Use these links to rapidly review the document

Table of contents

OBJET LTD. (FORMERLY OBJET GEOMETRIES LTD.) CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on March 22, 2012.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

OBJET LTD.

(Exact Name of Registrant as Specified in its Charter)

| State of Israel (State or other jurisdiction of incorporation or organization) |

3577 (Primary Standard Industrial Classification Code Number) |

Not Applicable (I.R.S. Employer Identification No.) |

Objet Ltd.

2 Holtzman Street

Science Park, P.O. Box 2496

Rehovot 76124, Israel

+972-8-931-4314

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Frank Marangell

Objet Inc.

5 Fortune Drive

Billerica, Massachusetts 01821

(877) 489-9449

(Name, Address, including zip code, and telephone number, including area code, of agent for service)

| Copies of all correspondence to: | ||||||

Timothy Moore, Esq. Marc Recht, Esq. Cooley LLP 3175 Hanover Street Palo Alto, CA 94304-1130 Tel: (650) 843-5000 |

J. David Chertok, Adv. David S. Glatt, Adv. Jonathan M. Nathan, Adv. Meitar Liquornik Geva & Leshem Brandwein 16 Abba Hillel Silver Rd. Ramat Gan 52506, Israel Tel: +972-3-610-3100 |

Alan F. Denenberg, Esq. Davis Polk & Wardwell LLP 1600 El Camino Real Menlo Park, CA 94025 Tel: (650) 752-2000 |

Barry Levenfeld, Adv. Yigal Arnon & Co. 22 Rivlin Street Jerusalem 94240, Israel Tel: +972-2-623-9220 |

|||

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE(1)

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price(2) |

Amount of registration fee |

||

|---|---|---|---|---|

| Class A ordinary shares, par value NIS 0.01 per share | $75,000,000 | $8,595.00 | ||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 22, 2012

Class A ordinary shares

We are offering of our Class A ordinary shares. This is our initial public offering, and no public market currently exists for our Class A ordinary shares. We have applied to have our Class A ordinary shares listed on the NASDAQ Global Market under the symbol "OBJT." We anticipate that the initial public offering price for our Class A ordinary shares will be between $ and $ per share.

Following this offering, we will have two classes of authorized ordinary shares, Class A ordinary shares and Class B ordinary shares. The rights of the holders of Class A ordinary shares and Class B ordinary shares will be identical, except with respect to voting and conversion. Each Class A ordinary share will be entitled to one vote. Each Class B ordinary share will be entitled to five votes and will be convertible at any time into one Class A ordinary share upon the election of the holder thereof. Each Class B ordinary share will furthermore automatically convert into one Class A ordinary share upon transfer (with certain limited exceptions) or when the Class B ordinary shares represent less than 15% of the combined number of Class A and Class B ordinary shares.

Investing in our Class A ordinary shares involves a high degree of risk. See "Risk factors" beginning on page 11 for a discussion of information that should be considered in connection with an investment in our Class A ordinary shares.

| |

Per share |

Total |

||

|---|---|---|---|---|

| Public offering price | $ | $ | ||

| Underwriting discounts and commissions | $ | $ | ||

| Proceeds, before expenses, to us | $ | $ | ||

Neither the U.S. Securities and Exchange Commission, nor any state or other foreign regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We have granted the underwriters a 30-day option to purchase up to an additional Class A ordinary shares to cover over-allotments, if any, at the initial public offering price per share, less underwriting discounts and commissions.

The underwriters expect to deliver the Class A ordinary shares against payment in New York, New York on or about , 2012.

| J.P. Morgan | Goldman, Sachs & Co. | |

Needham & Company |

||

The date of this prospectus is , 2012

We have not authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus. In addition, we are not offering, and the underwriters are not offering, to sell or solicit any securities to or from any person in any jurisdiction where it is unlawful to make this offer to or solicit an offer from a person in that jurisdiction. The information contained in this prospectus is accurate as of the date on the front of this prospectus.

Neither we nor any of the underwriters has done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required other than the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our Class A ordinary shares and the distribution of this prospectus outside of the United States.

This prospectus includes statistical data, market data and other industry data and forecasts, which we obtained from market research, publicly available information and independent industry publications and reports that we believe to be reliable sources.

Through and including , 2012 (the 25th day after the date of this prospectus), federal securities laws may require all dealers that effect transactions in these securities, whether or not participating in this offering, to deliver a prospectus. This requirement is in addition to the dealers' obligation to deliver a prospectus when acting as underwriter and with respect to their unsold allotments or subscriptions.

i

This summary highlights selected information contained elsewhere in this prospectus that we consider important. This summary does not contain all of the information you should consider before investing in our Class A ordinary shares. You should read this summary together with the more detailed information appearing in this prospectus, including "Risk factors," "Selected consolidated financial data," "Management's discussion and analysis of financial condition and results of operations," "Business" and our consolidated financial statements and the related notes included at the end of this prospectus, before making an investment in our Class A ordinary shares. Unless the context otherwise requires, all references to "Objet," "we," "us," "our," the "company" and similar designations refer to Objet Ltd. and its wholly-owned subsidiaries: Objet Inc., a Delaware corporation, Objet GMBH, a German limited liability company, Objet AP Limited, a Hong Kong limited company, and Objet Shanghai Ltd., a Chinese company. The term "NIS" refers to New Israeli Shekels, the lawful currency of the State of Israel, the terms "dollar," "US$" or "$" refer to U.S. dollars, the lawful currency of the United States, and the terms "Euros" or "€" refer to Euros, the lawful currency of the European Union. Unless otherwise indicated, U.S. dollar translations of NIS amounts presented in this prospectus are translated using the rate of NIS 3.82 to US$1.00, the exchange rate reported by the Bank of Israel on December 30, 2011 (as December 31, 2011 was not a business day in Israel). Unless otherwise indicated, U.S. dollar translations of Euro amounts presented in this prospectus are translated using the rate of €0.77 to US$1.00, the exchange rate reported at www.xe.com on December 31, 2011.

