Exhibit (a)(5)(D)

Stratasys Special Tender Offer Investor Call Presented by Yoav Stern, Chairman & CEO May 30 th , 2023

© 2023 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 2 Forward Looking Statements This presentation of Nano Dimension Ltd . (the “Company” or “Nano Dimension”) contains “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act and other securities laws . Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward - looking statements . For example, the Company is using forward - looking statements when it discusses its vision, favorable trends, milestones, pipeline, innovative products and their advantages and benefits, its strategy and growing . Because such statements deal with future events and are based on the Company’s current expectations, they are subject to various risks and uncertainties . Actual results, performance, or achievements of Company’s could differ materially from those described in or implied by the statements in this Forward - looking statements are not historical facts, and are based upon management’s current expectations, beliefs and projections, many of which, by their nature, are inherently uncertain . Such expectations, beliefs and projections are expressed in good faith . However, there can be no assurance that management's expectations, beliefs and projections will be achieved, and actual results may differ materially from what is expressed in or indicated by the forward - looking statements . Forward - looking statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the forward - looking statements . For a more detailed description of the risks and uncertainties affecting the Company, reference is made to the Company’s reports filed from time to time with the Securities and Exchange Commission (“SEC”), including, but not limited to, the risks detailed in the Company’s annual report for the year ended December 31 , 2022 , filed with the SEC . Forward - looking statements speak only as of the date the statements are made . The Company assumes no obligation to update forward - looking statements to reflect actual results, subsequent events or circumstances, changes in assumptions or changes in other factors affecting forward - looking information except to the extent required by applicable securities laws . If the Company does update one or more forward - looking statements, no inference should be drawn that the Company will make additional updates with respect thereto or with respect to other forward - looking statements .

© 2023 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 3 Important Information About the Special Tender Offer This presentation is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to se ll any ordinary shares of Stratasys or any other securities, nor is it a substitute for the tender offer materials described herein. On May 25, 2023, N ano Dimension filed with the SEC a tender offer statement on Schedule TO, including an offer to purchase, a related letter of transmittal and other te nde r offer documents. The Company expects that Stratasys will file with the SEC a solicitation/recommendation statement on Schedule 14D - 9, as required by the tender offer rules. INVESTORS AND SECURITY HOLDERS ARE URGED TO CAREFULLY READ BOTH THE TENDER OFFER MATERIALS (INCLUDING THE OFFER TO PURCHASE, RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D - 9 REGARDING THE OFFER, AS THEY MAY BE AMENDED FROM TIME TO TIME, WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN AND WILL CONTAIN IMPORTANT INFORMATION THAT INVESTORS AND SECURITY HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SECURITIES. Investors and security holders may obtain a free copy of the offer to purchase, the related letter of transmittal, certain ot her tender offer documents and the solicitation/recommendation statement (when available) and other documents filed with the SEC at the websit e m aintained by the SEC at www.sec.gov or by directing such requests to Georgeson LLC, the information agent for the tender offer, named in the tender offer statement. In addition, Stratasys files annual reports, interim financial statements and other information with the SEC, and Nan o Dimension files annual reports, interim financial statements and other information with the SEC, which are available to the public at the web sit e maintained by the SEC at www.sec.gov . Copies of the documents filed with the SEC by Stratasys may be obtained at no charge on the investor relations page of Stratasys’ website at www.stratasys.com . Copies of the documents filed with the SEC by Nano Dimension may be obtained at no charge on the investor relations page of Nano Dimension’s website at www.nano - di.com . A0

