Exhibit 99.2

1 Stratasys Q3 2021 Results Speakers Dr. Yoav Zeif , CEO Lilach Payorski , CFO Yonah Lloyd, CCO & VP IR November 4 th 2021

2 Stratasys Conference Call and Webcast Details US Toll - Free dial - in 1 - 877 - 407 - 0619 International dial - in +1 - 412 - 902 - 1012 Live webcast and replay https://78449.themediaframe.com/dataconf/productusers/ssys /mediaframe/47128/indexl.html

3 Stratasys Forward - looking Statements Cautionary Statement Regarding Forward - Looking Statements The statements in this slide presentation regarding Stratasys' strategy, and the statements regarding its projected future financial performance, including the financial guidance concerning its expected results for 2021, are forward - looking statements reflecting management's current expectations and beliefs. These forward - looking statements are based on current information that is, by its nature, subject to rapid and even abrupt change. Due to risks and uncertainties associated with Stratasys' business, actual results could differ materially from those projected or implied by these forward - looking statements. These risks and uncertainties include, but are not limited to: the degree of our success at introducing new or improved products and solutions that gain market share; the degree of growth of the 3D printing market generally; the duration and degree of severity of, and strength of recovery from, the global COVID - 19 pandemic; the impact of potential shifts in the prices or margins of the products that we sell or services that we provide, including due to a shift towards lower margin products or services; the impact of competition and new technologies; the extent of our success at successfully integrating into our existing business, or making additional, acquisitions or investments in new businesses, technologies, products or services; potential changes in our management and board of directors; global market, political and economic conditions, and in the countries in which we operate in particular (including risks related to the impact of coronavirus on our supply chain and business); potential further charges against earnings that we could be required to take due to impairment of additional goodwill or other intangible assets that we have recently acquired or may acquire in the future; costs and potential liability relating to litigation and regulatory proceedings; risks related to infringement of our intellectual property rights by others or infringement of others' intellectual property rights by us; the extent of our success at maintaining our liquidity and financing our operations and capital needs; the impact of tax regulations on our results of operations and financial condition; and those additional factors referred to in Item 3.D “Key Information - Risk Factors”, Item 4, “Information on the Company”, Item 5, “Operating and Financial Review and Prospects,” and all other parts of our Annual Report on Form 20 - F for the year ended December 31, 2020 (the “ 2020 Annual Report ”). Readers are urged to carefully review and consider the various disclosures made throughout our 2020 Annual Report and the Reports of Foreign Private Issuer on Form 6 - K that attach Stratasys’ unaudited, condensed consolidated financial statements and its review of its results of operations and financial condition, for the quarterly periods throughout 2021, which are furnished to the SEC over the course of 2021 (including on or about the date hereof), and our other reports filed with or furnished to the SEC, which are designed to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects. Any guidance provided, and other forward - looking statements made, in this slide presentation are made as of the date hereof, and Stratasys undertakes no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise, except as required by law.

4 Stratasys Use of non - GAAP financial information Use of non - GAAP financial measures The non - GAAP data included herein, which excludes certain items as described below, are non - GAAP financial measures. Our management believes that these non - GAAP financial measures are useful information for investors and shareholders of our Company in gauging our results of operations (i) on an ongoing basis after excluding mergers, acquisitions and divestments related expense or gains and reorganization - related charges or gains, legal provisions, and (ii) excluding non - cash items such as stock - based compensation expenses, acquired intangible assets amortization, including intangible assets amortization related to equity method investments, impairment of long - lived assets and goodwill, revaluation of our investments and the corresponding tax effect of those items. These non - GAAP adjustments either do not reflect actual cash outlays that impact our liquidity and our financial condition or have a non - recurring impact on the statement of operations, as assessed by management. These non - GAAP financial measures are presented to permit investors to more fully understand how management assesses our performance for internal planning and forecasting purposes. The limitations of using these non - GAAP financial measures as performance measures are that they provide a view of our results of operations without including all items indicated above during a period, which may not provide a comparable view of our performance to other companies in our industry. Investors and other readers should consider non - GAAP measures only as supplements to, not as substitutes for or as superior measures to, the measures of financial performance prepared in accordance with GAAP. Reconciliation between results on a GAAP and non - GAAP basis is provided in a table later in this slide presentation.

