Exhibit (a)(5)(G)

Forward Looking Statements This presentation of Nano Dimension Ltd. (the “Company” or “Nano Dimension”) contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act and other securities laws. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements. For example, the Company is using forward-looking statements when it discusses the timing of the proposed tender offer, the comparative benefits of the Company’s tender offer weighed against the anticipated outcomes of the alternative transactions between Stratasys Ltd. (“Stratasys”) and Desktop Metal Inc. (“Desktop”) and between Stratasys and 3D Systems Corp. (“3D Systems”), respectively, the integration of Stratasys’ assets, business verticals, and customer base into the Company’s current operations, the integration of Stratasys’ assets, business verticals, and customer base into 3D Systems’ current operations, the integration of Desktop’s assets, business verticals, and customer base into Stratasys’ current operations, and the integration of Stratasys the potential upside of the Company’s and Stratasys’s products opportunities. Because such statements deal with future events and are based on the Company’s current expectations, they are subject to various risks and uncertainties. Actual results, performance, or achievements of Company’s could differ materially from those described in or implied by the statements in this Forward-looking statements are not historical facts, and are based upon management’s current expectations, beliefs and projections, many of which, by their nature, are inherently uncertain. Such expectations, beliefs and projections are expressed in good faith. However, there can be no assurance that management’s expectations, beliefs and projections will be achieved, and actual results may differ materially from what is expressed in or indicated by the forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the forward-looking statements. For a more detailed description of the risks and uncertainties affecting the Company and Stratasys, reference is made to the Company’s and Stratasys’s reports filed from time to time with the Securities and Exchange Commission (“SEC”), including, but not limited to, the risks detailed in the Company’s annual report for the year ended December 31, 2022, and the risks detailed in Stratasys’s annual report for the year ended December 31, 2022, filed with the SEC. Forward-looking statements speak only as of the date the statements are made. The Company assumes no obligation to update forward-looking statements to reflect actual results, subsequent events or circumstances, changes in assumptions or changes in other factors affecting forward-looking information except to the extent required by applicable securities laws. If the Company does update one or more forward-looking statements, no inference should be drawn that the Company will make additional updates with respect thereto or with respect to other forward-looking statements. Certain of the statistical and graphical information contained in this presentation is drawn from research databases and other sources, including websites of the Company’s competitors. Such expectations, beliefs and projections as they relate to information derived from these sources are expressed in good faith, but the actual data and information derived from these sources may differ materially from what is described herein.

Important Information About the Special Tender Offer This presentation is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell any ordinary shares of Stratasys or any other securities, nor is it a substitute for the tender offer materials described herein. A tenderoffer statement on Schedule TO, including an offer to purchase, a letter of transmittal and related documents was filed on May 25th, 2023by Nano Dimension with the SEC and we expect that Stratasys will file a solicitation/recommendation statement on Schedule 14D-9 with theSEC as required by the tender offer rules. INVESTORS AND SECURITY HOLDERS ARE URGED TO CAREFULLY READ BOTH THE TENDER OFFER MATERIALS (INCLUDING THE OFFER TO PURCHASE, RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 REGARDING THE OFFER, AS THEY MAY BE AMENDED FROM TIME TO TIME, WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN AND WILL CONTAIN IMPORTANT INFORMATION THAT INVESTORS AND SECURITY HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SECURITIES. Investors and security holders may obtain a free copy of the Offer to Purchase, the related Letter of Transmittal, certain othertender offer documents and the Solicitation/Recommendation Statement (when available) and other documents filed with the SEC at the website maintained by the Important Information About the Special Tender Offer This presentation is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell any ordinary shares of Stratasys or any other securities, nor is it a substitute for the tender offer materials described herein. A tender offer statement on Schedule TO, including an offer to purchase, a letter of transmittal and related documents was filed on May 25th, 2023, as subsequently amended, by Nano Dimension with the SEC. Stratasys filed a solicitation/recommendation statement on Schedule 14D-9 with the SEC on May 31, 2023, as subsequently amended. INVESTORS AND SECURITY HOLDERS ARE URGED TO CAREFULLY READ BOTH THE TENDER OFFER MATERIALS (INCLUDING THE OFFER TO PURCHASE, RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 REGARDING THE OFFER, AS THEY MAY BE AMENDED FROM TIME TO TIME, WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN AND WILL CONTAIN IMPORTANT INFORMATION THAT INVESTORS AND SECURITY HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SECURITIES. Investors and security holders may obtain a free copy of the Offer to Purchase, the related Letter of Transmittal, certain other tender offer documents and the Solicitation/Recommendation Statement and other documents filed with the SEC at the website maintained by the SEC at www.sec.gov or by directing such requests to Georgeson LLC, the information agent for the tender offer named in the tender offer statement. In addition, Stratasys files annual reports, interim financial statements and other information, and Nano Dimension files annual reports, interim financial statements and other information with the SEC, which are available to the public at the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by Stratasys may be obtained at no charge on the investor relations page of Stratasys’ website at www.stratasys.com. Copies of the documents filed with the SEC by Nano Dimension may be obtained at no charge on the investor relations page of Nano Dimension’s website at www.nano-di.com. No Offer or Solicitation This presentation is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell any ordinary shares of Stratasys or any other securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction, nor is it a substitute for the tender offer materials described herein.

