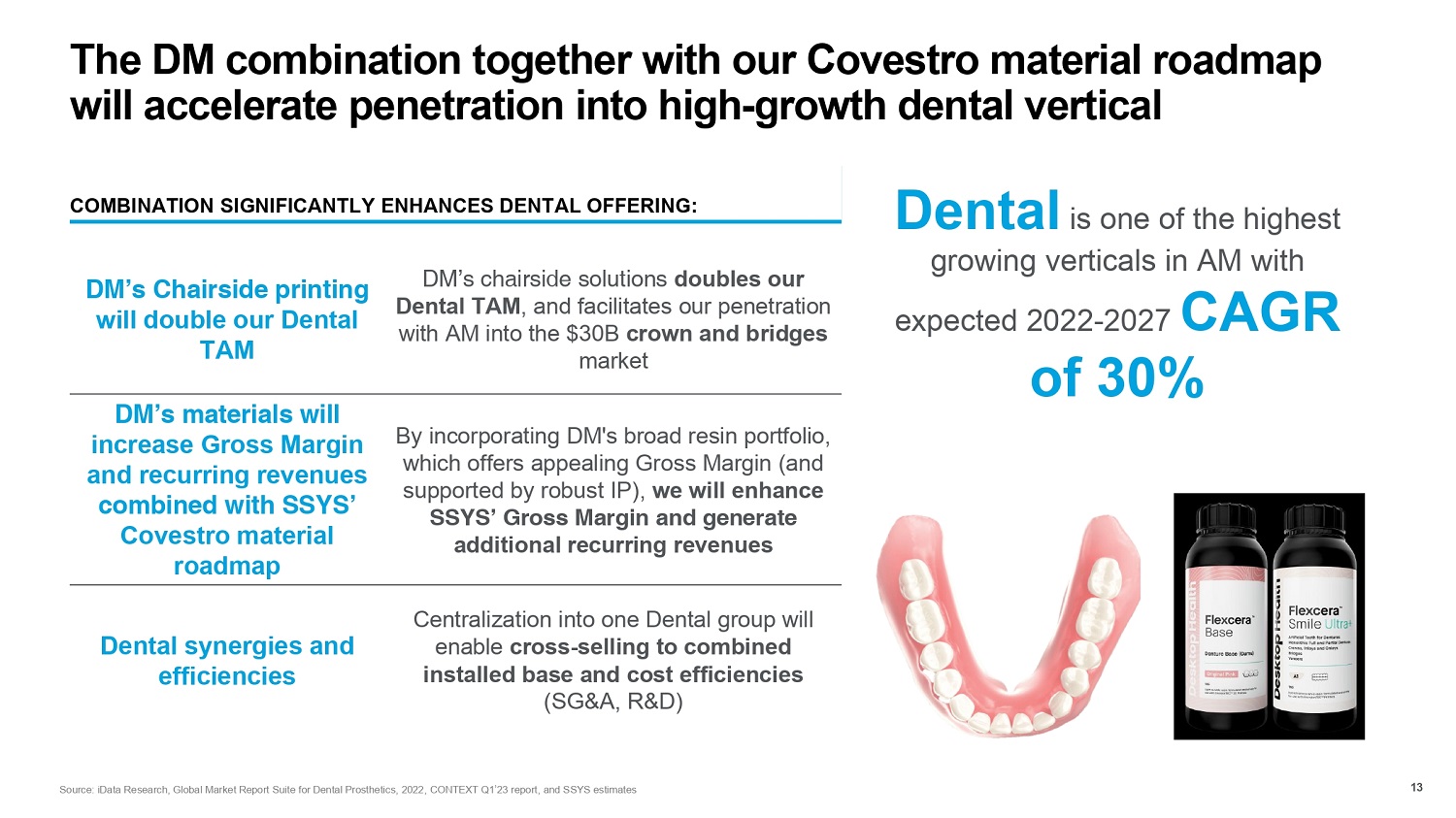

COMBINATION SIGNIFICANTLY ENHANCES DENTAL OFFERING: The DM combination together with our Covestro material roadmap will accelerate penetration into high - growth dental vertical Dental is one of the highest growing verticals in AM with expected 2022 - 2027 CAGR of 30% DM’s chairside solutions doubles our Dental TAM , and facilitates our penetration with AM into the $30B crown and bridges market DM’s Chairside printing will double our Dental TAM By incorporating DM's broad resin portfolio, which offers appealing Gross Margin (and supported by robust IP), we will enhance SSYS’ Gross Margin and generate additional recurring revenues DM’s materials will increase Gross Margin and recurring revenues combined with SSYS’ Covestro material roadmap Centralization into one Dental group will enable cross - selling to combined installed base and cost efficiencies (SG&A, R&D) Dental synergies and efficiencies 13 Source: iData Research, Global Market Report Suite for Dental Prosthetics, 2022, CONTEXT Q1’23 report, and SSYS estimates

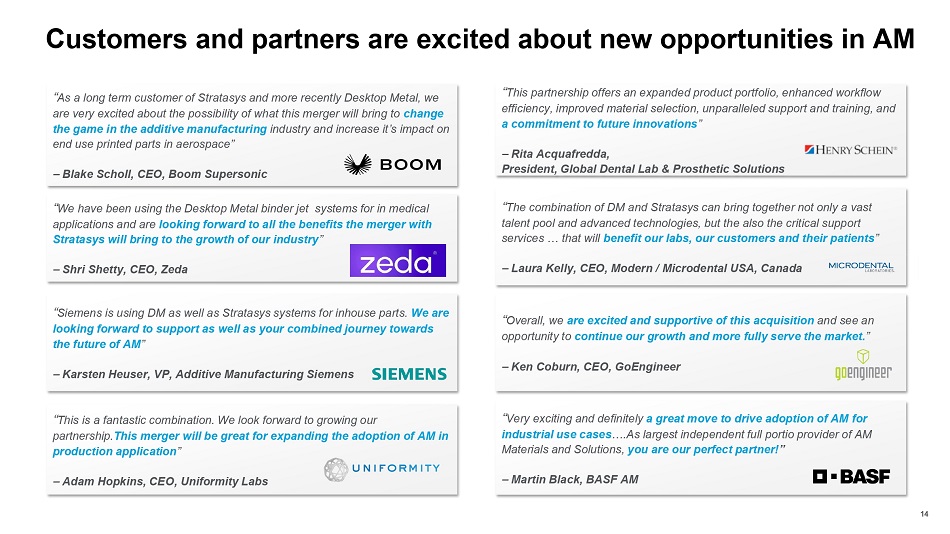

Customers and partners are excited about new opportunities in AM 14 “ As a long term customer of Stratasys and more recently Desktop Metal, we are very excited about the possibility of what this merger will bring to change the game in the additive manufacturing industry and increase it’s impact on end use printed parts in aerospace” – Blake Scholl, CEO, Boom Supersonic “ We have been using the Desktop Metal binder jet systems for in medical applications and are looking forward to all the benefits the merger with Stratasys will bring to the growth of our industry ” – Shri Shetty, CEO, Zeda “ This is a fantastic combination. We look forward to growing our partnership. This merger will be great for expanding the adoption of AM in production application ” – Adam Hopkins, CEO, Uniformity Labs “ Siemens is using DM as well as Stratasys systems for inhouse parts. We are looking forward to support as well as your combined journey towards the future of AM ” – Karsten Heuser, VP, Additive Manufacturing Siemens “ Very exciting and definitely a great move to drive adoption of AM for industrial use cases ….As largest independent full portio provider of AM Materials and Solutions, you are our perfect partner! ” – Martin Black, BASF AM “ The combination of DM and Stratasys can bring together not only a vast talent pool and advanced technologies, but the also the critical support services … that will benefit our labs, our customers and their patients ” – Laura Kelly, CEO, Modern / Microdental USA, Canada “ This partnership offers an expanded product portfolio, enhanced workflow efficiency, improved material selection, unparalleled support and training, and a commitment to future innovations ” – Rita Acquafredda, President, Global Dental Lab & Prosthetic Solutions “ Overall, we are excited and supportive of this acquisition and see an opportunity to continue our growth and more fully serve the market. ” – Ken Coburn, CEO, GoEngineer

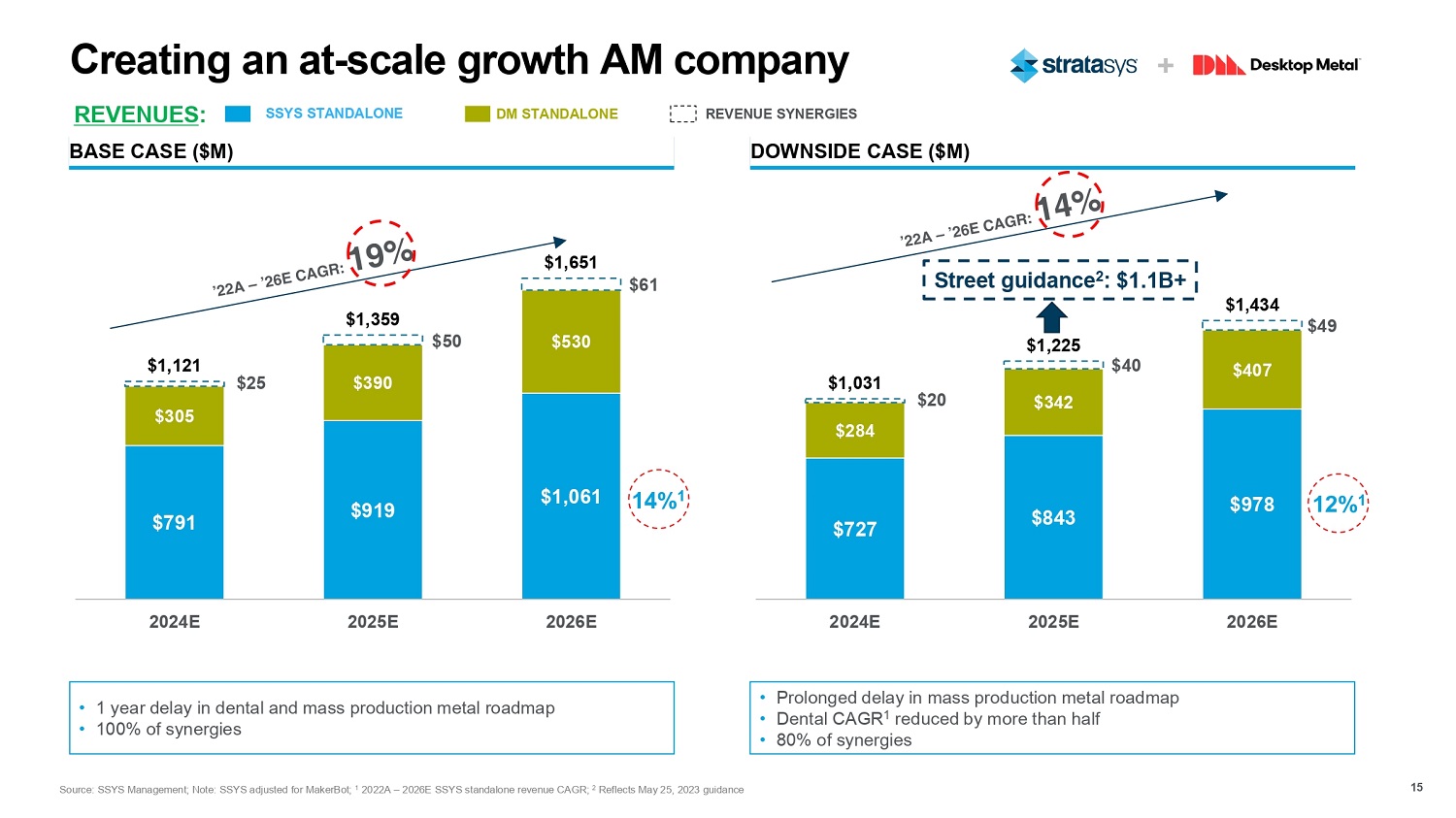

$727 $843 $978 $284 $342 $407 $20 $40 $49 $1,031 $1,225 $1,434 2024E 2025E 2026E $791 $919 $1,061 $305 $390 $530 $25 $50 $61 $1,121 $1,359 $1,651 2024E 2025E 2026E Creating an at - scale growth AM company 15 + BASE CASE ($M) DOWNSIDE CASE ($M) • 1 year delay in dental and mass production metal roadmap • 100% of synergies 14% 1 12% 1 • Prolonged delay in mass production metal roadmap • Dental CAGR 1 reduced by more than half • 80% of synergies Street guidance 2 : $1.1B+ SSYS STANDALONE DM STANDALONE REVENUE SYNERGIES REVENUES : Source: SSYS Management; Note: SSYS adjusted for MakerBot; 1 2022A – 2026E SSYS standalone revenue CAGR; 2 Reflects May 25, 2023 guidance

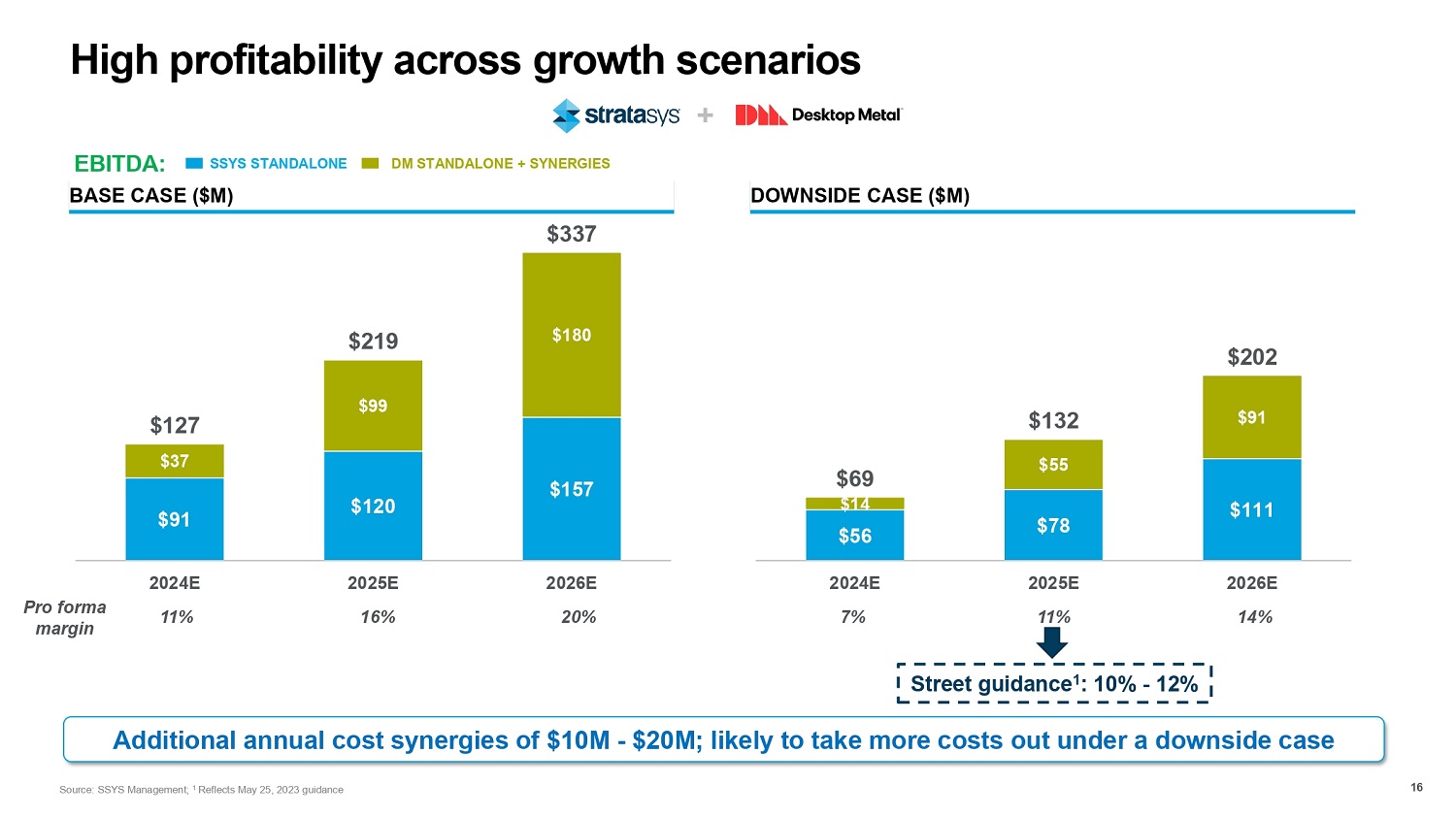

High profitability across growth scenarios 16 BASE CASE ($M) DOWNSIDE CASE ($M) $56 $78 $111 $14 $55 $91 $69 $132 $202 2024E 2025E 2026E $91 $120 $157 $37 $99 $180 $127 $219 $337 2024E 2025E 2026E SSYS STANDALONE DM STANDALONE + SYNERGIES EBITDA: 20% 16% 11% Pro forma margin 14% 11% 7% + Street guidance 1 : 10% - 12% Additional annual cost synergies of $10M - $20M; likely to take more costs out under a downside case Source: SSYS Management; 1 Reflects May 25, 2023 guidance