5 Stratasys Welcome • Additive manufacturing is at an inflection point • Improved technology, compelling advantages and supply chain needs are driving the shift from prototyping to production of end - use parts • As we prepare to launch two new mass production systems, Stratasys is executing on our strategy to be the first choice for polymer 3D printing Dr. Yoav Zeif CEO

6 Highlights from Q3 • Growth across all business lines and regions • 24% YoY revenue growth, driven by 35% Systems and 27% Consumables growth • System sales +7% over Q3’19 driven in part by our manufacturing systems Stratasys

7 Stratasys Q3 Highlights Trade shows return • More leads compared to 2019 at Rapid+TCT despite lower attendance • Strong Origin One interest • Returning to Formnext in Germany this month

8 Stratasys Manufacturing focus gains traction • U.S. Navy signs contract for $20 million for up to 25 F900 systems, materials and support services over 5 years • We believe it is the largest government additive manufacturing contract of its kind • Advancing U.S. Department of Defense strategy to increase its use of additive manufacturing Q3 Highlights • Additional multi - million - dollar, multi - year manufacturing contract for F900 systems with global, brand - name repeat customer • Awards demonstrate Stratasys’ reputation for excellence in technology and service, and industry trust for manufacturing of end - use parts

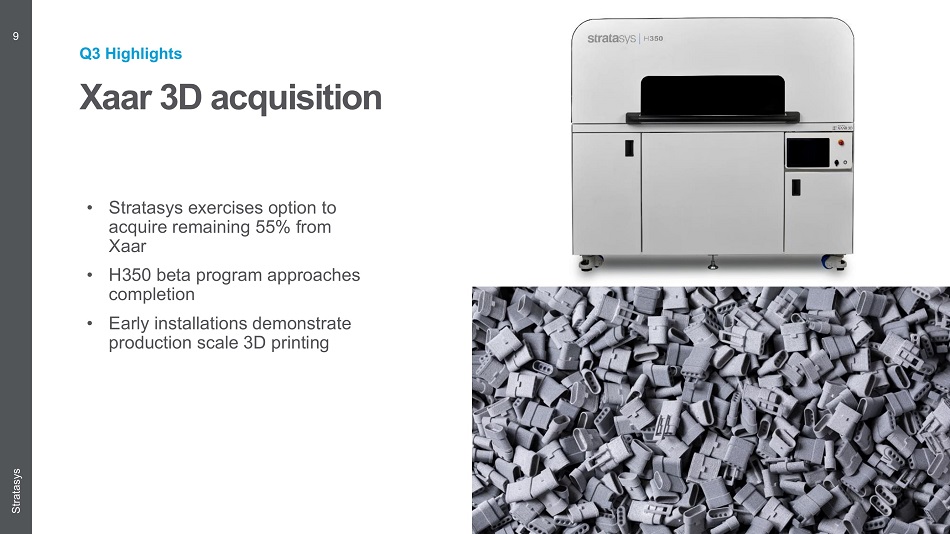

9 Stratasys Q3 Highlights Xaar 3D acquisition • Stratasys exercises option to acquire remaining 55% from Xaar • H350 beta program approaches completion • Early installations demonstrate production scale 3D printing

10 Stratasys Q3 Highlights Recent healthcare accomplishments • Healthcare is our fastest - growing business • J5 DentaJet and J5 MediJet see early market momentum • Ricoh partnership with Stratasys and IBM Watson Health brings point - of - care and on - demand anatomical modeling services to healthcare facilities • Bone 3D brings on - site access to 3D printing through “ Hospifactory ” project • Life - changing impact illustrated through conjoined twin separation

11 Stratasys Q3 Highlights Software strategy advances • ProtectAM enhances cybersecurity of additive manufacturing, the first to work with Red Hat Enterprise Linux, world’s leading enterprise platform • GrabCAD Additive Manufacturing Open Platform Announced o TAM $3.3B by 2026* o Enterprise - ready platform designed to integrate the entire ‘digital thread’ o Open to broad set of software partners and third - party 3D printing systems o Manufacturers turning to Stratasys for Industry 4.0 connectivity for additive manufacturing • Adobe Substance 3D Painter collaboration announced at Adobe MAX * “Opportunities in Additive Manufacturing Software Markets 2020” SmarTech Analysis, June 2020