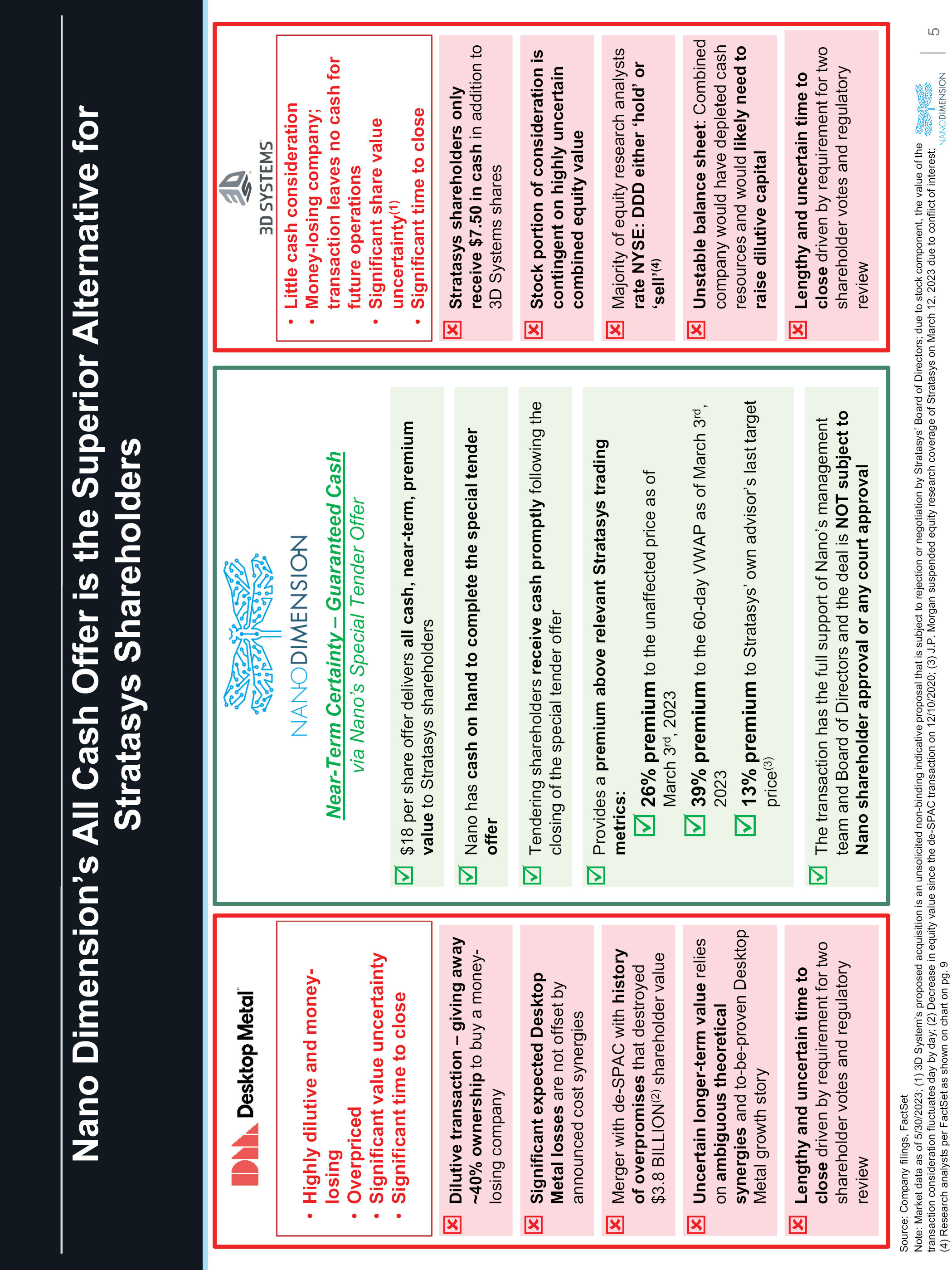

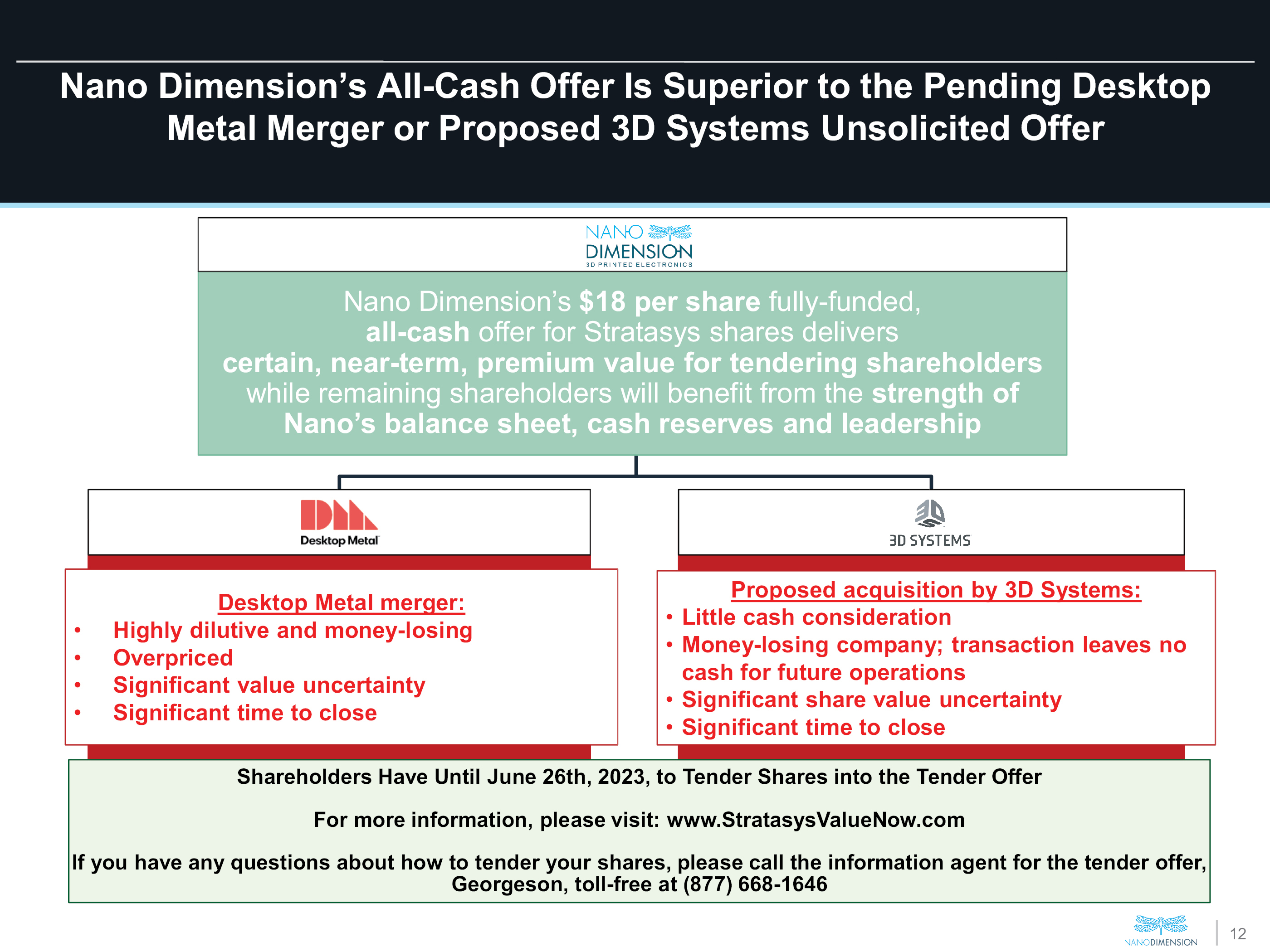

Nano Dimension’s All-Cash Offer Is Superior to the Pending Desktop Metal Merger or Proposed 3D Systems Unsolicited Offer Uncertain alternative transactions would leave Stratasys shareholders dependent for a long time on the share price performance of Stratasys or 3D Systems, which have both been underperforming for many years Nano Dimension’s $18 per share fully-funded, all-cash offer for Stratasys shares delivers certain, near-term, premium value for tendering shareholders while remaining shareholders will benefit from the strength of Nano’s balance sheet, cash reserves and leadership Desktop Metal merger: Highly dilutive and money-losing Overpriced Significant value uncertainty Significant time to close Proposed acquisition by 3D Systems: Little cash consideration Money-losing company; transaction leaves no cash for future operations Significant share value uncertainty Significant time to close On May 25, 2023, Stratasys entered into a Merger Agreement with Desktop Metal This transaction is subject to closing conditions including Desktop Metal and Stratasys shareholder approvalsOn June 2, 2023, 3D Systems submitted a non-binding indicative offer to acquire Stratasys with cash and stock Stratasys has not yet responded to 3D Systems’ offer and an agreed transaction may not materialize

Nano Dimension’s All Cash Offer is the Superior Alternative for Stratasys Shareholders Highly dilutive and money-losing Overpriced Significant value uncertainty Significant time to close Dilutive transaction – giving away ~40% ownership to buy a money-losing company Significant expected Desktop Metal losses are not offset by announced cost synergies Merger with de-SPAC with history of overpromises that destroyed $3.8 BILLION(2) shareholder value Uncertain longer-term value relies on ambiguous theoretical synergies and to-be-proven Desktop Metal growth story Lengthy and uncertain time to close