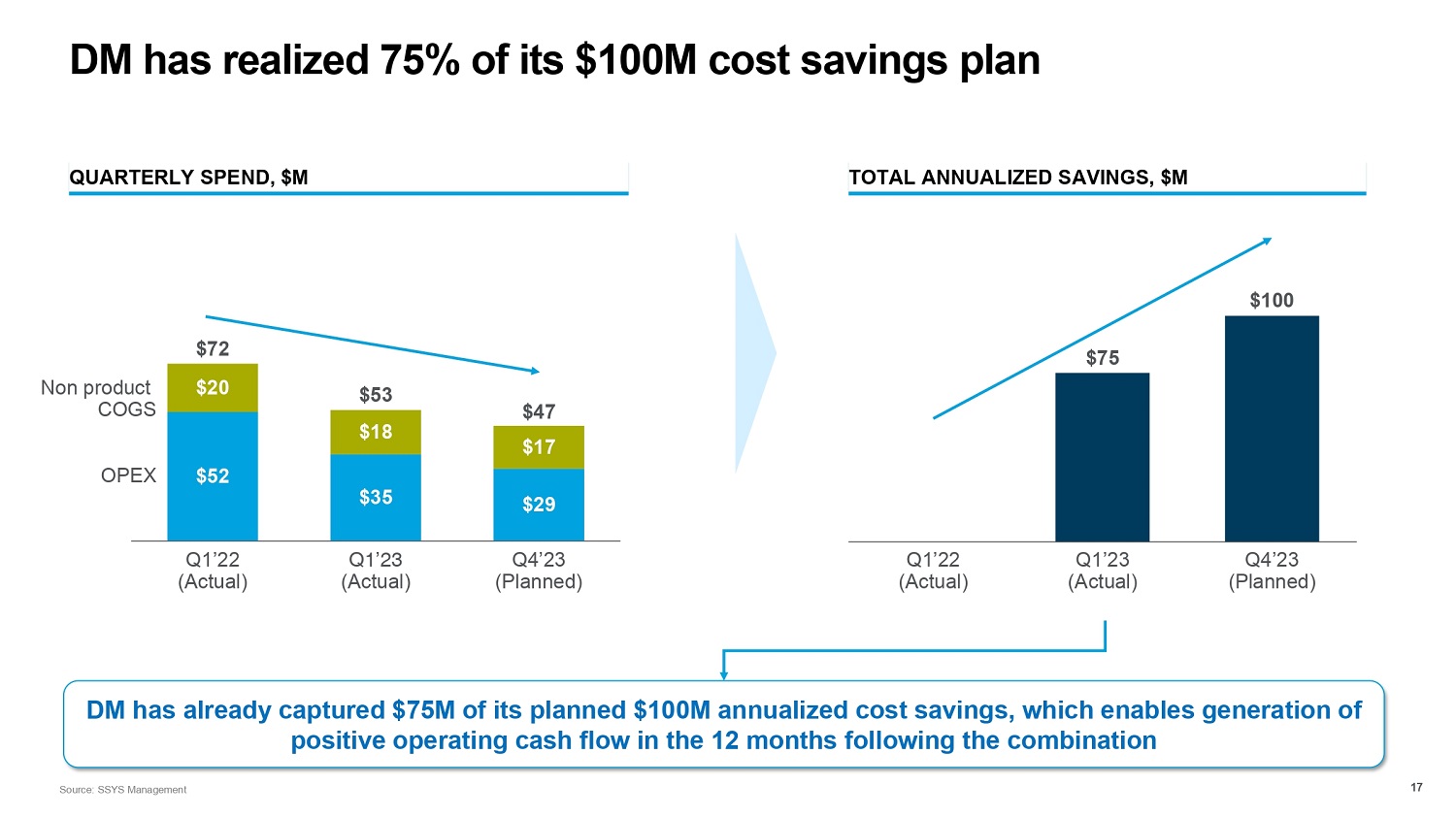

DM has realized 75% of its $100M cost savings plan 17 QUARTERLY SPEND, $M TOTAL ANNUALIZED SAVINGS, $M $52 $35 $29 $20 $18 $17 OPEX Q1’23 (Actual) $53 Q1’22 (Actual) Q4’23 (Planned) $72 Non product COGS $47 $75 $100 Q4’23 (Planned) Q1’23 (Actual) Q1’22 (Actual) DM has already captured $75M of its planned $100M annualized cost savings, which enables generation of positive operating cash flow in the 12 months following the combination Source: SSYS Management

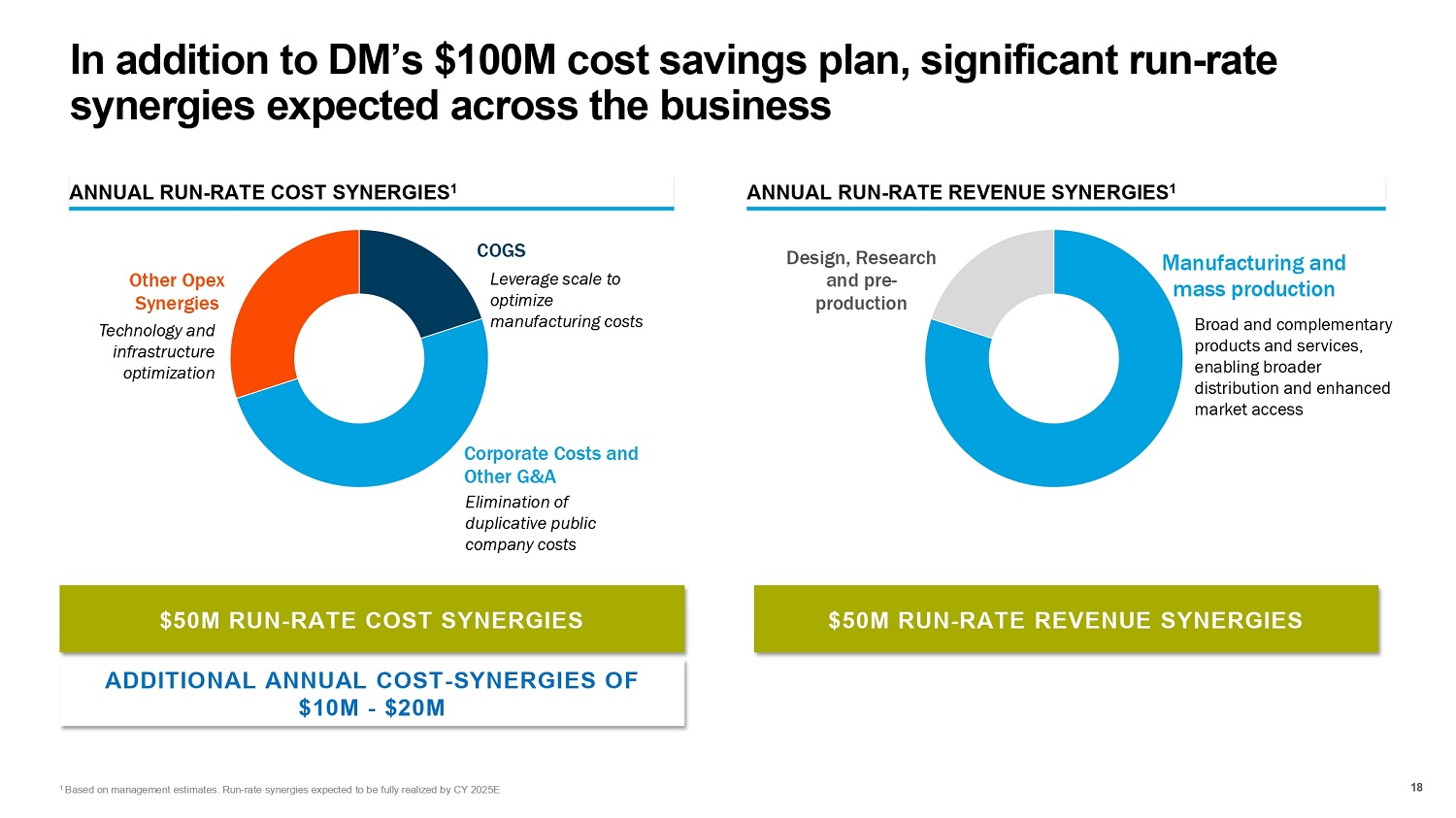

In addition to DM’s $100M cost savings plan, significant run - rate synergies expected across the business ANNUAL RUN - RATE COST SYNERGIES 1 COGS Leverage scale to optimize manufacturing costs Corporate Costs and Other G&A Elimination of duplicative public company costs Other Opex Synergies Technology and infrastructure optimization $50M RUN - RATE COST SYNERGIES Design, Research and pre - production ANNUAL RUN - RATE REVENUE SYNERGIES 1 Manufacturing and mass production Broad and complementary products and services, enabling broader distribution and enhanced market access $50M RUN - RATE REVENUE SYNERGIES ADDITIONAL ANNUAL COST - SYNERGIES OF $10M - $20M 18 1 Based on management estimates. Run - rate synergies expected to be fully realized by CY 2025E

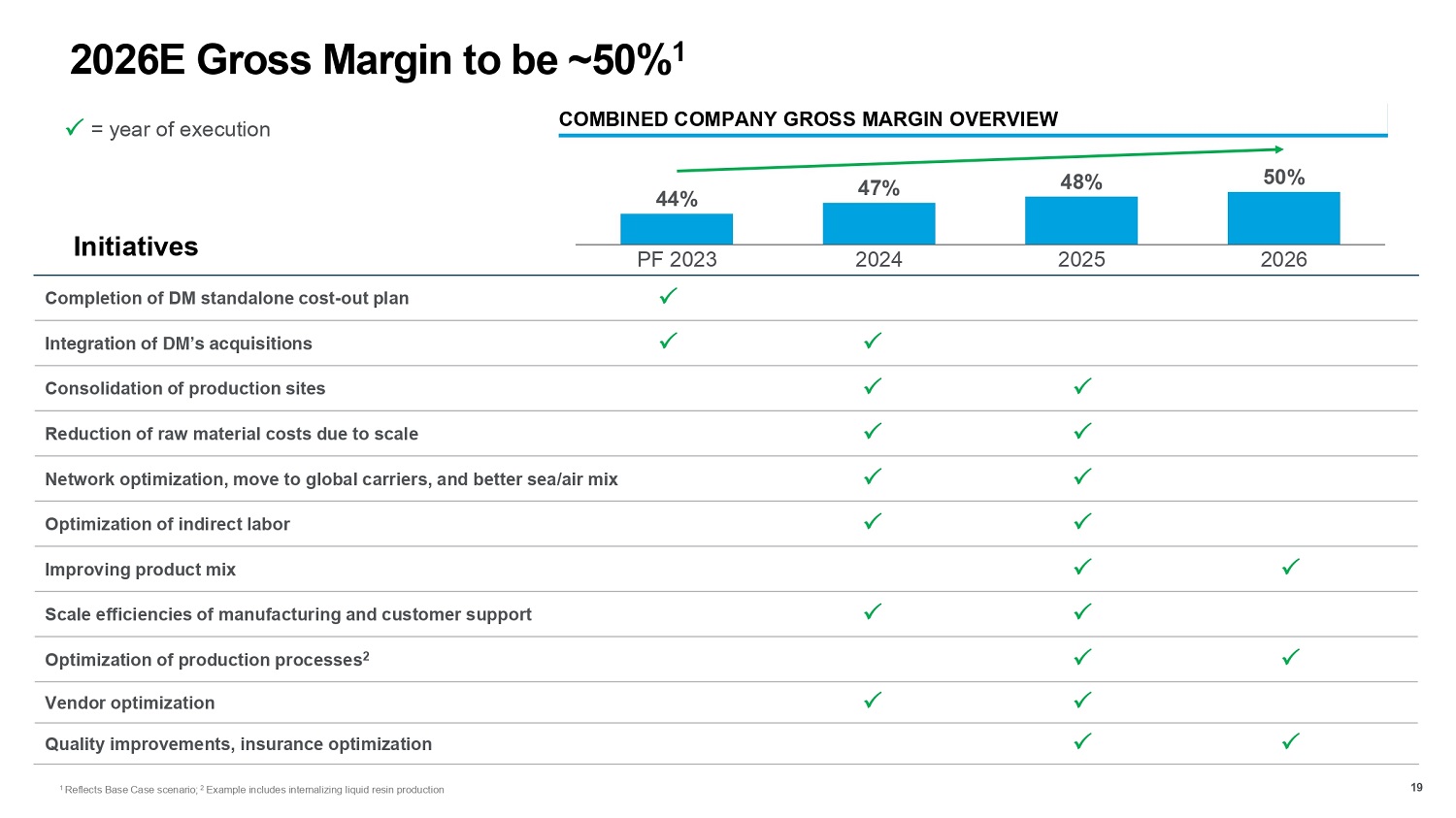

COMBINED COMPANY GROSS MARGIN OVERVIEW 2026E Gross Margin to be ~50% 1 48% 44% 47% 50% Initiatives ᴣ Completion of DM standalone cost - out plan ᴣ ᴣ Integration of DM’s acquisitions ᴣ ᴣ Consolidation of production sites ᴣ ᴣ Reduction of raw material costs due to scale ᴣ ᴣ Network optimization, move to global carriers, and better sea/air mix ᴣ ᴣ Optimization of indirect labor ᴣ ᴣ Improving product mix ᴣ ᴣ Scale efficiencies of manufacturing and customer support ᴣ ᴣ Optimization of production processes 2 ᴣ ᴣ Vendor optimization ᴣ ᴣ Quality improvements, insurance optimization ᴣ = year of execution PF 2023 2024 2025 2026 19 1 Reflects Base Case scenario; 2 Example includes internalizing liquid resin production

Combined company will be led by SSYS management EITAN ZAMIR CFO Stratasys DR. YOAV ZEIF CEO Stratasys CFO Combined Company CEO and Director Combined Company 20

Agenda Desktop Metal is highly complementary and creates significant value Assessing 3D Systems proposal 1 21 2 Desktop Metal is a superior combination to 3D Systems 3

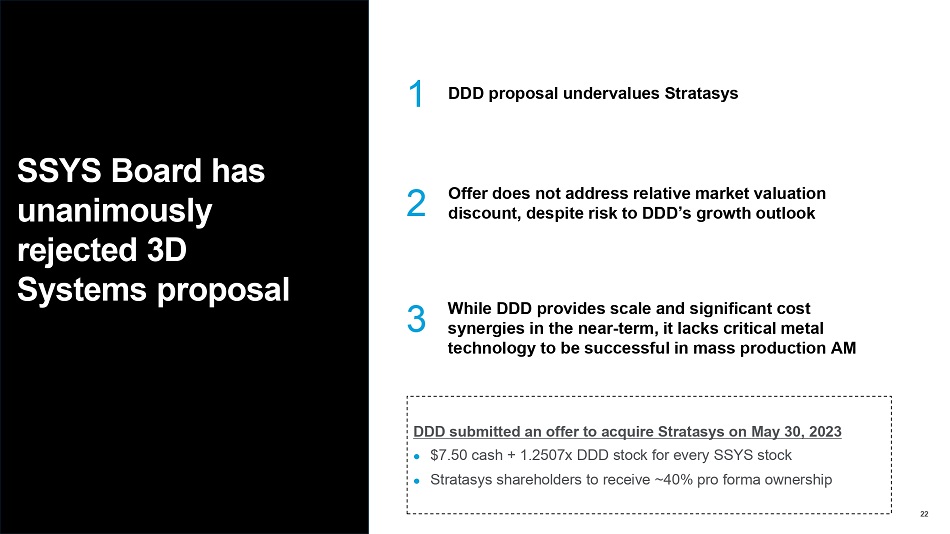

Offer does not address relative market valuation discount, despite risk to DDD’s growth outlook 2 3 While DDD provides scale and significant cost synergies in the near - term, it lacks critical metal technology to be successful in mass production AM 22 DDD proposal undervalues Stratasys 1 DDD submitted an offer to acquire Stratasys on May 30, 2023 $7.50 cash + 1.2507x DDD stock for every SSYS stock Stratasys shareholders to receive ~40% pro forma ownership SSYS Board has unanimously rejected 3D Systems proposal