12 Stratasys Competitive advantages to lead polymer additive manufacturing Broadest polymer technology platform Five best - in - class technologies for every step in the product lifecycle – from concept through manufacturing Enterprise - ready software platform to scale additive manufacturing Comprehensive open platform connects to Industry 4.0, integrates the digital thread, and strengthens’ Stratasys’ competitive position Leading go - to - market infrastructure Network of over 200 channel partners – largest and most experienced in the industry Deep application engineering expertise Multi - disciplinary application engineering expertise to educate customers and drive innovation Resilient business model designed to scale Corporate and GTM infrastructure can absorb and scale new business with operating leverage to drive profits and generate cash Delivering innovative, next - generation technologies to address the fastest growing manufacturing applications

13 Stratasys Q3 Financial Results Lilach Payorski CFO • Third quarter results demonstrate continued strength in growing our market • Generated operating profit and cash o Revenue +24.3% o Systems +34.7% o Consumables +26.6% o OCF $3.0M

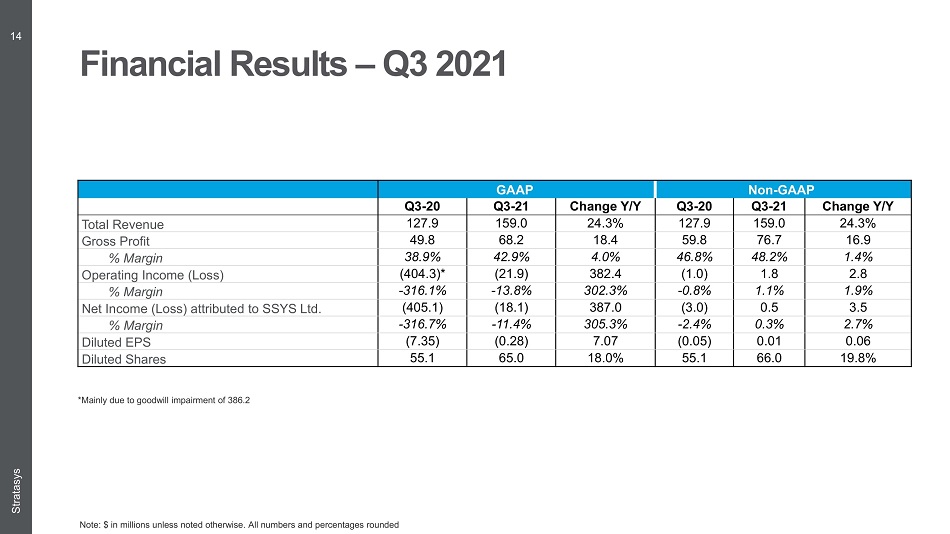

14 Stratasys GAAP Non - GAAP Q3 - 20 Q3 - 21 Change Y/Y Q3 - 20 Q3 - 21 Change Y/Y Total Revenue 1 27.9 1 59. 0 2 4.3% 1 27.9 1 . 0 2 4.3% Gross Profit 4 9 . 8 6 8 . 2 1 8 . 4 5 9.8 76.7 16. 9 % Margin 3 8.9% 42.9% 4 . 0% 46.8% 48.2% 1 . 4% Operating Income (Loss) ( 404. 3 ) ( 2 1.9) 382 . 4 (1.0) 1.8 2.8 % Margin - 316.1% - 13.8% 302 . 3% - 0. 8 % 1.1% 1.9% Net Income (Loss) attributed to SSYS Ltd. (405.1) (18.1) 387.0 (3.0) 0.5 3.5 % Margin - 316.7% - 11.4% 305.3% - 2.4% 0.3% 2.7% Diluted EPS (7.35) (0.28) 7.07 (0.05) 0.01 0.06 Diluted Shares 55.1 6 5 . 0 18 .0% 55.1 66.0 1 9.8% Financial Results – Q3 2021 Note: $ in millions unless noted otherwise. All numbers and percentages rounded M ainly due to goodwill impairment of 386.2