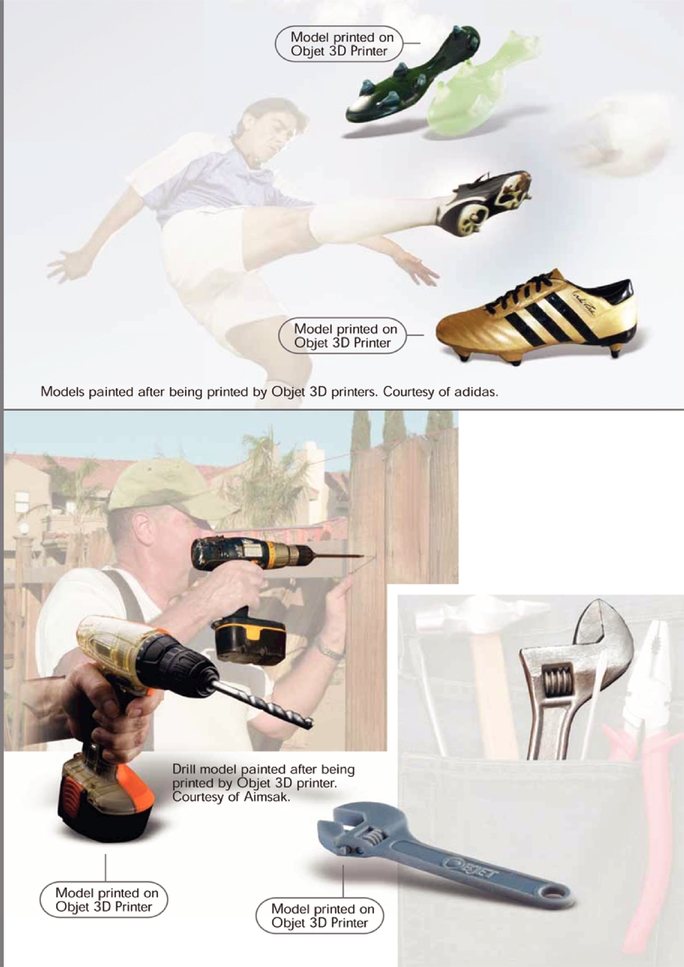

Our business

Objet is a global provider of three-dimensional, or 3D, printing solutions, offering a broad range of 3D printing systems, resin consumables and services. Our printers use our proprietary inkjet-based technology, resin consumables and integrated software to create 3D models directly from computer data such as 3D computer-aided design, or CAD, files. Our printers build 3D objects by depositing multiple layers of resin one on top of another. We enhance the ability of designers, engineers and manufacturers to visualize, verify and communicate product designs, thereby improving the design process and reducing time-to-market. Our easy-to-use, high-speed 3D printers create high-resolution, smooth surface finish models that have the look, feel and functionality of the final designed product. We offer the only 3D printing systems that deposit two materials simultaneously, enabling the printing of models with a broad range of physical attributes. As of December 31, 2011, we had sold 3,378 3D printing systems, of which 569 and 929 were sold in 2010 and 2011, respectively. Our installed base of 3D printers provides the basis for recurring revenues from the sale of resin consumables and services.

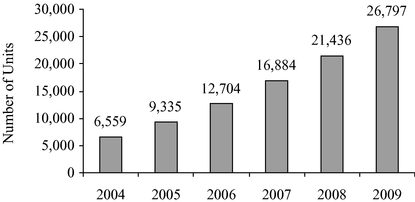

3D printing is transforming prototype development and customized manufacturing processes, and is displacing traditional methodologies such as metal extrusion, computer-controlled machining and manual modeling techniques. 3D printing significantly improves the design process, reduces the time required for product development and facilitates creativity, while keeping the entire design process in-house. According to the 2010 report of Wohlers Associates, Inc., or the Wohlers Report, the 3D printer market grew at a 20% compound annual growth rate, or CAGR, from 2004 to 2009. We expect that the adoption of 3D printing will continue to increase over the next several years as a result of the proliferation of 3D content

1

and authoring tools (3D CAD and other simplified 3D authoring tools) as well as increased availability of 3D scanners.

We are pioneers in 3D inkjet printing technology, which we believe is differentiated from competing technologies primarily in its ability to be scaled and to deliver high-resolution and multi-material printing. We combine our proprietary hardware platform, integrated software and resin consumables with widely-deployed inkjet printer heads to develop leading 3D printing systems. Our products are used in a broad array of applications, including concept and functional modeling, focus groups and sales presentations, ergonomic studies, prototype production, short-run tooling and customized small series manufacturing. Our 3D printing systems are deployed at over 2,800 companies in a wide range of industries. Our systems are used by a number of Fortune 100 companies. We provide products and services to our global customer base through our offices in Israel, the United States, Germany, Japan, China and Hong Kong, as well as through our worldwide network of over 85 distributors and sales agents.

Headquartered in Israel, we were founded in 1998 and sold our first 3D printing systems in 2002. Our revenues and net income were $121.1 million and $14.7 million, respectively, in 2011, marking our seventh consecutive profitable year and reflecting growth of 37.8% and 41.8% over the corresponding amounts for 2010.

Industry overview

3D printing addresses the inherent limitations of traditional modeling technologies through its combination of functionality, quality, ease-of-use, speed and cost. 3D printing can be significantly more efficient and effective than traditional model-making techniques for use across the design process, from concept modeling and design review and validation to fit and function prototyping, pattern making and tooling. An indicator of the total addressable market is the number of licensed 3D design software seats, such as 3D CAD seats, although multiple CAD seat licenses will often utilize only one printing system. According to "The Worldwide CAD Market Report 2010," or the CAD Report, by Jon Peddie Research, there was an installed base of over five million 3D CAD seats at the end of 2009. With only 26,797 3D printing systems installed worldwide at the end of 2009, according to the Wohlers Report, we believe that the 3D printing industry is significantly under-penetrated and has considerable room for growth. Additionally, users are increasingly upgrading their CAD software from 2D to 3D, as illustrated by the increasing share of 3D CAD installed seats from 30% in 2007 to 41% of the 14 million total CAD installed seats at the end of 2009, according to the CAD Report. While the number of 3D CAD seats is an indicator of the total addressable market, the growth of 3D printing extends beyond the number of 3D CAD users, as users can print 3D content files without the need for specialized 3D CAD design software.

We believe that increased market adoption in 3D printing will be facilitated by continued improvements in 3D printing technology, including:

2

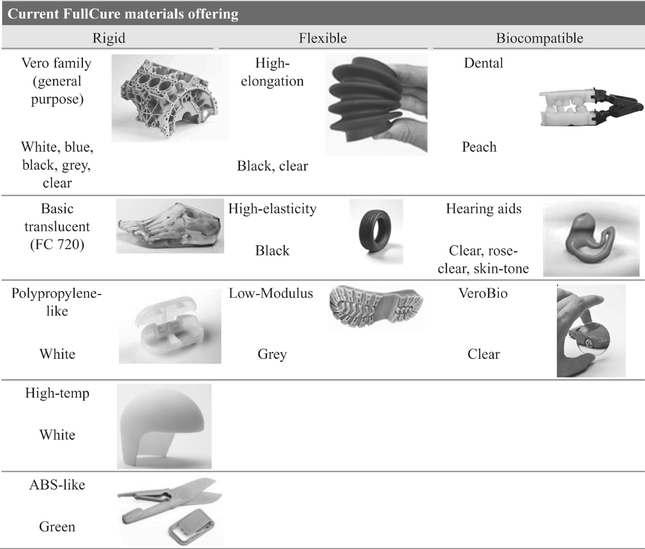

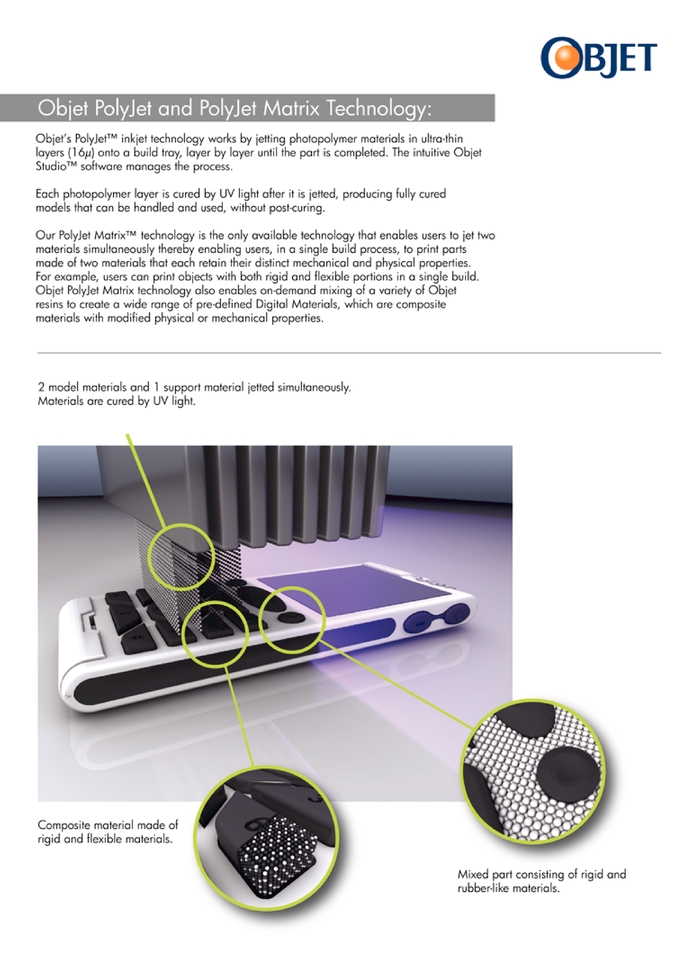

There are a number of available 3D printing technologies. The technologies differ on the basis of accuracy, surface quality, variety and properties of resin consumables, capacity, speed, color variety, transparency, the ability to print multiple materials and others. According to Wohlers Associates, inkjet-based technology has several characteristics that offer competitive benefits, including flexible rubber and plastic-like materials, multi-material printing, composite materials, transparency and accuracy.