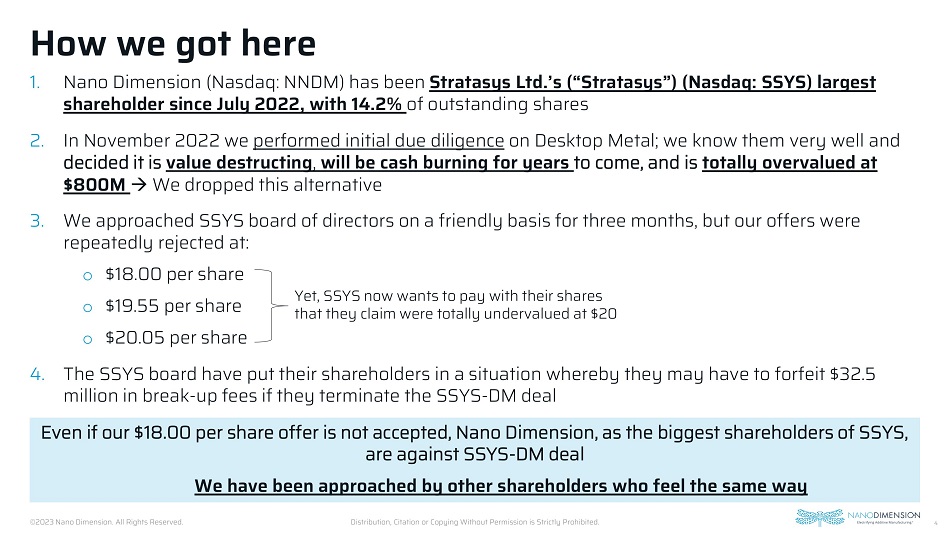

4 © 2023 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. How we got here Yet, SSYS now wants to pay with their shares that they claim were totally undervalued at $20 1. Nano Dimension (Nasdaq: NNDM) has been Stratasys Ltd.’s (“Stratasys”) (Nasdaq: SSYS) largest shareholder since July 2022, with 14.2% of outstanding shares 2. In November 2022 we performed initial due diligence on Desktop Metal; we know them very well and decided it is value destructing , will be cash burning for years to come, and is totally overvalued at $800M àWe dropped this alternative 3. We approached SSYS board of directors on a friendly basis for three months, but our offers were repeatedly rejected at: o $18.00 per share o $19.55 per share o $20.05 per share 4. The SSYS board have put their shareholders in a situation whereby they may have to forfeit $32.5 million in break - up fees if they terminate the SSYS - DM deal Even if our $18.00 per share offer is not accepted, Nano Dimension, as the biggest shareholders of SSYS, are against SSYS - DM deal We have been approached by other shareholders who feel the same way

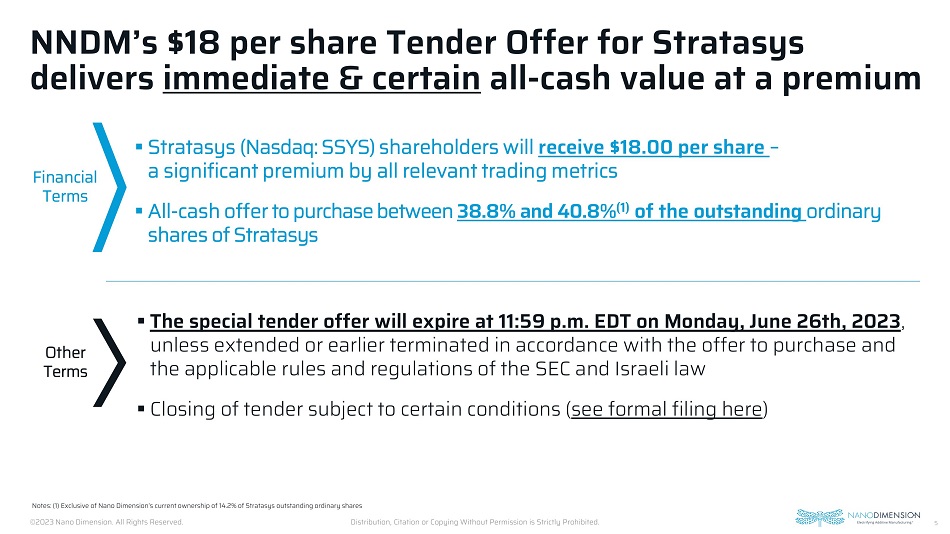

5 © 2023 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. NNDM’s $18 per share Tender Offer for Stratasys delivers immediate & certain all - cash value at a premium Financial Terms Other Terms ▪ The special tender offer will expire at 11:59 p.m. EDT on Monday, June 26th, 2023 , unless extended or earlier terminated in accordance with the offer to purchase and the applicable rules and regulations of the SEC and Israeli law ▪ Closing of tender subject to certain conditions ( see formal filing here ) Notes: (1) Exclusive of Nano Dimension’s current ownership of 14.2% of Stratasys outstanding ordinary shares ▪ Stratasys (Nasdaq: SSYS) shareholders will receive $18.00 per share – a significant premium by all relevant trading metrics ▪ All - cash offer to purchase between 38.8% and 40.8% (1) of the outstanding ordinary shares of Stratasys