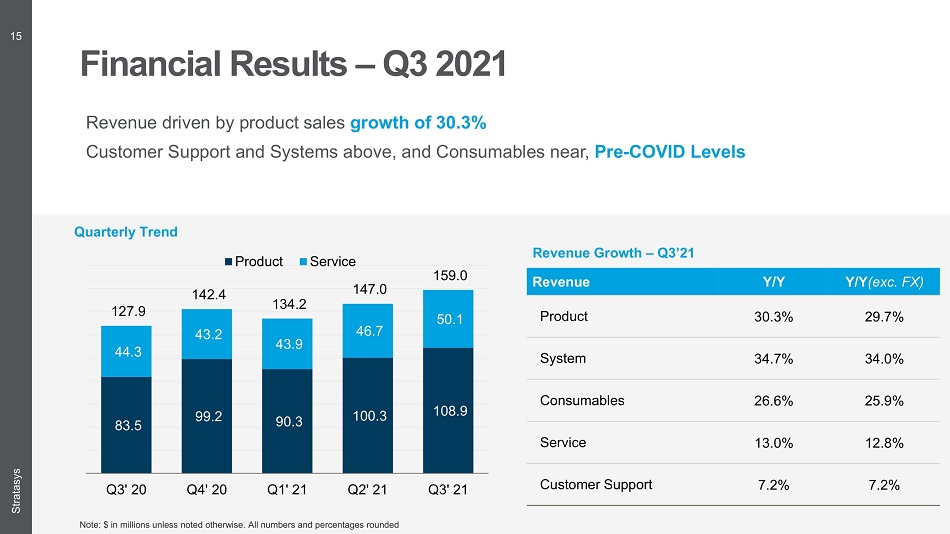

15 Stratasys Financial Results – Q3 2021 Revenue driven by product sales growth of 30.3% Customer Support and Systems above, and Consumables near, Pre - COVID Levels Note: $ in millions unless noted otherwise. All numbers and percentages rounded Quarterly Trend 83.5 99.2 90.3 100.3 108.9 44.3 43.2 43.9 46.7 50.1 127.9 142.4 134.2 147.0 159.0 Q3' 20 Q4' 20 Q1' 21 Q2' 21 Q3' 21 Product Service Revenue Growth – Q3’21 Revenue Y/Y Y/Y (exc. FX) Product 30.3% 29.7% System 34.7% 34.0% Consumables 26.6% 25.9% Service 13.0% 12.8% Customer Support 7.2% 7.2%