Our solution

Our 3D printing solution uses our proprietary PolyJet inkjet-based technology, resin consumables and integrated software to create 3D models directly from computer data such as 3D CAD files. Our printers build 3D objects by depositing multiple layers of resin one on top of another. We are the only providers of 3D printers that allow the simultaneous jetting of two materials, enabling our end-users to print models with a variety of model features, such as objects with both rigid and flexible parts in a single build.

We offer our customers a broad range of 3D printer systems, including our advanced Connex family, our mid-range Eden family and our lower capacity, entry-level Desktop family. While all of our products offer our customers high-quality printing capabilities with high resolution and accuracy, our customers typically base their selection of a particular Objet system primarily on tray size, cartridge capacity, duty cycle, print speed, features and price. We offer a wide variety of office-friendly resin consumables, including rigid and flexible (rubber-like) materials and bio-compatible materials for medical and dental applications.

Our solutions allow our end-users to print 3D models which enhance their ability to visualize, verify and communicate product designs, thereby improving the design process and reducing time-to-market. Our systems create visual aids for concept modeling and functional prototypes to test fit, form and function, permitting rapid evaluation of product designs. In addition to contributing to the design process, our systems may also be used as part of the manufacturing process for smaller-volume manufacturing of customized products.

Our competitive strengths

We believe that the following are our key competitive strengths:

3

Our strategy

The key elements of our strategy for growth include the following:

Risk factors

Our business is subject to a number of risks that you should understand before deciding to invest in our Class A ordinary shares, including those discussed under "Risk factors."

Our corporate information

We were incorporated under the laws of the State of Israel in March 1998. Our principal executive offices are located at 2 Holtzman Street, Science Park, P.O. Box 2496, Rehovot 76124,

4

Israel, and our telephone number is +972-8-931-4314. We have offices in Israel, the United States, Germany, Japan, China and Hong Kong. Our website is www.objet.com. Information contained on, or that can be accessed through, our website does not constitute a part of this prospectus and is not incorporated by reference herein. We have included our website address in this prospectus solely as an inactive textual reference.

Unless the context otherwise indicates or requires, "Objet," "FullCure," "PolyJet," "PolyJet Matrix," "Digital Materials," "Connex," "Eden," "Vero" and all product names and trade names used by us in this prospectus are our trademarks and service marks, which may be registered in certain jurisdictions. Although we have omitted the "®" and "TM" trademark designations for such marks in this prospectus, all rights to such trademarks and service marks are nevertheless reserved. Furthermore, the "Objet" design logo is our property. This prospectus contains additional trade names, trademarks and service marks of other companies. We do not intend our use or display of other companies' tradenames, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

5

| Issuer | Objet Ltd. | |

Class A ordinary shares we are offering |

Class A ordinary shares |

|

Class A ordinary shares to be outstanding immediately after this offering |

Class A ordinary shares |

|

Class B ordinary shares to be outstanding immediately after this offering |

Class B ordinary shares |

|

Total number of ordinary shares (Class A and Class B) to be outstanding after this offering |

ordinary shares |

|

Voting rights |

Following this offering, we will have two classes of authorized ordinary shares: Class A ordinary shares and Class B ordinary shares. The rights of the holders of Class A and Class B ordinary shares are identical, except with respect to voting and conversion. The holders of Class B ordinary shares are entitled to five (5) votes per share, and the holders of Class A ordinary shares are entitled to one (1) vote per share, on all matters that are subject to a shareholder vote. Each Class B ordinary share may be converted into one (1) Class A ordinary share at any time at the election of the holder thereof, and will be automatically converted into one (1) Class A ordinary share upon the earlier of (i) the date on which the outstanding Class B ordinary shares represent less than 15% of the combined number of Class A and Class B ordinary shares and (ii) transfer thereof (except for certain excluded distributions). The Class A ordinary shares are not convertible. See "Description of share capital." |

|

Offering price |

We expect that the initial public offering price for the Class A ordinary shares being sold in this offering will be between $ and $ per share. |

|

Over-allotment option |

We have granted the underwriters a 30-day option to purchase up to an additional Class A ordinary shares from us to cover over-allotments, if any, at the initial public offering price per share, less underwriting discounts and commissions. |

6

| Use of proceeds | We estimate that we will receive net proceeds from this offering of approximately $ million, based on an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses. | |

We expect to use the net proceeds from this offering to meet our anticipated increased working capital requirements resulting from the expected growth in our business. We may also use a portion of the net proceeds for the potential acquisition of, or investment in, technologies, products or companies that complement our business, although we have no understandings, commitments or agreements to consummate any such acquisition or investment. |

||

Risk factors |

Investing in our Class A ordinary shares involves a high degree of risk and purchasers of our Class A ordinary shares may lose part or all of their investment. See "Risk factors" for a discussion of factors you should carefully consider before deciding to invest in our Class A ordinary shares. |

|

Proposed NASDAQ Global Market symbol |

We have applied to have our Class A ordinary shares listed on the NASDAQ Global Market under the symbol "OBJT." |

Unless otherwise stated, the number of Class A and Class B ordinary shares to be outstanding after this offering is based on the offering of Class A ordinary shares in this offering, and Class B ordinary shares that will be outstanding prior to the consummation of this offering. Such Class B ordinary shares will be issued upon the reclassification of an equivalent aggregate number of our outstanding preferred shares and ordinary shares immediately prior to the consummation of this offering and following a -for- reverse stock split of our outstanding shares that we will effect prior to the effectiveness of the registration statement of which this prospectus forms a part.

Unless otherwise indicated, all information in this prospectus:

7

8

Summary consolidated financial data

The following table is a summary of our historical consolidated financial data, which is derived from our consolidated financial statements, which have been prepared in accordance with U.S. Generally Accepted Accounting Principles, or U.S. GAAP. The summary consolidated financial statement data for the years ended December 31, 2009, 2010 and 2011, and as of December 31, 2011, is derived from our audited consolidated financial statements included elsewhere in this prospectus.