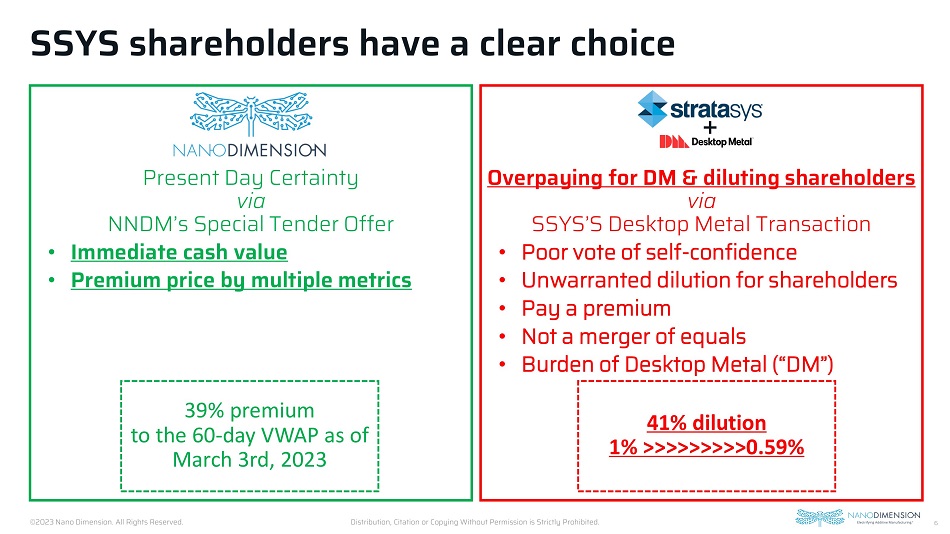

6 © 2023 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. Overpaying for DM & diluting shareholders via SSYS’S Desktop Metal Transaction • Poor vote of self - confidence • Unwarranted dilution for shareholders • Pay a premium • Not a merger of equals • Burden of Desktop Metal (“DM”) SSYS shareholders have a clear choice Present Day Certainty via NNDM’s Special Tender Offer • Immediate cash value • Premium price by multiple metrics + 39% premium to the 60 - day VWAP as of March 3rd, 2023 41% dilution 1% >>>>>>>>>0.59%

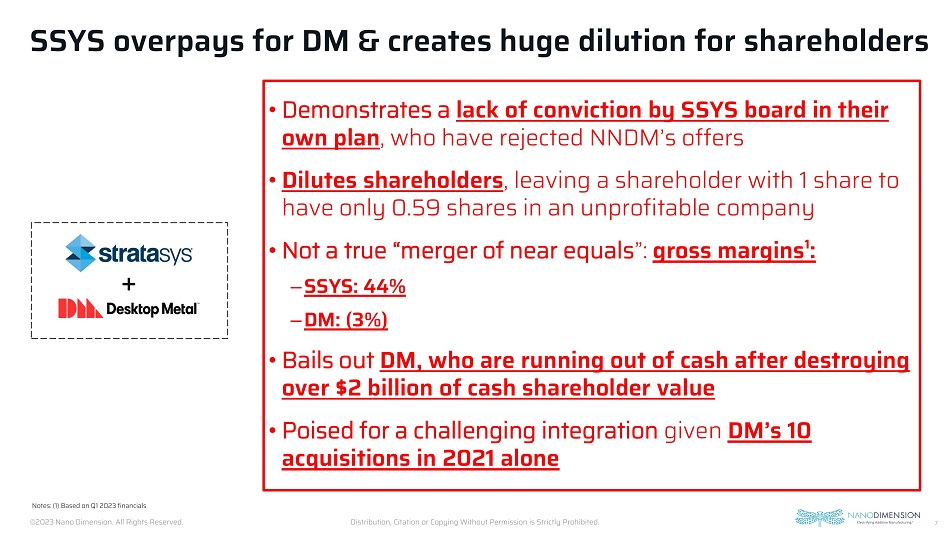

7 © 2023 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. SSYS overpays for DM & creates huge dilution for shareholders • Demonstrates a lack of conviction by SSYS board in their own plan , who have rejected NNDM’s offers • Dilutes shareholders , leaving a shareholder with 1 share to have only 0.59 shares in an unprofitable company • Not a true “merger of near equals ”: gross margins¹: – SSYS: 44% – DM: (3%) • Bails out DM , who are running out of cash after destroying over $2 billion of cash shareholder value • Poised for a challenging integration given DM’s 10 acquisitions in 2021 alone Notes: (1) Based on Q1 2023 financials +