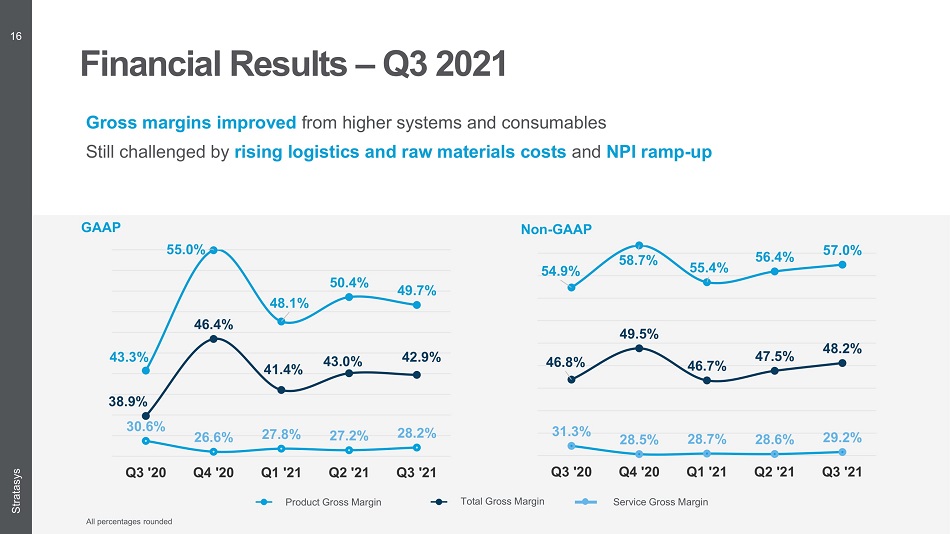

16 Stratasys Financial Results – Q3 2021 Gross margins improved from higher systems and consumables Still challenged by rising logistics and raw materials costs and NPI ramp - up Non - GAAP GAAP Total Gross Margin Product Gross Margin Service Gross Margin All percentages rounded 38.9% 46.4% 41.4% 43.0% 42.9% 43.3% 55.0% 48.1% 50.4% 49.7% 30.6% 26.6% 27.8% 27.2% 28.2% 25.0% 35.0% 45.0% 55.0% 65.0% 75.0% 85.0% 95.0% 35.0% 37.0% 39.0% 41.0% 43.0% 45.0% 47.0% 49.0% 51.0% 53.0% 55.0% Q3 '20 Q4 '20 Q1 '21 Q2 '21 Q3 '21 46.8% 49.5% 46.7% 47.5% 48.2% 54.9% 58.7% 55.4% 56.4% 57.0% 31.3% 28.5% 28.7% 28.6% 29.2% 28.0% 38.0% 48.0% 58.0% 68.0% 78.0% 88.0% 98.0% 40.0% 42.0% 44.0% 46.0% 48.0% 50.0% 52.0% 54.0% 56.0% 58.0% Q3 '20 Q4 '20 Q1 '21 Q2 '21 Q3 '21

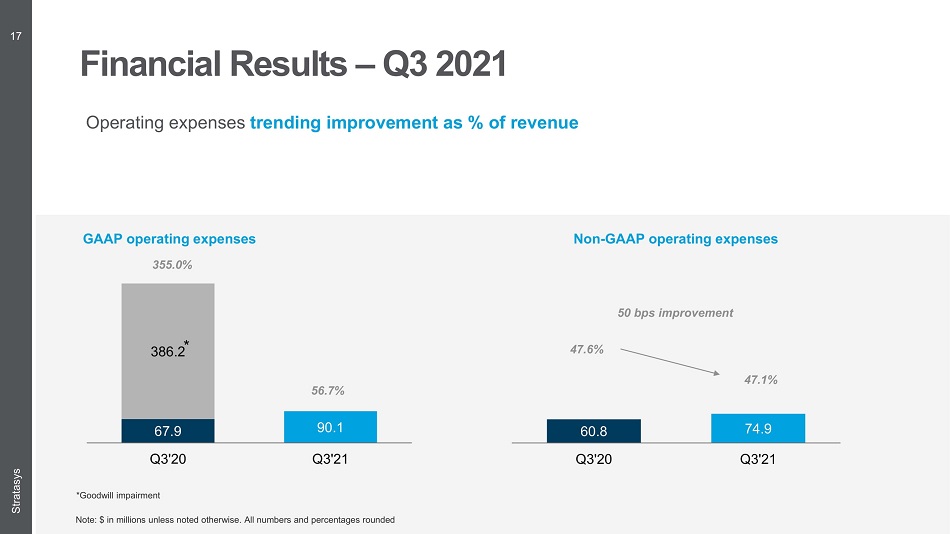

17 Stratasys Financial Results – Q3 2021 Operating expenses trending improvement as % of revenue Non - GAAP operating expenses GAAP operating expenses 67.9 90.1 386.2 Q3'20 Q3'21 60.8 74.9 Q3'20 Q3'21 47.6% 47.1% Note: $ in millions unless noted otherwise. All numbers and percentages rounded 355.0% 56.7% 50 bps improvement * Goodwill impairment