You should read this summary financial data in conjunction with, and it is qualified in its entirety by, reference to our historical financial information and other information provided in this prospectus including, "Selected consolidated financial data," "Management's discussion and analysis of financial condition and results of operations" and our consolidated financial statements and related notes. The historical results set forth below are not necessarily indicative of the results to be expected in future periods.

| |

Year ended December 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands, except per share data) |

2009 |

2010 |

2011 |

|||||||||

Consolidated statements of operations data: |

||||||||||||

Revenues |

||||||||||||

Products |

$ | 56,993 | $ | 76,556 | $ | 105,759 | ||||||

Services |

10,537 | 11,322 | 15,337 | |||||||||

Total revenues |

67,530 | 87,878 | 121,096 | |||||||||

Cost of revenues |

||||||||||||

Cost of products |

19,835 | 23,734 | 34,008 | |||||||||

Cost of services |

9,286 | 10,039 | 12,946 | |||||||||

Gross profit |

38,409 | 54,105 | 74,142 | |||||||||

Operating expenses |

||||||||||||

Research and development |

9,297 | 11,980 | 14,569 | |||||||||

Sales and marketing |

12,791 | 19,979 | 28,366 | |||||||||

General and administrative |

7,988 | 10,009 | 13,696 | |||||||||

Operating profit |

8,333 | 12,137 | 17,511 | |||||||||

Finance income (expense), net |

232 | (365 | ) | (1,228 | ) | |||||||

Income before income taxes |

8,565 | 11,772 | 16,283 | |||||||||

Tax on income (tax benefit) |

960 | 1,411 | 1,589 | |||||||||

Net income |

$ | 7,605 | $ | 10,361 | 14,694 | |||||||

Earnings per share attributable to ordinary shareholders: |

||||||||||||

Basic and diluted(1) |

$ | 0.00 | $ | 0.00 | $ | 0.07 | ||||||

Weighted average number of ordinary shares: |

||||||||||||

Basic and diluted |

3,237 | 3,237 | 3,237 | |||||||||

Pro forma net income per Class B ordinary share(2) (unaudited): |

||||||||||||

Basic and diluted |

$ | 0.00 | $ | 0.55 | ||||||||

Pro forma weighted average number of ordinary shares(2) (unaudited): |

||||||||||||

Basic and diluted |

26,846 | |||||||||||

9

| |

As of December 31, 2011 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands) |

Actual |

Pro forma(1) |

Pro forma as adjusted(2) |

||||||||

Consolidated balance sheets data: |

|||||||||||

Cash and cash equivalents |

$ | 42,954 | $ | 42,954 | $ | ||||||

Total assets |

124,538 | 124,538 | |||||||||

Current liabilities |

34,239 | 34,239 | |||||||||

Long-term liabilities |

4,436 | 4,436 | |||||||||

Convertible preferred shares(3) |

38,231 | — | |||||||||

Total shareholders' equity(3) |

47,632 | 85,863 | |||||||||

10

Investing in our Class A ordinary shares involves a high degree of risk. You should carefully consider the following risk factors, in addition to the other information set forth in this prospectus, before purchasing our Class A ordinary shares. If any of the following risks actually occurs, our business, financial condition and results of operations could suffer. In that case, the trading price of our Class A ordinary shares would likely decline and you might lose all or part of your investment. The risks below are not the only ones facing our company. Additional risks not currently known to us or that we currently deem immaterial may also adversely affect us.

Risks relating to our business and industry

If the market does not grow as we expect, our revenues may stagnate or decline.

The marketplace for prototype development, which is our primary market, is dominated by conventional methods that do not involve 3D printing technology. If the market does not broadly accept 3D printing as an alternative for prototype development, or if it adopts 3D printing based on a technology other than inkjet technology, we may not be able to increase or sustain the level of sales of our products and related materials and our results of operations would be adversely affected as a result.

We may not be able to introduce new 3D printers and resin consumables acceptable to the market or to improve the technology and resin consumables used in our current systems in response to changing technology and end-user needs.

We derive most of our revenues from the sale of 3D printers and related resin consumables (both modeling and support materials) for prototype development and customized manufacturing and general 3D printing applications. The 3D printing market is subject to innovation and technological change. A variety of technologies compete against one another for market share, which is, in part, driven by technological advances and end-user requirements and preferences, as well as the emergence of new standards and practices. Our ability to compete in the 3D printing market depends, in large part, on our success in enhancing and developing new 3D printers, our success in enhancing and adding to our PolyJet jetting technology and PolyJet Matrix technology, and our success in developing new resin consumables. We believe that to remain competitive we must continuously enhance and expand the functionality and features of our products and technologies. However, there is a risk that we may not be able to:

11

If our product mix shifts too far into lower margin products, our profitability could be impaired.

Sales of our high-end 3D printers and our resin consumables yield a greater gross margin than our entry-level 3D printers. We started shipping entry-level 3D printers in 2009, and we anticipate that they will continue to grow as a percentage of the number of printers that we sell. If our product mix shifts too far into lower margin products and we are not able to sufficiently reduce the engineering and production costs associated with our entry-level 3D printers, our profitability could be impaired.

Our business model is predicated on building an end-user base that will generate a recurring stream of revenues through the sale of our resin consumables. If that recurring stream of revenues does not develop as expected, or if our business model changes as the industry evolves, our operating results may be adversely affected.

Our business model is dependent on our ability to maintain and increase sales of our proprietary resin consumables as they generate recurring revenues. Existing and future end-users of high-end 3D printers may not purchase resin consumables at the same rate at which end-users currently purchase those resin consumables, and as we expand our sales of entry-level 3D printers, end-users of entry-level printers may purchase a lower volume of resin consumables. If our current and future end-users purchase a lower volume of resin consumables, our recurring revenue stream would be reduced, and our operating results would be adversely affected.

Our revenues and operating results may fluctuate.

Our revenues and operating results may fluctuate from quarter-to-quarter and year-to-year and are likely to continue to vary due to a number of factors, many of which are not within our control. A significant portion of our orders are typically received during the last month of a quarter. Our printers typically are shipped shortly after orders are received. Thus, revenues and operating results for any future period are not predictable with any significant degree of certainty. We also typically experience weaker demand for our printers in the first and third quarters. For these reasons, comparing our operating results on a period-to-period basis may not be meaningful. You should not rely on our past results as an indication of our future performance.

Fluctuations in our operating results and financial condition may occur due to a number of factors, including, but not limited to, those listed below and those identified throughout this "Risk factors" section:

12

Due to the foregoing factors, you should not rely on quarter-to-quarter or year-to-year comparisons of our operating results as an indicator of future performance.

The market in which we participate is competitive. Our failure to compete successfully could cause our revenues and demand for our products to decline.

We compete for end-users with a wide variety of producers of equipment that create models, prototypes, other 3D objects and end-use parts as well as producers of materials and services for this equipment. Our principal competition currently consists of other manufacturers of systems for prototype development and customized manufacturing processes, including Stratasys Inc. (and Hewlett-Packard Company, or HP, based on its agreement with Stratasys to distribute an HP-branded 3D printing system), 3D Systems Corporation, CMET, EOS Optronics GmbH, Z Corporation (which was acquired by 3D Systems Corporation), EnvisionTEC GmbH, Solid Model Ltd. (the successor to the business of Solido Ltd.) and Solidscape, Inc. (which was acquired by Stratasys). In addition, there is a risk that consolidation among companies in the 3D printing industry could accelerate, whether in the form of acquisitions by, or strategic partnerships or marketing partnerships with, companies that may have significantly greater resources than we have.

Some of our current and potential competitors have larger installed bases of users, longer operating histories and more extensive name recognition than we have. In addition, many of these competitors have significantly greater financial, marketing, manufacturing, distribution and other resources than we have. Current and future competitors may be able to respond more quickly to new or emerging technologies and changes in end-user demands and to devote greater resources to the development, promotion and sale of their products than we can. Our current and potential competitors may develop and market new technologies that render our existing or future products obsolete, unmarketable or less competitive. In addition,

13

if these competitors develop products with similar or superior functionality to our products at prices comparable to or lower than ours, we may need to decrease the prices of our products in order to remain competitive. We cannot assure you that we will be able to maintain or enhance our current competitive position or continue to compete successfully against current and future sources of competition.