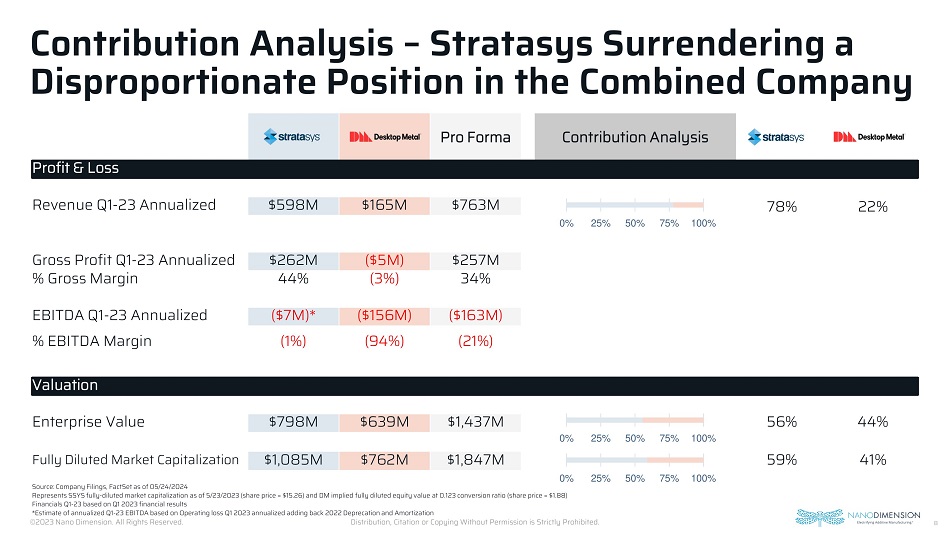

8 © 2023 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. Contribution Analysis – Stratasys Surrendering a Disproportionate Position in the Combined Company Source: Company Filings, FactSet as of 05/24/2024 Represents SSYS fully - diluted market capitalization as of 5/23/2023 (share price = $15.26) and DM implied fully diluted equity v alue at 0.123 conversion ratio (share price = $1.88) Financials Q1 - 23 based on Q1 2023 financial results *Estimate of annualized Q1 - 23 EBITDA based on Operating loss Q1 2023 annualized adding back 2022 Deprecation and Amortization Contribution Analysis Pro Forma Profit & Loss 22% 78% $763M $165M $598M Revenue Q1 - 23 Annualized $257M ($5M) $262M Gross Profit Q1 - 23 Annualized 34% (3%) 44% % Gross Margin ($163M) ($156M) ($7M)* EBITDA Q1 - 23 Annualized (21%) (94%) (1%) % EBITDA Margin Valuation 44% 56% $1,437M $639M $798M Enterprise Value 41% 59% $1,847M $762M $1,085M Fully Diluted Market Capitalization 0% 25% 50% 75% 100% 0% 25% 50% 75% 100% 0% 25% 50% 75% 100%