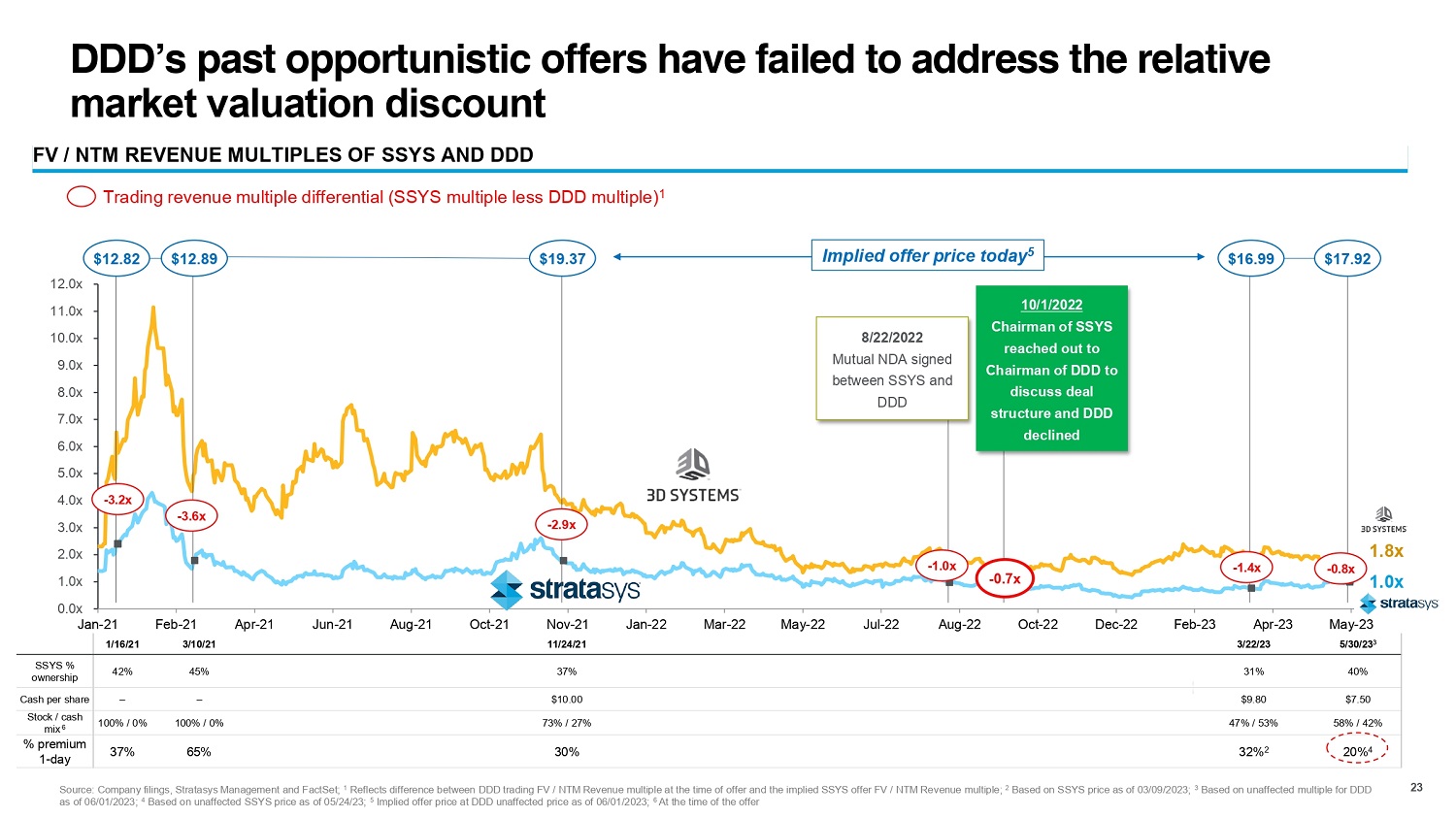

12.0x 11.0x 10.0x 9.0x 8.0x 7.0x 6.0x 5.0x 4.0x 3.0x 2.0x 1.0x 0.0x Jan - 21 Feb - 21 Apr - 21 Jun - 21 Aug - 21 Oct - 21 Nov - 21 Jan - 22 Mar - 22 May - 22 Jul - 22 Aug - 22 Oct - 22 Dec - 22 Feb - 23 Apr - 23 May - 23 DDD’s past opportunistic offers have failed to address the relative market valuation discount 23 1.8x 1.0x 1/16/21 3/10/21 11/24/21 3/22/23 5/3 0/23 DDD LOI : 5/30/23 3 3/22/23 11/24/21 3/10/21 1/16/21 40% 31% 37% 45% 42% SSYS % ownership $7.50 $9.80 $10.00 – – Cash per share 58% / 42% 47% / 53% 73% / 27% 100% / 0% 100% / 0% Stock / cash mix 6 20% 4 32% 2 30% 65% 37% % premium 1 - day $12.82 $12.89 $19.37 $16.99 $17.92 - 3.2x - 3.6x - 0.8x - 1.4x - 2.9x FV / NTM REVENUE MULTIPLES OF SSYS AND DDD Trading revenue multiple differential (SSYS multiple less DDD multiple) 1 8/22/2022 Mutual NDA signed between SSYS and DDD - 1.0x - 0.7x 10/1/2022 Chairman of SSYS reached out to Chairman of DDD to discuss deal structure and DDD declined Source: Company filings, Stratasys Management and FactSet; 1 Reflects difference between DDD trading FV / NTM Revenue multiple at the time of offer and the implied SSYS offer FV / NTM Revenue multiple; 2 Based on SSYS price as of 03/09/2023; 3 Based on unaffected multiple for DDD as of 06/01/2023; 4 Based on unaffected SSYS price as of 05/24/23; 5 Implied offer price at DDD unaffected price as of 06/01/2023; 6 At the time of the offer Implied offer price today 5

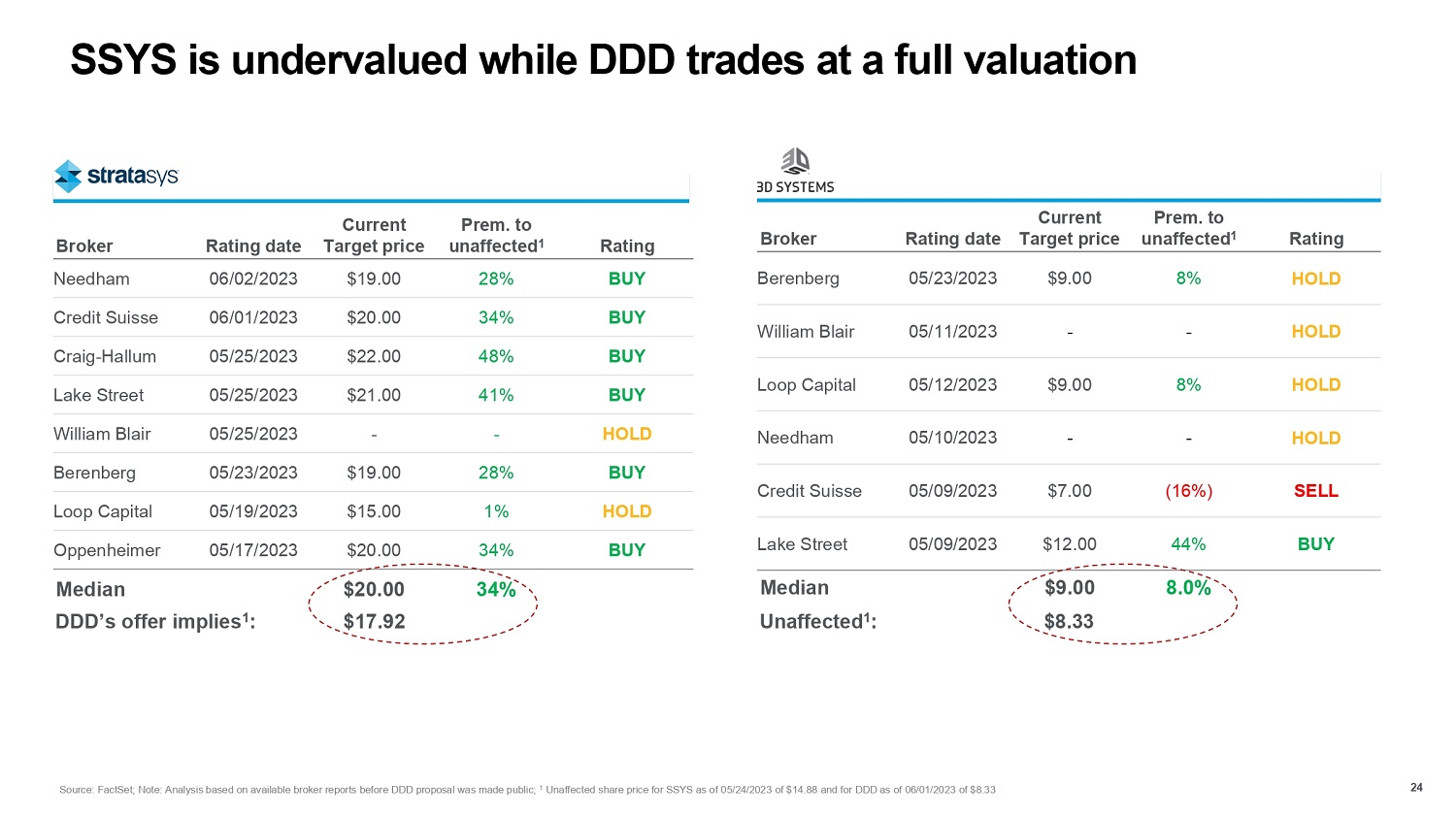

SSYS is undervalued while DDD trades at a full valuation Rating Prem. to unaffected 1 Current Target price Rating date Broker BUY 28% $19.00 06/02/2023 Needham BUY 34% $20.00 06/01/2023 Credit Suisse BUY 48% $22.00 05/25/2023 Craig - Hallum BUY 41% $21.00 05/25/2023 Lake Street HOLD - - 05/25/2023 William Blair BUY 28% $19.00 05/23/2023 Berenberg HOLD 1% $15.00 05/19/2023 Loop Capital BUY 34% $20.00 05/17/2023 Oppenheimer 34% $20.00 Median DDD’s offer implies 1 : $17.92 Rating Prem. to unaffected 1 Current Target price Rating date Broker HOLD 8% $9.00 05/23/2023 Berenberg HOLD - - 05/11/2023 William Blair HOLD 8% $9.00 05/12/2023 Loop Capital HOLD - - 05/10/2023 Needham SELL (16%) $7.00 05/09/2023 Credit Suisse BUY 44% $12.00 05/09/2023 Lake Street 8.0% $9.00 Median $8.33 Unaffected 1 : Source: FactSet; Note: Analysis based on available broker reports before DDD proposal was made public; 1 Unaffected share price for SSYS as of 05/24/2023 of $14.88 and for DDD as of 06/01/2023 of $8.33 24

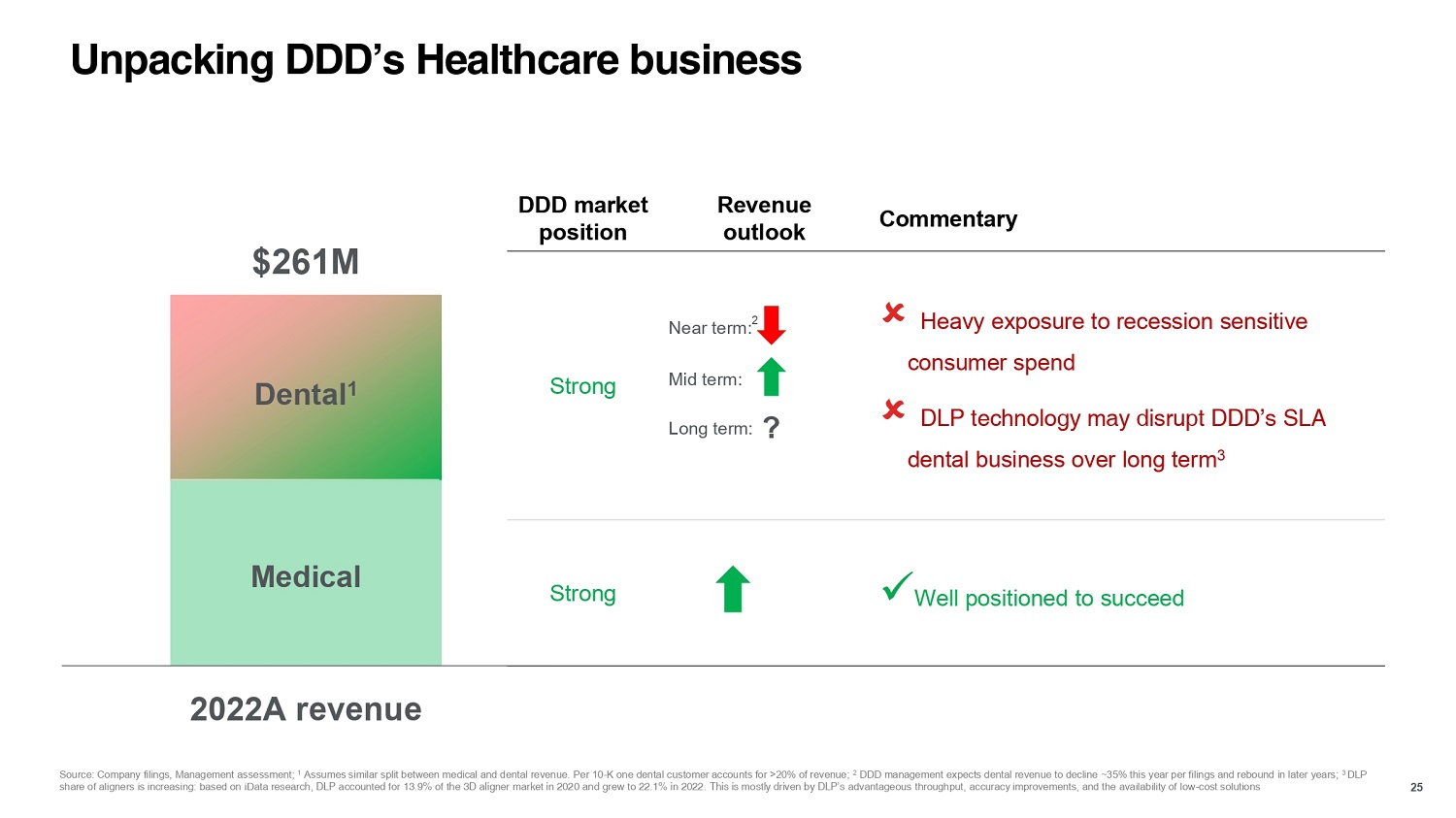

Unpacking DDD’s Healthcare business Commentary Revenue outlook DDD market position Heavy exposure to recession sensitive consumer spend DLP technology may disrupt DDD’s SLA dental business over long term 3 ear term: 2 id term: ng term: ? $261M N Dental 1 Strong M Lo x Well positioned to succeed Medical Strong 2022A revenue 25 Source: Company filings, Management assessment; 1 Assumes similar split between medical and dental revenue. Per 10 - K one dental customer accounts for >20% of revenue; 2 DDD management expects dental revenue to decline ~35% this year per filings and rebound in later years; 3 DLP share of aligners is increasing: based on iData research, DLP accounted for 13.9% of the 3D aligner market in 2020 and grew to 22.1% in 2022. This is mostly driven by DLP’s advantageous throughput, accuracy improvements, and the availability of low - cost solutions