driven by requirement for two shareholder votes and regulatory review Near-Term Certainty – Guaranteed Cash via Nano’s Special Tender Offer $18 per share offer delivers all cash, near-term, premium value to Stratasys shareholders Nano has cash on hand to complete the special tender offer Tendering shareholders receive cash promptly following the closing of the special tender offer Provides a premium above relevant Stratasys trading metrics: 26% premium to the unaffected price as of March 3rd, 2023 39% premium to the 60-day VWAP as of March 3rd, 2023 13% premium to Stratasys’ own advisor’s last target price(3) The transaction has the full support of Nano’s management team and Board of Directors and the deal is NOT subject to Nano shareholder approval or any court approval Little cash consideration Money-losing company; transaction leaves no cash for future operations Significant share value uncertainty(1) Significant time to close Stratasys shareholders only receive $7.50 in cash in addition to 3D Systems shares Stock portion of consideration is contingent on highly uncertain combined equity value Majority of equity research analysts rate NYSE: DDD either ‘hold’ or ‘sell’(4) Unstable balance sheet: Combined company would have depleted cash resources and would likely need to raise dilutive capital Lengthy and uncertain time to close driven by requirement for two shareholder votes and regulatory review Source: Company filings, FactSet Note: Market data as of 5/30/2023; (1) 3D System’s proposed acquisition is an unsolicited non-binding indicative proposal that is subject to rejection or negotiation by Stratasys’ Board of Directors; due to stock component, the value of the transaction consideration fluctuates day by day; (2) Decrease in equity value since the de-SPAC transaction on 12/10/2020; (3) J.P. Morgan suspended equity research coverage of Stratasys on March 12, 2023 due to conflict of interest; (4) Research analysts per FactSet as shown on chart on pg. 9