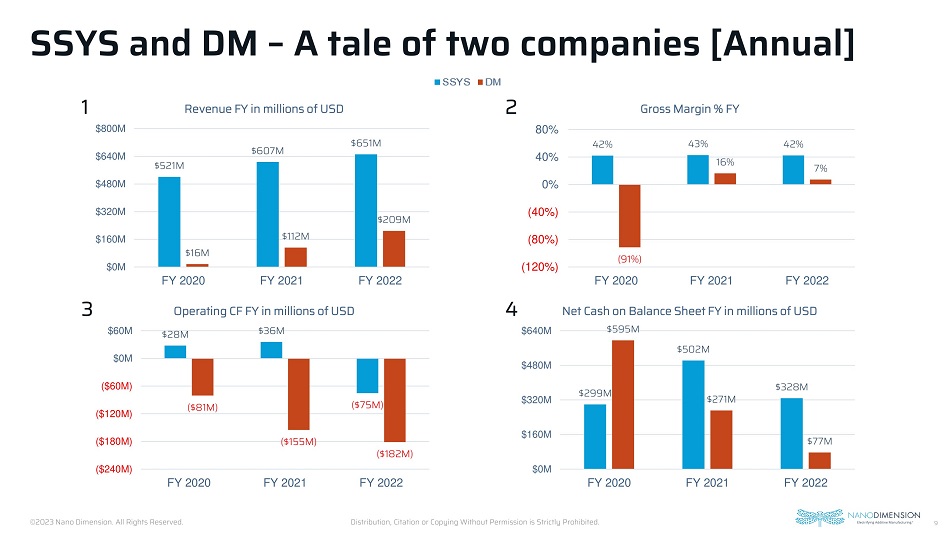

9 © 2023 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 42% 43% 42% (91%) 16% 7% (120%) (80%) (40%) 0% 40% 80% FY 2020 FY 2021 FY 2022 Gross Margin % FY SSYS and DM – A tale of two companies [Annual] $521M $607M $651M $16M $112M $209M $0M $160M $320M $480M $640M $800M FY 2020 FY 2021 FY 2022 Revenue FY in millions of USD $28M $36M ($75M) ($81M) ($155M) ($182M) ($240M) ($180M) ($120M) ($60M) $0M $60M FY 2020 FY 2021 FY 2022 Operating CF FY in millions of USD $299M $502M $328M $595M $271M $77M $0M $160M $320M $480M $640M FY 2020 FY 2021 FY 2022 Net Cash on Balance Sheet FY in millions of USD 1 2 4 3

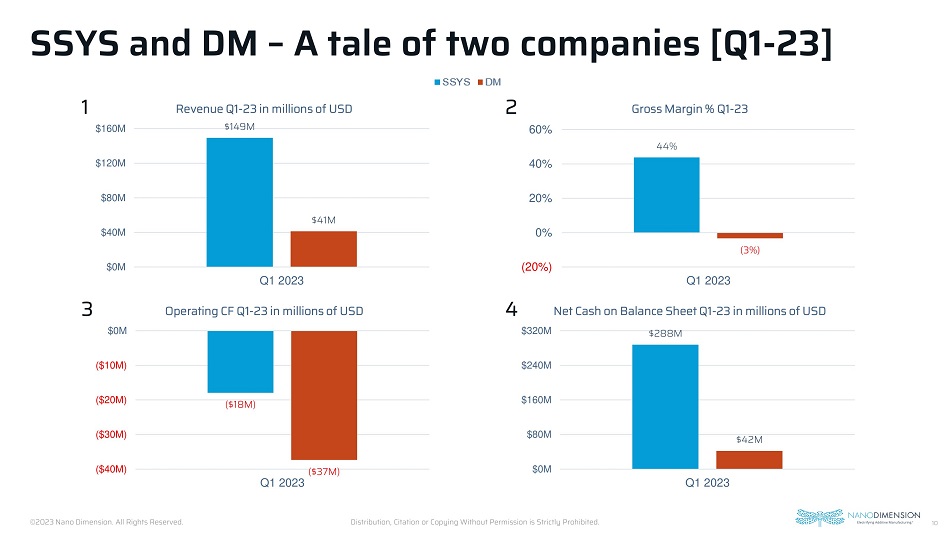

10 © 2023 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 44% (3%) (20%) 0% 20% 40% 60% Q1 2023 Gross Margin % Q1 - 23 SSYS and DM – A tale of two companies [Q1 - 23] $149M $41M $0M $40M $80M $120M $160M Q1 2023 Revenue Q1 - 23 in millions of USD ($18M) ($37M) ($40M) ($30M) ($20M) ($10M) $0M Q1 2023 Operating CF Q1 - 23 in millions of USD $288M $42M $0M $80M $160M $240M $320M Q1 2023 Net Cash on Balance Sheet Q1 - 23 in millions of USD 1 2 4 3