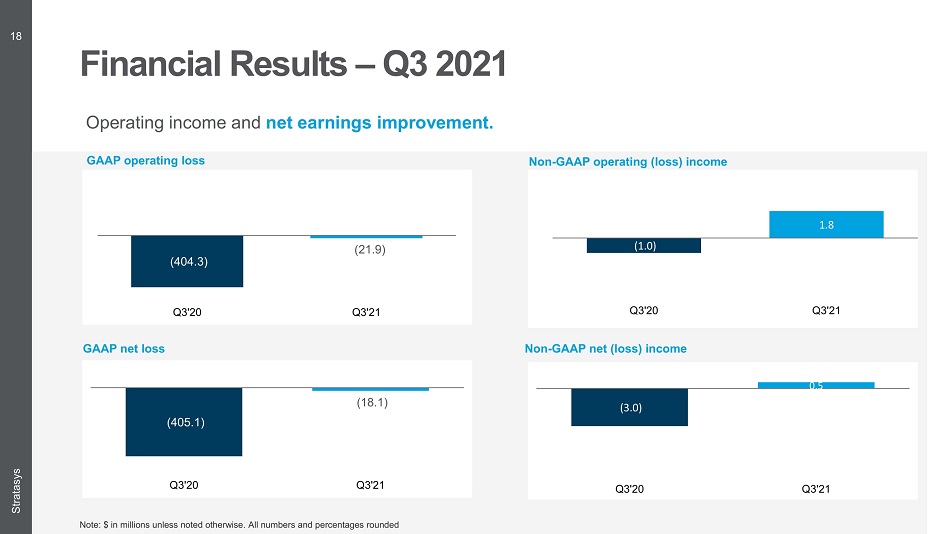

18 Stratasys Financial Results – Q 3 2021 Financial Results – Q3 2021 Operating income and net earnings improvement. GAAP operating loss (404.3) (21.9) Q3'20 Q3'21 Non - GAAP operating (loss) income ( 1.0 ) 1.8 Q3'20 Q3'21 GAAP net loss Non - GAAP net (loss) income (405.1) (18.1) Q3'20 Q3'21 (3.0) 0.5 Q3'20 Q3'21 Note: $ in millions unless noted otherwise. All numbers and percentages rounded

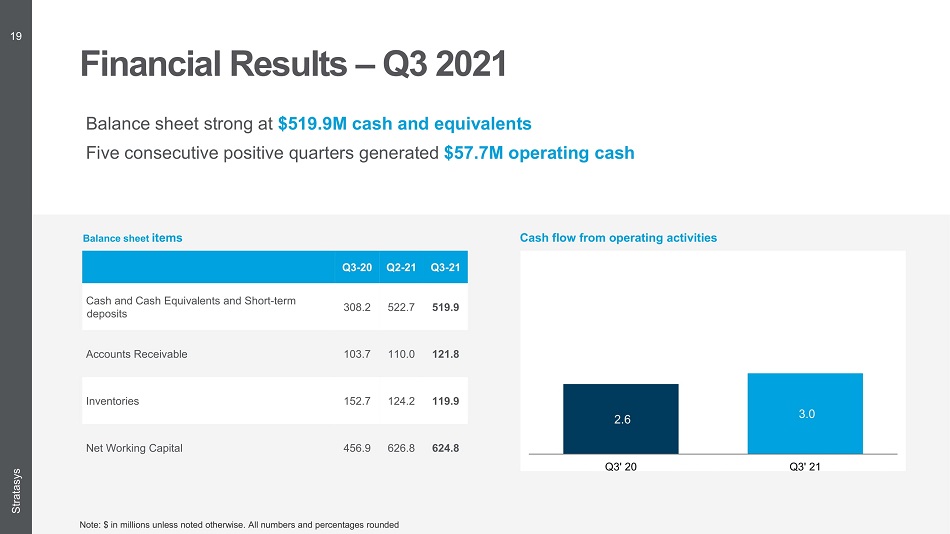

19 Stratasys Financial Results – Q3 2021 Balance sheet strong at $519.9M cash and equivalents Five consecutive positive quarters generated $57.7M operating cash Cash flow from operating activities Balance sheet items Q3 - 20 Q2 - 21 Q3 - 21 Cash and Cash Equivalents and Short - term deposits 308.2 522.7 519.9 Accounts Receivable 103.7 110.0 121.8 Inventories 152.7 124.2 119.9 Net Working Capital 456.9 626.8 624.8 2.6 3.0 Q3' 20 Q3' 21 Note: $ in millions unless noted otherwise. All numbers and percentages rounded