Desktop Metal Merger is Cash Burning and Value Destroying From day one, Desktop Metal has underperformed and destroyed shareholder value Desktop Metal Value Destruction (Share price in $) Desktop Metal has destroyed $3.8 BILLION of value – more than 85% - since its de-SPAC(1) on December 10th, 2020 $40 $30 $20 $10 $0 $41 $72 $110 $155 $211 $266 $306 $337 $374 (90.3)%(2) (Share price in $) Jan-21 Apr-21 Jul-21 Oct-21 Jan-22 Apr-22 Jul-22 Oct-22 Jan-23 Apr-23 Desktop Metal Share Price Desktop Metal Cumulative Cash Burn(3) ($ in millions) Source: Desktop Metal SEC filings, FactSet Note: Market data as of 5/30/2023; (1) Represents equity values; (2) Discrepancy between percentage decrease in equity value and percentage decrease in share price is due to change in share count over time; (3) Represents cumulative cash flow from operations since Q1 2021

Combination of Nano Dimension & Stratasys: Enhances the Value Proposition to the Companies’ Current and Future Customer Bases Through Enlarged Product Portfolio and R&D Efforts Establishes world-leading player in evolving AM

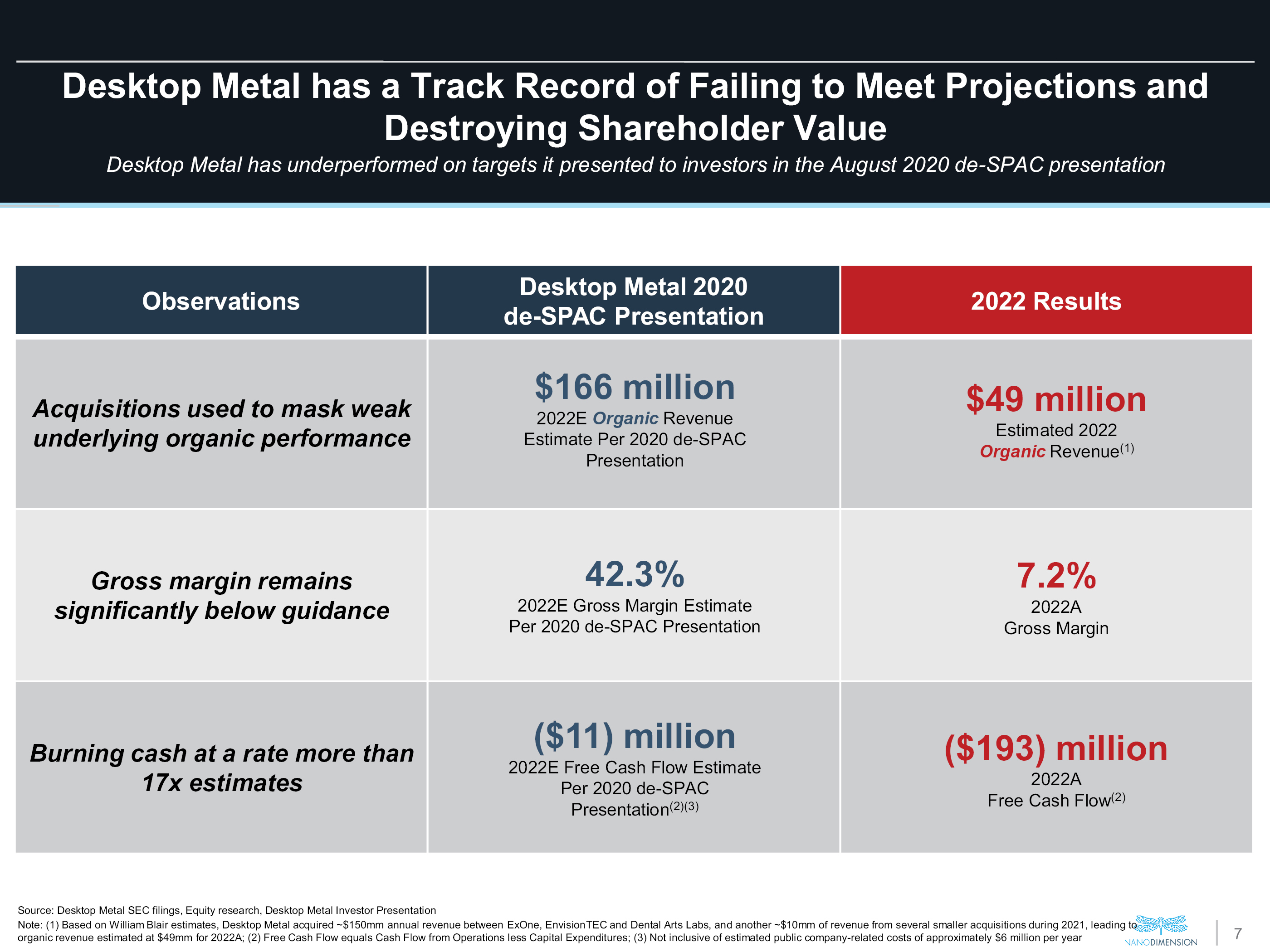

Desktop Metal has a Track Record of Failing to Meet Projections and Destroying Shareholder Value Desktop Metal has underperformed on targets it presented to investors in the August 2020 de-SPAC presentation Observations Desktop Metal 2020 de-SPAC Presentation 2022 Results Acquisitions used to mask weak underlying organic performance Gross margin remains significantly below guidance Burning cash at a rate more than 17x estimates $166 million 2022E Organic Revenue Estimate Per 2020 de-SPAC Presentation 42.3% 2022E Gross Margin Estimate Per 2020 de-SPAC Presentation ($11) million 2022E Free Cash Flow Estimate Per 2020 de-SPAC Presentation(2)(3) $49 million Estimated 2022 Organic Revenue(1) 7.2% 2022A Gross Margin ($193) million 2022A Free Cash Flow(2) Source: Desktop Metal SEC filings, Equity research, Desktop Metal Investor Presentation Note: (1) Based on William Blair estimates, Desktop Metal acquired ~$150mm annual revenue between ExOne, EnvisionTECand Dental Arts Labs, and another ~$10mm of revenue from several smaller acquisitions during 2021, leading to organic revenue estimated at $49mm for 2022A; (2) Free Cash Flow equals Cash Flow from Operations less Capital Expenditures; (3)Not inclusive of estimated public company-related costs of approximately $6 million per year