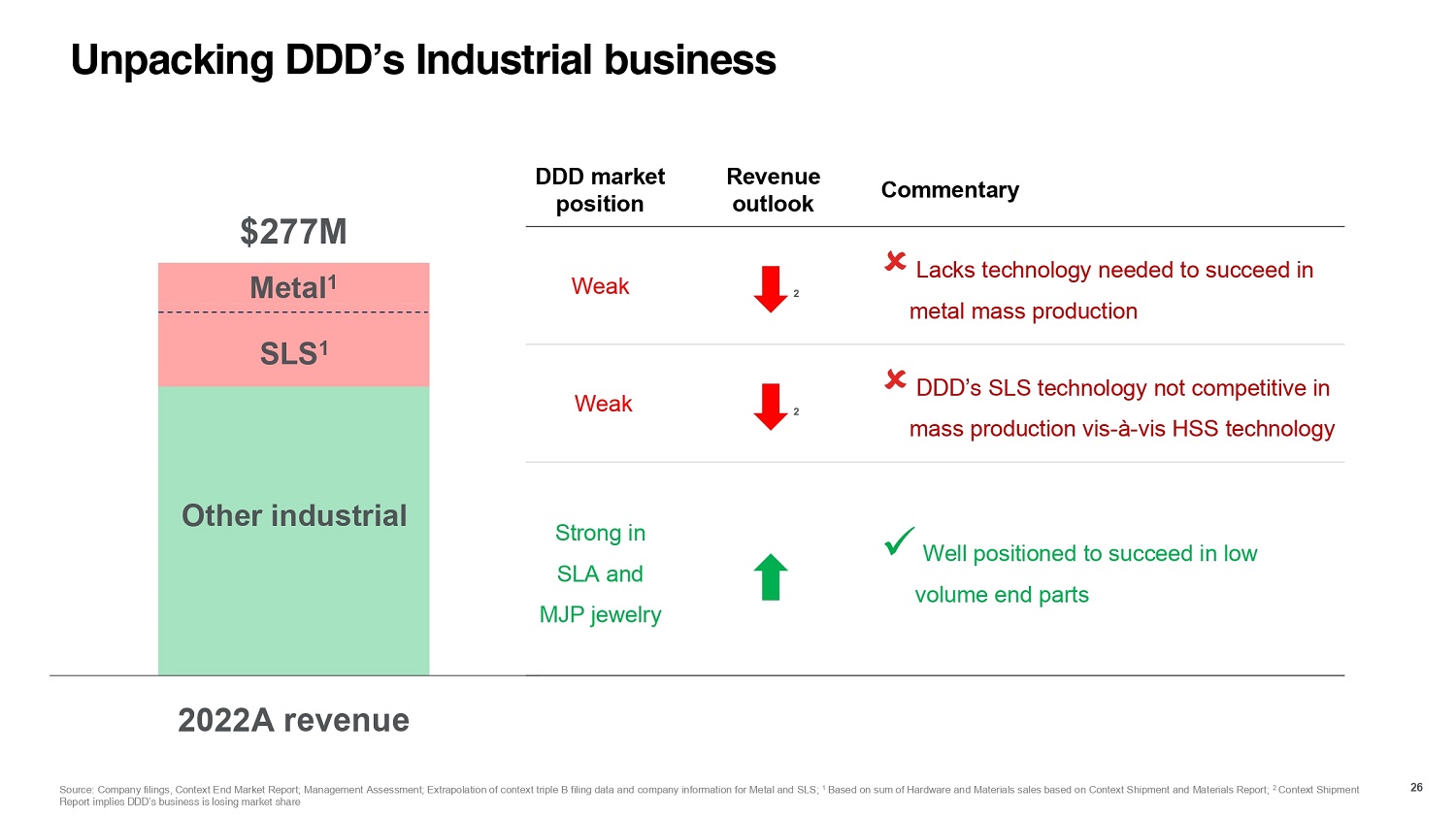

Unpacking DDD’s Industrial business $277M Metal 1 DDD market position Revenue outlook Commentary Weak Lacks technology needed to succeed in metal mass production Weak DDD’s SLS technology not competitive in mass production vis - à - vis HSS technology Strong in SLA and MJP jewelry x Well positioned to succeed in low volume end parts 2022A revenue SLS 1 Other industrial 26 Source: Company filings, Context End Market Report; Management Assessment; Extrapolation of context triple B filing data and company information for Metal and SLS; 1 Based on sum of Hardware and Materials sales based on Context Shipment and Materials Report; 2 Context Shipment Report implies DDD’s business is losing market share 2 2

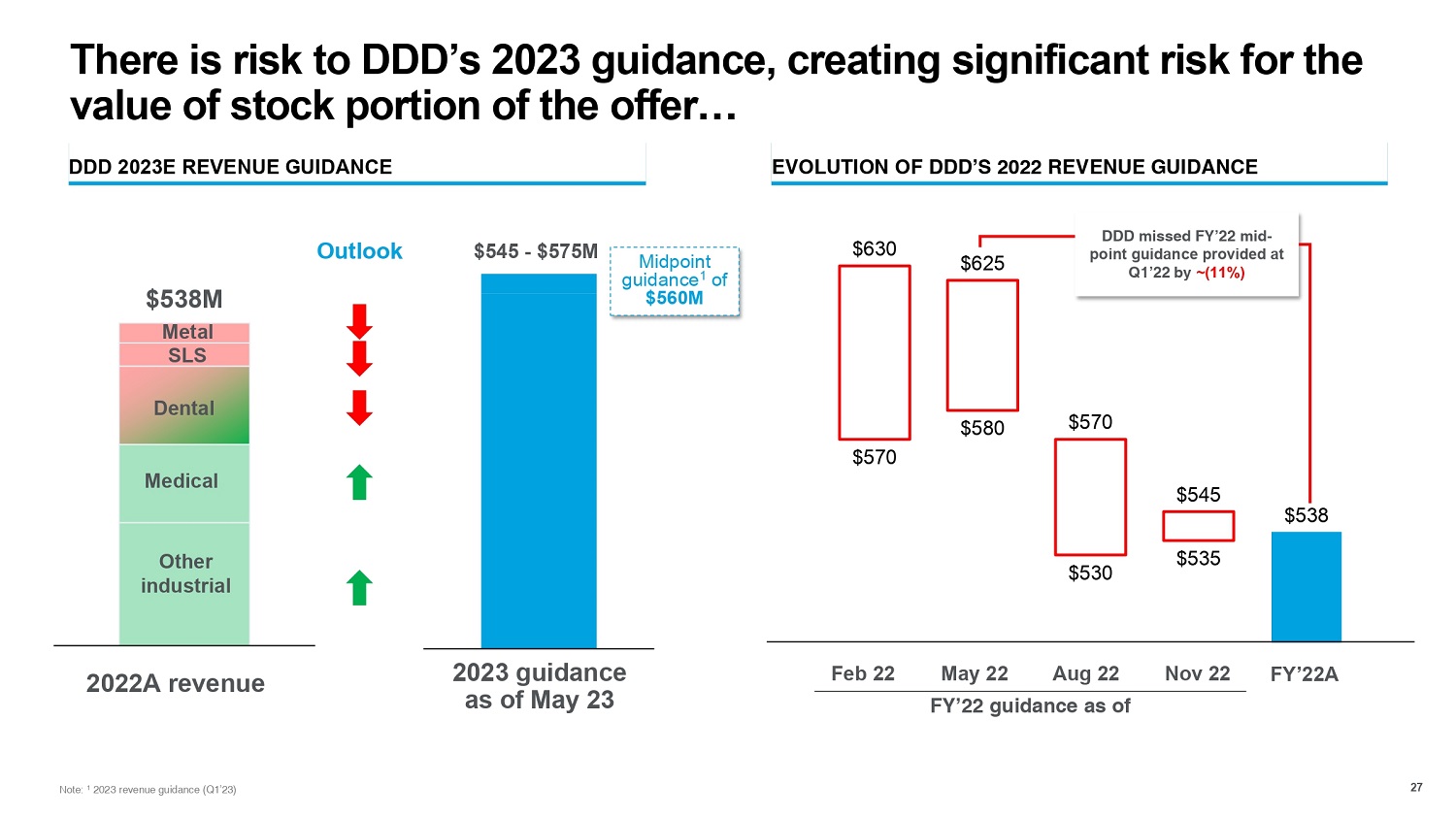

Metal SLS Dental Medical Other industrial There is risk to DDD’s 2023 guidance, creating significant risk for the value of stock portion of the offer… 27 $538M 2022A revenue 2023 guidance as of May 23 DDD 2023E REVENUE GUIDANCE EVOLUTION OF DDD’S 2022 REVENUE GUIDANCE $570 $580 $530 $535 $630 $625 $570 $545 $538 Feb 22 May 22 Aug 22 FY’22 guidance as of Nov 22 FY’22A DDD missed FY’22 mid - point guidance provided at Q1’22 by ~(11%) Outlook Midpoint guidance 1 of $560M $545 - $575M Note: 1 2023 revenue guidance (Q1’23)

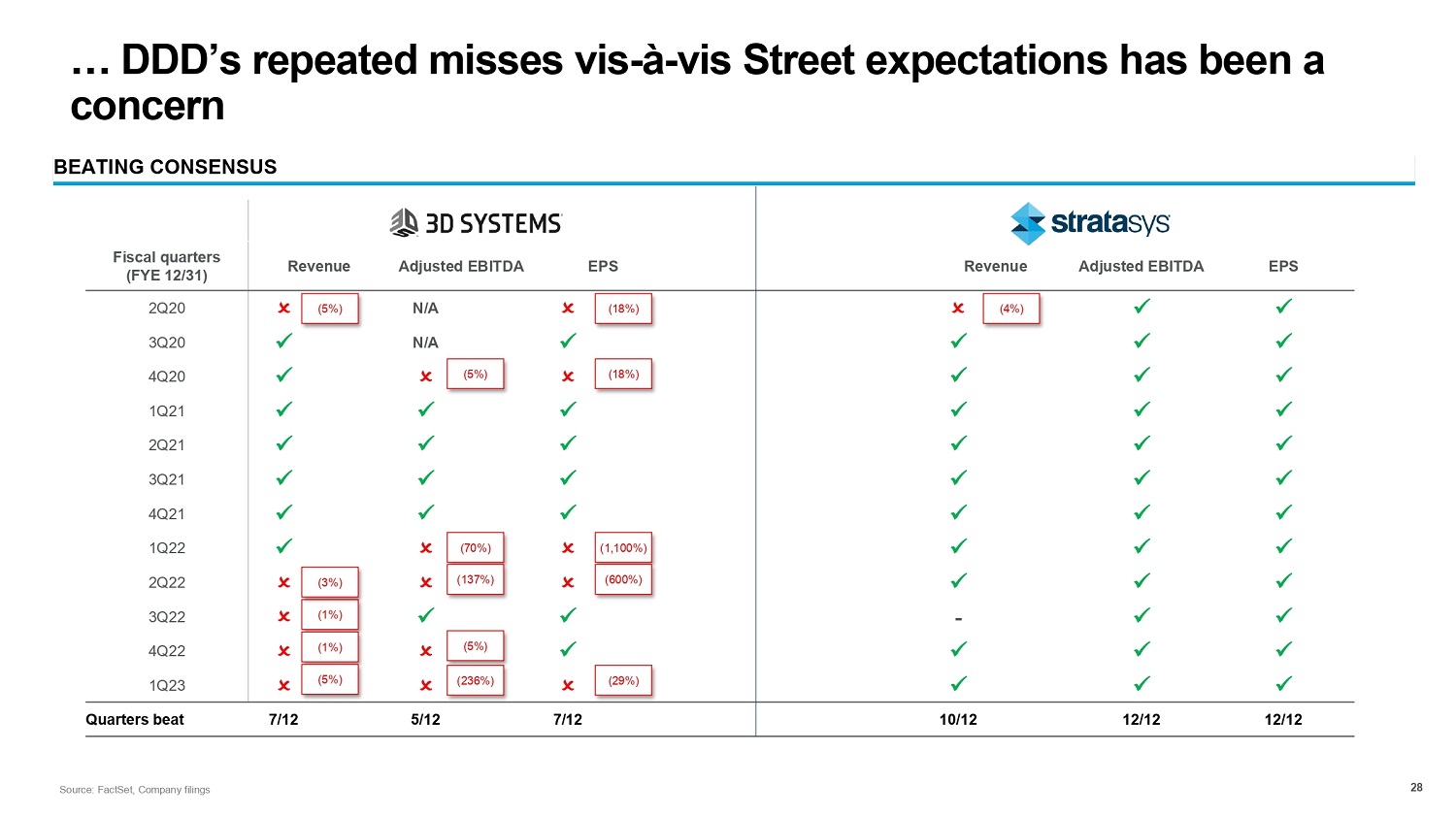

… DDD’s repeated misses vis - à - vis Street expectations has been a concern 28 BEATING CONSENSUS EPS Adjusted EBITDA Revenue EPS Adjusted EBITDA Revenue Fiscal quarters (FYE 12/31) x x X (4%) X (18%) N/A X (5%) 2Q20 x x x x N/A x 3Q20 x x x X (18%) X (5%) x 4Q20 x x x x x x 1Q21 x x x x x x 2Q21 x x x x x x 3Q21 x x x x x x 4Q21 x x x X (1,100%) X (70%) x 1Q22 x x x X (600%) X (137%) X (3%) 2Q22 x x - x x X (1%) 3Q22 x x x x X (5%) X (1%) 4Q22 x x x X (29%) X (236%) X (5%) 1Q23 12/12 12/12 10/12 7/12 5/12 7/12 Quarters beat Source: FactSet, Company filings

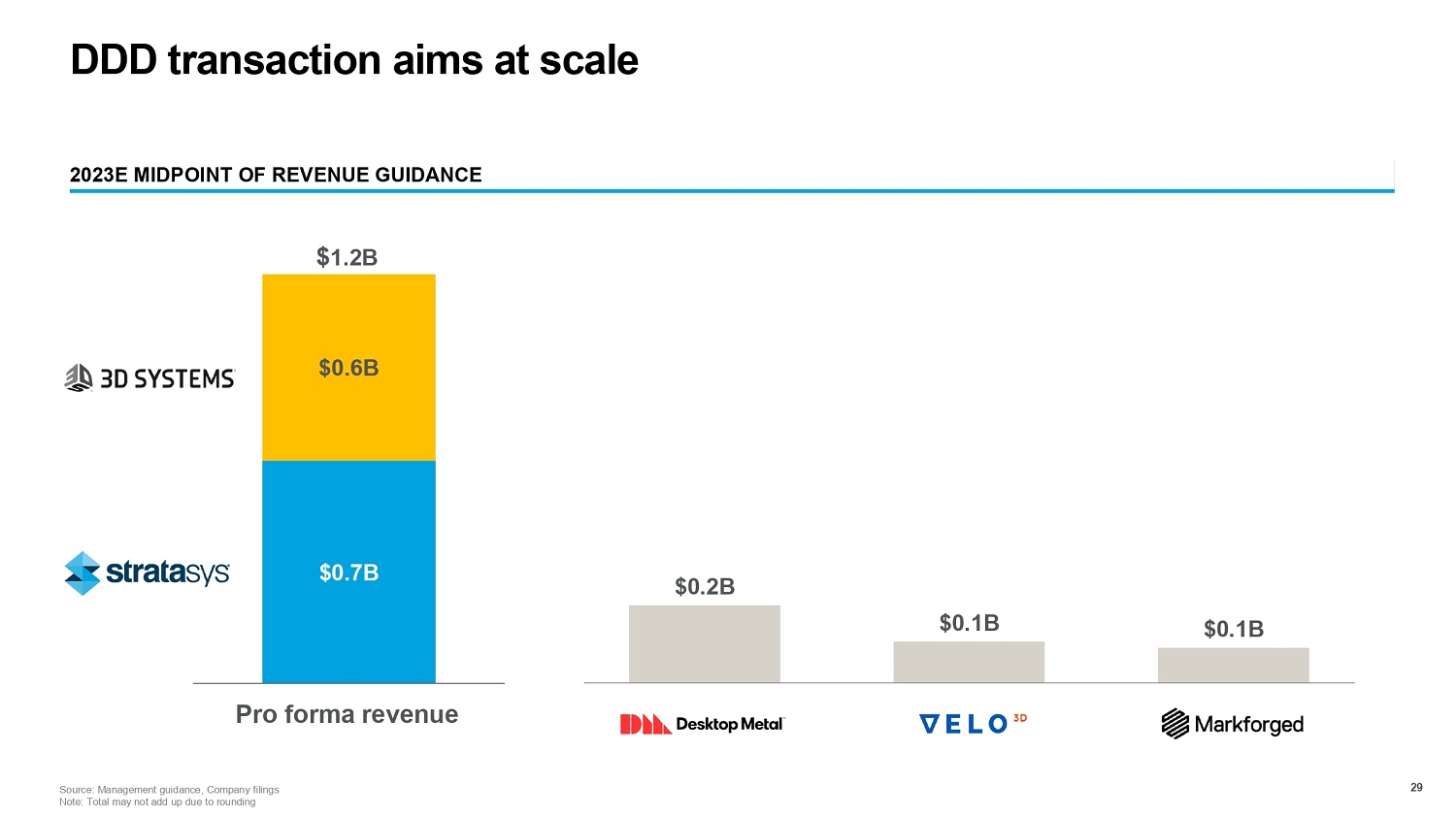

DDD transaction aims at scale 29 2023E MIDPOINT OF REVENUE GUIDANCE $ 1.2B $0.2B $0.1B $0.1B $0.7B $0.6B Pro forma revenue Source: Management guidance, Company filings Note: Total may not add up due to rounding