20 Stratasys • Revenue in Q4 2021 is expected to grow approximately 16% compared to Q4 2020, driven by continued growth in systems • Operating expenses for 2021 are expected to be approximately $36M higher than 2020 , reflecting full ownership of Xaar 3D and higher operating costs relative to higher revenues • Capital expenditures in 2021 expected to range from $24M to $30M • We are committed to growing our leadership and driving growth and profits as our revenues shift from prototyping to manufacturing Q4 and 2021 Outlook

21 Stratasys Summary Dr. Yoav Zeif , CEO • We have solutions for every step in the product life cycle chain to capitalize on this trend • Only Stratasys provides the full range of best - in - class technologies for polymer 3D printing • Our investments, balance sheet and strategy execution position us to build long - term value for our stakeholders * “Market Trend: 3D Printing Increases Production Flexibility for Manufacturers,” Gartner, A. Boparai, A. Hoeppe , I. Berntz , 14 October 2021 By 2025 , over 50 % of all discrete manufacturers will be using 3 D printers to produce parts for the products they sell or service, up from 10 % in 2019 . * “

22 Thank You Any questions? Thank You Q&A Stratasys

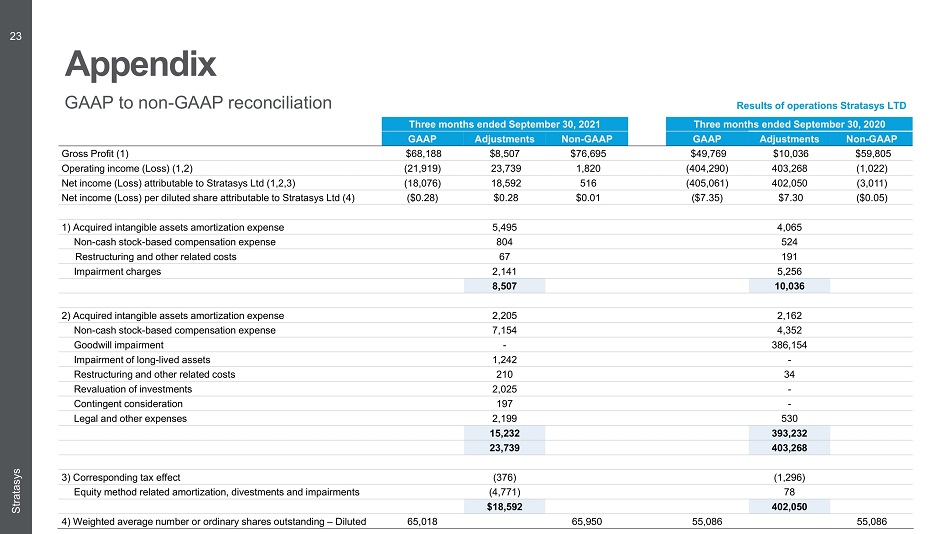

23 Stratasys Three months ended September 30, 2021 Three months ended September 30, 2020 GAAP Adjustments Non - GAAP GAAP Adjustments Non - GAAP Gross Profit (1) Operating income (Loss) (1,2) Net income (Loss) attributable to Stratasys Ltd (1,2,3) Net income (Loss) per diluted share attributable to Stratasys Ltd (4) 1) Acquired intangible assets amortization expense 5,495 4,065 Non - cash stock - based compensation expense 804 524 Restructuring and other related costs 67 191 Impairment charges 2,141 5,256 8,50 10,036 2) Acquired intangible assets amortization expense 2,205 2,162 Non - cash stock - based compensation expense 7,154 4,352 Goodwill impairment - 386,154 Impairment of long - lived assets 1,242 - Restructuring and other related costs 210 34 Revaluation of investments 2,025 - Contingent consideration 197 - Legal and other expenses 2,199 530 15,232 393,232 23,73 403,268 3) Corresponding tax effect (376) (1,296) Equity method related amortization, divestments and impairments (4,771) 78 $ 18,59 402,050 4) Weighted average number or ordinary shares outstanding – Diluted 65,018 65,950 55,086 55,086 Appendix GAAP to non - GAAP reconciliation Results of operations Stratasys LTD