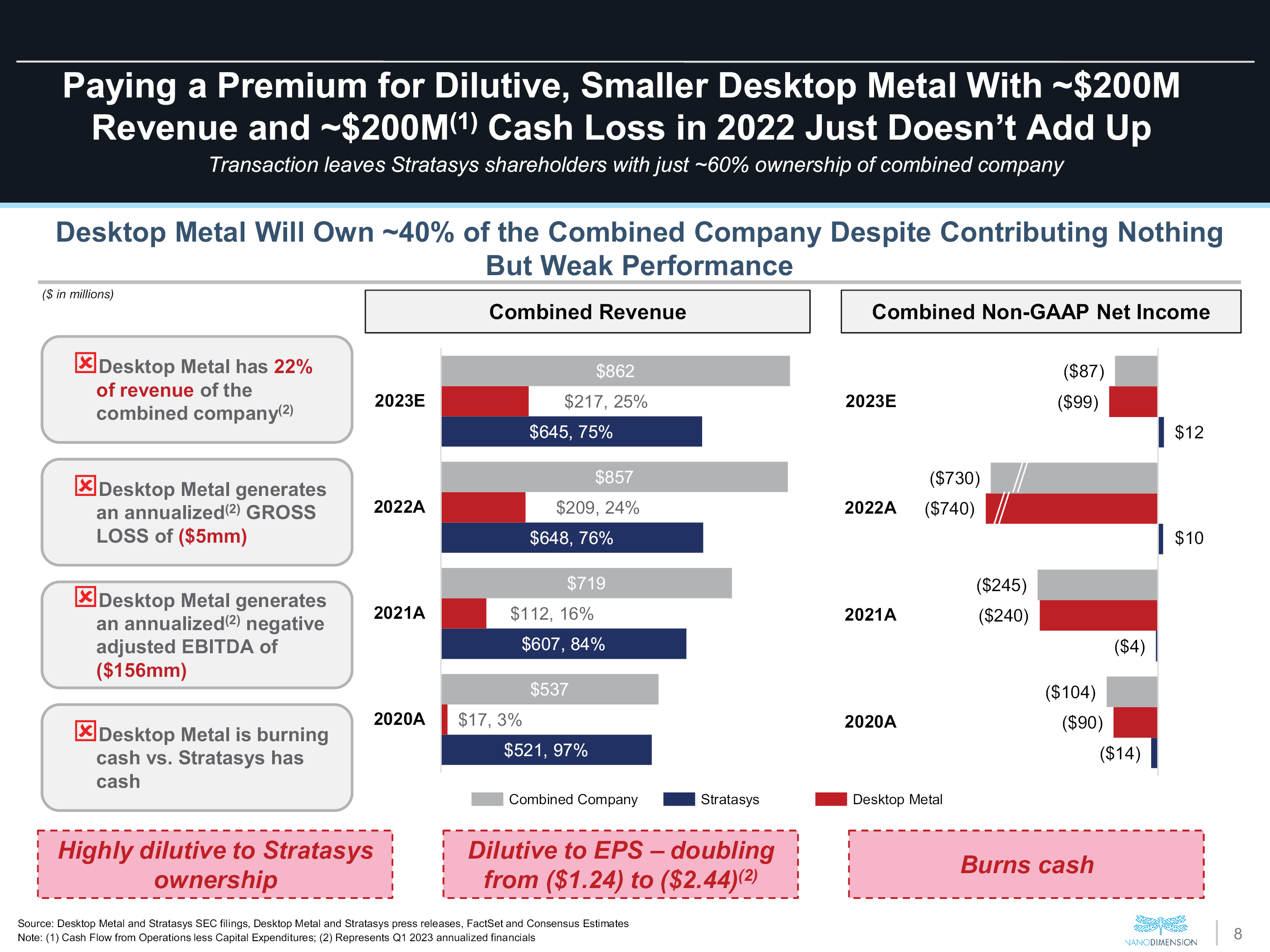

Paying a Premium for Dilutive, Smaller Desktop Metal With ~$200M Revenue and ~$200M(1) Cash Loss in 2022 Just Doesn’t Add Up Transaction leaves Stratasys shareholders with just ~60% ownership of combined company Desktop Metal Will Own ~40% of the Combined Company Despite Contributing Nothing But Weak Performance ($ in millions) Combined Revenue Combined Non-GAAP Net Income Desktop Metal has 22% of revenue of the combined company(2) Desktop Metal generates an annualized(2) GROSS LOSS of ($5mm) Desktop Metal generates an annualized(2) negative adjusted EBITDA of ($156mm) Desktop Metal is burning cash vs. Stratasys has cash 2023E 2022A 2021A 2020A $217, 25% $862 $645, 75% $857 $209, 24% $648, 76% $719 $607, 84% $537 $17, 3% $521, 97% ($87) ($99) $12 ($730) ($740) $10 ($245) ($240) ($240) ($104) ($90) ($14) Combined Company Stratasys Desktop Metal Highly dilutive to Stratasys ownership Dilutive to EPS – doubling from ($1.24) to ($2.44)(2) Burns cash Source: Desktop Metal and Stratasys SEC filings, Desktop Metal and Stratasys press releases, FactSet and Consensus Estimates Note: (1) Cash Flow from Operations less Capital Expenditures; (2) Represents Q1 2023 annualized financials