Declines in product prices may adversely affect our financial results.

Our business is subject to price competition. Such price competition may adversely affect our ability to maintain profitability, especially during periods of decreased demand. If we are not able to offset price reductions resulting from these pressures by improved operating efficiencies and reduced expenditures, those pricing reductions would adversely affect our operating results.

If other manufacturers were to successfully develop and market resin consumables for use in our 3D printers, our revenues and profits would likely be adversely affected.

Our proprietary resin consumables are specifically designed for use with our 3D printers. However, we may become subject to competition from chemical companies or other producers of resins and other materials who may develop materials that are compatible with our 3D printers in order to sell them to owners of our 3D printers in place of our proprietary materials. If our end-users were to purchase resin consumables from third parties, we could experience reduced sales of our resin consumables and could be forced to reduce prices for our proprietary consumable materials, either of which would impair our overall revenues and profitability.

If our relationships with suppliers, especially with single source suppliers of components, were to terminate or our manufacturing arrangements were to be disrupted, our business could be interrupted.

We purchase from third-party suppliers components and sub-assemblies for our 3D printers and raw materials that are used in our resin consumables.

While there are several potential suppliers of the components and sub-assemblies for our 3D printers and raw materials for our resin consumables, we currently choose to use only one or a limited number of suppliers for several of these components and materials, including the printer heads for our 3D printers, for which we rely exclusively on a sole supplier, Ricoh Printing Systems America, Inc., or Ricoh. Under the terms of our agreement with Ricoh, we purchase printer heads and associated electronic components, and receive a non-transferable, non-exclusive right to assemble, use and sell these purchased products under Ricoh's patent rights and trade secrets. See "Business—Manufacturing and Suppliers—Ricoh Agreement" for further discussion of this agreement.

Our reliance on a single or limited number of vendors involves a number of risks, including:

14

We require any new supplier to become "qualified" pursuant to our internal procedures. The qualification process involves evaluations of varying durations, which may cause production delays if we were required to qualify a new supplier unexpectedly. We generally assemble our systems based on our internal forecasts and the availability of raw materials, assemblies, components and finished goods that are supplied to us by third parties, which are subject to various lead times. In addition, at any time, certain suppliers may decide to discontinue production of an assembly, component or raw material that we use. Any unanticipated change in the availability of our supplies, or unanticipated supply limitations, could cause delays in, or loss of, sales, increase production or related costs and consequently reduce margins, and damage our reputation. Due to the risk of a discontinuation of the supply of our printer heads and other key components of our products, we maintain excess inventory of printer heads and other components. However, if our forecasts exceed actual orders, we may hold large inventories of slow-moving or unusable parts or resin consumables, which could result in inventory write offs or write downs and have an adverse effect on our cash flow, profitability and results of operations.

Discontinuation of operations at our manufacturing sites could prevent us from timely filling customer orders.

All assembly and testing of our proprietary printing systems takes place at our Rehovot, Israel facility and all production of our resin consumables takes place at our Kiryat Gat, Israel facility. Because of our reliance on those production facilities, a disruption at either of those facilities could cripple our ability to supply our 3D printers or consumable materials to the marketplace in a timely manner, adversely affecting our ability to generate revenues and potentially damaging our reputation.

If we fail to expand our operations effectively, we may not be able to achieve our anticipated level of growth and our operating results could be adversely affected.

We have significantly expanded our operations in recent periods. For example, we have increased the number of our employees from 282 as of December 31, 2008, to 438 as of December 31, 2011. We anticipate that further expansion of our infrastructure and headcount will be required to achieve the planned expansion of our product offerings, our client base, improvements in our 3D printers and related resin consumables, and our continued international expansion. In particular, we must increase our marketing and professional services staff to support new marketing and service activities and to meet the needs of new and existing end-users. Our future success will depend in part upon the ability of our management to expand our infrastructure and independent network of distributors and sales agents, and to manage our growth effectively. If our management is unsuccessful in meeting these challenges, we may not be able to achieve our anticipated level of growth and our operating results could be adversely affected.

15

A loss of, or reduction in revenues from, a significant number of our independent sales agents or distributors would impair our ability to sell our products and services and could result in a reduction of our revenues and operating results.

The majority of our product sales are made through our network of independent sales agents and distributors. We rely heavily on these sales agents and distributors to sell our products to end-users in their respective geographic regions. These sales agents and distributors are not precluded from selling our competitors' products in addition to ours. In addition, they may not be effective in selling our products or servicing our end-users. Further, if a significant number of our sales agents and distributors were to terminate their relationship with us or otherwise fail or refuse to sell our products, we may not be able to find replacements that are as qualified or as successful in selling our products. If these independent sales agents and distributors do not perform as anticipated or if we are unable to find qualified and successful replacements, our sales will suffer, which would have a material adverse effect on our revenues and operating results. Additionally, a default by one or more independent distributors that have a significant receivables balance could have an adverse financial impact on us.

The long sales cycle for our products makes the timing of our revenues difficult to predict.

Generally, our 3D printers have a long sales cycle. Because our 3D printers are complex and our sales typically involve significant capital investments by prospective end-users, we, our distributors and agents generally need to invest a significant amount of time educating prospective end-users about the benefits of our products. As a result, before purchasing our products, potential end-users may spend a substantial amount of time performing internal assessments. This may cause us to devote significant effort in advance of a potential sale without any guarantee of receiving any related revenues. Delays in sales could cause significant variability in our revenues and operating results for any particular period.

Global economic, political and social conditions have adversely impacted our sales, and may continue to do so.

The uncertain direction and relative strength of the global economy, difficulties in the financial services sector and credit markets, continuing geopolitical uncertainties and other macroeconomic factors all affect spending behavior of potential end-users of our products. The prospects for economic growth in the United States and other countries remain uncertain, and may cause end-users to further delay or reduce technology purchases. In particular, a substantial portion of our sales are made to customers in countries in Europe, which is experiencing a significant economic crisis. These and other macroeconomic factors had an adverse impact on the sales of our products in late 2008, 2009 and, to a lesser degree, in 2010, leading to reduced sales of our 3D printers and, reduced revenues from sales in 2009 relative to 2008 and longer sales cycles. While we saw an improvement in revenues from sales of our systems in 2010 and 2011, there can be no assurance that such improvement is sustainable particularly if global economic conditions remain volatile for a prolonged period or if European economies experience further disruptions. The global financial crisis affecting the banking system and financial markets has resulted in a tightening of credit markets, lower levels of liquidity in many financial markets, and extreme volatility in fixed income, credit, currency and equity markets. These conditions may make it more difficult for our end-users to obtain financing.

16

We face risks that may arise from financial difficulties experienced by our end-users, suppliers and distributors which may be exacerbated by continued weakness in the global economy, including:

Our existing and planned international operations currently expose us and will continue to expose us to additional market and operational risks, and failure to manage these risks may adversely affect our business and operating results.

We have sales offices at our headquarters in Israel, as well as in the United States, Germany, Japan, China and Hong Kong, and our principal research and development and manufacturing facilities are located at our headquarters in Israel. While the United States currently constitutes the most significant market for our products and services, and our operations are managed from our Israeli headquarters, we nevertheless derived 54%, 52% and 52% of our revenues in the years ended December 31, 2009, 2010 and 2011, respectively, from sales of products and provision of services outside of the United States and Israel. We face significant operational risks from doing business internationally, including:

17

Our failure to manage the market and operational risks associated with our international operations effectively could limit the future growth of our business and adversely affect our operating results.