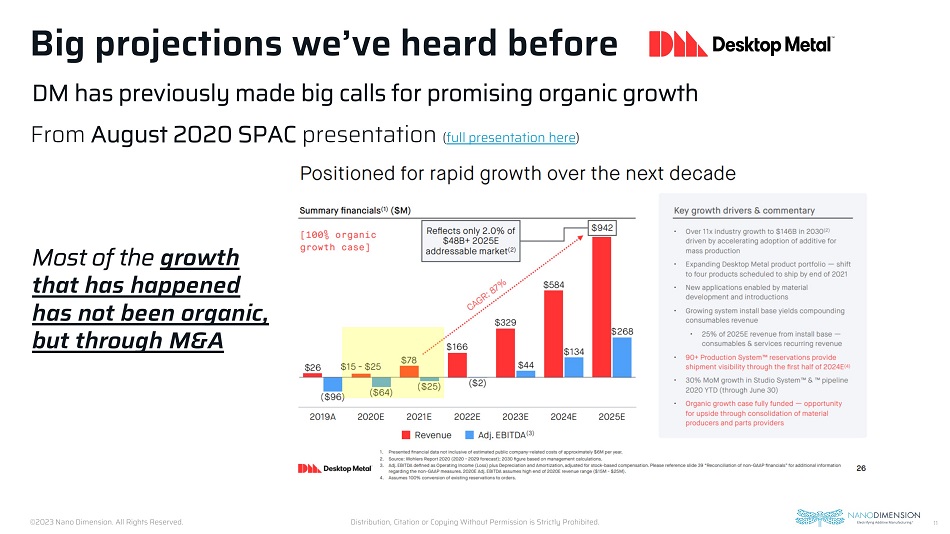

11 © 2023 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. Big projections we’ve heard before DM has previously made big calls for promising organic growth From August 2020 SPAC presentation ( full presentation here ) Most of the growth that has happened has not been organic, but through M&A

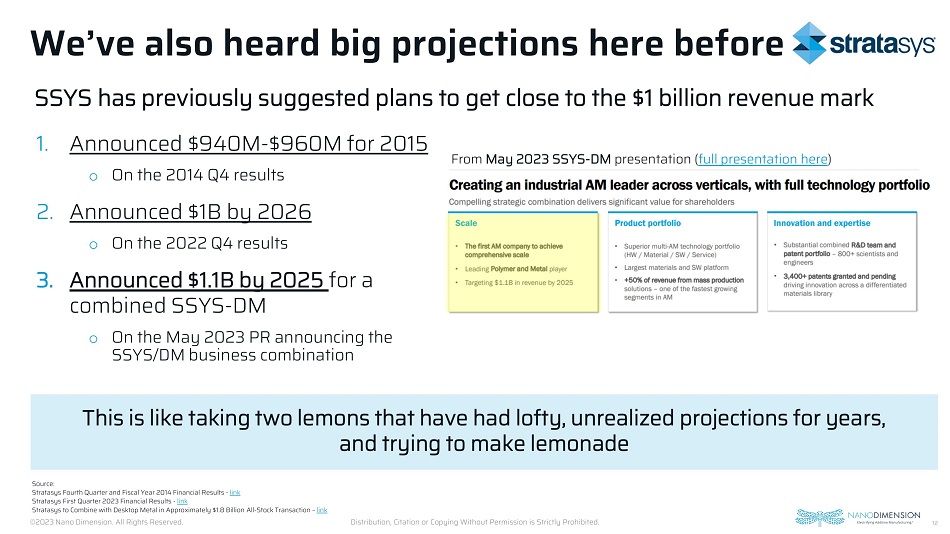

12 © 2023 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. We’ve also heard big projections here before 1. Announced $940M - $960M for 2015 o On the 2014 Q4 results 2. Announced $1B by 2026 o On the 2022 Q4 results 3. Announced $1.1B by 2025 for a combined SSYS - DM o On the May 2023 PR announcing the SSYS/DM business combination Source : Stratasys Fourth Quarter and Fiscal Year 2014 Financial Results - link Stratasys First Quarter 2023 Financial Results - link Stratasys to Combine with Desktop Metal in Approximately $1.8 Billion All - Stock Transaction – link This is like taking two lemons that have had lofty, unrealized projections for years, and trying to make lemonade From May 2023 SSYS - DM presentation ( full presentation here ) SSYS has previously suggested plans to get close to the $1 billion revenue mark A0