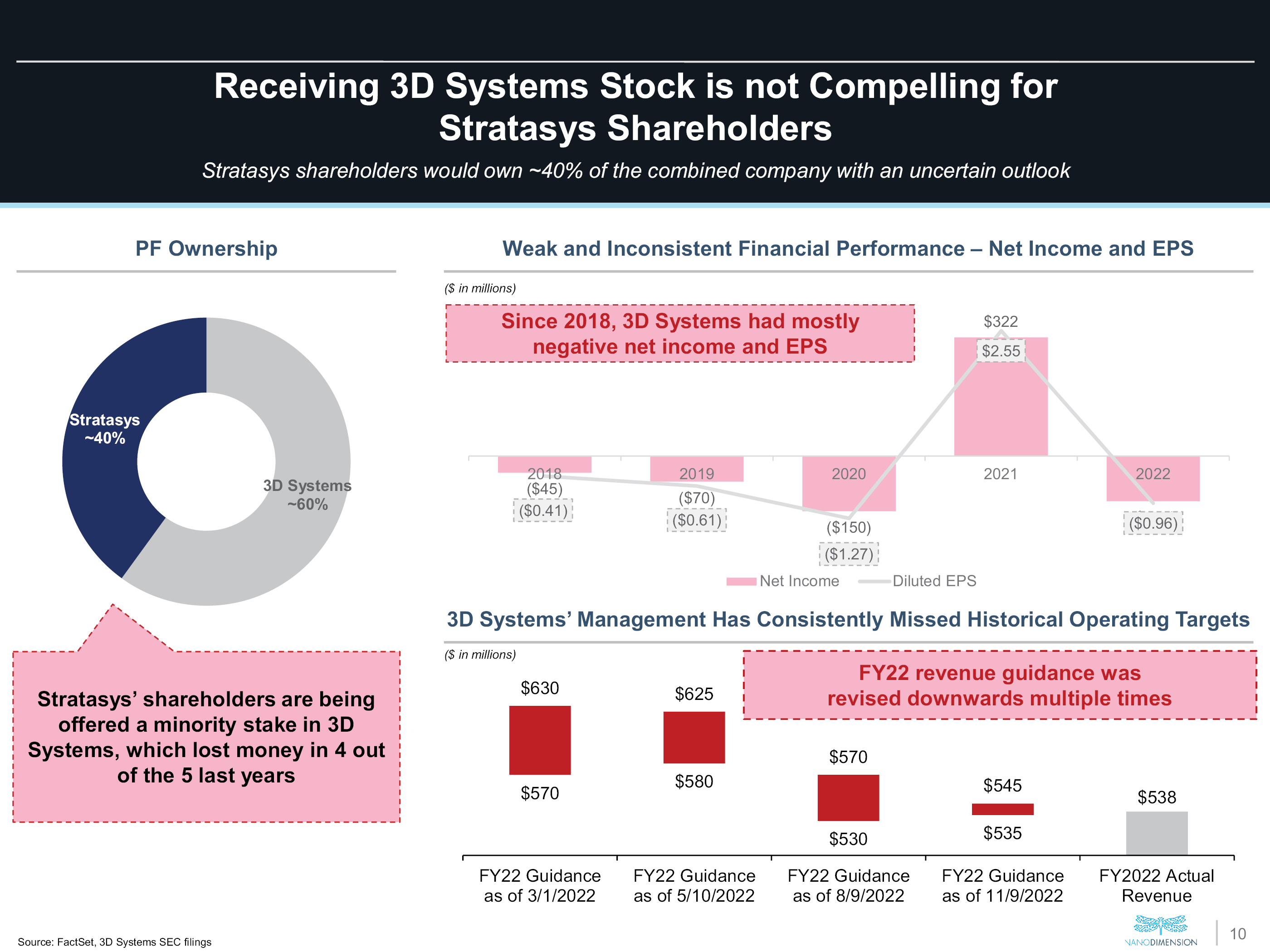

3D Systems’ Offer Does Not Provide Better Value to Stratasys Shareholders and Has Less Certainty – Weak Balance Sheet with $450M Debt(1) 3D Systems offer provides little cash value to Stratasys shareholders; the majority of transaction consideration is in 3D Systems stock, which has a history of financial and operational underperformance 3D Systems Offer Lagging 3D Systems Share Price Performance Despite Being One of the Industry Incumbents – 2 Year Share Price Performance Unclear Total Value Per Stratasys Share Stratasys shareholders will be left with very little cash and a minority stake in 3D Systems, which has a history of missed forecasts and value destruction Majority of equity research analysts rate NYSE: DDD either ‘hold’ or ‘sell’(3) Buy: 1 / 8 Hold: 6 / 8 Sell: 1 / 8 Value of Cash Component Value of Stock Componen(2) $7.50 t “We see minimal opportunity for scaling benefit [...]. We also see potential challenges from anti-trust […].” – Credit Suisse, June 1st, 2023(4) 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Jun-21Aug-21Oct-21Dec-21Feb-22Apr-22Jun-22Aug-22Oct-22Dec-22Feb-23Apr-23Jul-23 $40 $35 $30 $25 $20 $15 $10 64.4% 72.1% $5 Buy + Overweight (left) Hold (left) Sell + Underweight (left) Price (right) Target price (right) Source: FactSet, Company filings, Equity research Note: Market data as of 5/30/2023; (1) As of March 31, 2023; (2) Determined at 1.2057 3D Systems shares per one Stratasys share; (3) Research analysts per FactSet; (4) Shannon Cross, Credit Suisse, June 1st, 2023

Receiving 3D Systems Stock is not Compelling for Stratasys Shareholders Stratasys shareholders would own ~40% of the combined company with an uncertain outlook PF Ownership Weak and Inconsistent Financial Performance – Net Income and EPS Since 2018, 3D Systems had mostly negative net income and EPS ($ in millions) Stratasys’ shareholders are being offered a minority stake in 3D Systems, which lost money in 4 out of the 5 last years 3D Systems’ Management Has Consistently Missed Historical Operating Targets FY22 revenue guidance was revised downwards multiple times 3D Systems~60% Stratasys~40% $322 $2.55 2018 2019 2020 2021 2022 ($45) ($0.41) ($70) ($0.61) ($150) ($1.27) ($0.96) Net Income Diluted EPS $630 $625 $570 $580 $570 $530 $530 $535 $538 FY22 Guidanceas of 3/1/2022 FY22 Guidanceas of 5/10/2022 FY22 Guidanceas of 8/9/2022 FY22 Guidanceas of 11/9/2022 FY2022 ActualRevenue