We may be subject to product liability claims, which could result in material expenses, diversion of management time and attention and damage to our reputation.

Products as complex as our 3D printers may contain undetected defects or errors when first introduced or as enhancements are released that, despite testing, are not discovered until after a product has been used. This could result in delayed market acceptance of our products, claims from distributors, end-users or others, increased end-user service and support costs and warranty claims, damage to our reputation and business, or significant costs to correct the defect or error. We may from time to time, become subject to warranty or product liability claims that could lead to significant expenses as we compensate affected end-users for costs incurred related to product quality issues.

The sale and support of our products entail the risk of product liability claims. We intend to expand sales of our products for use in medical and dental applications, which carry a heightened risk of product liability claims. In addition, certain hazardous chemicals used in the manufacture of our products may expose us to a heightened risk of product liability claims. Specifically, those hazardous chemicals fall within three different categories (with several of the chemicals falling within multiple categories)—irritants, harmful chemicals and chemicals dangerous for the environment.

Any product liability claim brought against us, regardless of its merit, could result in material expense, diversion of management time and attention and damage to our reputation, and could cause us to fail to retain existing end-users or to attract new end-users. Although we maintain product liability insurance, such insurance is subject to significant deductibles and there is no guarantee that such insurance will be available or adequate to protect against all such claims, or we may elect to self-insure with respect to certain matters. Costs or payments made in connection with warranty and product liability claims and product recalls could materially affect our financial condition and results of operations.

Our business could suffer if we are unable to attract and retain key employees.

Our success depends upon the continued service and performance of our senior management and other key personnel. Our senior executive team is critical to the management of our business and operations, as well as to the development of our strategies. The loss of the services of any of these personnel could delay or prevent the continued successful implementation of our growth strategy, or our commercialization of new applications for our 3D printers, or could otherwise affect our ability to manage our company effectively and to carry out our business plan. Members of our senior management team may resign at any time. High demand exists for senior management and other key personnel in our industry. There can be no assurance that we will be able to continue to retain such personnel.

18

Our growth and success also depend on our ability to attract and retain additional highly qualified scientific, technical, sales, managerial and finance personnel. We experience intense competition for qualified personnel, and, in some jurisdictions in which we operate, the existence of non-competition agreements between prospective employees and their former employers may prevent us from hiring those individuals or subject us to suit from their former employers. While we attempt to provide competitive compensation packages to attract and retain key personnel, some of our competitors have greater resources and more experience than we have, making it difficult for us to compete successfully for key personnel. If we cannot attract and retain sufficiently qualified technical employees for our research and development and manufacturing operations on acceptable terms, we may not be able to continue to develop and commercialize our products or new applications for our existing products. Further, any failure to effectively integrate new personnel could prevent us from successfully growing our company.

Under applicable employment laws, we may not be able to enforce covenants not to compete and therefore may be unable to prevent our competitors from benefiting from the expertise of some of our former employees.

We generally enter into non-competition agreements with our employees. These agreements prohibit our employees, if they cease working for us, from competing directly with us or working for our competitors or clients for a limited period. We may be unable to enforce these agreements under the laws of the jurisdictions in which our employees work and it may be difficult for us to restrict our competitors from benefitting from the expertise our former employees or consultants developed while working for us. For example, Israeli courts have required employers seeking to enforce non-compete undertakings of a former employee to demonstrate that the competitive activities of the former employee will harm one of a limited number of material interests of the employer which have been recognized by the courts, such as the secrecy of a company's confidential commercial information or the protection of its intellectual property. If we cannot demonstrate that such interests will be harmed, we may be unable to prevent our competitors from benefiting from the expertise of our former employees or consultants and our ability to remain competitive may be diminished.

We are subject to extensive environmental, health and safety laws and regulations which could have a material adverse effect on our business, financial conditions and results of operations.

Our operations use chemicals and produce waste materials. We are subject to extensive environmental, health and safety laws and regulations in multiple jurisdictions governing, among other things, the use, storage, registration, handling and disposal of chemicals and waste materials, the presence of specified substances in electrical products, chemicals, air, water and ground contamination, air emissions and the cleanup of contaminated sites, including any contamination that results from spills due to our failure to properly dispose of chemicals and waste materials. Under these laws and regulations, we could also be subject to liability for improper disposal of chemicals and waste materials resulting from the use of our 3D printers and accompanying materials by our end-users. These laws and regulations could potentially require the expenditure of significant amounts for compliance and/or remediation. If we fail to comply with such laws or regulations, we may be subject to fines and other civil, administrative or criminal sanctions, including the revocation of permits and licenses necessary to continue our business activities. In addition, we may be required to pay damages or civil judgments in

19

respect of third-party claims, including those relating to personal injury (including exposure to hazardous substances we use, store, handle, transport, manufacture or dispose of), property damage or contribution claims. Some environmental laws allow for strict, joint and several liability for remediation costs, regardless of comparative fault. We may be identified as a potentially responsible party under such laws. Such developments could have a material adverse effect on our business, financial condition and results of operations.

We are subject to environmental laws due to the import and export of our products, which could subject us to compliance costs and/or potential liability in the event of non-compliance.

The export of our products internationally from our production facilities in Israel subjects us to environmental laws and regulations concerning the import and export of chemicals and hazardous substances such as the United States Toxic Substances Control Act, or TSCA, and the Registration, Evaluation, Authorisation and Restriction of Chemical Substances, or REACH. These laws and regulations require the testing and registration of some chemicals that we ship along with, or that form a part of, our 3D printers and other products. If we fail to comply with these or similar laws and regulations, we may be required to make significant expenditures to reformulate the chemicals that we use in our products and materials or incur costs to register such chemicals to gain and/or regain compliance. Additionally, we could be subject to significant fines or other civil and criminal penalties should we not achieve such compliance.

Potential future acquisitions of companies or technologies may distract our management and disrupt our business.

We may acquire or make investments in businesses, technologies, services or products, whether complementary or otherwise, as a means to expand our business if appropriate opportunities arise. We cannot give assurances that we will be able to identify future suitable acquisition or investment candidates, or, if we do identify suitable candidates, that we will be able to make the acquisitions or investments on reasonable terms or at all. In addition, we have limited prior experience in integrating acquisitions and we could experience difficulties incorporating an acquired company's personnel, operations, technology or products and service offerings into our own or in retaining and motivating key personnel from these businesses. We may also incur unanticipated liabilities. Any such difficulties could disrupt our ongoing business, distract our management and employees, increase our expenses and adversely affect our results of operations. Furthermore, we cannot provide any assurance that we will realize the anticipated benefits and/or synergies of any such acquisition or investment.

The financing of any such acquisition or investment, or of a significant general expansion of our business, may not be readily available on favorable terms. Any significant acquisition or investment, or major expansion of our business, may require us to explore external financing sources, such as an offering of our equity or debt securities. We cannot be certain that in the future these financing sources will be available to us or that we will be able to negotiate commercially reasonable terms for any such financing, or that our actual cash requirements for an acquisition, investment or expansion will not be greater than anticipated. In addition, any indebtedness that we may incur in such a financing may inhibit our operational freedom, while any equity securities that we may issue in connection with such a financing may dilute our shareholders. If we are unable to obtain future external financing on favorable terms, we may be unable to expand and achieve our business objectives.

20

We are currently subject to a number of lawsuits. These and any future lawsuits to which we become subject may have a material adverse impact on our capitalization, business and results of operations.