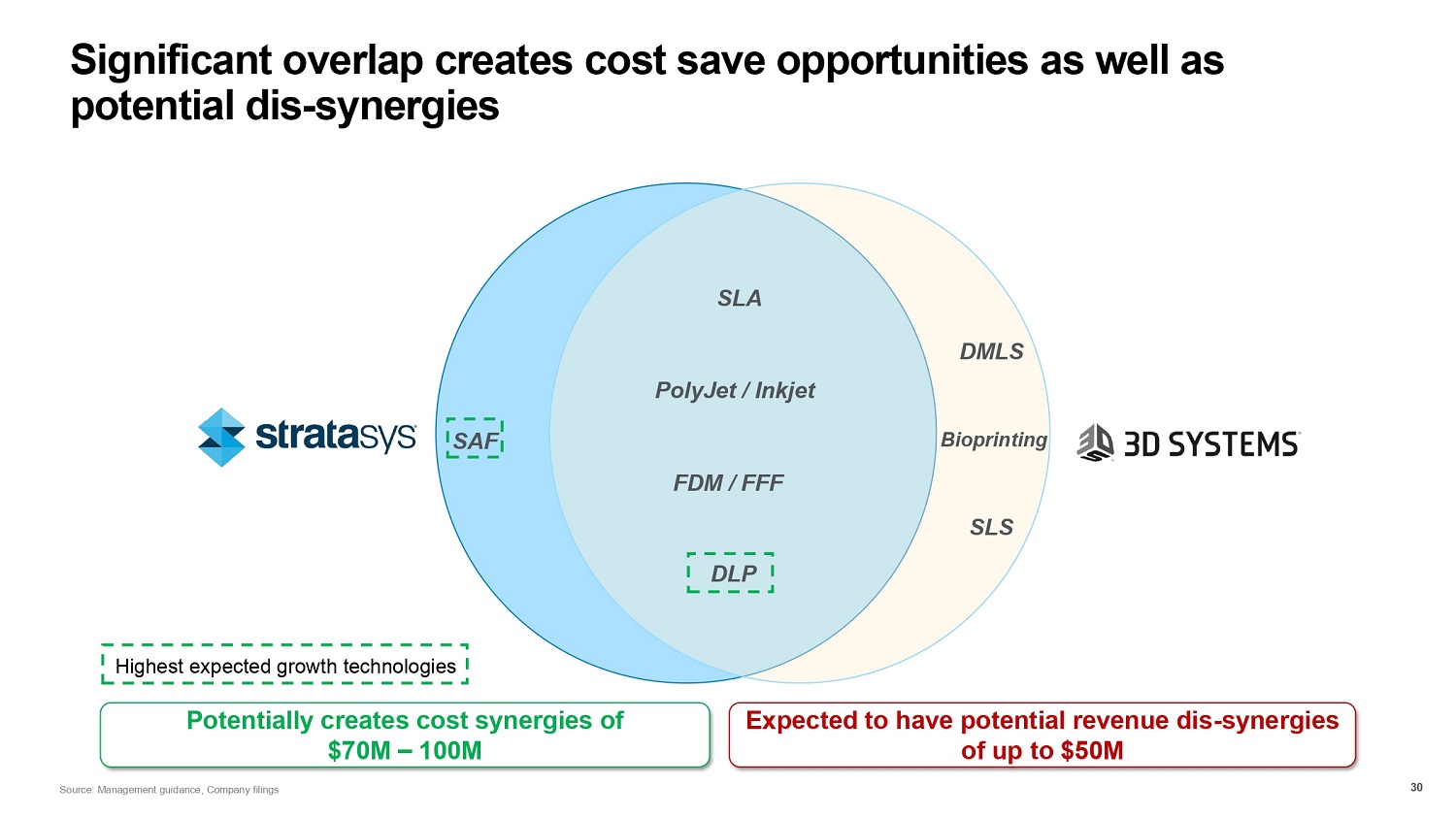

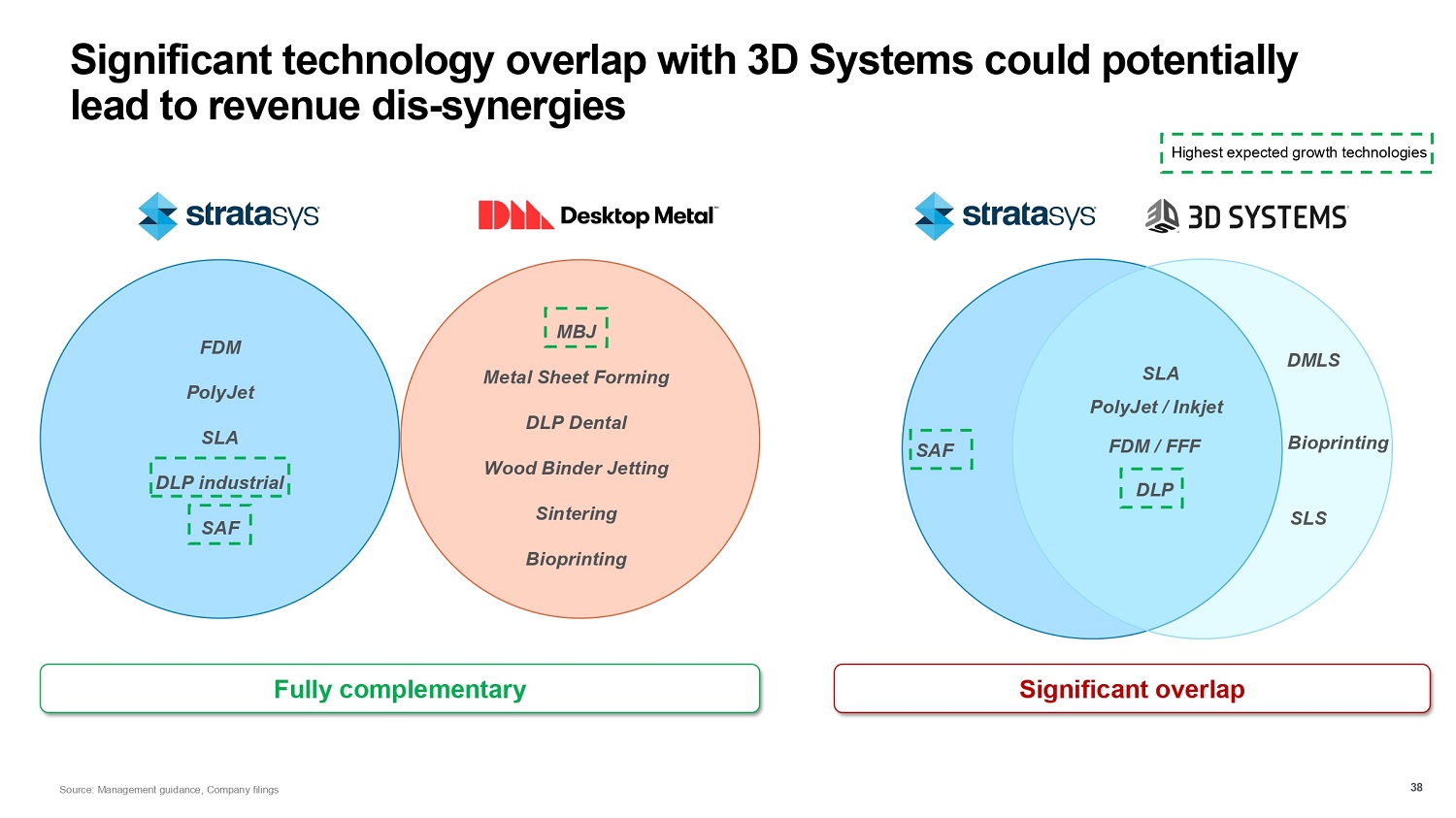

Highest expected growth technologies FDM / FFF PolyJet / Inkjet SLA DLP Bioprinting DMLS SLS SAF 30 Potentially creates cost synergies of $70M – 100M Expected to have potential revenue dis - synergies of up to $50M Significant overlap creates cost save opportunities as well as potential dis - synergies Source: Management guidance, Company filings

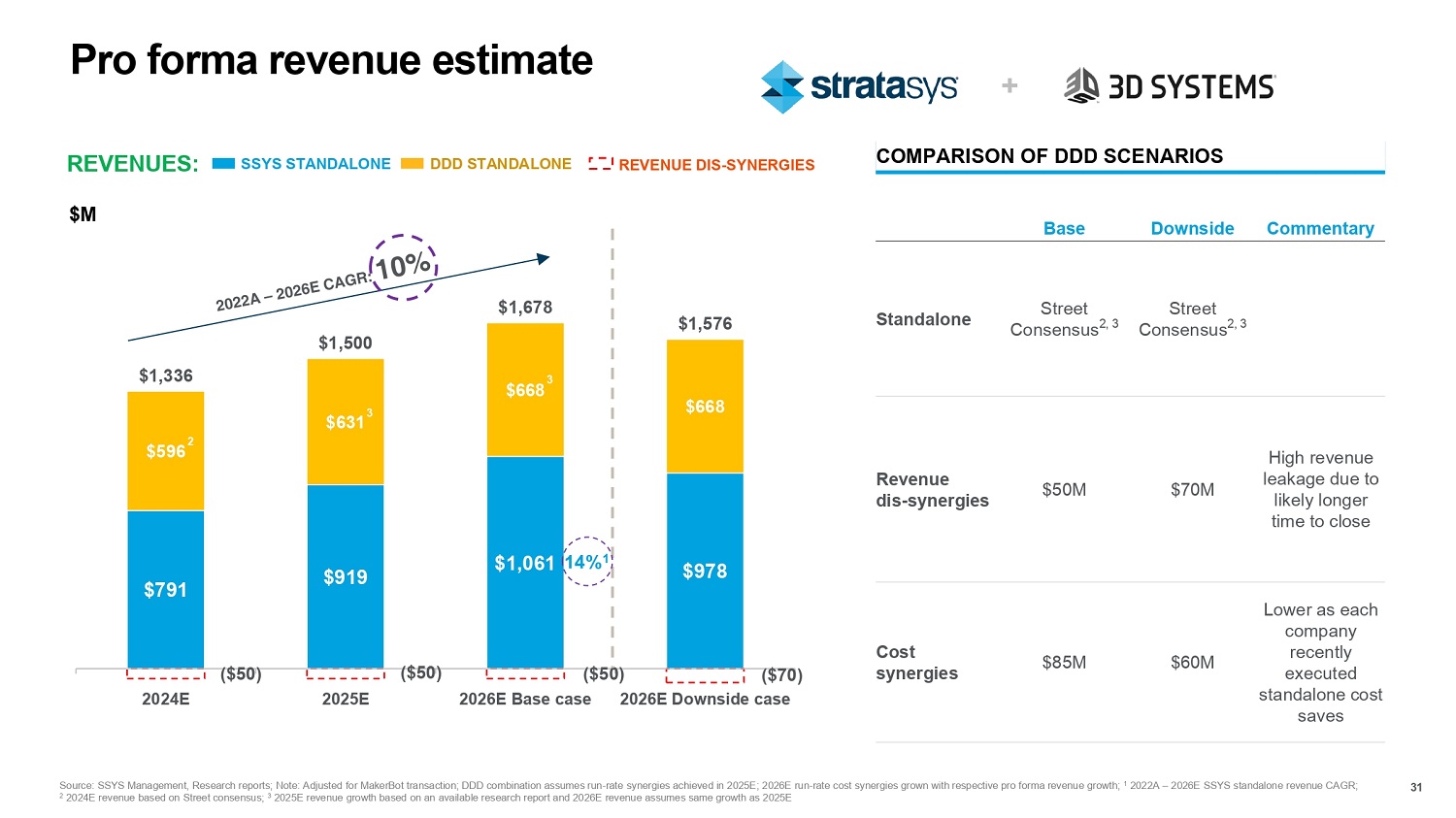

$M Pro forma revenue estimate 31 + $791 $919 $1,061 $978 $596 $668 $668 ($50) ($50) ($50) ($70) $1,336 $1,500 $1,678 $1,576 2024E 2025E 2026E Base case 2026E Downside case SSYS STANDALONE DDD STANDALONE REVENUE DIS - SYNERGIES REVENUES: Source: SSYS Management, Research reports; Note: Adjusted for MakerBot transaction; DDD combination assumes run - rate synergies achieved in 2025E; 2026E run - rate cost synergies grown with respective pro forma revenue growth; 1 2022A – 2026E SSYS standalone revenue CAGR; 2 2024E revenue based on Street consensus; 3 2025E revenue growth based on an available research report and 2026E revenue assumes same growth as 2025E 2 $631 3 3 COMPARISON OF DDD SCENARIOS Commentary Downside Base Street Consensus 2, 3 Street Consensus 2, 3 Standalone High revenue leakage due to likely longer time to close $70M $50M Revenue dis - synergies Lower as each company recently executed standalone cost saves $60M $85M Cost synergies 14% 1