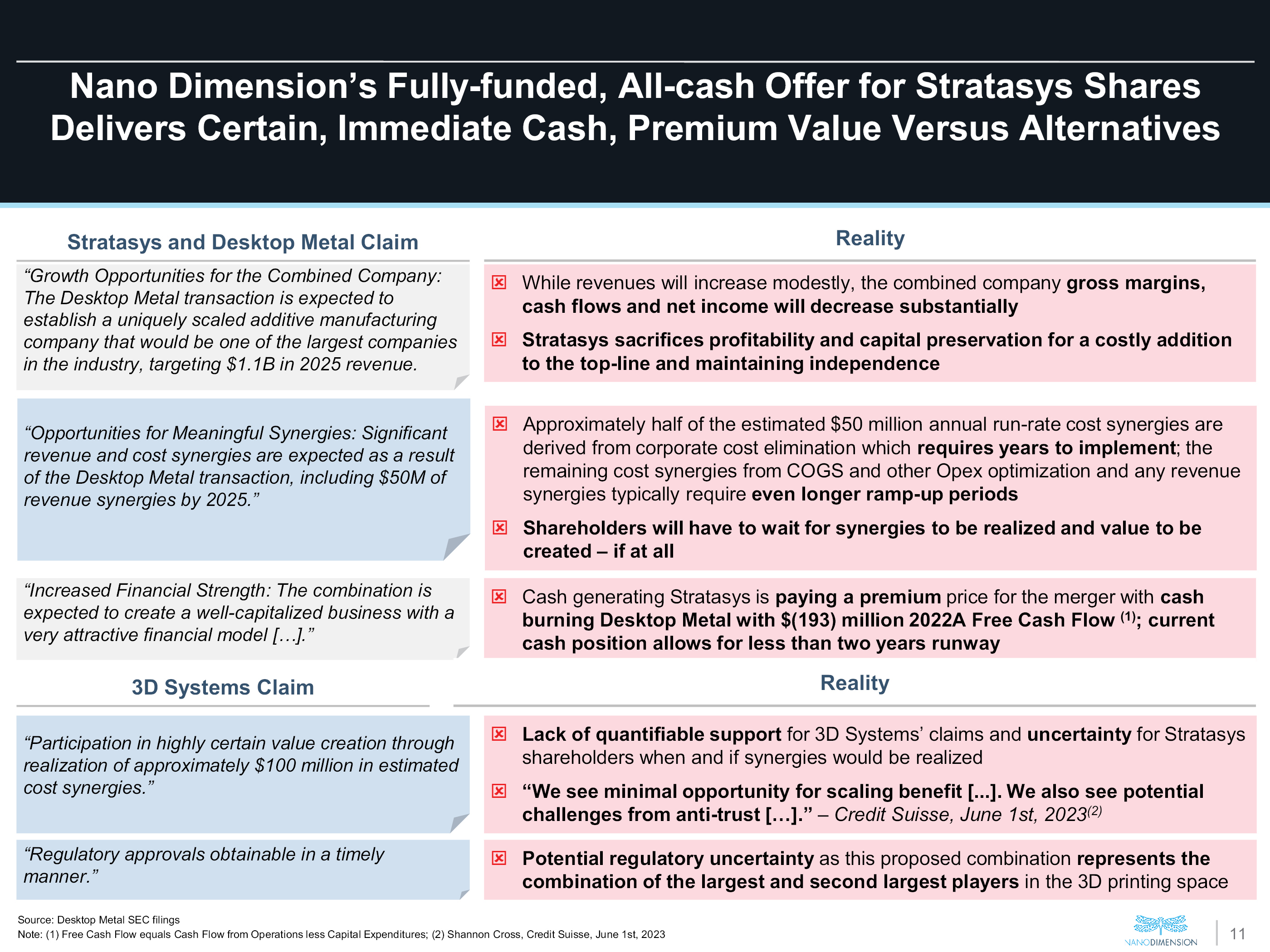

Nano Dimension’s Fully-funded, All-cash Offer for Stratasys Shares Delivers Certain, Immediate Cash, Premium Value Versus Alternatives Stratasys and Desktop Metal Claim “Growth Opportunities for the Combined Company: The Desktop Metal transaction is expected to establish a uniquely scaled additive manufacturing company that would be one of the largest companies in the industry, targeting $1.1B in 2025 revenue. “Opportunities for Meaningful Synergies: Significant revenue and cost synergies are expected as a result of the Desktop Metal transaction, including $50M of revenue synergies by 2025.” “Increased Financial Strength: The combination is expected to create a well-capitalized business with a very attractive financial model […].” 3D Systems Claim “Participation in highly certain value creation through realization of approximately $100 million in estimated cost synergies.” “Regulatory approvals obtainable in a timely manner.” Reality While revenues will increase modestly, the combined company gross margins, cash flows and net income will decrease substantially Stratasys sacrifices profitability and capital preservation for a costly addition to the top-line and maintaining independence Approximately half of the estimated $50 million annual run-rate cost synergies are derived from corporate cost elimination which requires years to implement; the remaining cost synergies from COGS and other Opex optimization and any revenue synergies typically require even longer ramp-up periods Shareholders will have to wait for synergies to be realized and value to be created – if at all Cash generating Stratasys is paying a premium price for the merger with cash burning