We are currently party to three actions by former employees seeking the issuance of options. The first action relates to an alleged breach of certain undertakings made by us to a former employee. This employee is seeking an option to acquire 1.75% of our outstanding shares, as well as monetary damages. The Israeli court hearing the case issued a verdict in our favor in May 2011, but the former employee appealed the decision to the national labor court, where the appeal is scheduled to be heard in November 2012. The second action relates to a demand by a former employee, based on an alleged undertaking we had made, that we issue him an option that would allow him to maintain an equity interest of 1.45% in our company and reimburse salary reductions he had suffered. This plaintiff has further demanded compensation on account of alleged wrongful termination. This action is currently ongoing and is being litigated in an Israeli labor court. The third action involves a claim by a former employee that he was promised 30,000 options to purchase our ordinary shares under his employment agreement with us, entered into in the year 2000. This plaintiff is also seeking monetary damages to compensate for salary reductions during the period of his employment with us. This claim was filed in April 2011 in an Israeli labor court. We submitted our statement of defense with respect thereto in June 2011, and we and the plaintiff are scheduled to submit affidavits. No date has been set for cross-examinations.

We can provide no assurance as to the outcome of these or any future actions, and such actions may result in judgments against us for significant damages and/or the issuance of options to acquire shares of our capital stock, the exercise of which would result in dilution to our shareholders. Resolution of these matters can be prolonged and costly, and the ultimate results or judgments are uncertain due to the inherent uncertainty in litigation and other proceedings. Moreover, our potential liabilities are subject to change over time due to new developments, changes in settlement strategy or the impact of evidentiary requirements. Regardless of the outcome, litigation has resulted in the past, and may result in the future, in significant legal expenses and require significant attention and resources of management. As a result, current and any future litigation could result in losses, damages and expenses that have a material adverse effect on our business.

Risks related to our intellectual property

If we are unable to obtain patent protection for our products or otherwise protect our intellectual property rights, our business could suffer.

We rely on a combination of patent and trademark laws in the United States and other countries, trade secret protection, confidentiality agreements and other contractual arrangements with our employees, end-users and others to maintain our competitive position. In particular, our success depends, in part, on our ability, and the ability of our licensors, to obtain patent protection for our and their products, technologies and inventions, maintain the confidentiality of our and their trade secrets and know-how, operate without infringing upon the proprietary rights of others and prevent others from infringing upon our and their proprietary rights.

21

We try to protect our proprietary position by, among other things, filing United States, European, Israeli and other patent applications related to our proprietary products, technologies, inventions, processes and improvements that may be important to the continuing development of our product offerings. As of March 1, 2012, our owned patent portfolio consisted of 63 granted patents and 67 pending patent applications (including foreign counterparts of both issued patents and pending patent applications) in addition to patents licensed from third parties. We have been granted patents in the United States, China, France, Germany, Italy, the UK, Spain, Austria, Belgium, Switzerland, Ireland and Hong Kong, and have pending patent applications in the United States, China, the European Union, Hong Kong and Japan, along with a U.S. provisional patent application and international applications pursuant to the Patent Cooperation Treaty.

Despite our efforts to protect our proprietary rights, it is possible that competitors or other unauthorized third parties may obtain, copy, use or disclose our technologies, inventions, processes or improvements. We cannot assure you that any of our existing or future patents or other intellectual property rights will not be challenged, invalidated or circumvented, or will otherwise provide us with meaningful protection. Our pending patent applications may not be granted, and we may not be able to obtain foreign patents or pending applications corresponding to our U.S. patents. The laws of certain countries, such as China, where one of our wholly-owned subsidiaries is located, do not provide the same level of patent protection as in the United States, so even if we assert our patents or obtain additional patents in China or elsewhere outside of the United States, effective enforcement of such patents may not be available. If our patents do not adequately protect our technology, our competitors may be able to offer 3D printers or resin consumables similar to ours. As described further below, we are subject to a cross-license agreement with a competitor, 3D Systems Corporation, pursuant to which that competitor practices certain of our patents in its own products in a manner that is similar to and/or competitive with our products. Our competitors may also be able to develop similar technology independently or design around our patents, and we may not be able to detect the unauthorized use of our proprietary technology or take appropriate steps to prevent such use. Any of the foregoing events would lead to increased competition and lower revenues or gross margins, which could adversely affect our operating results.

In addition, our products and technology, including the technology we license from others, may infringe the intellectual property rights of third parties. Patent applications in the United States and most other countries are confidential for a period of time until they are published, and the publication of discoveries in scientific or patent literature typically lags actual discoveries by several months or more. As a result, the nature of claims contained in unpublished patent filings around the world is unknown to us, and we cannot be certain that we were the first to conceive inventions covered by our patents or patent applications or that we were the first to file patent applications covering such inventions. Furthermore, it is not possible to know in which countries' patent holders may choose to extend their filings under the Patent Cooperation Treaty or other mechanisms. Any infringement by us or our licensors of the intellectual property rights of third parties may have a material adverse effect on our business, financial condition and results of operations.

22

If we are unable to protect the confidentiality of our trade secrets or know-how, such proprietary information may be used by others to compete against us, in particular in developing resin consumables that could be used with our printing systems in place of our proprietary resin consumables.

We have devoted substantial resources to the development of our technology, trade secrets, know-how and other unregistered proprietary rights. While we enter into confidentiality and invention assignment agreements intended to protect such rights, such agreements can be difficult and costly to enforce or may not provide adequate remedies if violated. Such agreements may be breached and confidential information may be willfully or unintentionally disclosed, or our competitors or other parties may learn of the information in some other way. The disclosure to, or independent development by, a competitor of any of our trade secrets, know-how or other technology not protected by a patent could materially reduce or eliminate any competitive advantage we may have over such competitor.

This concern could manifest itself in particular with respect to our proprietary resin consumables that are used with our 3D printers. Portions of our proprietary resin consumables may not be afforded patent protection. Chemical companies or other producers of resins and other materials may be able to develop resin consumables that are compatible to a large extent with our 3D printers, whether independently or in contravention of our trade secret rights and related proprietary and contractual rights. If such resin consumables are made available to owners of our 3D printers and are purchased in place of our proprietary resin consumables, our revenues and profitability would be reduced and we could be forced to reduce prices for our proprietary resin consumables.

We may incur substantial costs enforcing or acquiring intellectual property rights and defending against third-party claims as a result of litigation or other proceedings.

In connection with the enforcement of our intellectual property rights, the acquisition of third-party intellectual property rights or disputes related to the validity or alleged infringement of third-party intellectual property rights, including patent rights, we have been and may in the future be subject or party to claims, negotiations or complex, protracted litigation. Intellectual property disputes and litigation, regardless of merit, can be costly and disruptive to our business operations by diverting attention and energies of management and key technical personnel, and by increasing our costs of doing business. We may not prevail in any such dispute or litigation, and an adverse decision in any legal action involving intellectual property rights, including any such action commenced by us, could limit the scope of our intellectual property rights and the value of the related technology. For example, in 2005 in settlement of prior patent litigation, we entered into a cross-licensing arrangement with 3D Systems Corporation, under which each party licensed certain patents of the other party, and we incurred royalty payment obligations (which have been paid in-full based on our net sales of printing equipment covered by the patents we in-licensed).