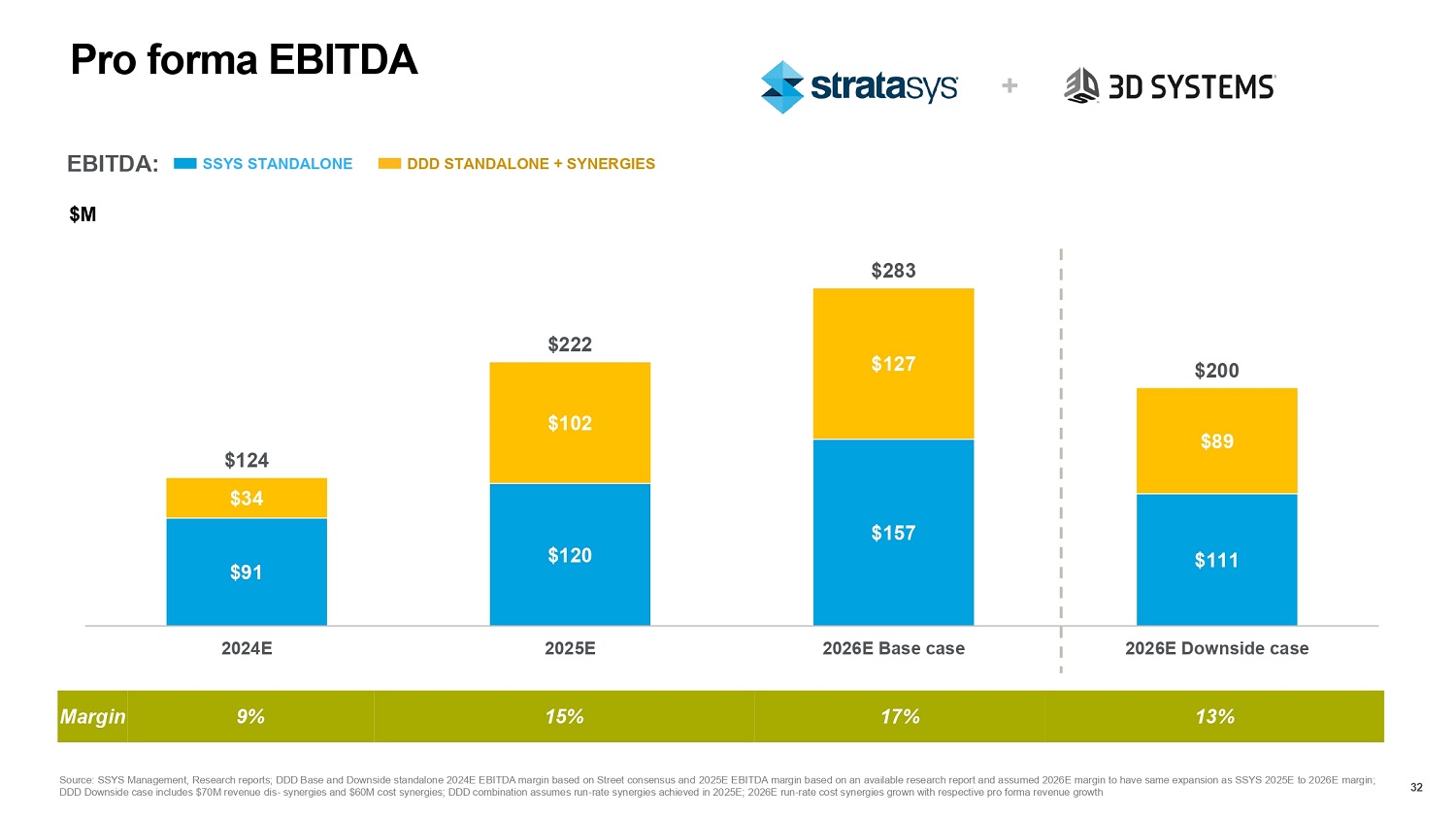

$91 $120 $157 $111 $34 $102 $127 $89 $124 $222 $283 $200 2024E 2025E 2026E Base case 2026E Downside case Pro forma EBITDA 32 $M Margin 9% 15% 17% 13% SSYS STANDALONE DDD STANDALONE + SYNERGIES EBITDA: Source: SSYS Management, Research reports; DDD Base and Downside standalone 2024E EBITDA margin based on Street consensus and 2025E EBITDA margin based on an available research report and assumed 2026E margin to have same expansion as SSYS 2025E to 2026E margin; DDD Downside case includes $70M revenue dis - synergies and $60M cost synergies; DDD combination assumes run - rate synergies achieved in 2025E; 2026E run - rate cost synergies grown with respective pro forma revenue growth +

Agenda Desktop Metal is highly complementary and creates significant value Assessing 3D Systems proposal 1 2 Desktop Metal is a superior combination to 3D Systems 3 33

DM offers superior value creation relative to DDD’s proposal. DM offers a natural and highly compelling next step to SSYS journey: DM merger creates more attractive business mix with robust manufacturing - based portfolio and superior metal offerings 1 2 DM offers higher growth as well as profitability relative to a combination with DDD 3 DM creates higher value for SSYS shareholders relative to current DDD offer 34

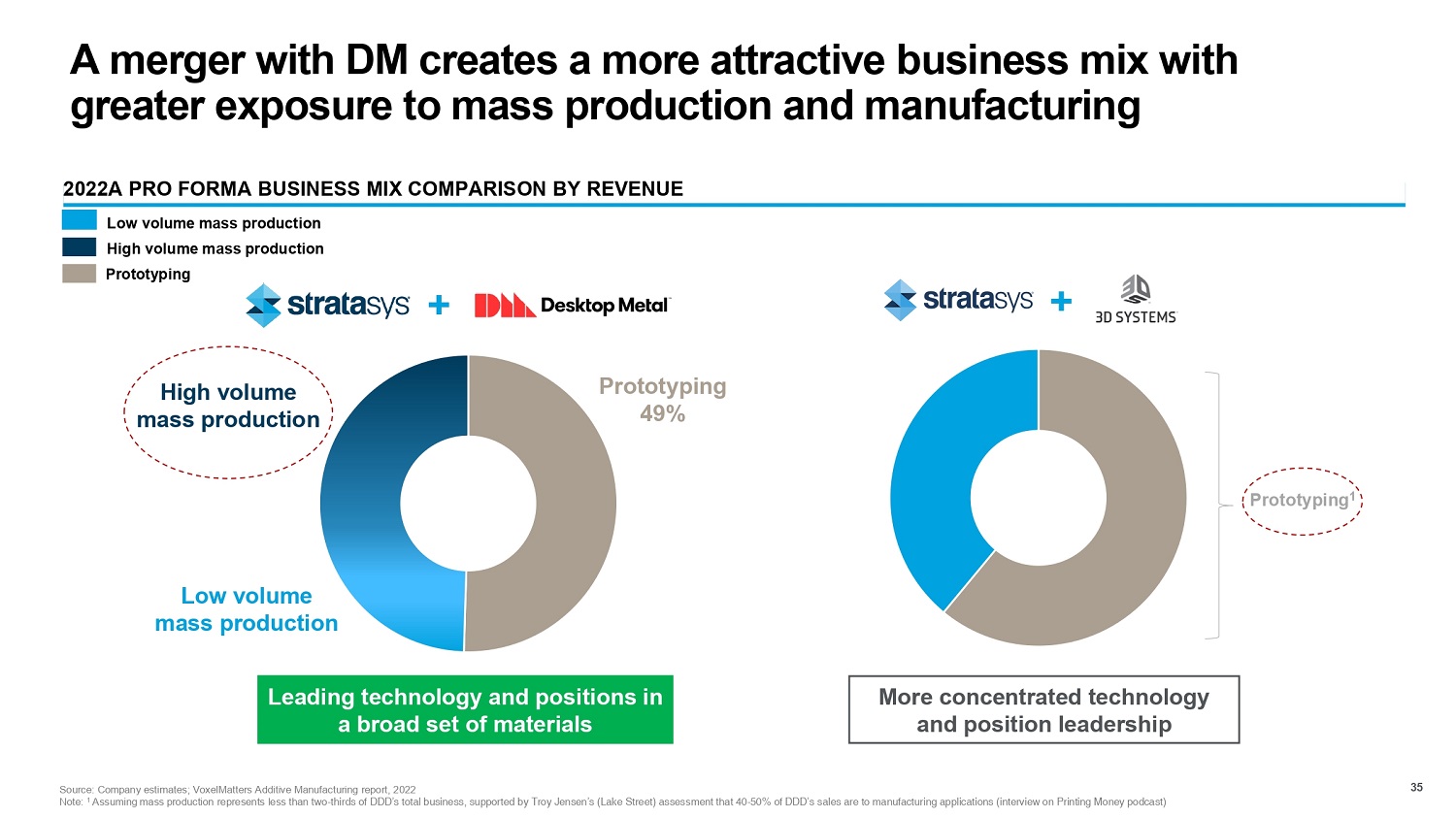

A merger with DM creates a more attractive business mix with greater exposure to mass production and manufacturing 35 Low volume mass production High volume mass production Prototyping + Prototyping 1 + 2022A PRO FORMA BUSINESS MIX COMPARISON BY REVENUE Low volume mass production Prototyping 49% Leading technology and positions in a broad set of materials More concentrated technology and position leadership High volume mass production Source: Company estimates; VoxelMatters Additive Manufacturing report, 2022 Note: 1 Assuming mass production represents less than two - thirds of DDD’s total business, supported by Troy Jensen’s (Lake Street) assessment that 40 - 50% of DDD’s sales are to manufacturing applications (interview on Printing Money podcast)

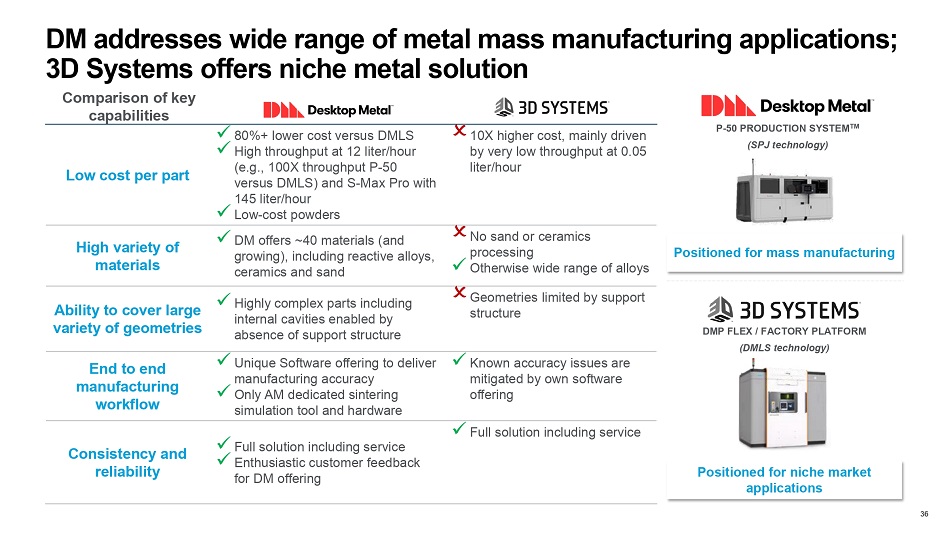

DMP FLEX / FACTORY PLATFORM (DMLS technology) P - 50 PRODUCTION SYSTEM TM (SPJ technology) Positioned for niche market applications x 10X higher cost, mainly driven by very low throughput at 0.05 liter/hour x 80%+ lower cost versus DMLS x High throughput at 12 liter/hour (e.g., 100X throughput P - 50 versus DMLS) and S - Max Pro with 145 liter/hour x Low - cost powders Low cost per part x No sand or ceramics processing x Otherwise wide range of alloys x DM offers ~40 materials (and growing), including reactive alloys, ceramics and sand High variety of materials x Geometries limited by support structure x Highly complex parts including internal cavities enabled by absence of support structure Ability to cover large variety of geometries x Known accuracy issues are mitigated by own software offering x Unique Software offering to deliver manufacturing accuracy x Only AM dedicated sintering simulation tool and hardware End to end manufacturing workflow x Full solution including service x Full solution including service x Enthusiastic customer feedback for DM offering Consistency and reliability DM addresses wide range of metal mass manufacturing applications; 3D Systems offers niche metal solution Comparison of key capabilities Positioned for mass manufacturing 36

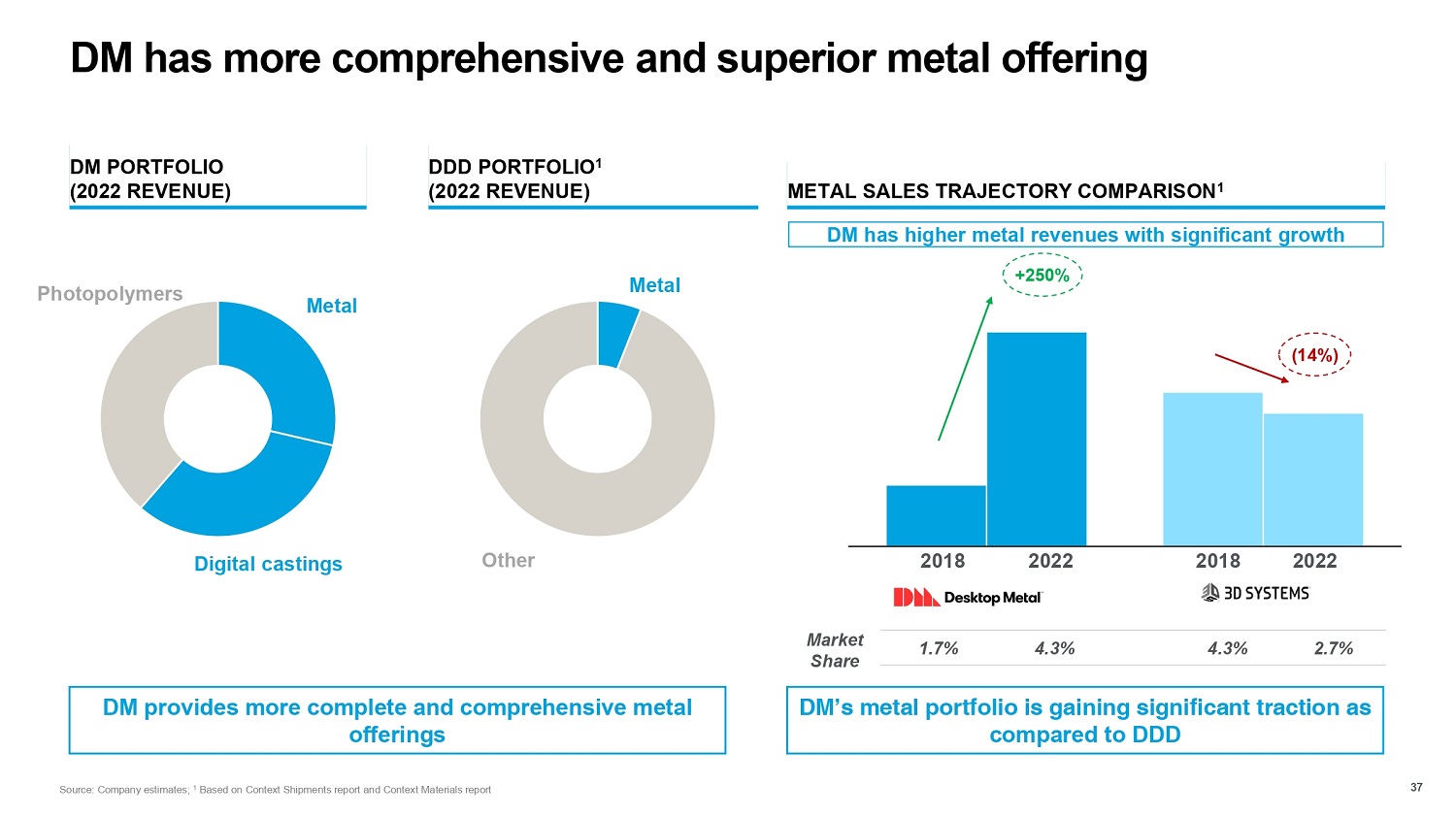

DM has more comprehensive and superior metal offering METAL SALES TRAJECTORY COMPARISON 1 DM PORTFOLIO (2022 REVENUE) Market Share DDD PORTFOLIO 1 (2022 REVENUE) 2.7% 4.3% 4.3% 1.7% DM provides more complete and comprehensive metal offerings 2018 2022 2018 2022 (14%) DM’s metal portfolio is gaining significant traction as compared to DDD 37 +250% Metal Digital castings Photopolymers Metal Other DM has higher metal revenues with significant growth Source: Company estimates; 1 Based on Context Shipments report and Context Materials report

Significant technology overlap with 3D Systems could potentially lead to revenue dis - synergies Significant overlap Fully complementary 38 Highest expected growth technologies SLA PolyJet / Inkjet FDM / FFF DLP Bioprinting DMLS SLS SAF Bioprinting Sintering Wood Binder Jetting MBJ Metal Sheet Forming DLP Dental SLA FDM PolyJet DLP industrial SAF Source: Management guidance, Company filings