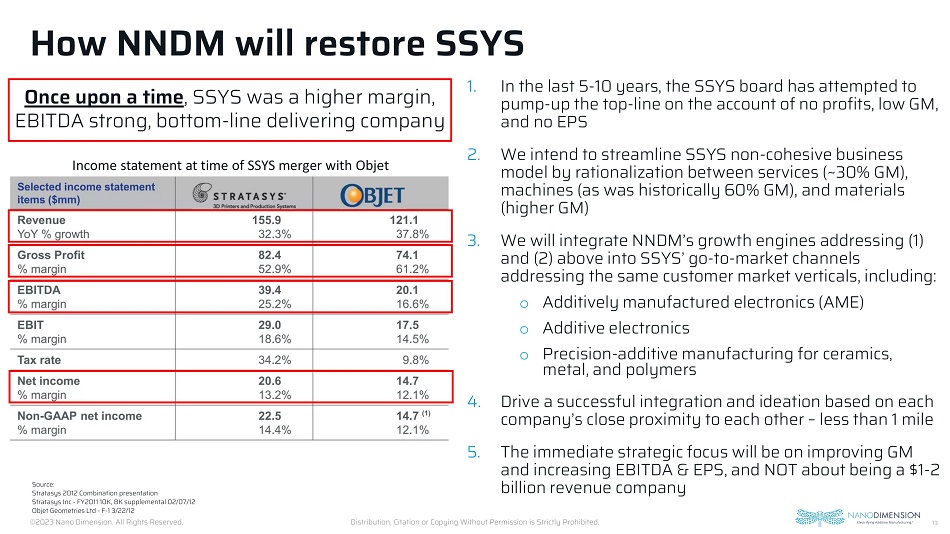

13 © 2023 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. Source: Stratasys 2012 Combination presentation Stratasys Inc - FY2011 10K, 8K supplemental 02/07/12 Objet Geometries Ltd - F - 1 3/22/12 1. In the last 5 - 10 years, the SSYS board has attempted to pump - up the top - line on the account of no profits, low GM, and no EPS 2. We intend to streamline SSYS non - cohesive business model by rationalization between services (~30% GM), machines (as was historically 60% GM), and materials (higher GM) 3. We will integrate NNDM’s growth engines addressing (1) and (2) above into SSYS’ go - to - market channels addressing the same customer market verticals, including: o Additively manufactured electronics (AME) o Additive electronics o Precision - additive manufacturing for ceramics, metal, and polymers 4. Drive a successful integration and ideation based on each company’s close proximity to each other – less than 1 mile 5. The immediate strategic focus will be on improving GM and increasing EBITDA & EPS, and NOT about being a $1 - 2 billion revenue company How NNDM will restore SSYS Once upon a time , SSYS was a higher margin, EBITDA strong, bottom - line delivering company Income statement at time of SSYS merger with Objet

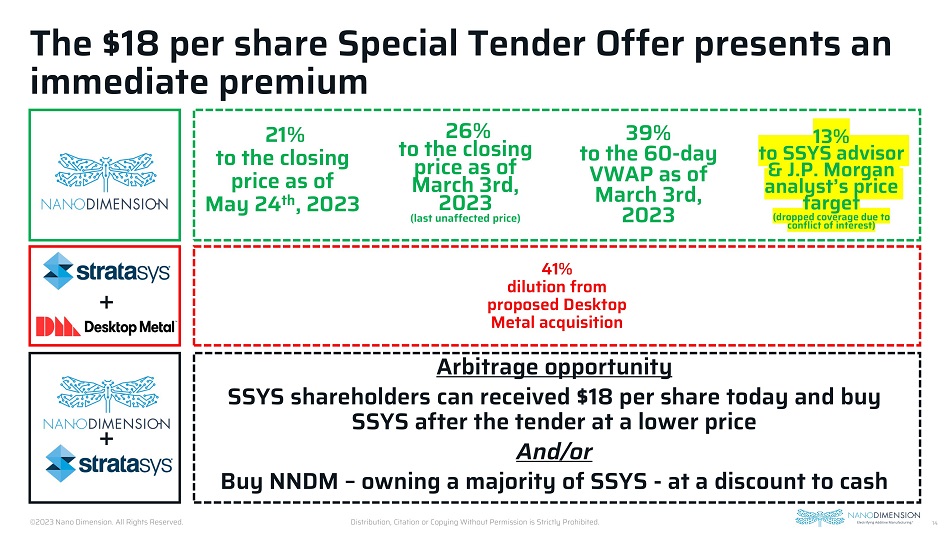

14 © 2023 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. The $18 per share Special Tender Offer presents an immediate premium 26% to the closing price as of March 3rd, 2023 (last unaffected price) 39% to the 60 - day VWAP as of March 3rd, 2023 13% to SSYS advisor & J.P. Morgan analyst’s price target (dropped coverage due to conflict of interest) 41% dilution from proposed Desktop Metal acquisition 21% to the closing price as of May 24 th , 2023 + Arbitrage opportunity SSYS shareholders can received $18 per share today and buy SSYS after the tender at a lower price And/or Buy NNDM – owning a majority of SSYS - at a discount to cash +

Additional comments and Q&A

Thank You