Third-party claims of intellectual property infringement successfully asserted against us may require us to redesign infringing technology or enter into costly settlement or license agreements on terms that are unfavorable to us, prevent us from manufacturing or licensing certain of our products, subject us to injunctions restricting our sale of products and use of infringing technology, cause severe disruptions to our operations or the markets in which we compete, impose costly damage awards or require indemnification of our distributors and

23

end-users. In addition, as a consequence of such claims, we may incur significant costs in acquiring the necessary third-party intellectual property rights for use in our products or developing non-infringing substitute technology. Any of the foregoing developments could seriously harm our business.

Risks related to an investment in our Class A ordinary shares

An active market for our Class A ordinary shares may not develop, which may inhibit the ability of our shareholders to sell Class A ordinary shares following this offering.

Prior to this offering, you could not buy or sell our Class A ordinary shares publicly. An active or liquid trading market in our Class A ordinary shares may not develop upon completion of this offering, or if it does develop, it may not continue. If an active trading market does not develop, you may have difficulty selling any of our Class A ordinary shares that you buy. The initial public offering price of our Class A ordinary shares has been determined through our negotiations with the underwriters and may be higher than the market price of our Class A ordinary shares after this offering. Consequently, you may not be able to sell our Class A ordinary shares at prices equal to or greater than the price paid by you in the offering. See "Underwriting" for a discussion of the factors that we and the underwriters considered in determining the initial public offering price.

The market price of our Class A ordinary shares may be subject to fluctuation, whether or not due to fluctuations in our operating results and financial condition, which could, in turn, result in substantial losses being incurred by our investors.

The stock market in general has been, and the market price of our Class A ordinary shares in particular will likely be, subject to fluctuation, whether due to, or irrespective of, periodic fluctuations in our operating results and financial condition. We expect the market price of our Class A ordinary shares on the NASDAQ Global Market to fluctuate as a result of a number of factors, including, but not limited to:

24

These factors and any corresponding price fluctuations may materially and adversely affect the market price of our Class A ordinary shares and result in substantial losses being incurred by our investors.

Market prices for securities of technology companies historically have been very volatile. The market for these securities has from time to time experienced significant price and volume fluctuations for reasons unrelated to the operating performance of any one company. In the past, following periods of market volatility, public company shareholders have often instituted securities class action litigation. If we were involved in securities litigation, it could impose a substantial cost upon us and divert the resources and attention of our management from our business.

The difference between the voting rights of our Class A and Class B ordinary shares may harm the value and liquidity of our Class A ordinary shares.

The rights of the holders of Class A and Class B ordinary shares are identical, except with respect to voting and conversion rights. So long as the number of outstanding Class B ordinary shares represents 15% or more of the combined number of Class A and Class B ordinary shares, the holders of Class B ordinary shares will be entitled to five (5) votes per share, and the holders of our Class A ordinary shares will be entitled to one (1) vote per share, on all matters presented to our shareholders. If a holder of our Class B ordinary shares transfers his, her or its Class B ordinary shares to any party, other than certain distributions by an initial Class B shareholder that is an entity (which are described below under "Description of share capital—Transfer of shares"), those shares would automatically convert into Class A ordinary shares. The Class B holders will hold shares of Class B ordinary shares following the offering, of which shares, or %, will be held by our directors and executive officers and their affiliates.

The holders of our Class B ordinary shares may have interests that are different or adverse to yours. After this offering, holders of our Class B ordinary shares , including our directors and executive officers and their affiliates, will together hold % of our outstanding capital stock but will have % of the outstanding voting rights. Based on their voting rights and because of the quorum provision that requires only 1/3 of the voting rights in our company to be present at our shareholders meetings, and the simple majority vote of shares present in person or by proxy that is sufficient for the approval of most actions at any such meeting, in each case as prescribed by our articles of association (and, with respect to the approval of transactions, also as prescribed by Israeli law), the holders of our Class B ordinary will be able to exercise a significant level of control over most matters requiring shareholder approval, including the election of directors, amendment of our articles of association and approval of significant corporate transactions, subject to rules requiring the approval of a special majority among

25

non-interested shareholders in certain situations. This control could have the effect of delaying or preventing a change of control of our company or changes in management and will make the approval of certain transactions difficult or impossible without the support of the holders of our Class B ordinary shares, including transactions in which you as a holder of our Class A ordinary shares might otherwise receive a premium for your shares over the then-current market price. The holders of our Class B ordinary shares are not prohibited from selling a controlling interest in us to a third party and may do so without your approval and without providing for a purchase of your Class A ordinary shares (although their shares would convert into Class A ordinary shares as a result of such sale). Accordingly, Class A ordinary shares may be worth less than they would be if the holders of our Class B ordinary shares did not maintain voting control over us.

Furthermore, the existence of two classes of ordinary shares could result in less liquidity for our Class A ordinary shares, as investors may view that class of shares as a less attractive investment opportunity in light of its limited voting power relative to the Class B ordinary shares. See "Description of share capital" for a description of our Class A and Class B ordinary shares and the rights associated with each of them.

If equity research analysts do not publish research or reports about our business or if they issue unfavorable commentary or downgrade our Class A ordinary shares, the price of our Class A ordinary shares could decline.

The trading market for our Class A ordinary shares will rely in part on the research and reports that equity research analysts publish about us and our business. We do not have control over these analysts and we do not have commitments from them to write research reports about us. The price of our Class A ordinary shares could decline if one or more equity research analysts downgrades our Class A ordinary shares or if those analysts issue other unfavorable commentary or cease publishing reports about us or our business.

Future sales of our Class A ordinary shares could reduce the market price of our Class A ordinary shares.

If our existing shareholders, particularly our directors, their affiliates or our executive officers, sell a substantial number of our ordinary shares in the public market, the market price of our Class A ordinary shares could decrease significantly. The perception in the public market that our shareholders might sell our ordinary shares could also depress the market price of our Class A ordinary shares. Substantially all of our existing shareholders prior to this offering are subject to lock-up agreements with the underwriters that restrict their ability to transfer their ordinary shares for at least 180 days after the date of this prospectus. Consequently, upon expiration of the lock-up agreements, an additional o f our Class A ordinary shares will be eligible for sale in the public market. As of March 1, 2012, after giving effect to the reclassification of our outstanding ordinary shares and preferred shares, options to purchase a total of 27,185,664 Class B ordinary shares would have been issued and outstanding under our 2004 equity incentive plan, of which options to purchase 19,831,820 Class B ordinary shares would have been vested as of that date at a weighted average exercise price of $0.433 per share. We intend to file registration statements on Form S-8 with the SEC covering all of our Class A ordinary shares issuable under this plan, including Class A ordinary shares issuable upon conversion of Class B ordinary shares underlying the options granted under this plan. The market price of our Class A ordinary shares may drop significantly when

26

the restrictions on resale by our existing shareholders lapse and our shareholders are able to sell our ordinary shares into the market. In addition, a sale by the company of additional ordinary shares or similar securities in order to raise capital might have a similar negative impact on the share price of our Class A ordinary shares. A decline in the price of our Class A ordinary shares might impede our ability to raise capital through the issuance of additional Class A ordinary shares or other equity securities, and may cause you to lose part or all of your investment in our Class A ordinary shares.

Raising additional capital by issuing securities may cause dilution to our shareholders.

We may need or desire to raise substantial capital in the future. Our future capital requirements will depend on many factors, including, among others:

If we raise additional funds by issuing equity or convertible debt securities, we will reduce the percentage ownership of our then-existing shareholders, and the holders of such securities may have rights, preferences or privileges senior to those possessed by our then-existing shareholders. See also "—Future sales of our Class A ordinary shares could reduce the market price of our Class A ordinary shares" above.

Investors in this offering will experience immediate substantial dilution in net tangible book value.