Desktop Metal with $(193) million 2022A Free Cash Flow (1); current cash position allows for less than two years runway Lack of quantifiable support for 3D Systems’ claims and uncertainty for Stratasys shareholders when and if synergies would be realized “We see minimal opportunity for scaling benefit [...]. We also see potential challenges from anti-trust […].” – Credit Suisse, June 1st, 2023(2) Potential regulatory uncertainty as this proposed combination represents the combination of the largest and second largest players in the 3D printing space Source: Desktop Metal SEC filings Note: (1) Free Cash Flow equals Cash Flow from Operations less Capital Expenditures; (2) Shannon Cross, Credit Suisse, June 1st, 2023

Nano Dimension’s All-Cash Offer Is Superior to the Pending Desktop Metal Merger or Proposed 3D Systems Unsolicited Offer Nano Dimension’s $18 per share fully-funded, all-cash offer for Stratasys shares delivers certain, near-term, premium value for tendering shareholders while remaining shareholders will benefit from the strength of Nano’s balance sheet, cash reserves and leadership Desktop Metal merger: Highly dilutive and money-losing Overpriced Significant value uncertainty Significant time to close Proposed acquisition by 3D Systems: Little cash consideration Money-losing company; transaction leaves no cash for future operations Significant share value uncertainty Significant time to close Shareholders Have Until June 26th, 2023, to Tender Shares into the Tender Offer For more information, please visit: www.StratasysValueNow.com If you have any questions about how to tender your shares, please call the information agent for the tender offer, Georgeson, toll-free at (877) 668-1646