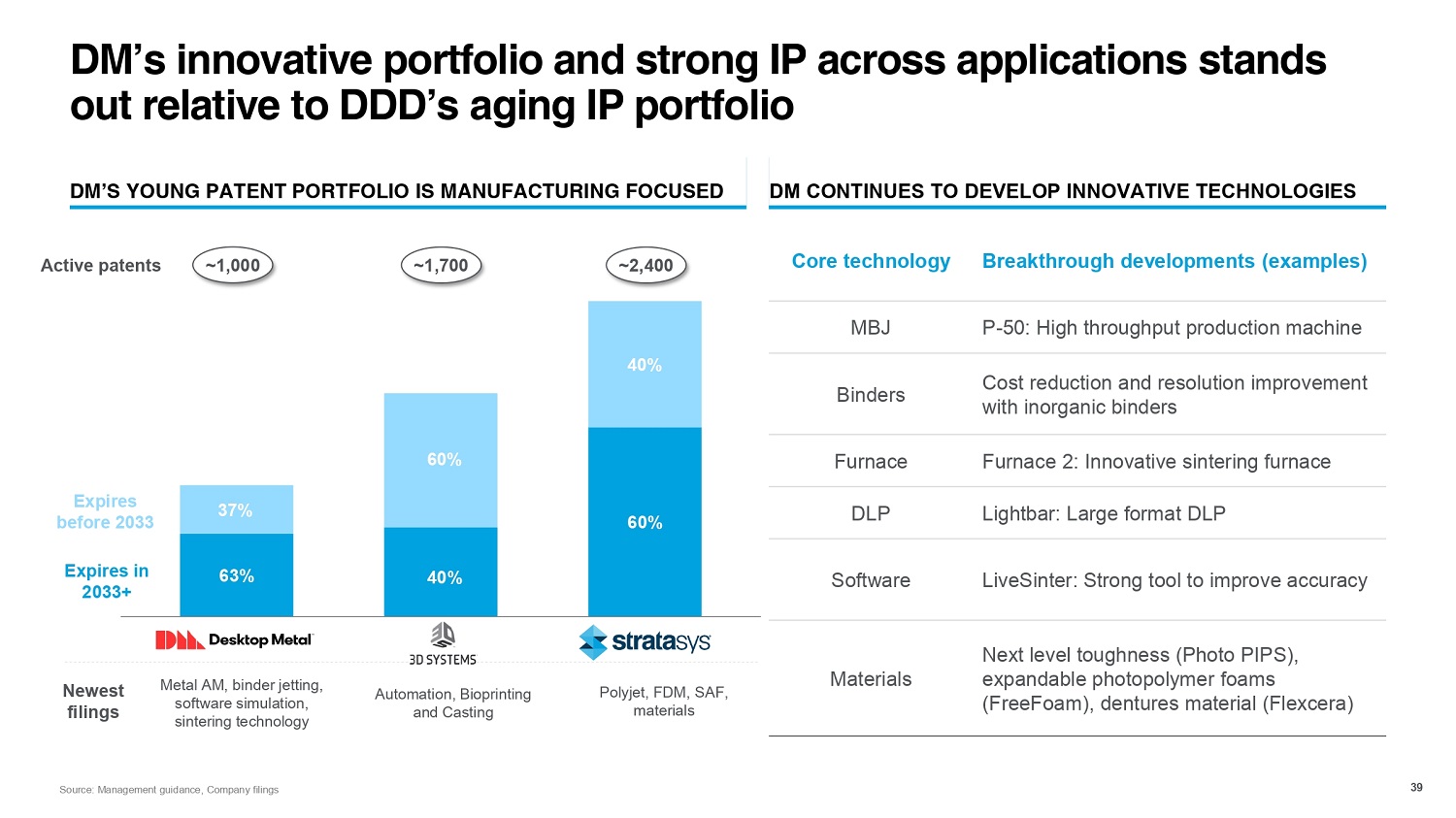

DM’s innovative portfolio and strong IP across applications stands out relative to DDD’s aging IP portfolio DM’S YOUNG PATENT PORTFOLIO IS MANUFACTURING FOCUSED DM CONTINUES TO DEVELOP INNOVATIVE TECHNOLOGIES Newest filings Active patents Me s s 39 Expires before 2033 Expires in 2033+ Breakthrough developments (examples) Core technology ~2,400 ~1,700 ~1,000 P - 50: High throughput production machine MBJ Cost reduction and resolution improvement with inorganic binders Binders 40% Furnace 2: Innovative sintering furnace Furnace 60% Lightbar: Large format DLP DLP 60% 37% LiveSinter: Strong tool to improve accuracy Software 40% 63% Next level toughness (Photo PIPS), expandable photopolymer foams (FreeFoam), dentures material (Flexcera) Materials AF, Polyjet, FDM, S materials nting utomation, Biopri and Casting ting, A n, gy tal AM, binder jet oftware simulatio intering technolo Source: Management guidance, Company filings

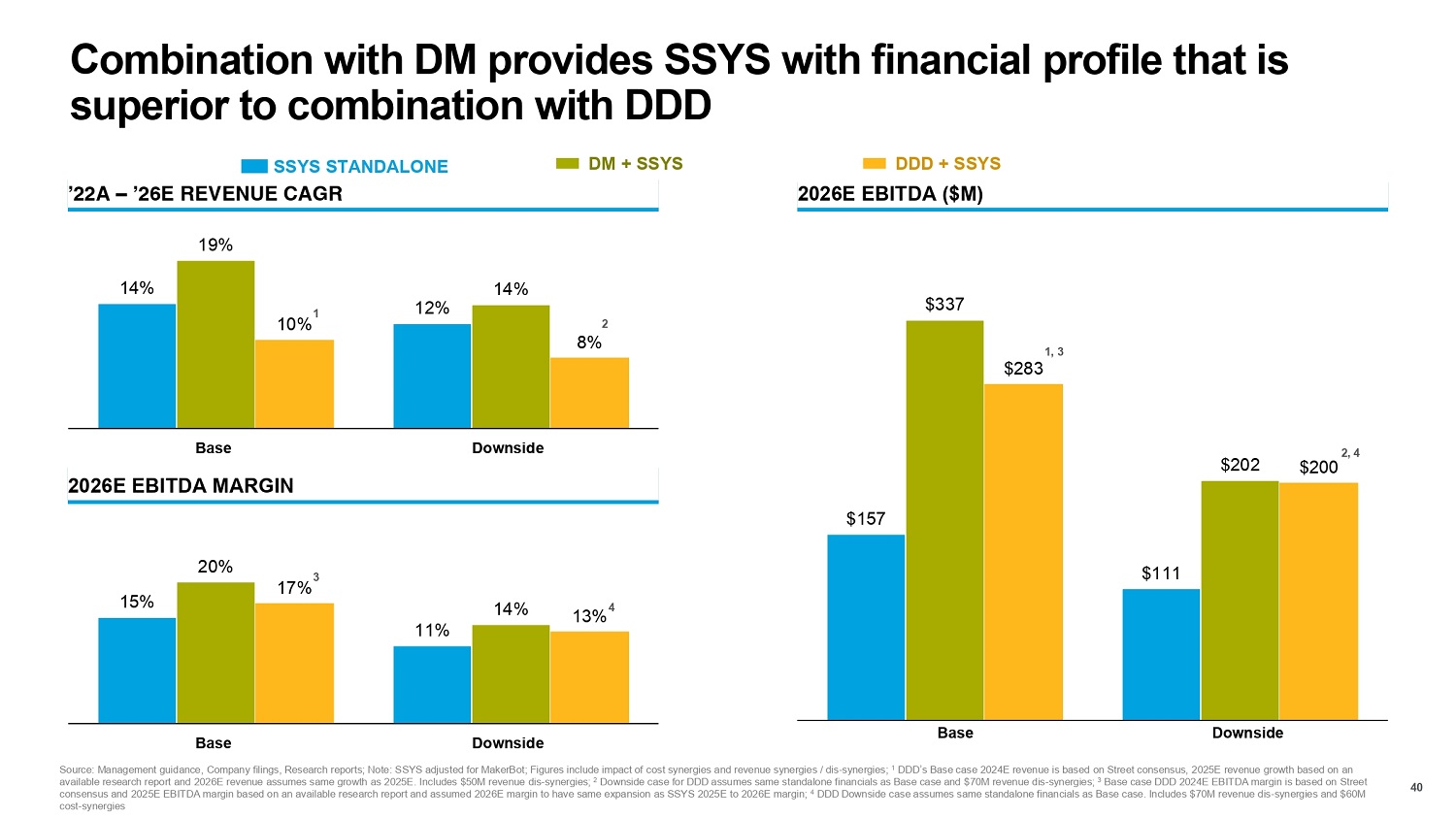

$157 $111 $337 $202 $283 $200 Combination with DM provides SSYS with financial profile that is superior to combination with DDD 40 ’22A – ’26E REVENUE CAGR 2026E EBITDA ($M) 14% 12% 19% 14% 10% Base Downside 2026E EBITDA MARGIN Base Downside Base Downside 15% 11% 20% 14% 17% Source: Management guidance, Company filings, Research reports; Note: SSYS adjusted for MakerBot; Figures include impact of cost synergies and revenue synergies / dis - synergies; 1 DDD’s Base case 2024E revenue is based on Street consensus, 2025E revenue growth based on an available research report and 2026E revenue assumes same growth as 2025E. Includes $50M revenue dis - synergies; 2 Downside case for DDD assumes same standalone financials as Base case and $70M revenue dis - synergies; 3 Base case DDD 2024E EBITDA margin is based on Street consensus and 2025E EBITDA margin based on an available research report and assumed 2026E margin to have same expansion as SSYS 2025E to 2026E margin; 4 DDD Downside case assumes same standalone financials as Base case. Includes $70M revenue dis - synergies and $60M cost - synergies SSYS STANDALONE DM + SSYS DDD + SSYS 1 2 8% 3 13% 4 1, 3 2, 4

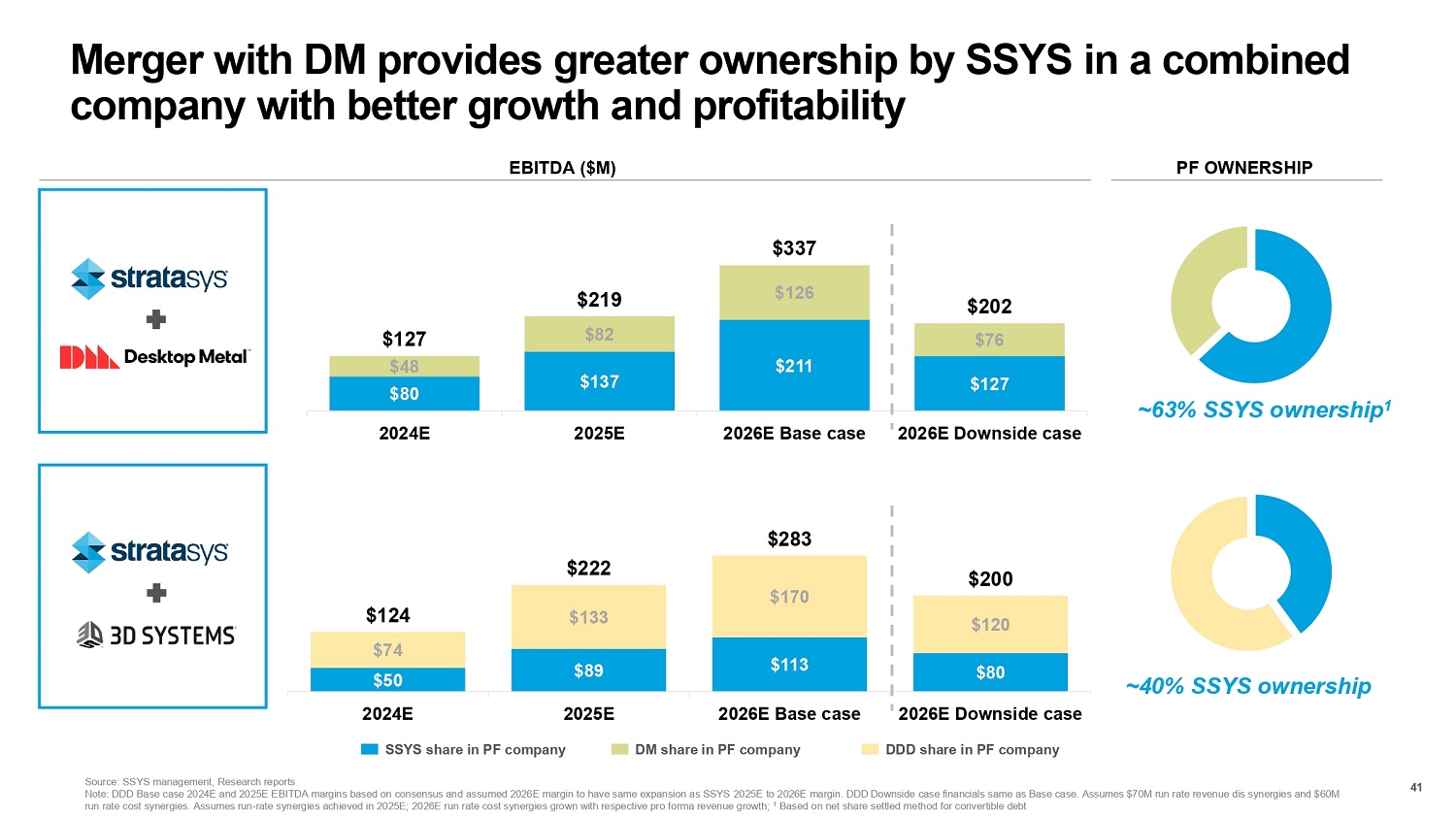

Merger with DM provides greater ownership by SSYS in a combined company with better growth and profitability 41 ~63% SSYS ownership 1 ~40% SSYS ownership $80 $137 $211 $127 $48 $82 $126 $76 $127 $219 $337 $202 2024E 2025E 2026E Base case 2026E Downside case $50 $89 $113 $80 $74 $133 $170 $120 $124 $222 $283 $200 2024E 2025E 2026E Base case 2026E Downside case SSYS share in PF company DM share in PF company DDD share in PF company Source: SSYS management, Research reports Note: DDD Base case 2024E and 2025E EBITDA margins based on consensus and assumed 2026E margin to have same expansion as SSYS 2025E to 2026E margin. DDD Downside case financials same as Base case. Assumes $70M run rate revenue dis synergies and $60M run rate cost synergies. Assumes run - rate synergies achieved in 2025E; 2026E run rate cost synergies grown with respective pro forma revenue growth; 1 Based on net share settled method for convertible debt EBITDA ($M) PF OWNERSHIP

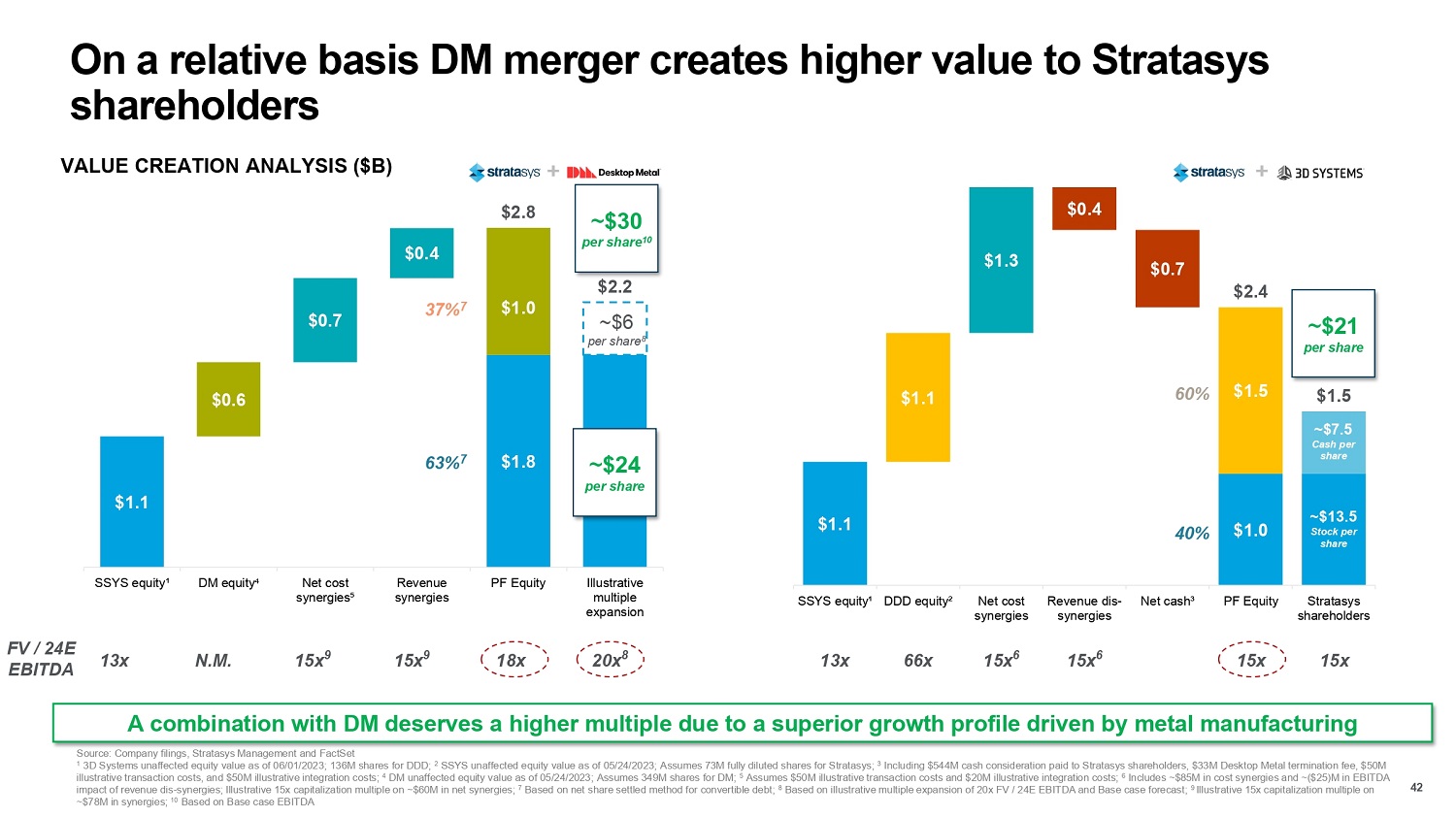

Source: Company filings, Stratasys Management and FactSet 1 3D Systems unaffected equity value as of 06/01/2023; 136M shares for DDD; 2 SSYS unaffected equity value as of 05/24/2023; Assumes 73M fully diluted shares for Stratasys; 3 Including $544M cash consideration paid to Stratasys shareholders, $33M Desktop Metal termination fee, $50M illustrative transaction costs, and $50M illustrative integration costs; 4 DM unaffected equity value as of 05/24/2023; Assumes 349M shares for DM; 5 Assumes $50M illustrative transaction costs and $20M illustrative integration costs; 6 Includes ~$85M in cost synergies and ~($25)M in EBITDA impact of revenue dis - synergies; Illustrative 15x capitalization multiple on ~$60M in net synergies; 7 Based on net share settled method for convertible debt; 8 Based on illustrative multiple expansion of 20x FV / 24E EBITDA and Base case forecast; 9 Illustrative 15x capitalization multiple on ~$78M in synergies; 10 Based on Base case EBITDA On a relative basis DM merger creates higher value to Stratasys shareholders 42 A combination with DM deserves a higher multiple due to a superior growth profile driven by metal manufacturing $1.0 $1.1 $1.1 $1.3 $0.4 $0.7 $1.5 $2.4 $1.5 Stratasys PF Equity Net cash³ Revenue dis - Net cost DDD equity² SSYS equity¹ shareholders synergies synergies 40% 60% ~$13.5 Stock per share ~$7.5 Cash per share $1.8 $1.1 $0.6 $0.7 $0.4 $1.0 $2.8 $2.2 SSYS equity¹ DM equity⁴ Net cost synergies⁵ Revenue synergies PF Equity Illustrative multiple expansion VALUE CREATION ANALYSIS ($B) 37% 7 63% 7 ~$24 per share FV / 24E EBITDA ~$6 per share 8 + + ~$30 per share 10 ~$21 per share 20x 8 18x 15x 9 15x 9 N.M. 13x 15x 15x 15x 6 15x 6 66x 13x

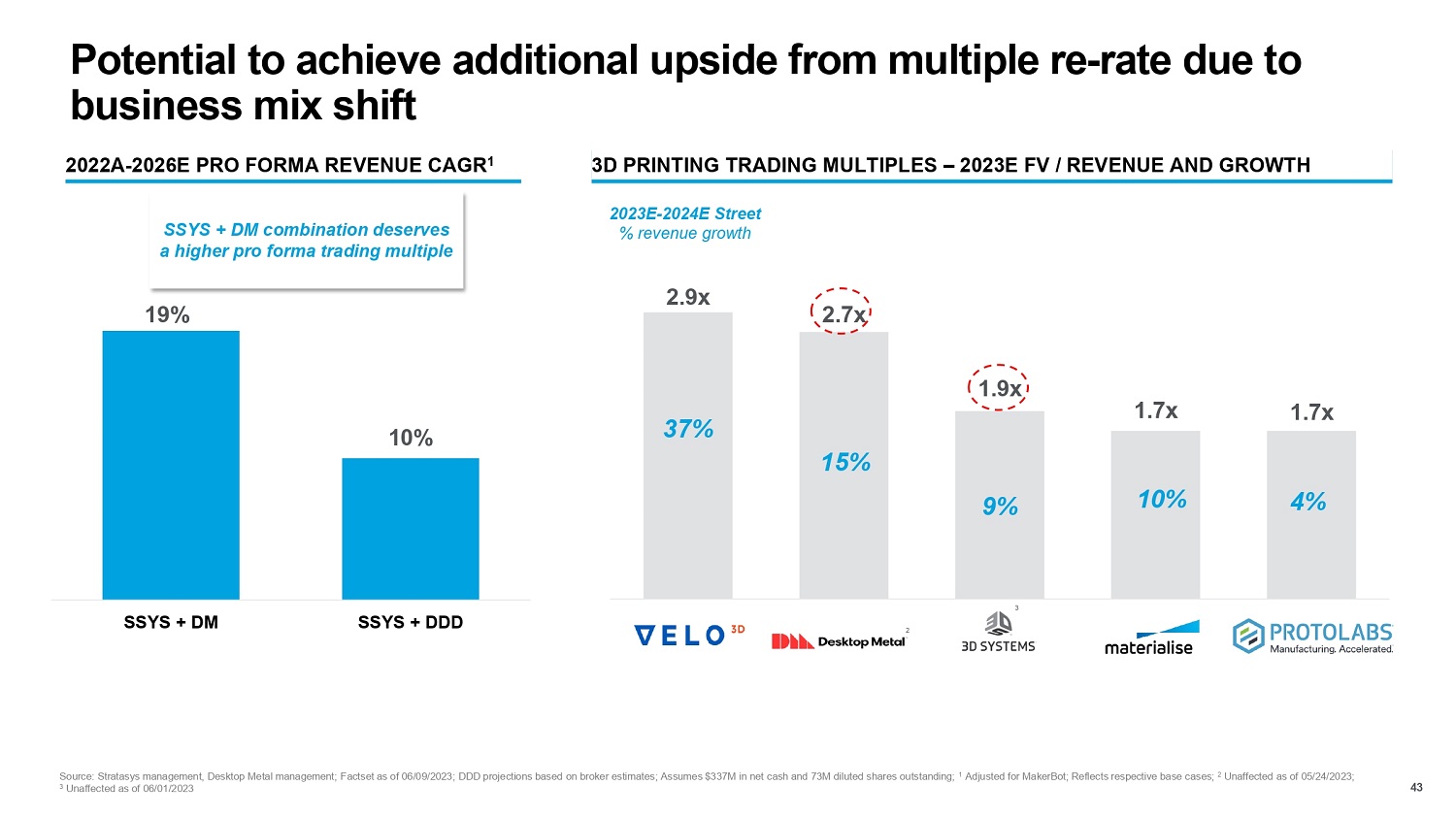

2.9x 2.7x 1.9x 1.7x 1.7x 37% 15% 9% 10% 4% Potential to achieve additional upside from multiple re - rate due to business mix shift 43 19% 10% SSYS + DM SSYS + DDD 2022A - 2026E PRO FORMA REVENUE CAGR 1 3D PRINTING TRADING MULTIPLES – 2023E FV / REVENUE AND GROWTH 3 2 2023E - 2024E Street % revenue growth SSYS + DM combination deserves a higher pro forma trading multiple Source: Stratasys management, Desktop Metal management; Factset as of 06/09/2023; DDD projections based on broker estimates; Assumes $337M in net cash and 73M diluted shares outstanding; 1 Adjusted for MakerBot; Reflects respective base cases; 2 Unaffected as of 05/24/2023; 3 Unaffected as of 06/01/2023

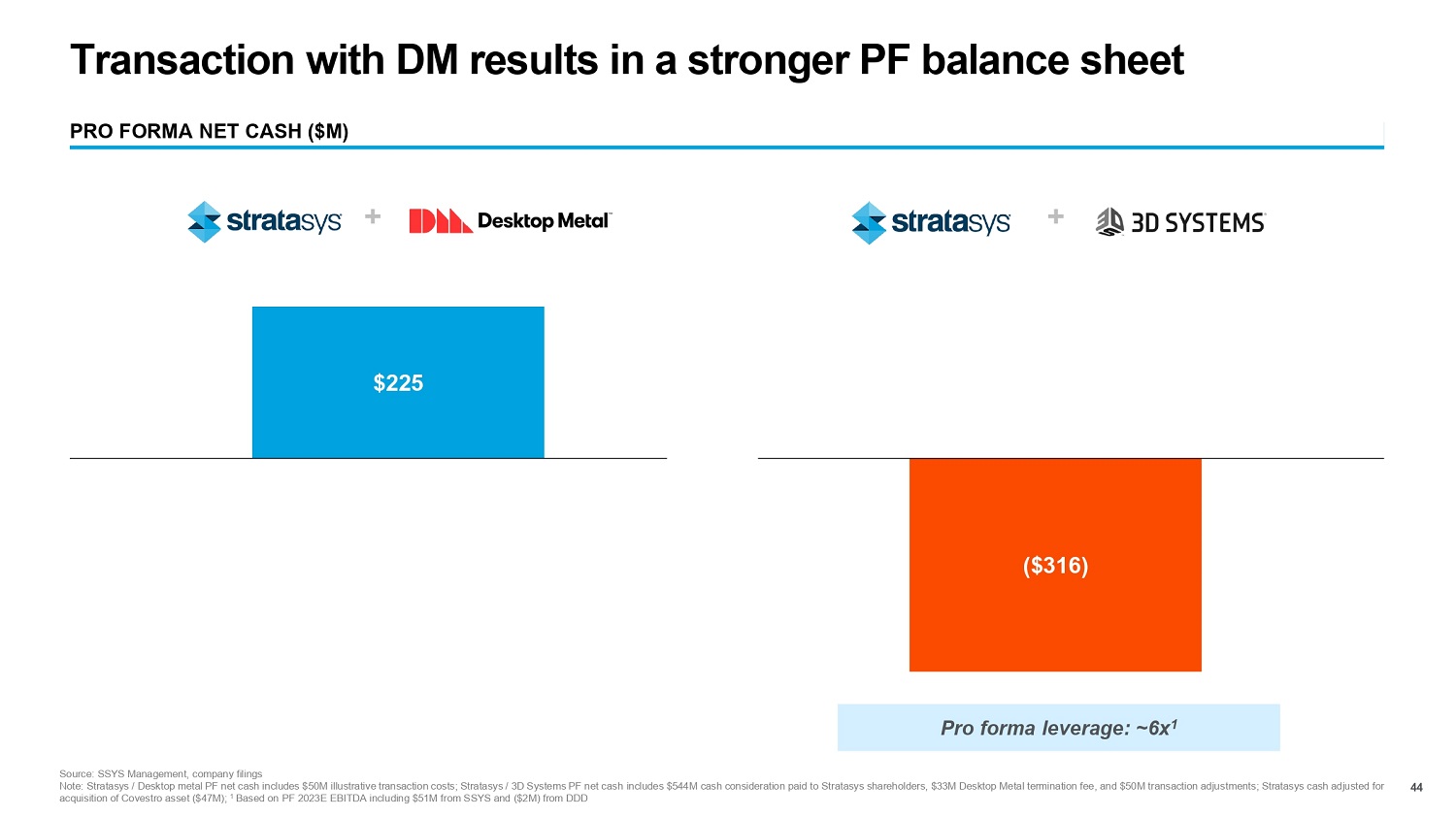

$225 ($316) Transaction with DM results in a stronger PF balance sheet 44 PRO FORMA NET CASH ($M) + + Pro forma leverage: ~6x 1 Source: SSYS Management, company filings Note: Stratasys / Desktop metal PF net cash includes $50M illustrative transaction costs; Stratasys / 3D Systems PF net cash includes $544M cash consideration paid to Stratasys shareholders, $33M Desktop Metal termination fee, and $50M transaction adjustments; Stratasys cash adjusted for acquisition of Covestro asset ($47M); 1 Based on PF 2023E EBITDA including $51M from SSYS and ($2M) from DDD

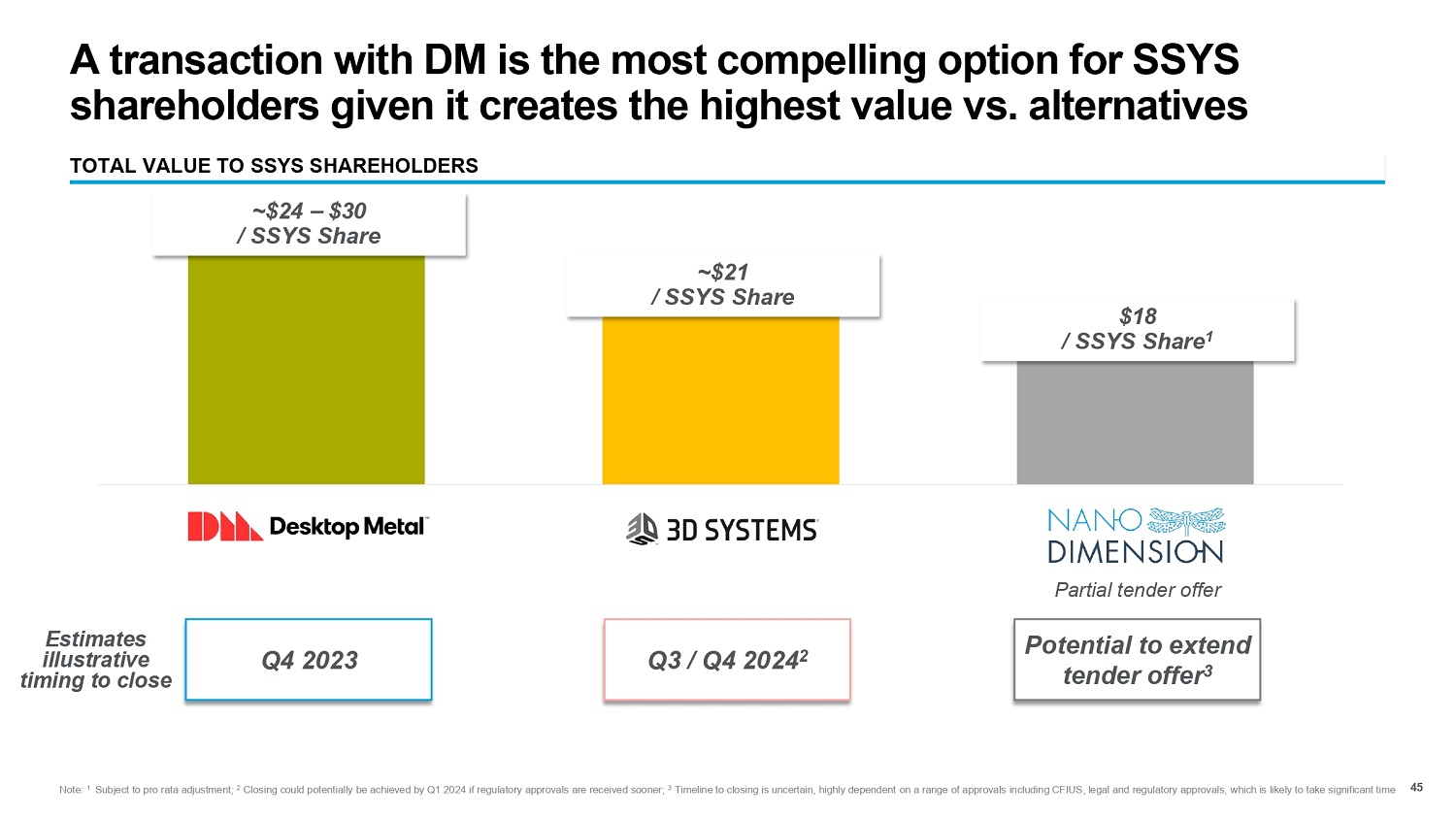

A transaction with DM is the most compelling option for SSYS shareholders given it creates the highest value vs. alternatives TOTAL VALUE TO SSYS SHAREHOLDERS ~$24 – $30 / SSYS Share ~$21 / SSYS Share $18 / SSYS Share 1 45 Note: 1 Subject to pro rata adjustment; 2 Closing could potentially be achieved by Q1 2024 if regulatory approvals are received sooner; 3 Timeline to closing is uncertain, highly dependent on a range of approvals including CFIUS, legal and regulatory approvals, which is likely to take significant time Q4 2023 Q3 / Q4 2024 2 Potential to extend tender offer 3 Partial tender offer Estimates illustrative timing to close